Your phone rings at 8 AM. Again. The same debt collector who called yesterday, and the day before. They threaten to garnish your wages, call your employer, or ruin your credit. You feel trapped, stressed, and powerless. But here’s what they won’t tell you: when debt collectors cross the line into harassment, you can sue debt collector for harassment under federal law. And you might get paid for their violations.

The Fair Debt Collection Practices Act (FDCPA) protects you from abusive collection tactics. This law gives you the right to take legal action against collectors who harass you, and you can recover statutory damages up to $1,000 per violation, plus actual damages, and often your attorney fees. You don’t need to prove the debt is invalid. You just need to prove they broke the law.

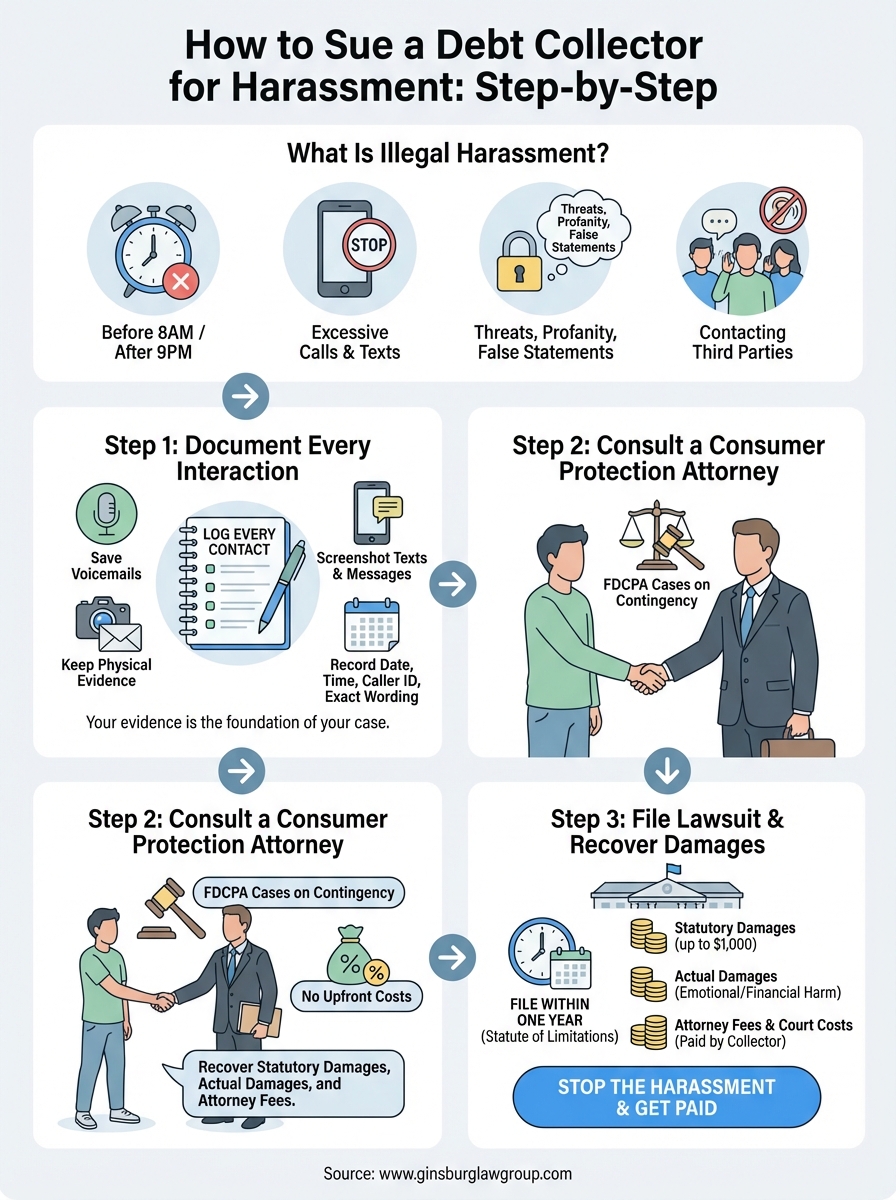

This guide walks you through the complete process of filing a lawsuit against a debt collector. You’ll learn what counts as illegal harassment, how to document violations, when to involve an attorney, and what compensation you can expect. Let’s turn their harassment into your payday. https://www.youtube.com/embed/C66ghTqdITQ

What qualifies as illegal debt collection harassment

The FDCPA draws clear lines that debt collectors cannot cross. When a collector violates these rules, you gain the legal right to sue debt collector for harassment regardless of whether you owe the debt. The law protects you from specific tactics that courts have ruled abusive, and collectors who use these methods face statutory penalties that you can collect.

Prohibited contact methods

Debt collectors can’t call you at unreasonable times. The law defines unreasonable as before 8 AM or after 9 PM in your time zone. They also can’t contact you at work if you tell them your employer prohibits such calls. Once you send a written request to stop contact, they must stop all communication except to confirm they received your letter or notify you of specific legal action.

Repeated calls intended to harass or annoy violate the FDCPA. Courts look at the frequency, pattern, and intent behind the calls. Collectors who call multiple times per day, call back immediately after you hang up, or call continuously for weeks commit harassment. The law doesn’t specify an exact number of calls that crosses the line, but patterns of excessive contact give you grounds to sue.

Prohibited threats and language

Collectors can’t threaten actions they cannot legally take or don’t intend to take. Empty threats about arrest, garnishment without a judgment, or contacting immigration authorities all violate federal law. They also can’t use obscene or profane language, or publish your debt information to shame you into paying.

“Debt collectors who lie about legal consequences or use abusive language give you actionable claims under the FDCPA.”

Misrepresenting the amount you owe, claiming to be attorneys when they’re not, or falsely stating that papers are legal documents when they’re collection letters all count as violations. These deceptive practices create liability even if you eventually pay the debt.

Prohibited disclosure practices

The FDCPA limits who collectors can contact about your debt. They can’t discuss your debt with third parties like family members, neighbors, or coworkers, except to locate you. Even then, they can only ask for your address, phone number, and workplace. They can’t mention the debt or their identity as collectors.

Leaving detailed voicemails that others might hear violates this rule. Sending postcards with debt information visible, contacting you through social media where others see the message, or calling your employer about the debt (except to verify employment) all give you legal grounds to file a lawsuit. Each improper disclosure can result in separate damages.

Step 1. Document every interaction

Your documentation becomes the foundation of your case when you sue debt collector for harassment. Courts require concrete evidence of violations, not just your memory of what happened. Start building your case file immediately by recording every single contact from the collector. This evidence proves the pattern of harassment and establishes the violations that entitle you to damages.

What to record for each contact

You need to capture specific details that courts consider when evaluating harassment claims. Create a log entry for every call, text, voicemail, letter, or email you receive. Include the date and time of contact, the caller’s name or identification, the company they represent, and what they said or threatened. Note the exact wording of threats, profanity, or false statements they make.

Record the phone number that appears on your caller ID, even if the collector claims to represent a different company. Document how many times they called in a single day and whether calls came before 8 AM or after 9 PM. If they contact you at work, note the time and what they said. Keep track of who else might have heard the conversation or received information about your debt.

How to organize your evidence

Store all physical evidence in one dedicated location. Save every letter, notice, or document the collector sends. Keep voicemails on your phone and back them up to another device or cloud storage. Take screenshots of texts, emails, or social media messages with visible dates and times. If possible, record phone calls where your state law allows single-party consent.

“A detailed, chronological record of violations gives your attorney the ammunition needed to build a strong FDCPA case.”

Create a simple spreadsheet or notebook where you log each contact immediately after it happens. Memory fades, but written records made at the time carry more weight in court.

Step 2. Consult a consumer protection attorney

You don’t need money upfront to sue debt collector for harassment. Most consumer protection attorneys handle FDCPA cases on contingency, meaning they only get paid if you win. The law requires the debt collector to pay your attorney fees when you prevail, which makes these cases accessible even if you’re broke. Finding the right attorney transforms your evidence into a winning case.

Why FDCPA cases work on contingency

The FDCPA’s fee-shifting provision allows your attorney to recover fees directly from the collector who violated the law. This means you risk nothing by pursuing your case. Attorneys take these cases because the statutory damages, combined with actual damages and attorney fees, create strong incentives for collectors to settle. You walk away with compensation while the collector pays all legal costs.

What to bring to your consultation

Gather all your documented evidence before meeting with an attorney. Bring your call log with dates and times, copies of threatening letters, saved voicemails, text message screenshots, and any other proof of harassment. Include documentation of the original debt if you have it, but remember that proving the debt is invalid isn’t required to win an FDCPA case.

“The strength of your documentation directly impacts the settlement value and likelihood of success in your harassment case.”

Prepare a written timeline of events showing the pattern of violations. Note any financial or emotional harm you suffered, like missed work, medical bills for stress-related issues, or therapy costs. This information helps your attorney calculate the full damages you can recover beyond the statutory minimum.

Questions to ask your attorney

Ask how many FDCPA cases they’ve handled and their success rate. Find out their typical timeline from consultation to resolution and whether they expect your case to settle or go to trial. Confirm they work on contingency with no upfront costs. Request an explanation of how damages are calculated and what settlement range seems realistic based on your violations.

Step 3. File the lawsuit within one year

The FDCPA gives you one year from the date of the violation to file your lawsuit. This statute of limitations deadline is strict and absolute. If you miss it, you lose your right to sue debt collector for harassment, no matter how egregious the violations. Courts have no discretion to extend this deadline, so acting quickly protects your legal rights and preserves your ability to recover damages.

Understanding the statute of limitations clock

The one-year clock starts running on the date the collector committed the violation, not when you discovered it or when you hired an attorney. For single violations like one threatening call, you count from that specific date. When collectors engage in a pattern of harassment with multiple violations over weeks or months, courts may apply the “continuing violation doctrine,” which starts the clock from the last violation in the series.

Document the date of every violation because you can sue for any violation that occurred within the year before filing. Older violations fall outside the statute of limitations and can’t support your claim. However, you can use them as background evidence to show a pattern of harassment, even if you can’t recover damages for those specific acts.

Where to file your case

You can file FDCPA lawsuits in federal court or state court, depending on your preference and circumstances. Federal court handles these cases regularly and judges understand the law well. State court may offer faster resolution in some jurisdictions. Your attorney will recommend the best venue based on local court procedures and judge experience with consumer protection cases.

“Filing in the correct jurisdiction within the one-year deadline ensures your harassment case moves forward and prevents the collector from escaping liability on a technicality.”

Your attorney handles all filing procedures, including drafting the complaint, serving the defendant, and meeting court deadlines. You simply provide the evidence you documented and answer questions about your experience. Most cases settle within months after filing, though the statute of limitations gives you a full year to act.

Damages available in FDCPA cases

When you sue debt collector for harassment, you can recover multiple types of compensation. The FDCPA provides three categories of damages that stack together, meaning you collect all of them simultaneously. Understanding what you can claim helps you evaluate settlement offers and know the full value of your case.

Statutory damages

You receive up to $1,000 in statutory damages for FDCPA violations without proving financial harm. Courts award this amount per lawsuit, not per violation, though multiple violations strengthen your case and increase settlement value. The judge considers the frequency and severity of violations when determining the exact amount within the $1,000 cap.

Class action lawsuits follow different rules. Statutory damages are capped at the lesser of $500,000 or 1% of the collector’s net worth. This allows groups of harassed consumers to pursue larger collectors who violate the law systematically.

Actual damages

Actual damages compensate you for real financial and emotional harm caused by the harassment. You can recover lost wages from missed work, medical bills for stress-related treatment, therapy costs, and other documented expenses directly tied to the collector’s illegal conduct. Courts also award damages for emotional distress, anxiety, humiliation, and loss of sleep.

“Combining statutory damages with proven actual damages significantly increases your total recovery in FDCPA cases.”

Keep receipts, medical records, and written statements documenting how the harassment affected your life and finances.

Attorney fees and costs

The collector pays your attorney fees and court costs separately from your damage award. This fee-shifting provision means you keep 100% of your damages while the collector covers all legal expenses. Your attorney bills the collector directly for time spent on your case at reasonable hourly rates that courts approve.

Stop the harassment now

You have the power to sue debt collector for harassment and make them pay for their violations. The FDCPA gives you specific rights that debt collectors must respect, and when they cross the line, you can recover statutory damages, actual damages, and attorney fees without spending a penny upfront. Each violation creates legal liability that puts money in your pocket while punishing their illegal conduct.

Don’t wait until the one-year deadline passes. Document every violation starting today, consult with a consumer protection attorney who understands these cases, and file your lawsuit before time runs out. The harassment stops when you fight back with legal action backed by federal law.

Ginsburg Law Group handles FDCPA cases on contingency with free case evaluations. Contact us to review your documentation, assess your violations, and start building your case against the collectors who harassed you. You deserve compensation for the harassment you endured.