When you’re contacted about a debt you don’t believe you owe, your first move isn’t to panic or pay—it’s to challenge the claim. You must demand proof from the collector that the debt is valid and that they have the legal authority to collect it. This simple act of debt defense shifts the burden of proof from you to them, forcing collectors to back up their claims before they can take another step.

Know Your Rights: Your Shield Against Debt Collectors

Before writing a letter or picking up the phone, your most powerful asset is knowing your consumer rights. Dealing with a debt collector is designed to be intimidating, but a suite of federal laws has your back. Key statutes like the Fair Debt Collection Practices Act (FDCPA), the Telephone Consumer Protection Act (TCPA), and the Fair Credit Reporting Act (FCRA) form the foundation of your debt defense.

These aren’t just dense rulebooks; they’re practical tools you can use right away. Think of them as your strategic playbook, spelling out exactly what a collector can and can’t get away with. Understanding these rules lets you act with confidence, turning a situation that feels scary into one where you’re in control.

The Fair Debt Collection Practices Act (FDCPA)

The FDCPA is your front-line defense against abusive, deceptive, or unfair collection tactics. It’s aimed specifically at third-party debt collectors—the companies that buy up old debts for pennies on the dollar or are hired by the original creditor to collect on an account.

This law draws clear lines in the sand. For instance, a collector can’t harass you. That means no threatening language, no calling you repeatedly just to annoy you, and no publishing your name on a “bad debt” list. They also can’t use deception, like inflating the amount you owe, misrepresenting their identity, or pretending to be a law enforcement officer.

One of the most useful protections under the FDCPA is your right to control how they contact you. You can tell a collector in writing to stop contacting you, and they must comply. They’re also forbidden from calling at “inconvenient times,” legally defined as before 8 a.m. or after 9 p.m. your time, unless you give them permission. You can find more practical ways to use these rules in our guide on the Fair Debt Collection Practices Act.

A key part of the FDCPA is the ‘mini-Miranda’ warning. The first time a collector contacts you, they must tell you they are a debt collector and that any information they get will be used to collect the debt. When you hear that, it’s your signal that the FDCPA rules are officially in play.

The Fair Credit Reporting Act (FCRA)

While the FDCPA governs how collectors behave, the FCRA is all about ensuring the information on your credit report is accurate. This law becomes incredibly important when you’re disputing a debt because an unverified or incorrect account can severely damage your credit score.

The FCRA gives you the legal right to an accurate credit report and the power to dispute any information you believe is incorrect. If a collector places an account on your report that isn’t yours, has the wrong balance, or is too old to be reported, you can file a formal dispute with the credit bureaus (Experian, Equifax, and TransUnion).

Once you file a dispute, the credit bureau has a legal duty to investigate, typically within 30 days. They must contact the source of the information—in this case, the debt collector—and ask them to verify it. If the collector can’t prove the debt is accurate and verifiable, the credit bureau must delete it from your report. This is a cornerstone of consumer rights and effective debt defense.

It’s more important than ever to know these rights. In the first quarter of this year alone, Americans filed a staggering 112,583 complaints with the Federal Trade Commission about debt collectors. Even more concerning, nearly 47% of those complaints involved abusive, threatening, or harassing behavior. You can see more data on these surging debt collection complaints on NumberBarn.com.

Crafting Your Debt Validation Letter

Alright, you know your consumer rights. Now it’s time to put them to work. The most powerful first move you can make against a debt collector is sending a debt validation letter. This isn’t just sending a form letter; it’s a strategic legal maneuver that puts the burden of proof right where it belongs: on the collector.

Think of this letter as your official demand for evidence. By sending it, you legally require the collector to prove the debt is legitimate and that they actually have the right to collect it from you. This simple action triggers your FDCPA protections and forces them to stop all collection activity until they can provide that proof. It’s your chance to pause the harassment and regain control.

What Your Letter Needs to Accomplish

The goal here is simple and direct: clearly state that you are disputing their claim and require validation. You have to resist the urge to tell your side of the story, explain your financial hardships, or use emotional language. Any of that can—and will—be used against you.

Your letter should be professional, concise, and focused on a few key points:

- A clear statement that you are disputing the debt.

- The original account number they’ve associated with the claim.

- A demand that they cease all communication until the debt is properly verified.

This is not the time to offer a small payment or negotiate. Keep it strictly business.

I’ve seen this happen countless times: someone makes a small “good faith” payment just to get a collector off their back. Never do this for a debt you’re disputing. Paying even a single dollar can be legally interpreted as you admitting the debt is yours. Worse, in many states, it can restart the statute of limitations, giving them a fresh clock to sue you.

Key Information to Demand in Your Letter

To make this work, you can’t just vaguely ask for “proof.” A weak request will get you a generic printout with a balance, which proves nothing. You are legally entitled to ask for specific, detailed verification.

Here’s what you should absolutely demand in your letter:

- Proof You Owe the Debt: A copy of the original signed contract or application with the original creditor.

- Original Creditor Details: The full name and address of the creditor you supposedly first owed money to. It can sometimes be tough to find your original creditor, but it’s a non-negotiable piece of the puzzle.

- A Full Account Breakdown: A complete history of the account, showing all charges, interest, fees, and payments from day one.

- Proof of Their Authority: Documentation showing the debt was legally sold or assigned to them, giving them the authority to collect.

- Licensing Information: Proof that their agency is licensed to collect debts in your state.

By demanding these specifics, you force them to actually do their homework. Many debt buyers purchase old accounts in massive portfolios with little to no original documentation. It’s surprisingly common for them to have nothing more than a name and a balance on a spreadsheet. When faced with a proper validation request, they often just drop the account and move on.

The following table breaks down exactly what to include in your letter to make sure it’s legally sound and effective.

Essential Components of an Effective Debt Validation Letter

| Component | What to Include | Why It Matters |

|---|---|---|

| Your Information | Your full name and current mailing address. | Identifies you clearly, but do not include other personal info like your SSN or date of birth. |

| Collector’s Information | The collection agency’s name and address, as it appears on their notice. | Ensures the letter is directed to the correct entity and creates a clear record. |

| Date | The date you are writing and sending the letter. | Establishes a clear timeline for the 30-day validation period under the FDCPA. |

| Dispute Statement | A clear sentence like, “I am writing to dispute the validity of this debt.” | This is the official language that triggers your legal rights and their obligations. |

| Account Reference | The specific account number or reference number provided by the collector. | Helps the collector identify the exact account you are disputing without you admitting ownership. |

| Request for Validation | List the specific documents you are demanding (e.g., original contract, payment history). | Forces them to provide concrete proof, not just a summary statement. Vague requests get vague answers. |

| Cease Communication Clause | A statement demanding they cease all communication until the debt is verified. | Legally obligates them to stop calling and writing until they send you proof. |

| Proof of Mailing | State that you are sending the letter via Certified Mail with a return receipt requested. | Puts them on notice that you are creating a legal paper trail they can’t deny. |

Putting these elements together creates a powerful legal document that collectors are required by law to take seriously.

The Critical Final Step: Sending Your Letter

How you send the letter is just as important as what’s inside it. You need an ironclad paper trail proving you sent it and, more importantly, that they received it. The only way to do this is by using USPS Certified Mail with a return receipt requested.

For a few extra dollars, you’ll get a green postcard mailed back to you, signed by someone at the collection agency. That receipt is gold—it’s your legal proof of the exact date they were notified of your dispute. File it away safely with a copy of your letter and the original mailing receipt.

This documentation becomes your shield and your sword. If the collector ignores your request and keeps contacting you, they are now in clear violation of the FDCPA. This small step is often the deciding factor. The Consumer Financial Protection Bureau (CFPB) received 207,800 debt collection complaints last year, and a staggering 93,510 of them were for attempts to collect a debt the consumer didn’t actually owe. As highlighted in Marcadis Law’s analysis of complaint trends, a proper dispute is your strongest defense.

Protecting Your Credit Report During the Dispute

A debt dispute isn’t just a private disagreement between you and a debt collector. Your credit score is often caught in the crossfire, and an unverified negative mark can do real, lasting damage. That’s why protecting your credit report during this process is just as vital as sending that initial validation letter.

This means you need a separate, proactive strategy focused on the three major credit bureaus: Experian, Equifax, and TransUnion. While the FDCPA deals with the collector’s actions, the Fair Credit Reporting Act (FCRA) is your best tool for cleaning up your credit files. This federal law gives you the power to challenge any information you believe is inaccurate, incomplete, or can’t be proven.

Pull and Scrutinize Your Credit Reports

First things first: you need to see exactly what the collector is reporting about you. You’re entitled to free weekly credit reports from all three bureaus through the official government-mandated site, AnnualCreditReport.com. Make sure you pull reports from all three—collectors don’t always report to each one, and you need the full picture.

Once you have the reports, it’s time to go through them with a fine-tooth comb. Zero in on the specific account the collector contacted you about. Pay close attention to these details:

- The original creditor’s name and the account number.

- The balance they’re reporting. Does it match what the collector is claiming you owe?

- The date of first delinquency and other important dates.

- Any personal information tied to the account.

Even a small discrepancy is enough to file a formal dispute. If you spot errors, you can get more information on your rights by reading up on the Fair Credit Reporting Act.

Filing a Formal Dispute with the Credit Bureaus

Finding a mistake is one thing; getting it removed is another battle entirely. Each credit bureau has its own online dispute portal, and this is almost always the fastest way to get the ball rolling. Remember, you have to file a separate dispute with each bureau that shows the incorrect information.

When you file, be direct and stick to the facts. Clearly state why you believe the information is wrong. For instance, you could write, “This account is not mine,” or “The balance shown is incorrect; my records show it was paid in full on [Date].”

Here’s a pro tip: You absolutely must provide evidence. Just saying an item is wrong isn’t enough to win. Attach a copy of your debt validation letter, the certified mail receipt, a police report if it’s identity theft, or any other document that backs up your claim. This moves the dispute from your word against theirs to a matter of documented proof.

After you submit your dispute, the FCRA gives the credit bureau a deadline—usually 30 days—to conduct a reasonable investigation. They will reach out to the debt collector who furnished the information and ask them to verify its accuracy. If the collector can’t prove it or simply doesn’t respond, the bureau is legally required to delete the negative item from your report.

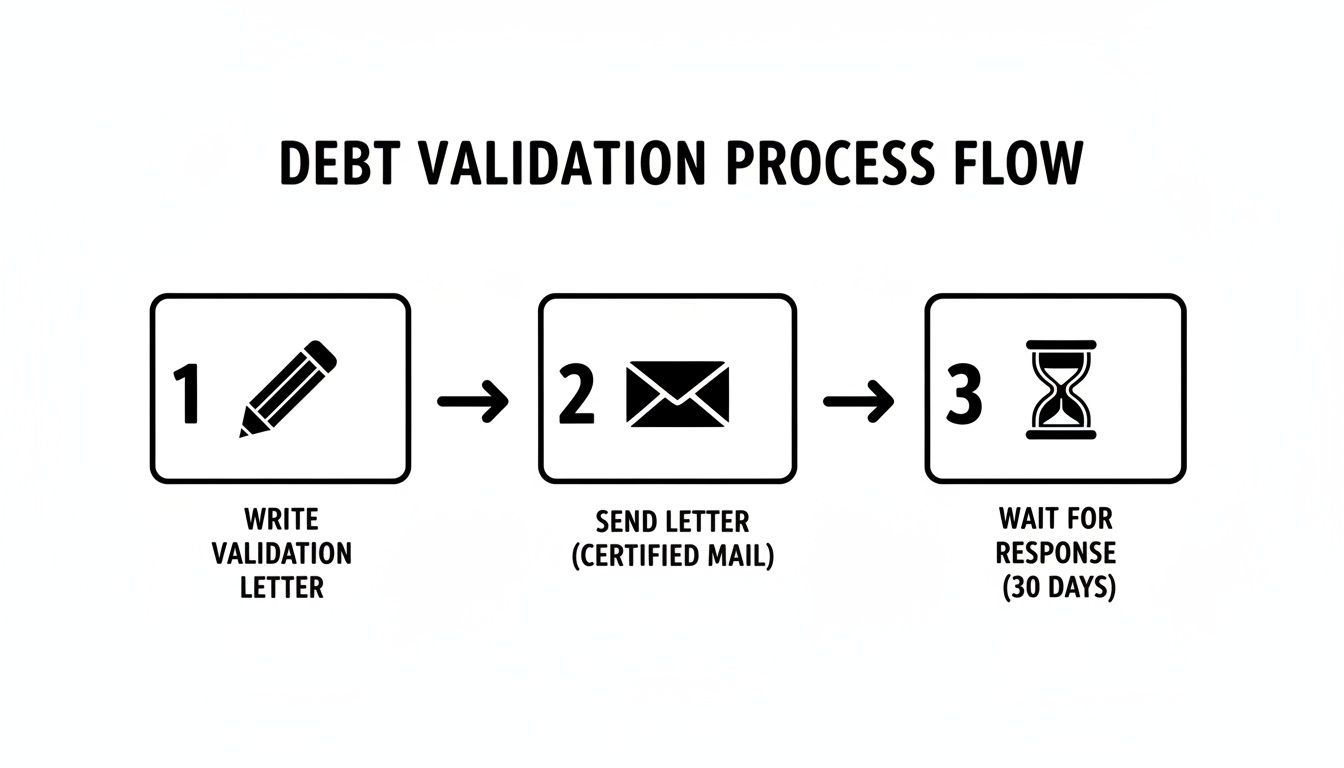

This flowchart breaks down the core of the process: writing the letter, sending it securely, and then waiting for the legally mandated response.

When the Bureaus Verify Incorrect Information

So, what happens if the collector doubles down, “verifies” the incorrect debt, and the credit bureau refuses to remove it? It’s a frustratingly common scenario, but don’t give up. You still have options.

Your next step is to add a consumer statement to your credit file. Under the FCRA, you have the right to add a 100-word statement to your report explaining your side of things. While this won’t actually remove the negative mark, anyone who pulls your credit in the future—like a mortgage lender or landlord—will see your explanation right next to the disputed account.

Keep your statement professional and straight to the point. Something like this works well: “This account is inaccurate. I disputed this debt with the collector (Account #XXXXX) on [Date] via certified mail. The collector failed to provide legally required validation. This entry is unverified and incorrect.”

This statement gets your side of the story on the official record, providing crucial context that can help protect your financial reputation while you figure out what to do next.

What to Do When a Debt Collector Sues You

It’s a heart-stopping moment: a court summons arrives with your name on it. Seeing that legal document can make you want to freeze up, but what you do in the next few days is absolutely crucial. When a debt dispute turns into a lawsuit, your strategy must evolve from sending letters to mounting a formal legal debt defense.

This is a serious escalation, and you have to treat it that way. Debt collectors often file lawsuits betting that you won’t show up. If you don’t, they win by default.

Do Not Ignore a Court Summons

The single biggest mistake you can make is to ignore the lawsuit. Tossing the papers aside won’t make the problem vanish; in fact, it guarantees a much worse outcome.

If you miss the deadline to respond in court, the collector’s attorney will simply ask the judge for a default judgment. That’s an automatic win for them, and it hands them a set of powerful legal tools to take your money.

With a default judgment in hand, they can legally come after your assets through:

- Wage Garnishment: Taking a chunk of money directly out of every paycheck.

- Bank Levies: Freezing your bank account and seizing the funds to pay the debt.

- Property Liens: Placing a legal claim on your property, like your house or car.

This entire scenario is avoidable, but only if you act fast. The clock starts ticking the second you’re served with those papers.

Understand the Summons and Your Deadline

The documents you receive—usually a Summons and a Complaint—are packed with vital information. The Summons is the court’s official notice telling you that you’ve been sued. The Complaint is the document from the collector’s lawyer outlining why they are suing you and what they want.

Right away, your most important task is to find the response deadline. This deadline varies by state and court, but it’s typically somewhere around 20 to 30 days. This isn’t a suggestion; it’s a hard legal cutoff. The formal document you file in response is called an Answer.

This is the point where the game changes. You are no longer just dealing with a collection agency; you are now involved in a court case. The rules are different, the stakes are higher, and a misstep can have severe financial consequences.

Building Your Legal Defense Strategy

Just because you’ve been sued doesn’t mean the collector has an airtight case. In fact, many collection lawsuits are built on shaky ground, hoping you won’t push back. Your job, through your formal Answer, is to challenge their claims and lay out your debt defense.

Here are some of the strongest legal defenses you can use in debt collection lawsuits:

- Expired Statute of Limitations: Every state has a legal time limit, known as the statute of limitations, on how long a creditor can wait to sue you over a debt. If that clock has run out, they have legally lost their right to sue.

- Lack of Standing: The collector suing you must prove they have the legal right to do so. This means showing a clear, unbroken chain of ownership for your specific debt. You’d be surprised how often they can’t produce this paperwork.

- Incorrect Amount: If the collector has padded the balance with illegal fees, miscalculated the interest, or is simply suing for the wrong amount, you can challenge the total they claim you owe.

- FDCPA Violations: Did the collector harass you, lie to you, or fail to validate the debt when you asked before filing the lawsuit? If they violated your consumer rights under the Fair Debt Collection Practices Act, you might be able to file a counterclaim against them.

Raising these defenses forces the collection attorney to prove every single element of their case. Many of them can’t—or simply won’t bother—once they realize you’re putting up a real fight. The court system is currently swamped with these cases. As The Pew Charitable Trusts reports, debt collection lawsuits are overwhelming U.S. courts, making a solid dispute strategy more important than ever.

Seeking Professional Legal Help

While you technically have the right to represent yourself (known as “pro se”), getting sued is a flashing red light that it’s time to talk to a consumer law attorney. The law firms that file these suits handle thousands of them. They know the system inside and out, and they are counting on you not knowing the rules.

An experienced consumer rights attorney can spot weaknesses in the collector’s case you’d never see. They know how to properly draft and file your Answer, raise the strongest legal defenses, and can even turn the tables by suing the collector back for FDCPA violations. Better yet, the FDCPA has a “fee-shifting” provision, which means if you win, the collector might have to pay your attorney’s fees. This makes getting expert legal help far more affordable than most people think.

Don’t let a lawsuit bully you into silence. Responding correctly and asserting your rights is your first and best step toward defeating the claim and protecting your financial future.

When to Partner with a Consumer Law Attorney

You can absolutely handle the first few rounds of a debt dispute on your own. But there’s a tipping point where DIY becomes a liability. Some situations flat-out require the expertise and legal authority of a consumer law attorney.

Hiring a lawyer isn’t throwing in the towel. Far from it. It’s a strategic decision to level a playing field that is, by design, tilted in the debt collector’s favor. Your debt validation letter is a potent first move, but if a collector ignores it or decides to get aggressive, you need to bring in bigger guns. Knowing when to make that call can be the difference between a clean resolution and a world of financial hurt.

The Undeniable Red Flags

Certain scenarios are not subtle hints; they are glaring, flashing signs that you need legal backup, and you need it now. Don’t “wait and see” what happens next. If you run into any of these, your very next step should be finding an attorney who specializes in consumer rights and debt defense.

- You’ve Been Sued. As we’ve discussed, a lawsuit is the ultimate escalation. The court system is a maze of procedural rules and unforgiving deadlines. Going it alone against a seasoned collection attorney is a gamble you can’t afford to lose.

- Your Validation Request is Ignored. You sent a validation letter by certified mail, have the receipt, and yet the collector is still blowing up your phone or reporting the debt without sending a shred of proof. This is a clear-cut violation of the FDCPA, and an attorney will know exactly how to leverage it.

- The Harassment Doesn’t Stop. If the calls are abusive or the threats continue, an attorney can shut it down, often with a single letter. Collectors who bully consumers tend to change their tune the moment they get a formal letter of representation from a law firm.

- The Credit Bureaus Refuse to Budge. You’ve disputed a blatant error with Experian, Equifax, or TransUnion, provided solid evidence, and they still “verify” it as accurate. A lawyer can take the fight to the next level under the Fair Credit Reporting Act (FCRA).

These red flags mean the collector is either willfully breaking the law or betting that you don’t have the resources or knowledge to fight back. A lawyer is the message that you do.

I see it all the time—people think hiring a lawyer is a luxury they can’t afford. But for many consumer protection cases, the reality is you might pay little to nothing out of your own pocket.

How Can You Possibly Afford Legal Help?

This is probably the single most important thing to understand when you’re in this fight. Federal consumer rights laws like the Fair Debt Collection Practices Act (FDCPA) and the Fair Credit Reporting Act (FCRA) were written with powerful “fee-shifting” provisions.

This legal mechanism is a total game-changer.

What it means is this: if you sue a debt collector or credit bureau for breaking the law and you win, the law requires the defendant—the company that violated your rights—to pay your attorney’s fees and court costs.

Congress designed the laws this way intentionally. They knew that an average person couldn’t afford to pay a lawyer by the hour to take on a multi-billion dollar corporation. Fee-shifting is what makes justice accessible. It allows consumer attorneys to take on strong cases without asking for a big check from you upfront. Their paycheck comes from the other side when they win.

Your Attorney Is Your Shield and Your Sword

A good consumer law attorney does so much more than file paperwork. They become your advocate, your strategist, and your shield. They take over all communications, so the harassing calls stop immediately. They’ll scrutinize every detail of your case, looking for legal weaknesses to exploit.

They’ll spot violations you might have missed entirely, like an expired statute of limitations that makes the debt legally uncollectible or a missing link in the debt’s chain of ownership.

Bringing in a lawyer isn’t a last resort. In the face of an aggressive or law-breaking collector, it’s the most powerful move you can make.

Common Questions About Disputing Debt

Going head-to-head with a debt collector can bring up a lot of “what if” scenarios. It’s a process filled with legal terms and strict deadlines, so it’s completely normal to have questions. Let’s clear up some of the most common ones that come up when you’re figuring out how to dispute a debt.

What Happens if I Miss the 30-Day Deadline?

That initial 30-day window to send a validation letter is your golden opportunity. It’s when you have the most power under the FDCPA. If you miss it, the collector is no longer legally required to stop collection efforts while they dig up proof.

But don’t panic—it’s not a total loss. You can, and absolutely should, still send a validation letter. A collector can’t legally pursue a debt they can’t prove you owe, period. Sending the letter late is far better than not sending it at all. It still puts them on the spot to verify their records and gives you a paper trail.

Can a Collector Just Ignore My Validation Request?

Absolutely not. If you sent your validation request within that critical 30-day period, the law is on your side. The collector must stop all collection activities—no calls, no letters, no credit reporting—until they’ve sent you proof.

If they keep contacting you anyway, they’ve just broken the law and violated the FDCPA. That’s a major mistake for them and a huge advantage for you.

This is where your documentation becomes your best weapon. Log every single call, save every letter, and screenshot every email they send after you’ve mailed your request. This evidence is exactly what you’d need to build a solid legal case against them for their violations.

Will Disputing a Debt Hurt My Credit Score?

This is a big one, but the short answer is no. Simply disputing a debt doesn’t damage your credit. In fact, it’s the most important step you can take toward removing an inaccurate negative mark that’s already hurting your score. Think of it as cleaning up your financial record for the long haul.

Once you file a formal dispute with a credit bureau, they usually place a temporary comment on your report stating the account is “in dispute.” If you win the dispute and the item gets deleted, you’ll almost certainly see your credit score go up.

Should I Send a Debt Validation or Cease and Desist Letter?

Nine times out of ten, a debt validation letter is the right first move. It’s a direct challenge that says, “Prove it.” The burden of proof shifts entirely to the collector to show that the debt is legitimate and that you’re the one who owes it.

A cease and desist letter, however, simply tells them to stop contacting you. It doesn’t make the debt go away. The collector might stop calling, but they could still sue you or keep the negative item on your credit report.

Here’s a simple way to look at it:

- Validation Letter: “Prove to me that this debt is even real.”

- Cease and Desist: “Stop bothering me about this debt.”

Always start by demanding they validate the debt. If they can’t, the problem often solves itself. A cease and desist is a tool for a different situation—like stopping harassment for a debt you already know is valid but just can’t pay right now.

Navigating debt disputes can be complex, but you don’t have to do it alone. The team at Ginsburg Law Group PC is dedicated to defending consumer rights and providing expert legal guidance on everything from FDCPA violations to debt defense and estate planning. If you’re facing a tough financial situation, we are here to help you understand your options and fight for the best possible outcome.