The Fair Debt Collection Practices Act (FDCPA) is a cornerstone of consumer rights, serving as the official rulebook for debt collectors. Congress passed this critical federal law to draw a hard line in the sand, protecting everyday people from abusive, unfair, and deceptive collection tactics. It’s a key part of a broader shield of consumer protection laws, including the TCPA, FCRA, and state-specific regulations like Lemon Laws, all designed to ensure you are treated fairly in the marketplace.

Your First Line of Defense in Debt Defense

Imagine a scenario where a company harasses you with endless robocalls, reports inaccurate information on your credit report, and then uses intimidation to collect a debt. This trifecta of consumer rights violations is precisely what laws like the FDCPA, TCPA, and FCRA were created to prevent. Before the FDCPA, intimidating tactics were unfortunately a common reality for many consumers dealing with debt collectors.

The law, which went into effect on September 20, 1977, was a game-changer for consumer debt defense. It was created to stop rampant abuse that pushed millions of Americans into deeper financial trouble. Back then, it wasn’t unusual for collectors to call people at all hours, threaten them with arrest, or lie about being attorneys. For a deeper dive, you can read the full FTC report on the FDCPA’s history and enforcement.

Who the FDCPA Protects

So, who gets to stand behind this shield? The FDCPA is designed specifically to protect individual consumers from third-party debt collectors. It does not cover business debts.

The core idea behind the FDCPA is simple: people deserve to be treated with dignity and respect, even when they owe money. It is a fundamental consumer right that sets clear boundaries for what collectors can and can’t do, taking fear and intimidation out of their toolbox.

If you’re an individual being contacted about a personal debt, the FDCPA has your back. This protection is automatic—there’s no need to sign up or apply for it.

What Debts Are Covered

The law focuses on the kinds of debts most of us encounter in our daily lives: personal, family, and household debts. This is a key area of debt defense strategy.

Here are a few common examples of debts the FDCPA covers:

- Credit card debt: Money you owe on your personal credit cards.

- Medical bills: Unpaid invoices from hospitals, doctors, or dentists.

- Mortgages: The loan you took out for your home.

- Auto loans: Financing for your personal car or truck, a common issue alongside Lemon Law claims.

- Student loans: Both federal and private loans for your education.

Now, here’s a crucial distinction. The FDCPA generally applies only to third-party debt collectors—agencies hired by a company to collect debts on their behalf. It usually doesn’t apply to the original creditor trying to collect its own debt.

For example, if you miss a payment on your credit card, the credit card company itself can call you without having to follow the FDCPA’s rules. But the moment they hire or sell your debt to a collection agency, that agency must play by the FDCPA’s book.

To make these protections crystal clear, let’s break down some of your most important consumer rights under this law.

Key Consumer Rights Under the FDCPA

The table below summarizes the core consumer rights established by the Fair Debt Collection Practices Act.

| Your Right As a Consumer | What This Means for You |

|---|---|

| Right to Be Free from Harassment | Collectors can’t threaten violence, use profane language, or repeatedly call you to annoy or abuse you. This right is also protected under the Telephone Consumer Protection Act (TCPA) for robocalls. |

| Right to Control Communications | You can tell a collector in writing to stop contacting you. They can only contact you again to confirm they’ve received your request or to inform you of a specific action, like a lawsuit. |

| Right to Specific Contact Times | Collectors are prohibited from calling you before 8:00 a.m. or after 9:00 p.m. in your local time zone, unless you agree to it. |

| Right to Be Free from False Statements | Collectors cannot lie. They can’t misrepresent the amount you owe, claim to be attorneys if they aren’t, or threaten you with arrest if it’s not legally possible. This aligns with the FCRA’s requirement for accurate credit reporting. |

| Right to Dispute and Verify Debts | You have the right to demand written verification of a debt. Once you dispute it, the collector must stop collection efforts until they provide you with proof. |

Understanding these rights is the first step in a strong debt defense. Knowing what’s out of bounds gives you the power to identify violations and take action when a debt collector crosses the line.

What Debt Collectors Are Forbidden From Doing

To stand up for your rights under the Fair Debt Collection Practices Act, you first need to know where the lines are drawn. The law is refreshingly direct—it sets firm boundaries on what collectors can and can’t do to get you to pay.

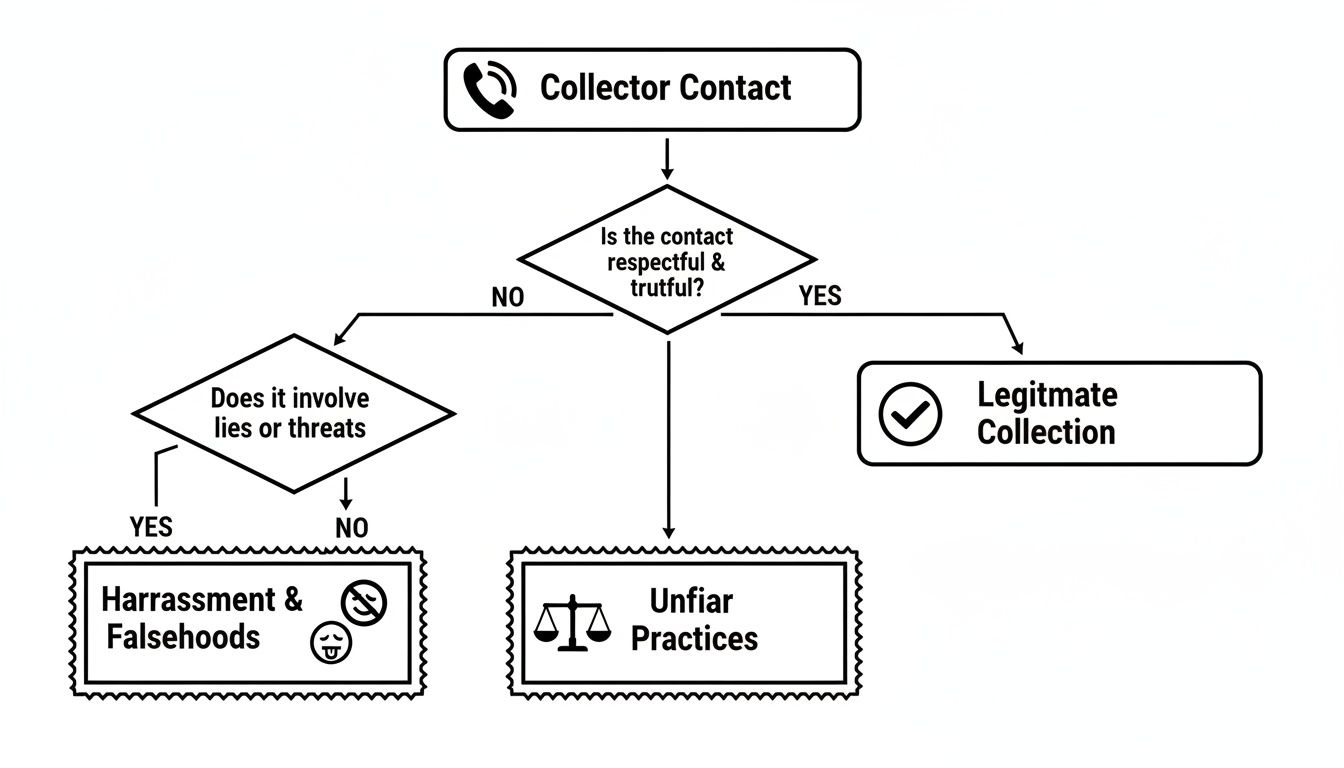

Think of it this way: the FDCPA isn’t about vague suggestions for being “nice.” It’s a rulebook with clear-cut prohibitions that fall into three main buckets: harassment, false statements, and unfair practices. Recognizing these illegal tactics is your first and most powerful step in protecting your consumer rights.

Harassment and Abusive Conduct

Let’s start with the most obvious one: harassment. A debt collector’s job is to collect a debt, not to make your life a living nightmare. The FDCPA explicitly bans any behavior designed to harass, oppress, or abuse you.

This means a collector absolutely cannot:

- Use or threaten violence: This is a huge red flag. They can’t threaten you, your family, your reputation, or your property.

- Use obscene or profane language: Cursing at you or using insulting and derogatory language is strictly out of bounds.

- Call you over and over just to annoy you: If they’re blowing up your phone repeatedly, that’s illegal harassment under the FDCPA and may also violate the TCPA if robocalls are used.

- Publish your name on a public “bad debt” list: They can’t try to shame you into paying by publicly listing you as a debtor (though reporting to credit bureaus is allowed under FCRA rules).

These tactics aren’t just unprofessional; they’re against the law. And they happen more often than you’d think. By 2017, the FTC’s Consumer Sentinel Network had already received over 620,800 complaints about debt collectors. The top offenders were collectors who kept calling after being told to stop (227,917 cases) and those who made repeated, harassing calls (210,238 cases). You can dig into more FDCPA complaint data to see just how widespread these problems are.

False Statements and Misrepresentation

Deception is another powerful tool for shady collectors, and it’s something the FDCPA comes down on hard. Collectors are required to be truthful. Lying or misleading you is a serious violation of your consumer rights.

The law forbids any false, deceptive, or misleading representation. It’s a broad rule that catches all sorts of lies.

The Bottom Line: A debt collector cannot lie to you. They can’t lie about who they are, how much you owe, or what might happen if you don’t pay. This principle of truthfulness is a cornerstone of consumer protection, similar to the FCRA’s mandate for accurate credit information.

To help you spot these violations in the wild, we’ve put together a table of common illegal tactics and what they actually look like.

Common FDCPA Violations and What They Look Like

| Prohibited Practice | Real-World Example |

|---|---|

| Falsely claiming to be an attorney or government agent. | “This is Agent Miller from the IRS tax recovery unit. You need to pay this debt now or we’ll issue a warrant.” |

| Misrepresenting the amount or legal status of the debt. | “Your original $500 debt has now ballooned to $2,500 with our mandatory legal fees.” (When those fees aren’t legally allowed.) |

| Threatening arrest or imprisonment. | “If you don’t wire the money by 5 PM, we’ll have the local sheriff’s department come and arrest you at your job.” |

| Implying legal action that isn’t actually planned or possible. | “We are filing a lawsuit to garnish your wages tomorrow.” (When they have no intention or legal right to do so.) |

These deceptive tricks are all about creating a false sense of panic. Remember, you cannot be thrown in jail for failing to pay a consumer debt. Threats of arrest are an empty, illegal scare tactic and a gross violation of your consumer rights.

Unfair or Unconscionable Practices

Finally, the FDCPA has a catch-all category for practices that are simply “unfair.” These are the sneaky, underhanded tactics that might not be outright lies or harassment but are fundamentally unjust and designed to exploit you.

The law gives specific examples so collectors can’t weasel their way through loopholes.

Here are a few key actions that are considered unfair:

- Piling on extra fees: A collector can’t add interest, fees, or charges to your debt unless your original contract or state law explicitly says they can.

- Cashing a post-dated check early: If you give them a check dated for the 15th, they can’t try to deposit it on the 10th.

- Sending you a postcard about your debt: All communication needs to be private. A postcard is a public notice, and it’s illegal.

- Using an envelope that screams “debt collector”: The outside of the envelope they send you can’t have any words or symbols that indicate it’s from a collection agency.

These rules exist to make sure the collection process is handled fairly and with respect for your basic consumer rights. When you know what’s prohibited, you can confidently spot when a collector steps over the line and begin your debt defense.

How to Respond and Assert Your Consumer Rights

Knowing a debt collector has broken the rules is one thing; stopping them in their tracks is another. The Fair Debt Collection Practices Act doesn’t just list what’s illegal—it gives you specific, powerful tools for your debt defense.

The moment a collector first contacts you, a clock starts ticking. Your best bet isn’t to ignore them or get into a shouting match. The key is to be strategic, put everything in writing, and document every single step. This approach transforms you from a passive target into someone who knows and uses their consumer rights.

This decision tree can help you figure out if a collector’s actions are crossing the line into FDCPA violation territory.

As you can see, any contact that involves harassment, lies, or unfair tactics is a huge red flag and a potential violation of your consumer rights under the law.

The Power of the Debt Validation Letter

Your strongest opening move is to send a debt validation letter. This is a formal, written request that forces the collector to prove you actually owe the money and that they have the legal standing to collect it. You must send this letter within 30 days of the collector’s first contact with you.

Once they get that letter, the FDCPA says they have to hit the brakes. Hard.

They must cease all collection efforts—no more calls, no more letters—until they mail you written verification of the debt. This isn’t a suggestion; it’s a legal command and a vital debt defense tool.

This one step can stop a collector cold, especially if they are working with inaccurate records—a potential violation under the Fair Credit Reporting Act (FCRA) as well. It puts the burden of proof squarely back on them. For a complete walkthrough, you can learn more about how to use a debt validation letter template to dispute a debt in our detailed guide.

So, what kind of proof do they need to provide? At a minimum, the verification should include:

- The total amount of the debt.

- The name of the original creditor you supposedly owe.

- Something that connects you to the debt.

If a collector can’t provide this basic proof, they can’t legally resume collection. If they do, they are breaking the law.

Sending a Cease and Desist Letter

Okay, but what if the debt is legitimate and you just can’t take the constant calls anymore? The FDCPA gives you the right to tell a debt collector to stop contacting you altogether. You do this by sending a cease and desist letter.

This is a straightforward written notice telling the collector you no longer wish to be contacted. Once they receive it, the law allows them to contact you only two more times:

- To confirm they got your letter and will stop all communication.

- To let you know they’re taking a specific legal action, like filing a lawsuit.

This is an incredibly effective tool for ending harassment. It doesn’t make the debt vanish, but it forces the collector’s hand. They either have to give up or take you to court, which is where a strong debt defense becomes critical.

The Golden Rule: Always Use Certified Mail

When you send a debt validation or cease and desist letter, how you send it is almost as important as what you write. Always, always use certified mail with a return receipt requested.

Why is this so non-negotiable? It creates an ironclad paper trail for your debt defense.

- Proof of Delivery: The return receipt is your legal proof that the debt collector received your letter and the exact date it arrived.

- Establishes a Timeline: This paperwork is your best friend if you have to sue them later. If a collector calls you even one day after signing for your cease and desist letter, that little green card becomes Exhibit A in your FDCPA case.

Without it, it’s just your word against theirs. Spending a few extra bucks on certified mail is one of the smartest investments you can make when standing up for your consumer rights.

Documenting Violations to Build Your Case

Knowing your consumer rights under the Fair Debt Collection Practices Act is one thing, but proving a collector broke the law is what really matters. If you ever have to go to court or file a formal complaint, it can’t just be your word against theirs. You need proof.

So, start thinking like a detective. Every voicemail, every letter, every note you take is another piece of evidence. This documentation becomes the bedrock of your debt defense, giving you the leverage to hold abusive collectors accountable.

Create a Detailed Communication Log

The single most important tool you have is a detailed log of every interaction. Don’t ever trust your memory—it’s not reliable enough for a legal challenge. Get a dedicated notebook or start a simple spreadsheet to track every single contact.

For each time they reach out, you need to jot down the essentials:

- Date and Time of the Call: Be precise. The FDCPA and TCPA have specific rules about when collectors can and can’t call.

- Collector’s Name and Agency: Make a habit of asking for the name of the person you’re speaking to and the company they work for.

- Phone Number They Called From: Check your caller ID and write it down.

- A Summary of the Conversation: What was said? If they used abusive language, made threats, or lied, write down their exact words.

- Any Witnesses: Was anyone else in the room who heard the call? Note their name.

A detailed log does more than just record events; it reveals patterns. One questionable call might be brushed off. But a log showing ten calls in a single day? That’s compelling evidence of harassment.

Preserve Every Piece of Evidence

Your log is just the start. You need to save everything. Collectors leave a paper (and digital) trail, and it’s your job to collect it for your debt defense.

Meticulous record-keeping is not just about organization; it’s about building an undeniable case. Every saved message and logged call is a brick in the wall of your defense, making it much harder for a collector to deny their illegal actions.

Treat every single piece of communication as potential evidence. For a closer look at what to hang onto, you can find a more in-depth breakdown of what constitutes strong FDCPA evidence in our detailed article.

Here’s a quick checklist of what to keep:

- Voicemails: Never delete voicemails from a debt collector. Save them, and if you can, back them up.

- Letters and Envelopes: Keep all mail, and don’t toss the envelopes. The postmark can be critical evidence.

- Emails and Text Messages: Screenshot every digital message and save them all in a designated folder.

- Your Phone Records: Your phone bill serves as an official record of incoming calls, perfectly corroborating the entries in your communication log.

When you present this collection of evidence, you’re not just telling a judge or a government agency what happened—you’re showing them. It proves you’re credible and paints a clear picture of a collector’s illegal behavior under the Fair Debt Collection Practices Act.

Taking Action and Seeking Legal Remedies

When a debt collector violates your consumer rights, the Fair Debt Collection Practices Act gives you real power to fight back. If you’ve been harassed or lied to, you’re not helpless. You can take concrete legal action to hold that collector accountable and get compensation for the harm they’ve caused. This is the heart of debt defense.

This goes way beyond just filing a complaint. The FDCPA gives you the right to sue an abusive debt collector in either state or federal court. If you can prove they harassed you, made false threats, or used other illegal tactics, a judge can order them to pay you. This is what gives the FDCPA its teeth, turning its protections into consumer rights you can actually enforce.

Understanding the Compensation You Can Pursue

When you bring a lawsuit for an FDCPA violation, you can go after a few different kinds of compensation. The law is set up not only to make you whole but also to punish the collector and discourage them from violating consumer rights in the future.

Here’s what you can typically seek in a successful case:

- Actual Damages: This is compensation for any real harm the collector’s actions caused you. This can include lost wages, medical bills from stress, or significant emotional distress.

- Statutory Damages: The law recognizes that it’s not always easy to put a price tag on harassment. Even if you can’t prove specific financial losses, the court can award you up to $1,000 just for the FDCPA violation itself. Other laws like the TCPA may allow for even higher statutory damages.

- Attorney’s Fees and Court Costs: This part is huge. If you win your lawsuit, the FDCPA requires the debt collector to pay your reasonable attorney’s fees and the costs of filing the case.

The provision that makes the collector pay your legal fees is a game-changer for consumer rights. It levels the playing field, allowing you to hire a skilled debt defense lawyer without paying anything out of your own pocket. Because the collector is on the hook for your legal bills if you win, everyone has a fair shot at justice.

This setup removes the biggest barrier most people face when considering a lawsuit. To get a deeper dive into how this all works, take a look at our guide on how to sue debt collectors and win your case.

The One-Year Statute of Limitations

Time is of the essence. If you believe your consumer rights have been violated, you have to act quickly. The FDCPA has a very strict deadline for filing a lawsuit, known as the statute of limitations.

You have exactly one year from the date the violation happened to file your case. If you miss that one-year window, you lose your right to sue for that specific illegal act. This is why documenting everything and consulting a consumer rights attorney promptly is so important.

For instance, if a collector calls you and makes an illegal threat on May 10th, the clock starts ticking. You have until May 10th of the next year to get your lawsuit filed. Hesitate too long, and your opportunity for justice is gone.

And it’s not just individuals fighting back. Government agencies are cracking down, too. Between 2021 and 2025, enforcement actions by the CFPB led to companies paying over $6.2 billion in consumer relief and $3.2 billion in penalties, with many of these cases involving FDCPA violations. You can discover more insights about the CFPB’s enforcement legacy to see how serious this is. This government oversight, combined with your personal right to sue, creates a powerful shield for your consumer rights.

Got Questions About the FDCPA? We’ve Got Answers.

Even when you know the basics of the Fair Debt Collection Practices Act, navigating a debt defense can be confusing. Let’s tackle some of the most common questions people have when a collector is on the line. Our goal is to empower you with the knowledge to protect your consumer rights.

Knowing how the FDCPA works in the real world is the key to protecting yourself. Think of these as practical answers you can use right away.

Can a Debt Collector Call Me at Work?

The short answer is yes, a collector can try to call you at work. But there’s a huge catch. If they know—or have any reason to believe—your boss doesn’t allow personal calls, they must stop immediately.

The best way to shut this down for good is to tell them directly. You can say it over the phone, but it’s much smarter to send a quick letter via certified mail. Once you’ve officially told them you can’t take calls at your job, any call they make to you there is a clear FDCPA violation. This is a simple but effective debt defense tactic.

Does the FDCPA Apply to the Original Company I Owe?

This is a really important distinction in consumer rights law. For the most part, the FDCPA does not cover the original creditor—the credit card company, hospital, or lender you first opened the account with. The law was written specifically to rein in the behavior of third-party debt collectors.

There are a couple of wrinkles to watch out for, though:

- Tougher State Laws: Some states have their own consumer protection laws that go further than the FDCPA and hold original creditors to similar standards.

- Collecting Under a Different Name: If the original company creates a separate department with a different name to collect its own debts, making it look like a third-party agency, the FDCPA rules can kick in.

So, while the original business you owe has more freedom, any professional collection agency they hire must play by every single rule in the FDCPA book.

The FDCPA focuses on third-party collectors because they have less skin in the game. An original creditor has a brand reputation to protect, while a collection agency’s main incentive is just to get the money, which historically led to more aggressive tactics. This is a key principle in consumer rights law.

Knowing who you’re dealing with—the original creditor or a hired collector—tells you exactly which rules they have to follow.

What if I Don’t Believe the Debt Is Mine?

If a collector calls about a debt you don’t recognize, you have a powerful consumer right: the right to demand proof. You need to send a written debt validation letter to the collector within 30 days of their first contact. This deadline is absolutely critical for your debt defense.

The moment they receive your letter, the law requires them to stop everything. They are legally barred from resuming collection efforts until they mail you written verification of the debt. If they fail to validate the debt but report it to credit bureaus, they could also be violating the Fair Credit Reporting Act (FCRA).

If they keep trying to collect after you’ve disputed it in writing but before they’ve sent proof, they are breaking federal law. It’s that simple.

Can a Debt Collector Threaten to Have Me Arrested?

Absolutely, unequivocally not. This is one of the most serious violations of your consumer rights under the Fair Debt Collection Practices Act. In the United States, failing to pay a consumer debt like a credit card bill or a medical invoice is a civil matter, not a criminal one. You cannot be arrested or jailed for it.

Any threat of arrest is an illegal scare tactic, period. It’s designed to bully you into paying. Along the same lines, a collector can’t threaten to garnish your wages or seize your property unless they’ve already taken you to court, won a judgment, and have the legal authority to do so. Making empty threats about lawsuits they don’t actually intend to file is also strictly forbidden.

If a debt collector has violated your consumer rights, you don’t have to take them on by yourself. The experienced consumer protection attorneys at Ginsburg Law Group PC are here to help you understand your options and fight back with a strong debt defense. Contact us today for a consultation to learn how we can defend your rights under the FDCPA, TCPA, FCRA, and other consumer protection laws.