The short answer? Yes, a debt collector can try calling you at work. But here’s the crucial part: you have the absolute right to make them stop, a right protected by powerful consumer defense laws.

Federal law, specifically the Fair Debt Collection Practices Act (FDCPA), acts as your shield. If you simply tell a collector—verbally or in writing—that your employer doesn’t allow personal calls, they are legally required to stop immediately. Understanding this and other consumer rights is the first step in effective debt defense.

Your Rights When Debt Collectors Call Your Job

Getting a call from a collection agency is stressful enough at home. At work, it’s a whole different level of anxiety. A tense conversation overheard in a cubicle can spark gossip with coworkers or, even worse, earn you a reprimand from your boss. The fear of your job being on the line because of a personal debt is very real.

This is exactly why consumer rights laws like the FDCPA were created. Lawmakers recognized that letting bill collectors harass you on the job could put your entire livelihood in jeopardy. The most important protection you have is a straightforward rule baked right into this cornerstone of consumer law.

The FDCPA’s Workplace Protection Rule

Under the Fair Debt Collection Practices Act, first passed in 1977, debt collectors are flat-out forbidden from calling you at work if they have reason to believe your employer prohibits it. This single consumer right is your key to keeping your professional life separate from personal financial matters.

Think about it. You’re at your desk, trying to meet a deadline, and the phone rings with a collector on the other end. That’s a huge distraction and a source of unnecessary stress. When you consider that major collection agencies make nearly 87 million consumer contacts a month—that’s over 1 billion contacts a year—it’s clear why this protection is so vital. You can dig deeper into the scale of U.S. debt collection to see just how big this industry is.

You Are in Control

The most powerful part of this rule is that you are the one who tells the collector about your workplace policy. You don’t need to get a note from HR or send them a copy of the employee handbook. All it takes is your word.

Once you tell a debt collector, “My employer does not permit me to receive these calls at work,” they are legally obligated to end the call and never contact you at that number again. Ignoring your request is a direct violation of federal consumer protection law.

This simple statement puts the control squarely back in your hands. The law was designed to be easy for consumers to use, ensuring that you can enforce your rights without jumping through hoops. Knowing this transforms you from someone just enduring harassing calls into an empowered individual who can shut them down for good.

Here’s a quick reference for what to do the moment you get a call at work.

Quick Guide to Stopping Workplace Collection Calls

| Action to Take | What to Say or Do | Your Legal Protection Under the FDCPA |

|---|---|---|

| State the Rule Verbally | Clearly say: “My employer does not allow personal calls at work. Do not call this number again.” | § 1692c(a)(3) – Prohibits communication at the consumer’s place of employment if the collector knows or has reason to know the employer disallows such calls. |

| Document the Call | Immediately write down the date, time, collector’s name, and the company they represent. Note exactly what you said. | This creates a log of evidence in case they violate the law by calling again. |

| Send a Written Follow-Up | Mail a certified cease-and-desist letter reiterating that your employer forbids these calls. | Creates a solid paper trail, making it undeniable that the collector was put on notice. |

By taking these simple steps, you are not just asking them to stop—you are legally instructing them to.

Understanding Your FDCPA Shield Against Harassment

Think of the Fair Debt Collection Practices Act (FDCPA) as your personal legal armor against aggressive debt collectors. This powerful federal consumer rights law was specifically built to stop abuse, and it lays down clear, non-negotiable rules that collectors have to follow—especially when it comes to contacting you at work.

The FDCPA isn’t just a list of polite suggestions; it’s the law. Its core mission is to shield you from harassment, deceit, and other unfair tactics. While we’ve talked about how it can stop calls to your job, its protections are actually much broader, giving you a solid defense against a wide range of predatory behavior.

Your Word Is Your Power

One of the most potent weapons the FDCPA gives you is control over workplace calls. The law is very clear: a collector cannot call you at work if they “know or have reason to know” that your boss forbids personal calls. The wording here is deliberately crafted to put the power in your hands.

So, how do they “know”? It’s surprisingly simple. You just have to tell them. A clear verbal statement is all it takes to legally put them on notice.

It’s like putting up a “No Trespassing” sign on your work line. The moment you say, “My employer does not allow these calls,” you’ve posted that sign. Any collector who calls back is now knowingly and illegally crossing a boundary you’ve set. They can’t play dumb after you’ve warned them directly.

This rule is a direct response to the reality of the debt collection industry. The volume of calls is almost unbelievable—ACA International members alone attempt over 1 billion contacts every year. With some collectors making around 20 calls per hour, this FDCPA rule is a critical defense to keep that kind of relentless pressure from costing you your job. You can dig into the data yourself by reading about the trends in debt collection communication on TransUnion.com.

Key Protections Beyond Workplace Calls

The FDCPA’s shield doesn’t just cover your desk phone; it protects you from all sorts of harassment. Getting familiar with these other consumer rights helps you spot illegal behavior right away. If a collector repeatedly breaks the law, you might have a strong case against them. You can learn more about what that entails in our in-depth guide to the Fair Debt Collection Practices Act.

Here are some other crucial protections the FDCPA provides:

- Time Restrictions: Collectors can’t call you at all hours. The law establishes a clear window for contact, making calls before 8:00 a.m. or after 9:00 p.m. in your local time zone illegal, unless you’ve specifically told them it’s okay.

- Third-Party Contact Limits: A debt collector is strictly forbidden from discussing your debt with anyone else. They are allowed to contact a third party, like a relative or neighbor, but only to ask for your address and phone number. They can’t mention they’re a debt collector or that you owe money.

- Prohibition on Harassment: The FDCPA flat-out bans any conduct meant to harass, oppress, or abuse you. This includes everything from using profanity and threatening violence to calling over and over again just to annoy you.

- No False Statements: Collectors cannot lie to you. Period. This is a core consumer right. They are barred from misrepresenting how much you owe, falsely claiming to be an attorney or a government official, or threatening to have you arrested when they have no power to do so.

When you know these rules, you’re no longer an easy target. You can confidently tell when a collector has gone from being persistent to being illegal.

How to Legally Stop Debt Collection Calls at Work

Knowing your rights under the FDCPA is one thing, but actually using them is how you get your life back. This consumer law gives you a clear path to legally stop collectors from calling your job. It’s a straightforward process that starts with a simple verbal instruction and should always be backed up in writing.

Step 1: Use a Simple Script on the Phone

The next time a bill collector calls your work phone, you don’t need to get into a debate. You just need one powerful sentence. Stay calm, be direct, and make your point clearly.

Try this simple script:

“My employer prohibits personal calls like this at work. You are legally required to stop calling me at this number. Do not call me here again.”

That’s it. Once those words are out of your mouth, the collector is officially on notice. Any call they make to your job after that is a potential violation of federal law.

As soon as you hang up, grab a notebook and jot down the date, time, the collector’s name, and their company. This simple log is the start of your evidence trail, just in case they don’t listen.

Step 2: Solidify Your Request With a Written Letter

A verbal request carries legal weight under the FDCPA, but it can quickly turn into a “he said, she said” argument. A collector can simply claim you never told them to stop.

This is exactly why you need to follow up with a written cease-and-desist letter. It creates an undeniable paper trail that becomes powerful evidence if you ever have to take legal action.

Always send the letter using certified mail with a return receipt requested. This service gives you legal proof of when the collection agency received your demand, leaving them no room to claim they never got it.

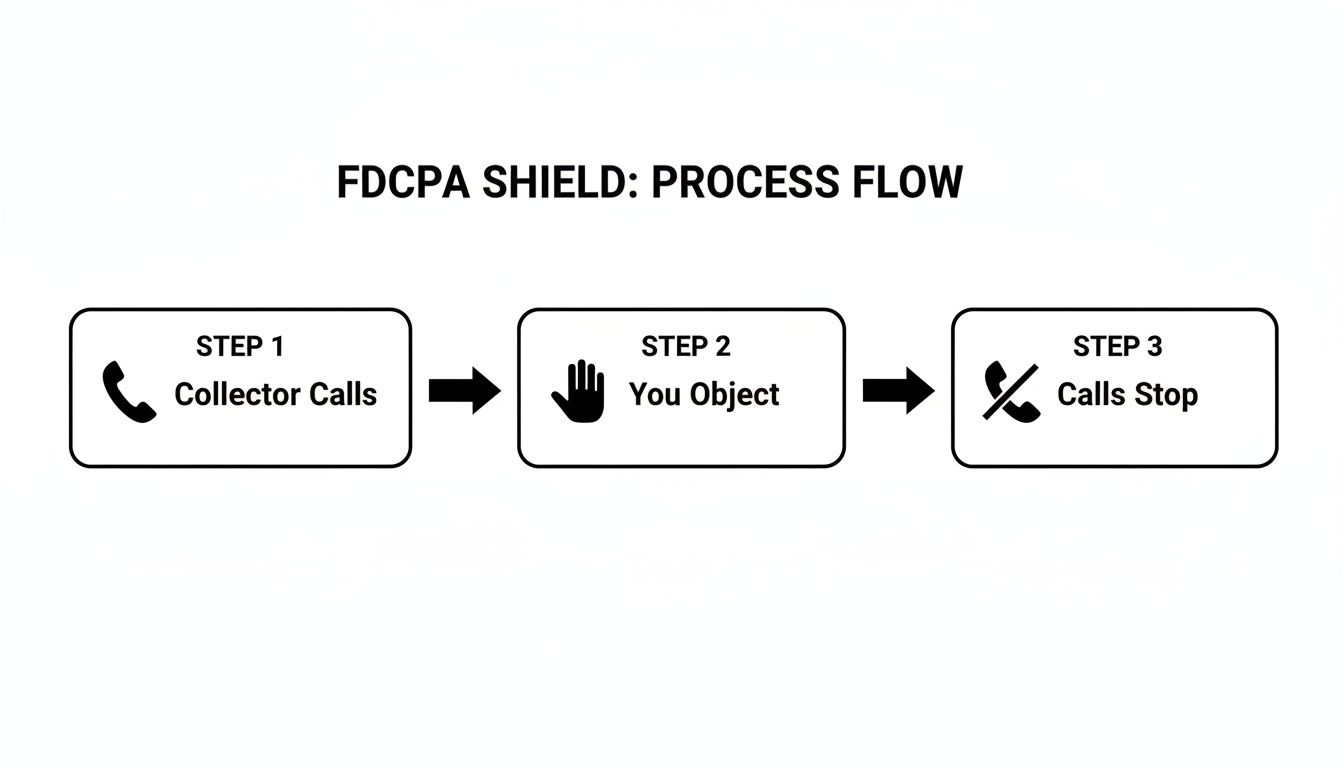

This process is your FDCPA shield. Your simple actions activate your legal protections.

As you can see, a clear objection—first verbal, then written—is the key to legally compelling the calls to stop and protecting your job from any more disruptions.

When you’re dealing with debt collectors, you have two ways to tell them to stop calling your job: you can say it or you can write it. While both have their place, one is far more powerful than the other.

Verbal vs Written Cease and Desist Requests

| Method | Effectiveness | Legal Strength | Our Recommendation |

|---|---|---|---|

| Verbal Request | Moderately Effective. It legally requires them to stop, but it’s hard to prove you said it. | Weak. It becomes your word against theirs without a recording (which can be tricky legally). | Use this immediately on the phone call, but always follow up with a written request. |

| Written Request | Highly Effective. The certified mail receipt proves they received your demand. | Strong. This is rock-solid evidence in court. It shows you made a formal, documented request. | This is the critical step. It provides the undeniable proof needed to enforce your consumer rights. |

Ultimately, starting with a verbal command and immediately following up with a certified letter is the one-two punch that gives you the best protection.

What to Include in Your Cease-and-Desist Letter

Keep your letter short and professional. The only goal is to formally state your demand, not to argue about the debt or explain your situation.

Here’s what you absolutely must include:

- Your full name and current address.

- The account number for the debt, if you have it. This helps them locate your file.

- A direct statement that you are not allowed to receive these calls at work.

- An unmistakable demand that they stop all communication with you at your job.

Just as important is what you leave out. Never admit the debt is yours, promise to send a payment, or give them any details about your finances. This letter has one job and one job only: to stop the calls.

Sample Cease-and-Desist Letter Template

Feel free to adapt this template for your own use. Just fill in the bracketed information, sign it, and send it via certified mail.

[Your Full Name] [Your Street Address] [Your City, State, ZIP Code]

[Date]

[Debt Collector’s Name] [Debt Collector’s Address] [City, State, ZIP Code]

Re: Account Number [Your Account Number, if known]

Dear [Debt Collector’s Name],

This letter is to formally notify you to cease all communications with me at my place of employment concerning the account referenced above.

Under my consumer rights outlined in the Fair Debt Collection Practices Act (FDCPA), my employer prohibits me from receiving personal calls at work. You are therefore legally obligated to stop calling me at my workplace.

Any further phone calls to me at my place of employment will be considered a willful violation of the FDCPA.

Sincerely,

[Your Signature]

[Your Printed Name]

By taking these two simple steps—a firm verbal warning followed by a documented letter—you put the full force of the FDCPA behind you to protect your job and end the harassment for good.

What to Do When the Calls Don’t Stop

So, you’ve done everything by the book. You told the collector on the phone to stop calling you at work, and you even sent a certified cease-and-desist letter. But your work phone rings again, and it’s the same agency on the other end of the line.

This isn’t just frustrating—it’s a clear violation of federal consumer law. When a debt collector ignores your formal, written request, they are knowingly breaking the rules of the FDCPA. This is the moment the power shifts completely into your hands. You’re no longer on the defensive; you’re now building a debt defense case against them.

Document Every Illegal Call

The second a collector violates your cease-and-desist request, your most important job is to create a detailed log of their illegal behavior. Think of this log as the foundation of your legal case. It provides the hard evidence you need to hold them accountable. Without it, it’s just your word against theirs.

For every single call you get after they were told to stop, make sure to write down:

- Date and Time: Be precise. Log the exact date and time the call came in.

- Collector’s Name: Always ask for the name of the individual calling. If they won’t give it, make a note of that.

- Agency’s Name: Get the full name of the collection agency they work for.

- A Summary of the Call: Jot down the basics of the conversation. Did they ask for a payment? Did you have to remind them, again, that they aren’t supposed to call you at work?

Keep this information in a dedicated notebook or a digital file. Consistency is your best friend here, as a detailed log shows a clear pattern of harassment that’s tough for any collection agency to argue against. Each illegal call you document becomes another piece of evidence working for you.

Your Right to Sue for FDCPA Violations

The FDCPA does more than just give you the right to stop the calls. It gives you the power to seek justice when a collector breaks the law. If an agency keeps calling you at work after you’ve told them to stop, you have every right to sue them in federal court. This is the ultimate way to turn the tables on an abusive collector.

A lot of people get nervous at the mere thought of suing a company, picturing a long, expensive legal battle. But consumer defense laws like the FDCPA were specifically designed to put power back into the hands of consumers. The law has a powerful clause that makes it financially possible for you to fight back.

Under the FDCPA, if you win your case against a harassing debt collector, the law requires the collection agency to pay your attorney’s fees and court costs. This “fee-shifting” provision is a game-changer, as it removes the financial barrier and lets you hire a skilled consumer protection attorney at no out-of-pocket cost to you.

This means you can get expert legal help to end the harassment and get compensation without ever worrying about how you’ll afford it.

Potential Compensation for Harassment

When you successfully sue a debt collector for FDCPA violations, you may be entitled to several types of damages. The law recognizes that harassment causes very real harm, and it provides a way for you to be compensated for it. If you’re at this stage, our guide on how to sue a debt collector for harassment gives you a much deeper look into the entire process.

Here’s a breakdown of the damages you can pursue:

- Statutory Damages: The law allows you to receive up to $1,000 in statutory damages for each lawsuit where a violation is proven. This is a penalty set by the FDCPA itself, and you can get it even if you can’t prove you lost any money.

- Actual Damages: This is compensation for any real harm the illegal calls caused. This could include things like emotional distress, anxiety, lost wages from time off work dealing with the calls, or even damage to your professional reputation.

- Attorney’s Fees and Court Costs: As mentioned, this is the big one. If you win, the collector pays for your lawyer. This ensures the cost of fighting back doesn’t fall on you, the person they were harassing in the first place.

By carefully documenting every illegal call and understanding your right to sue, you can take control of the situation. You are anything but powerless when a collection agency ignores the law—you are empowered to make them pay for it.

Looking Beyond the FDCPA: Other Laws That Have Your Back

The Fair Debt Collection Practices Act (FDCPA) is your primary shield against abusive debt collectors, but it’s not the only tool in your consumer rights arsenal. When collectors use modern technology like robocallers to hound you, other powerful federal laws like the Telephone Consumer Protection Act (TCPA) step in to stop the harassment.

Think about it: when a collector calls you at work, they’re probably ringing your cell phone. This is where another critical consumer law, the TCPA, becomes your best friend. The TCPA puts you in control of who can use automated tech to contact your mobile device.

The TCPA: Your Defense Against Robocalls

The TCPA was created specifically to fight back against autodialers and prerecorded messages—the engines that power those relentless, automated robocalls and texts. At its core, the law says a debt collector can’t use this technology to call or text your cell phone without getting your express permission first.

So, what does that mean in the real world? If a debt collector is robocalling your cell while you’re trying to work, they are almost certainly breaking federal law, unless you explicitly gave the original creditor permission to contact you that way.

Here’s the most powerful part of the TCPA: you can take back your consent at any time. You don’t need a lawyer or a fancy form. A simple statement over the phone like, “I revoke my consent for you to call my cell phone,” is legally binding. If they use an autodialer to call you again after that, every single call could be another illegal violation.

Violating the TCPA Carries a Heavy Price

The TCPA isn’t just a suggestion; it has serious financial consequences for violators. While the FDCPA has a cap of $1,000 in statutory damages for the entire lawsuit, the TCPA awards damages per illegal call or text. This can add up fast and gives collectors a powerful incentive to stop.

- You can recover $500 for each call made negligently (carelessly).

- That amount triples to $1,500 for each call made willfully (knowingly).

These penalties are designed to stop agencies that rely on aggressive, high-volume robocalling. If you’re getting bombarded with dozens of illegal calls, the potential damages can quickly become substantial, giving you serious leverage. For a more detailed look, you can dive deeper into your rights under the Telephone Consumer Protection Act.

Don’t Forget About State-Level Protections

On top of powerful federal consumer protection laws like the FDCPA and TCPA, many states have their own debt collection laws that can offer even more robust protections. For instance, some state laws might:

- Extend FDCPA-style rules to cover the original creditor, not just third-party collectors.

- Mandate that debt collectors be licensed to operate in the state.

- Impose even tighter restrictions on when and how often a collector can call you.

These rules can differ wildly from state to state, so it’s crucial to know what protections you have where you live. An action that might be technically legal under federal law could be a clear violation of your state’s laws. This is a huge reason why speaking with a local consumer protection attorney is so valuable—they can stack up all the applicable federal and state laws to build the strongest debt defense case against a harassing collector.

For debt collectors, the telephone is still the weapon of choice. A staggering 86% of collection companies name phone calls as their primary tactic. This strategy is all about volume; a seasoned collector can easily make 20 calls an hour. When you’re up against that kind of machine, knowing every law on your side is your best defense. You can find more call center statistics and their impact on consumers on ximasoftware.com.

When to Contact a Consumer Protection Attorney

You can absolutely handle the first few steps on your own, like sending a cease-and-desist letter. But there are certain red flags—clear signals that it’s time to stop talking to the debt collector and start talking to a professional. Knowing when to escalate things is the key to protecting your consumer rights and holding an abusive agency accountable.

Think of it like a leaky faucet. You might be able to fix a small drip yourself. But when a pipe bursts and starts flooding your kitchen, you call a plumber immediately. When a debt collector’s behavior crosses the line from annoying to illegal, you need a consumer protection attorney.

Clear Signs You Need Legal Help

Some tactics aren’t just aggressive; they’re flat-out illegal. If a collector does any of the following, it’s a sign that you should get legal advice right away. Don’t wait for the harassment to get worse.

These actions are serious violations of the FDCPA and TCPA:

- They ignore your cease-and-desist letter. This one is a slam dunk. If you sent a certified letter telling them to stop calling you at work and they call again, they are knowingly breaking the law.

- They use threatening or abusive language. Any collector who swears, threatens you with harm, or uses intimidating language is way out of line.

- They discuss your debt with anyone else. This is a huge one. If a collector tells a coworker, your boss, or a family member about your debt, they’ve committed a serious privacy violation.

- They lie or misrepresent who they are. This includes falsely claiming to be an attorney, threatening to have you arrested, or lying about the amount you owe.

How Attorneys Handle These Cases

One of the biggest reasons people hesitate to call a lawyer is the fear of cost. I get it. But here’s something you need to know: consumer protection law was specifically designed to solve that problem.

Most consumer attorneys take FDCPA and TCPA cases on a contingency fee basis.

A contingency fee arrangement means you pay nothing out of your own pocket for a lawyer. The attorney’s fees get paid by the debt collector after you win the case. If you don’t win, you don’t owe your attorney a dime.

This powerful setup is called fee-shifting, and it’s written directly into consumer protection laws. It completely removes the financial risk of fighting back, allowing anyone to stand up to a big collection agency without worrying about legal bills.

Essentially, it forces the lawbreakers—not their victims—to pay for the legal fight. By contacting an attorney, you can turn their harassment into your leverage and potentially get paid for the stress and trouble they’ve caused you.

Your Questions Answered: Debt Collector Calls at Work

When you’re dealing with debt collectors, a lot of specific questions pop up, especially when they start calling your job. Let’s clear up some of the most common worries people have about their consumer rights.

Can a Debt Collector Really Call My Boss or Coworkers?

The short answer is a firm no. The FDCPA is incredibly strict on this point to protect your privacy and consumer rights. A collector is absolutely forbidden from discussing your debt with anyone else—that includes your boss, someone in HR, or your nosy coworker in the next cubicle.

There’s really only one reason they can contact your employer: to confirm your contact details. They can ask to verify your address or phone number, but that’s it. When they make that call, they can’t even mention they’re a debt collector or that you owe money. Spilling the beans about your debt is a direct violation of the law.

What if They Keep Calling for a Debt That Isn’t Even Mine?

This is a surprisingly common—and incredibly frustrating—situation. If you’re getting hounded for a debt you don’t actually owe, you have the right to shut down those calls completely, not just at work. The FDCPA and the Fair Credit Reporting Act (FCRA) give you a clear path to dispute the debt and stop harassment.

Your first move should be to send a letter by certified mail. You need that proof of delivery. In the letter, state very clearly that the debt is not yours and demand they stop all communication with you immediately. If they call even one more time after they get that letter, they’re breaking the law. That’s your cue to call a consumer protection attorney.

Does the FDCPA Apply to the Original Company I Owed Money To?

This is a crucial point that trips a lot of people up. Generally, the FDCPA’s rules apply to third-party debt collectors—the agencies hired by the company you originally owed. The original creditor themselves? Usually, they aren’t covered.

But, like with many laws, there are exceptions. Some states have their own consumer protection laws that are even tougher and do apply to original creditors. Also, if an original creditor starts using a different name that makes them sound like a collection agency, they might fall under the FDCPA’s umbrella. An attorney can help you figure out exactly who is bound by which rules in your situation.

Is It Okay for Me to Record My Calls with Debt Collectors?

Be very careful here. Whether you can legally record a call depends entirely on your state’s laws, and making a mistake can backfire. States are generally split into two camps:

- One-Party Consent: In these states, as long as you are part of the conversation, you can record it without telling the debt collector.

- Two-Party Consent: In these states, you absolutely must get the other person’s permission before you start recording.

It is critical to know which type of state you live in before you even think about hitting record. An illegally recorded call is useless as evidence and could land you in legal hot water. The smartest and safest approach is to always check with a consumer law attorney first.