Summary

Exit

Article: cedar financial debt

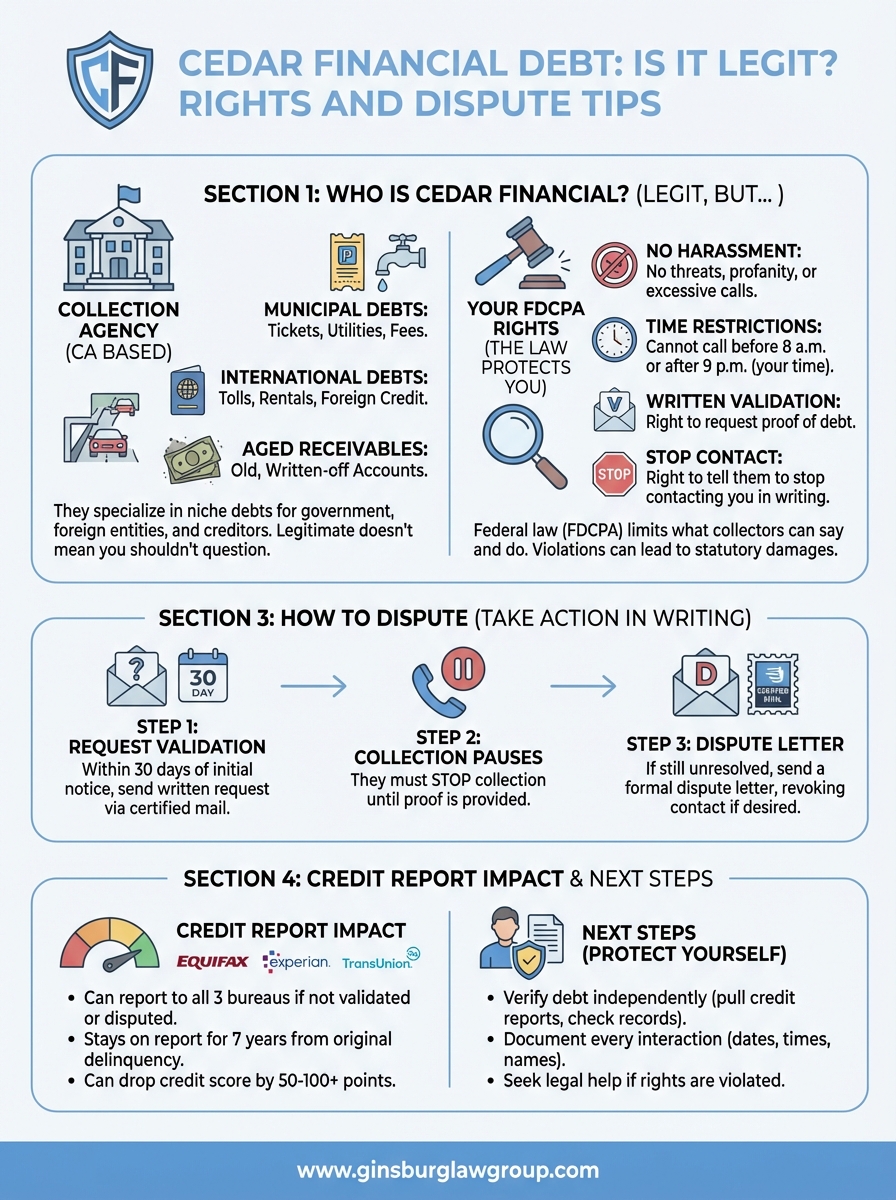

Cedar Financial is a legitimate California-based debt collection agency focusing on municipal fines, international toll violations, and purchased aged debt portfolios. While the company is legal, consumers should never pay without first verifying the claim's validity through a formal written validation request. Under the Fair Debt Collection Practices Act (FDCPA), individuals possess specific rights that prohibit collectors from utilizing harassment, misleading threats, or unauthorized communication. Within thirty days of the initial contact, you should send a dispute letter via certified mail to halt collection activity until documentation is provided. It is crucial to verify Cedar Financial’s licensing and compare the alleged debt against personal financial records or credit reports. Unpaid balances can significantly damage credit scores for up to seven years, though strategies like pay-for-delete agreements or credit bureau disputes may mitigate this impact. If Cedar Financial violates federal law by contacting you at prohibited times or misrepresenting their authority, you may be entitled to statutory damages. Documenting every interaction and understanding your legal protections ensures you can effectively challenge inaccurate claims and stop collector harassment. Seeking professional legal evaluation can provide additional leverage when dealing with persistent or unlawful collection attempts.

Getting a call or letter about Cedar Financial debt can catch you off guard, especially if you don’t recognize the company or the debt they claim you owe. Cedar Financial is a legitimate collection agency based in California that specializes in recovering debts for municipalities, utilities, and international creditors. But “legitimate” doesn’t mean you should pay without question or that their collection practices are always lawful.

Before you respond, you need to understand your rights under federal law. The Fair Debt Collection Practices Act (FDCPA) gives you specific protections against harassment, unfair tactics, and misleading statements from debt collectors. If Cedar Financial has crossed any lines, you may be entitled to statutory damages, and at Ginsburg Law Group, we’ve helped countless consumers fight back against collectors who don’t play by the rules.

This guide breaks down who Cedar Financial is, why they may be contacting you, how to verify any debt they claim, and what steps to take if you believe your rights have been violated.

Why Cedar Financial might be contacting you

Cedar Financial works with a wide range of clients, which means the debt they’re trying to collect could come from several different sources. Understanding why you’re being contacted helps you determine whether the claim is valid and how to respond. The company specializes in municipal accounts, international debts, and aged receivables that other collectors may have passed on.

Municipal and government debts

Cities, counties, and government agencies often hire Cedar Financial to recover unpaid fines, fees, and utility bills. If you’ve received a parking ticket you forgot about, an unpaid water or sewer bill, or a fine for a code violation, Cedar Financial may be the agency pursuing payment. These debts are typically documented and verifiable, but that doesn’t mean you can’t dispute the amount or the legitimacy of the charge.

Municipal debts can accumulate quickly because local governments add late fees and collection costs to the original balance. You might have moved and never received the initial notice, or the bill could have been sent to an old address. Cedar Financial debt in these cases often feels unexpected, especially if you haven’t lived in that city for years.

Municipal debts can follow you across state lines, and ignoring them may lead to wage garnishment or liens against your property in some jurisdictions.

International debts and toll violations

Cedar Financial also collects on behalf of foreign creditors and international toll authorities. If you’ve rented a car abroad and drove through toll zones without paying, or if you returned a rental vehicle with damage charges you disputed, Cedar Financial might be the agency contacting you months or even years later. These debts are notoriously difficult to track because communication barriers and currency conversions complicate the original transaction.

Rental car companies frequently sell unpaid balances to collection agencies like Cedar Financial. You may not have realized a charge was pending, especially if the rental company attempted to bill a credit card that expired or was declined. International parking tickets and speeding fines can also end up with Cedar Financial, and while enforcement varies by country, the debt can still appear on collection notices in the United States.

Purchased debt portfolios

Cedar Financial buys aged debt portfolios from original creditors who have written off the accounts. These debts can include old credit card balances, medical bills, or service charges that other collectors failed to recover. When a company sells your debt, you may have no prior relationship with Cedar Financial, which makes their contact feel suspicious.

Purchased debts are often past the statute of limitations for lawsuits, meaning Cedar Financial cannot take you to court to force payment. However, they can still attempt collection and report the debt to credit bureaus if it’s within the seven-year reporting window. Knowing the age of the debt and your state’s statute of limitations is critical before you make any payment or acknowledge the debt.

How to tell if Cedar Financial debt is legitimate

Before you pay or even acknowledge Cedar Financial debt, you need to verify the claim independently. Scammers frequently impersonate collection agencies, and even legitimate collectors sometimes pursue debts that aren’t yours or that you’ve already paid. Federal law gives you the right to request proof, and Cedar Financial must provide documentation showing they have legal authority to collect and that the debt is accurate.

Request written validation within 30 days

When Cedar Financial first contacts you, they must send a validation notice within five days that includes the creditor’s name, the amount owed, and a statement of your dispute rights. You have 30 days from receiving this notice to request debt validation in writing. Send your request via certified mail with a return receipt so you have proof of delivery.

Once Cedar Financial receives your validation request, they must stop all collection activity until they provide sufficient documentation. This documentation should include the original creditor’s name, the account number, an itemized breakdown of the debt, and proof that Cedar Financial owns the debt or has authority to collect it. If they cannot provide this proof, they must cease collection efforts entirely.

Requesting validation in writing creates a paper trail that protects you if the collector later violates your rights or attempts to sue.

Verify Cedar Financial’s identity and licensing

Scammers often pose as legitimate agencies, so verify Cedar Financial’s contact information before responding. The company operates from California and holds collection licenses in multiple states. You can check their licensing status through your state’s Department of Financial Protection or similar regulatory agency. Legitimate collectors will provide their physical address and license numbers upon request.

Compare the debt against your records

Pull your credit reports from all three bureaus and check your personal financial records to see if the debt appears legitimate. Look for the original creditor, the date the account was opened, and when it went delinquent. If Cedar Financial claims you owe money for a municipal fine or international rental charge, request documentation from the original entity. You may need to contact the city, toll authority, or rental company directly to confirm the debt exists.

Your rights during debt collection calls and letters

The Fair Debt Collection Practices Act (FDCPA) protects you from abusive, deceptive, and unfair collection practices, and Cedar Financial must follow these rules when attempting to collect any debt. You have specific rights that limit what collectors can say, when they can contact you, and how they can pursue payment. Knowing these protections helps you recognize violations and gives you leverage to stop harassment or pursue legal action if the collector crosses the line.

What Cedar Financial cannot do

Federal law prohibits Cedar Financial from using threats, profanity, or harassment to pressure you into paying. They cannot call you repeatedly with the intent to annoy, contact you before 8 a.m. or after 9 p.m. in your time zone, or falsely claim to be attorneys or law enforcement if they are not. If they tell you that you will be arrested, that your wages will be garnished without a court order, or that they can seize your property without legal process, they have violated your rights.

Cedar Financial debt collectors also cannot misrepresent the amount you owe or add unauthorized fees. They must provide accurate information about the debt and cannot threaten legal action they do not intend to take or are not legally permitted to pursue. Publishing your debt to harm your reputation or contacting your employer about the debt (except to verify employment for garnishment purposes after a judgment) is also illegal.

If Cedar Financial violates the FDCPA, you can sue them for up to $1,000 in statutory damages plus any actual damages, and they must pay your attorney fees if you win.

Time and place restrictions

Collectors must stop contacting you at work if you tell them your employer prohibits personal calls. You can revoke this permission verbally during a call or send written notice to establish a clear record. Cedar Financial must honor your request immediately and cannot continue workplace contact after you’ve informed them it is not allowed.

Third-party contact is also restricted. Cedar Financial cannot discuss your debt with family, friends, neighbors, or coworkers except to locate you. They can contact these people only once unless they believe the person has new location information. Revealing that you owe a debt to anyone other than you, your spouse, or your attorney is a federal violation that can result in significant penalties.

How to dispute the debt and limit contact

If you believe Cedar Financial debt is inaccurate or you want to stop their calls entirely, federal law gives you the power to take action in writing. Disputing the debt forces the collector to provide proof before continuing collection efforts, and you can legally restrict how and when they contact you. These protections exist under the FDCPA, and Cedar Financial must comply with your written requests or face penalties.

Send a written dispute letter

You can challenge any Cedar Financial debt by sending a dispute letter within 30 days of receiving their initial validation notice. Your letter should clearly state that you dispute the debt and request full documentation proving its validity. Include your name, the account number they referenced, and a statement that you do not acknowledge the debt until they provide verification. Send this letter via certified mail with return receipt to create proof of delivery and the date Cedar Financial received your dispute.

Once Cedar Financial receives your dispute, they must stop all collection activity until they send you verification. They cannot report the debt to credit bureaus, contact you about payment, or threaten legal action during this period. If they resume collection without providing adequate proof, they violate federal law. Your dispute letter should request copies of the original creditor agreement, account statements showing the debt accrual, and documentation proving Cedar Financial has legal authority to collect.

A properly timed dispute letter can halt collection efforts indefinitely if the collector cannot provide sufficient documentation to verify the debt.

Request limited or no contact

You have the right to tell Cedar Financial to stop contacting you or to limit how they reach you. Send a written request stating that you revoke consent for phone calls and prefer communication only by mail. You can also specify that they contact you only at certain times or through your attorney if you have legal representation. Cedar Financial must honor your request and can only contact you again to confirm they will stop or to inform you of specific legal action they intend to take.

Limiting contact does not erase the debt, but it stops the harassment and gives you space to evaluate your options. If Cedar Financial continues calling after receiving your written request, they violate federal law and you can sue them for damages.

International tickets, municipal debts, and credit reports

Cedar Financial debt often involves municipal fines, international toll violations, and parking tickets that many consumers don’t realize can affect their credit reports. While these debts originate from government agencies or foreign creditors rather than traditional lenders, Cedar Financial can still report unpaid balances to Equifax, Experian, and TransUnion once the account enters collections. Understanding how these specific debt types appear on your credit and what you can do to address them protects your financial standing and prevents long-term damage to your credit score.

How these debts reach your credit report

Municipal debts and international charges typically go through multiple steps before appearing on your credit report. The original creditor must attempt collection through internal processes first, which can take months or even years depending on the agency’s procedures and your location. Once the municipality or international entity sells or assigns the debt to Cedar Financial, the collector has the option to report the account as a collection item if the debt remains unpaid.

Cedar Financial cannot report the debt immediately after acquiring it. They must first send you validation notice and give you the opportunity to dispute. If you don’t challenge the debt within 30 days or if they successfully validate it, they can report the collection to all three credit bureaus. The impact on your credit score depends on the amount owed and how recently the collection was added, but any collection account damages your creditworthiness and makes securing loans or credit cards significantly harder.

Collection accounts from municipal or international debts can remain on your credit report for seven years from the date the original debt became delinquent, even if you eventually pay the balance.

Credit report impact and removal strategies

A Cedar Financial collection can drop your credit score by 50 to 100 points depending on your existing credit profile and the debt amount. If you had good credit before the collection appeared, the damage is often more severe because collections represent a major negative event on an otherwise clean report. Multiple collection accounts from Cedar Financial or other agencies compound the damage and signal to lenders that you present high credit risk.

You can challenge inaccurate collections by disputing them directly with the credit bureaus through their online portals or by certified mail. If Cedar Financial cannot verify the debt with proper documentation, the bureaus must remove it from your report. Paying the collection does not automatically remove it, but some consumers negotiate pay-for-delete agreements where Cedar Financial agrees to remove the entry in exchange for full payment. Get any deletion promise in writing before sending money.

Next steps

Dealing with Cedar Financial debt requires understanding your rights and taking documented action to protect yourself from harassment or inaccurate collection attempts. Start by requesting written validation if you haven’t already, and check your credit reports to see if the collection has damaged your score. If Cedar Financial has violated the FDCPA through repeated calls, threats, or misrepresentations, you may have grounds for legal action that results in statutory damages and forces them to pay your attorney fees.

You don’t have to navigate debt collection laws alone or accept a collector’s word as final. Document every interaction, keep copies of all correspondence, and never pay a debt until you’ve verified its legitimacy and explored your options. If Cedar Financial refuses to validate the debt or continues contacting you after you’ve requested they stop, those violations give you leverage in negotiations or court.

Contact Ginsburg Law Group for a free case evaluation if you believe Cedar Financial has violated your consumer rights or if you need help disputing a collection account.