Yes, a debt collector can absolutely sue you. This isn’t just an empty threat used to scare you; it’s a very real—and very common—legal strategy to force payment on debts like old credit card bills, personal loans, or medical expenses.

The single biggest mistake you can make is ignoring a court summons. Doing so is like forfeiting a game before it even starts. The collector almost always wins by default, giving them powerful legal tools to take your money directly from your paycheck or bank account. This guide will focus on your consumer rights, especially under critical laws like the FDCPA and TCPA, to help you build a strong debt defense.

Why You’re Suddenly Hearing So Much About Debt Collection Lawsuits

If you’re facing a lawsuit from a debt collector, you are not alone. It can feel isolating, but this has become an everyday reality for millions of Americans. Lawsuits are no longer a last resort for collection agencies. Instead, they’ve become the go-to method for collecting on aged accounts, which they often buy from original creditors for just pennies on the dollar.

This shift means you have to take any notice of a lawsuit with the utmost seriousness. Here’s a quick look at the hard numbers to put this trend in perspective.

The Reality of Debt Collection Lawsuits at a Glance

This table breaks down some of the most important statistics. They paint a clear picture of why you need to be prepared and proactive if you’re contacted about a lawsuit.

| Key Statistic | What It Means for You |

|---|---|

| 4.7 million lawsuits filed in 2022 | The odds of being sued are higher than ever. It’s not a rare event; it’s a primary collection tool. |

| Over 70% of cases end in a default judgment | Most people don’t respond to the lawsuit, which results in an automatic loss for the consumer. |

| Only 1 in 10 consumers have legal representation | Facing a collector’s attorney alone puts you at a significant disadvantage. |

| Many debts are purchased for 4 cents on the dollar | The collector has very little invested, which can give you leverage in negotiations. |

These numbers aren’t meant to scare you—they’re meant to empower you. Understanding the landscape is the first step toward building a strong defense and protecting your finances.

What Pushes a Collector to Sue?

So, what’s the tipping point? Why does a collector decide to take you to court instead of just continuing to call and send letters? A few key factors often push them to escalate the situation from a simple collection effort to a full-blown legal fight.

Here’s what typically triggers a lawsuit:

- The Size of the Debt: While they can sue for any amount, larger balances make it more worthwhile for them to cover the court costs.

- A Breakdown in Communication: If you go completely silent and ignore their calls and letters, they see a lawsuit as their only remaining option.

- An Approaching Deadline: Every state has a statute of limitations—a legal deadline for filing a lawsuit. If that clock is about to run out, they may rush to court.

- Their Business Model: Some agencies are basically “litigation mills.” Their entire business model is built around suing consumers as their primary collection method.

The most critical thing to remember is this: A lawsuit is a formal legal process, not just another scare tactic. Ignoring it hands the collector an easy win and gives them the legal authority to garnish your wages or freeze your bank accounts.

The good news? You have powerful consumer rights. Federal laws like the Fair Debt Collection Practices Act (FDCPA) were created specifically to protect you from harassment and unfair tactics. In fact, violations of these laws are incredibly common. You can learn more about how FDCPA violations are surging and what it means for your rights.

This guide will walk you through everything you need to know—from what to do when you’re served with papers to how you can fight back and protect your financial future.

Navigating the Debt Lawsuit Process From Start to Finish

Getting hit with court papers is jarring, no doubt about it. But understanding the road ahead is the best way to get back in the driver’s seat. A debt lawsuit isn’t just one surprise event; it’s a series of steps that you can actually anticipate. When you know the debt collector’s playbook, the whole process becomes a lot less intimidating.https://www.youtube.com/embed/VwUne4eBMaA

The first official move is when you are “served.” This is the formal, legal delivery of the lawsuit paperwork. Usually, a process server or even a sheriff’s deputy will hand you the documents in person or leave them at your home, following very specific state rules. This is your official heads-up that a lawsuit has been filed with the court.

Decoding the Summons and Complaint

The stack of papers you receive will almost always contain two key documents: a Summons and a Complaint.

Think of the Summons as an official invitation to court—and it’s one you absolutely cannot turn down. It tells you who is suing you and, most importantly, the deadline you have to file a formal response with the court.

The Complaint is where the debt collector lays out their side of the story. It will detail who they are, why they think you owe them money, and exactly how much they’re trying to get. You need to read this document from top to bottom, because it contains the specific allegations you’ll have to answer.

That response deadline is ironclad. Missing it is like forfeiting the game before it even starts. The court can—and probably will—enter a default judgment against you, handing the collector an automatic win.

A Debt Collector’s Expiration Date: The Statute of Limitations

One of the most powerful tools in your debt defense toolkit is the statute of limitations. This is simply a law, which varies by state, that puts a time limit on how long a collector has to sue you over a debt.

For instance, the clock on credit card debt is often somewhere between three to six years, depending on your state’s laws. The countdown typically begins from the date of your last payment or the last time you used the account.

Once that time runs out, the debt is considered “time-barred.” A collector can technically still call and ask you to pay, but they lose the legal right to sue you for it. If they file a lawsuit on a time-barred debt anyway, they’ve just violated the Fair Debt Collection Practices Act (FDCPA).

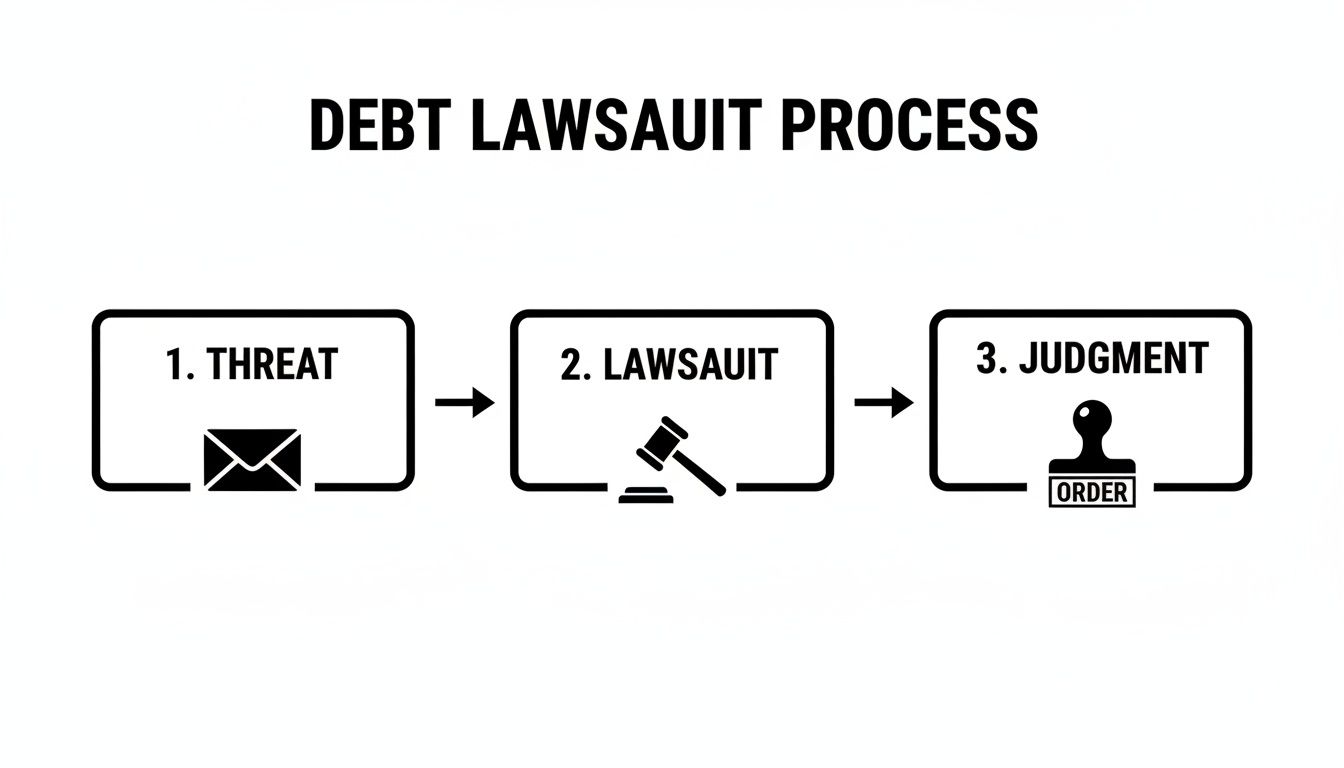

This flowchart breaks down the typical path of a debt lawsuit, from the first threat to the final judgment.

As you can see, the lawsuit is the critical step that turns a simple collection demand into a court order with real teeth.

Making Them Prove They Own the Debt

Here’s another key point: the burden of proof is entirely on the debt collector. It’s not your job to prove you don’t owe the money; it’s their job to prove you do. To win in court, they have to provide solid evidence for two things:

- You Owe the Debt: They need to produce the original agreement you signed or other documents that tie you to the debt.

- They Have the Right to Collect: If it’s a debt buyer suing you (not the original bank or hospital), they must show the court a complete “chain of title”—paperwork proving they legally bought your specific account.

This is often the weak link in their chain. Debt buyers frequently purchase thousands of accounts in bulk with flimsy documentation. They might be missing the very paperwork they need to make their case, which can be a game-changer for your defense. Knowing where to look for these gaps is how you start building a strong response.

The High Cost of Ignoring a Debt Lawsuit

Getting served with a lawsuit is incredibly stressful. It’s completely understandable to want to just ignore the papers and hope the problem disappears. But when a debt collector sues you, doing nothing is probably the worst thing you can do for your financial future. It’s like a football team not even showing up for the game—they lose by default.

If you don’t file a formal response (an “Answer”) with the court by the deadline, the collector’s attorney will simply ask the judge for a default judgment. This is a court order that says they win because you never bothered to defend yourself. It’s an automatic victory that legally rubber-stamps their claim, regardless of whether the debt was even valid in the first place.

The Power of a Default Judgment

A default judgment isn’t just some official-looking document. It’s a legal key that unlocks a whole new level of aggressive and invasive collection tools. It turns a collector’s polite requests into legally enforceable demands.

With this court order in hand, they now have the right to forcibly take money from you to satisfy the judgment, which now also includes their attorney’s fees and court costs.

“A default judgment gives the debt collector immense leverage. It moves the conflict from phone calls and letters to direct action against your income and assets, making your financial life an open book for them.”

This isn’t a rare occurrence. Debt collectors count on people not showing up. In fact, national analyses show that courts resolve over 70% of these cases through default judgments. After that, collectors can garnish up to 25% of your wages in most states or seize money directly from your bank account, trapping families in a devastating financial spiral. You can find more data on how these lawsuits impact consumers in J.G. Wentworth’s detailed breakdown.

How Collectors Enforce a Judgment

Once a judgment is on the books, the debt collector can start the collection process right away, often without another word of warning. They have three main weapons they can use.

Wage Garnishment

This is the collector’s favorite tool because it’s so effective. Armed with a court order, they send a notice straight to your employer. Your boss is then legally required to withhold a portion of your paycheck and send it directly to the collector. The amount they can take is limited by law, but it’s often a significant chunk of the income you need for rent, food, and bills.

Bank Account Levy

A bank levy (or attachment) is another powerful move. The collector can find out where you bank and send a legal order to freeze your account. Your bank must comply, locking you out of your own money. The funds in the account—up to the full judgment amount—are then seized and handed over to the collector. This often happens without any warning, causing checks to bounce and automatic payments to fail.

Property Liens

For larger debts, a collector might put a lien on your property, like your home or your car. A lien is simply a legal claim against an asset. It doesn’t mean they can kick you out of your house tomorrow. What it does mean is that if you ever try to sell or refinance that property, the debt collector gets paid first from the proceeds. It basically clouds the title to your property and makes it much harder to manage your own assets.

Ignoring a lawsuit turns a manageable problem into a full-blown financial crisis. You give up all your rights and hand the collector total control. The good news? You have the power to prevent all of this just by responding to the lawsuit and standing up for yourself.

Your Shield: Consumer Protection Laws That Pack a Punch

When you’re served with a lawsuit from a debt collector, it’s easy to feel like they have all the power. But they don’t. A powerful set of federal laws was designed specifically to protect you from unfair, deceptive, and abusive collection tactics. These aren’t just suggestions—they’re strict rules, and collectors who break them face real consequences.

Knowing your rights under these laws is more than just good defense; it’s a powerful offense. If a collector violated the law while trying to collect from you, you may have grounds to sue them right back with a counterclaim. This can completely turn the tables, stopping the harassment and potentially recovering money damages.

Your Primary Defense: The Fair Debt Collection Practices Act (FDCPA)

The most important law in your corner is the Fair Debt Collection Practices Act, or FDCPA. Think of it as the official rulebook for how third-party debt collectors must behave. It draws clear lines in the sand, defining exactly what they can and cannot do.

Many collectors push the boundaries, banking on the fact that most people don’t know their rights. A lawsuit stuffed with intimidating legal language is their primary tool, but their case can quickly crumble if they broke the law to get to that point.

The FDCPA makes a lot of their favorite pressure tactics illegal. Collectors are strictly forbidden from:

- Harassing you: They can’t call you over and over again or at odd hours (typically before 8 a.m. or after 9 p.m. your time).

- Making false threats: It’s illegal to threaten you with arrest, say they’ll garnish your wages without a court order, or claim they’ll take legal action they have no intention of pursuing.

- Lying or deceiving you: They can’t misrepresent the amount you owe or pretend to be an attorney or a government official.

- Publicly shaming you: A collector generally cannot tell your boss, family, or neighbors about your debt. They are only allowed to contact other people to get your location information, and that’s it.

A violation of the FDCPA isn’t just a simple mistake. It’s a legal opening. Each violation gives you powerful leverage for a settlement or becomes the foundation for a counterclaim filed right back at them.

Stop the Robocalls With the Telephone Consumer Protection Act (TCPA)

Beyond the FDCPA, the Telephone Consumer Protection Act (TCPA) gives you another layer of defense against modern high-tech harassment. This law was passed to protect all of us from the endless flood of unwanted robocalls, autodialed texts, and junk faxes.

If a debt collector is using an automated system to blow up your cell phone with calls or texts without your clear permission, they are almost certainly violating the TCPA. The penalties are no joke—they can range from $500 to $1,500 for every single illegal call or text.

This becomes incredibly powerful when you’re facing a lawsuit. If you start documenting every automated call and text, you can build a strong counterclaim that could offset the original debt or even result in the collector owing you money. This isn’t a rare problem. Federal data shows that illegal harassment is a top consumer complaint, and in some years, TCPA-related complaints have skyrocketed to over 88,000. You can reviewing the research on debt collection practices to see just how widespread these issues are.

Turning the Tables With a Counterclaim

So, what does this all mean for you? It means a lawsuit is not a one-way street. If you have proof that the collector broke the rules under the FDCPA or TCPA, you can file a counterclaim as part of your formal answer to their lawsuit.

Here’s a real-world example: A collector sues you for a $2,000 credit card debt. But in the months leading up to the suit, they illegally called your boss, threatened to have you arrested, and sent 10 automated robocalls to your cell. Your counterclaim could demand damages for every single one of those violations, potentially wiping out their lawsuit and stopping them cold.

To learn more about the specific protections you have, you can check out our guide on your rights against debt collectors.

Your Action Plan for Responding to a Lawsuit

It’s a jarring moment—a process server hands you a stack of legal papers. Your stomach might drop, but what you do in the next few hours and days is what really counts. Having a clear, strategic plan isn’t just helpful; it’s essential to protecting your rights and shaping the outcome of the case.

Let’s get one thing straight: ignoring the lawsuit is the worst thing you can do. That’s a one-way ticket to a default judgment against you. Instead, it’s time to shift into action mode. This means methodically preparing your response and building your defense from day one.

Your First Critical Steps

Time is not on your side here. Courts operate on strict deadlines, and you typically only have 20 to 30 days from the day you were served to file a formal response. The very first thing to do is find that deadline on the Summons, circle it, and put it on every calendar you have.

With the clock ticking, it’s crucial to get organized. The table below outlines your immediate, must-do steps.

Your Immediate Action Plan After Receiving a Summons

| Step | Action to Take | Why It’s Important |

|---|---|---|

| 1. Read Everything Carefully | Go through the Summons and Complaint line by line. Scrutinize every detail: your name, address, account numbers, and the debt amount claimed. | Even small errors or inconsistencies can become powerful points in your defense. You’re looking for anything that isn’t 100% accurate. |

| 2. Gather Your Evidence | Create a dedicated file for this case. Collect every piece of paper you have related to the debt—old statements, letters, notes from phone calls (with dates and times!), and any proof of payment. | This documentation is the foundation of your defense. Your records might contradict the collector’s claims or prove they lack the proper paperwork. |

| 3. Do Not Contact the Collector | Resist the urge to call the debt collector or their attorney to “work things out.” Your next communication should be a formal, legal one. | Anything you say can be used against you in court. You could even accidentally say something that restarts the statute of limitations. Let your official Answer do the talking. |

These initial steps are non-negotiable and set the stage for everything that follows.

The single most powerful move you can make right now is to consult with a consumer protection attorney. The legal system is a minefield of complex rules and procedures. An experienced lawyer can spot weaknesses in the collector’s case you’d never see and will ensure your response is filed correctly and on time.

Crafting Your Formal “Answer”

Your official response to the lawsuit is a legal document called an “Answer.” This is your chance to go on the record, responding to each claim (or “allegation”) the collector made in their Complaint. For each point, you’ll typically state that you admit it, deny it, or lack enough information to do either.

But an Answer is much more than a simple list of denials. It’s your primary opportunity to raise your “affirmative defenses.” Think of these as legal arguments that can defeat the lawsuit entirely, even if the debt was originally yours.

Common affirmative defenses include things like:

- Expired Statute of Limitations: The collector waited too long to sue, and the debt is now time-barred.

- Mistaken Identity: They’ve got the wrong person—you’re not the one who owes the debt.

- Lack of Standing: The debt collector suing you can’t prove they actually own your specific debt and have the legal right to collect it.

- Incorrect Debt Amount: The total they’re demanding is wrong because of misapplied payments, junk fees, or other errors.

Filing an Answer correctly is a technical process with very specific formatting rules. If you fail to raise your affirmative defenses in your initial Answer, you could lose the right to use them later in the case. This is another area where professional legal guidance is invaluable. To get a better sense of the process, you can learn more about how to answer a debt collection summons in our guide.

Why You Need a Consumer Law Attorney on Your Side

Let’s be clear: you don’t have to face a debt collector’s law firm on your own. While knowing your rights is a great first step, the legal system itself is a labyrinth. It’s filled with complex rules, unyielding deadlines, and procedural traps that are designed to trip up anyone who isn’t a lawyer.

Hiring an attorney isn’t a sign of weakness; it’s about leveling a very uneven playing field.

Debt collection agencies and their legal teams live and breathe these lawsuits. They file thousands of them. Their entire business model often relies on the assumption that you won’t know the rules of evidence or the fine points of civil procedure. A seasoned consumer law attorney completely flips that script. They turn what would be a stressful, reactive scramble on your part into a calculated, proactive strategy.

When Legal Help Is Non-Negotiable

Honestly, any lawsuit is serious enough to warrant a legal consultation. But certain situations are absolute red flags, signaling that you need to get a professional involved immediately.

- The Debt is Significant: The more money at stake, the harder the collector will fight. An attorney’s job is to protect you and minimize your financial exposure.

- You Suspect Illegal Behavior: Have they been harassing you with robocalls or making illegal threats? An attorney can use those FDCPA or TCPA violations to build a powerful counterclaim.

- The Debt is Old: Figuring out if a debt is past the statute of limitations isn’t always straightforward. It requires a detailed legal analysis of state laws and the specific history of your account.

- You Feel Overwhelmed: The sheer stress of a lawsuit can be debilitating. An attorney takes over the entire process—from filing the correct paperwork on time to dealing with the opposing lawyer—so you can breathe again.

A skilled consumer protection lawyer does so much more than just file an “Answer” to the complaint. They become your shield and your advocate, standing between you and the high-pressure tactics collectors use to get default judgments.

An attorney’s real value comes from their ability to pick apart the collector’s case from every angle. They demand concrete proof, scrutinize every document for errors or forgeries, and force the collector to meet every single one of their legal burdens.

From Defense to Offense

The right lawyer doesn’t just play defense. They actively hunt for opportunities to turn the tables and hold the debt collector accountable for their own illegal actions.

Did the collector keep calling after you sent a written request to stop? Did they reveal the details of your debt to a relative or coworker? These aren’t small mistakes. They are clear violations of federal law that can become the foundation for a strong counterclaim against them.

This move completely changes the dynamic. Suddenly, you’re not just defending yourself against a debt. You’re in a position to demand damages from the collector for their law-breaking behavior. This creates powerful leverage, often forcing them to negotiate a much better settlement or even drop their case against you entirely. An attorney knows how to use that leverage to negotiate from a position of strength and protect your financial future.

Your Top Questions About Debt Lawsuits, Answered

Getting hit with a lawsuit from a debt collector is confusing and stressful. You probably have a million questions running through your mind. Let’s cut through the noise and get you some clear, straightforward answers to the most common questions we hear from people in your situation.

How Long Can a Debt Collector Sue Me For a Debt?

This is one of the most important questions, and the answer comes down to something called the statute of limitations. Think of it as a legal stopwatch on the collector’s right to sue you.

This time limit varies quite a bit depending on where you live and the type of debt, but it’s generally somewhere between three to six years. The clock usually starts running from the date of your last payment or the date the account first went delinquent.

Once that time is up, the debt becomes “time-barred.” A collector can still call and ask you to pay, but they’ve lost their legal power to win a lawsuit against you.

What Happens If Someone Sues a Deceased Person’s Estate?

Yes, a creditor can sue a person’s estate after they’ve passed away. Debts don’t just disappear when someone dies; they become the responsibility of the estate, which is managed by an executor or administrator.

This is a key area of estate planning. Creditors must file a formal claim against the estate within a specific time frame. If the estate has sufficient assets (like bank accounts or property), the executor will use them to pay off valid debts according to a legal priority order. It’s important to know that family members and heirs are not personally responsible for the deceased’s debts unless they were a co-signer on the original loan.

Can I Be Sued for a Debt I Don’t Recognize?

You absolutely can, and it happens more often than you’d think. Debts are often bought and sold in massive bundles, and records can get messy. This leads to cases of mistaken identity or attempts to collect on debts that have already been paid off. This is a potential violation of the Fair Credit Reporting Act (FCRA) if it negatively impacts your credit report.

If you get sued for a debt that isn’t yours, you must respond to the lawsuit. You can’t just ignore it. In your formal response, you can challenge the collector and state that they have the wrong person. The ball is then in their court—they have to provide solid proof that you are the one who owes the money.

Never assume a lawsuit is legitimate, even if it has your name on it. Scrutinize every detail of the Complaint and demand that the collector provide concrete proof that they have the correct person and the correct debt.

Does Disputing a Debt Restart the Statute of Limitations?

No, it doesn’t. You have every right under the Fair Debt Collection Practices Act (FDCPA) to dispute a debt or ask for validation. Simply questioning the debt won’t reset that legal stopwatch.

But you have to be careful. Making even a tiny payment on an old debt can restart the statute of limitations, giving the collector a brand new window to sue you. The same goes for acknowledging the debt in writing or agreeing to a new payment plan.

Facing a lawsuit can feel overwhelming, but you don’t have to go through it alone. The experienced attorneys at Ginsburg Law Group PC are dedicated to defending consumers against unfair debt collection practices and protecting their financial futures. Contact us today to learn how we can help you fight back.