Your first move is your most important one: never admit you owe the debt or even confirm who you are on that initial call. Your only job is to get the collector’s information and then tell them to communicate with you only in writing. It’s a simple, powerful step rooted in debt defense principles that puts you back in control.

Your First Move When a Debt Collector Calls

Let’s be real—that first call from a debt collector is designed to be jarring. They want to catch you off guard, apply pressure, and get you to make a payment on the spot. But you’re not going to play that game.

Don’t negotiate. Don’t argue. And definitely don’t explain your life story. Treat this call like a fact-finding mission where your only goal is to gather intel while giving absolutely nothing away. This is the first step in building your debt defense.

Think of it this way: a legitimate collector should already have your basic details. When they ask you to “confirm” your name, address, or Social Security number, it’s often a tactic. They’re trying to get you to verbally tie yourself to the alleged debt, which can be used against you later.

What to Ask For on the Call

Before you hang up, you need to get some specific information. Stay calm, be firm, and ask for these details:

- The debt collector’s full name

- The name of their collection agency

- The agency’s physical mailing address and phone number

- The name of the original creditor they claim you owe

- The exact amount of the alleged debt

This information is non-negotiable. You’ll need it for the next step: sending a formal debt validation letter. Once you have what you need, end the call.

A simple, effective script I’ve seen work time and again is: “Thank you for providing that. I don’t discuss financial matters on the phone. From this point forward, you must send all communication to me in writing.” Then, hang up. Don’t wait for a response.

This initial interaction is your chance to establish the ground rules. Handling it this way is crucial, especially when you consider how often collectors cross the line. In 2023 alone, the Consumer Financial Protection Bureau (CFPB) received 147,762 complaints about debt collectors. Many of these complaints involved collectors making false claims or illegal threats. You can explore the CFPB’s complaint data yourself to see just how common these issues are.

Your power in this first interaction comes from what you don’t say. By refusing to engage, you avoid accidentally resetting the statute of limitations on an old debt or giving the collector ammunition to use against you later.

By staying calm and sticking to this script, you immediately assert your rights under the Fair Debt Collection Practices Act (FDCPA). This federal law is your best defense against harassment, and demanding written communication is the first, most critical step in using it to your advantage.

Your Initial Contact Checklist

That first call can feel overwhelming, so here’s a quick cheat sheet to keep you on track.

| Action to Take (Do This) | Action to Avoid (Don’t Do This) |

|---|---|

| Get the caller’s name and the agency’s name. | Confirm your name, address, or Social Security number. |

| Ask for their mailing address and phone number. | Admit the debt is yours or make any promise to pay. |

| Ask for the original creditor’s name and the debt amount. | Discuss your personal finances, job, or family. |

| State that all future contact must be in writing. | Lose your temper or get into an argument. |

| Hang up after you have the info and have made your statement. | Let the call continue after you’ve made your request. |

Sticking to this plan forces the collector to play by the rules and creates a paper trail, which is exactly what you want.

Understanding Your Rights Under Federal Law

When you’re dealing with debt collectors, knowledge is your best defense. A lot of people don’t realize there are powerful federal laws on the books specifically designed to shield you from harassment and abusive tactics. Knowing these laws isn’t just for attorneys; it’s the cornerstone of your debt defense strategy.

Debt collectors often count on consumers not knowing their rights. They might use intimidation, make vague threats, or just call relentlessly, hoping to wear you down until you pay. The moment you understand what they can and can’t legally do, the power dynamic shifts completely.

The main law you need to know is the Fair Debt Collection Practices Act (FDCPA). Think of it as the official rulebook for anyone trying to collect a consumer debt. It draws clear lines in the sand, and when a collector crosses them, you have the right to push back.

What the FDCPA Prohibits

The FDCPA gets into specifics, but the big picture is simple: it outlaws deceptive, unfair, and abusive collection practices. These aren’t just suggestions; they are hard-and-fast rules.

Keep an eye out for these common FDCPA violations:

- Harassing Calls: They can’t call you over and over again just to annoy you. There are also time restrictions—no calls before 8 a.m. or after 9 p.m. your time, unless you’ve given them the okay.

- Calling You at Work: A collector is strictly forbidden from discussing your debt with your boss, coworkers, or anyone else. They can generally only call your employer once, and only to confirm that you work there.

- Abusive Language: Collectors are not allowed to use obscene, profane, or threatening language. Conversations must be professional.

- False Threats: This is a big one. They can’t threaten to have you arrested, garnish your wages (unless they have a court order), or claim they’re about to file a lawsuit if they have no intention of doing so.

- Lying and Misrepresentation: Collectors have to be truthful. They can’t lie about the amount you owe or pretend to be an attorney or a government official.

If a collector has done any of these things, they’ve broken federal law. Each and every violation gives you grounds to file a formal complaint or even sue the collection agency. You can dive deeper into these protections in our guide to the Fair Debt Collection Practices Act.

Your Shield Against Robocalls: The TCPA

There’s another critical law that protects you from a very modern form of harassment: automated calls and texts. The Telephone Consumer Protection Act (TCPA) was put in place to stop the nonstop flood of unwanted robocalls.

The TCPA sets strict rules on how companies can use autodialers, prerecorded messages, and text messages to contact you.

In most cases, a company needs your express written permission before they can send marketing robocalls or automated texts to your cell phone. If you never gave it—or if you told them to stop—every single call or text could be a violation.

This is huge when it comes to debt collection, especially for collectors who buy old debt portfolios. The original company you owed money to might have had your consent to call, but that permission doesn’t just automatically pass along to a third-party collector.

Violations of the TCPA can come with steep penalties—we’re talking $500 to $1,500 per illegal call or text. This is why it’s so important to document everything. Save voicemails, take screenshots of texts, and log every automated call you get. That evidence is gold if you decide to take legal action.

Using Written Communication to Your Advantage

Want to stop debt collectors in their tracks? The single most powerful thing you can do is move all communication from the phone to paper. Phone calls are messy and deniable. Written letters, on the other hand, especially when sent via certified mail, create a powerful paper trail that becomes your best evidence if a collector breaks the law.

This isn’t about being difficult—it’s about being smart. When you force a collector to communicate in writing, you strip them of their ability to use high-pressure phone tactics. More importantly, you create a clear, documented history of every single interaction, moving the entire conflict onto your turf where federal law gives you the advantage.

The Debt Validation Letter: Your First Line of Defense

After you get that first call from a collection agency, your immediate next step should be to send a debt validation letter. This is simply a formal, written request that demands the agency prove you actually owe the money they’re trying to collect.

Under the Fair Debt Collection Practices Act (FDCPA), you have 30 days from the collector’s initial contact to mail this letter. Once they get it, they are legally required to stop all collection efforts—no more calls, no more letters—until they can mail you verification of the debt.

This is a critical, non-negotiable step. Think about it: debts get sold and resold, and crucial paperwork often gets lost in the shuffle. A validation letter makes the collector prove they have the legal right to come after you.

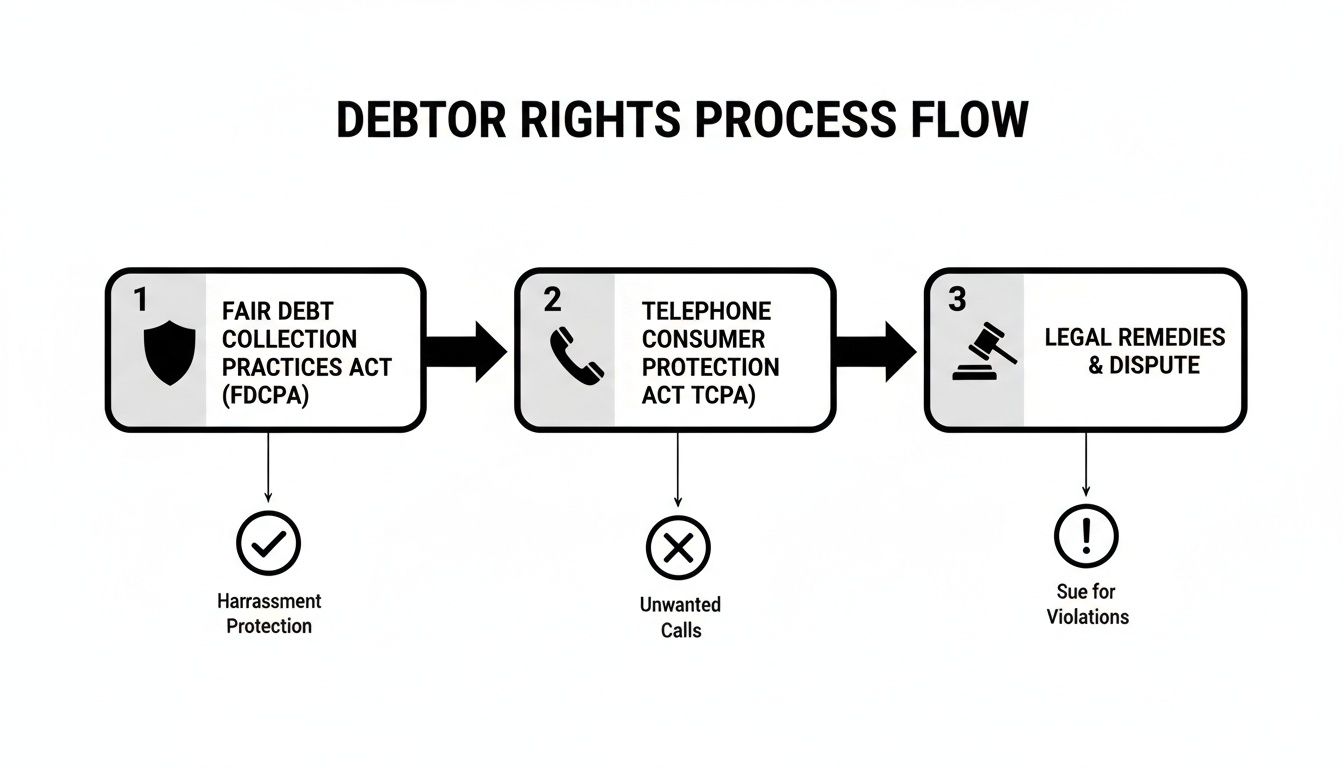

The chart below shows how federal laws like the FDCPA and TCPA give you a clear roadmap for fighting back and asserting your rights.

This entire process is built on a foundation of legal protection, starting with the shield provided by the FDCPA and the control over calls granted by the TCPA.

The Cease and Desist Letter: Ending All Contact

What if the debt turns out to be valid, but the harassment is relentless? Or maybe you just want them to stop contacting you, period. This is exactly what a cease and desist letter is for.

This letter is a straightforward, formal demand telling the debt collector to stop all communication with you immediately. The FDCPA gives you the absolute right to make this demand.

Once a collector receives your cease and desist letter, the law only allows them to contact you for two very specific reasons:

- To confirm they got your request and will stop contacting you.

- To tell you they are taking a specific legal action, like filing a lawsuit.

That’s it. No more calls. No more letters demanding payment. Nothing. Sending this letter puts the ball squarely in their court—they either have to drop it or take you to court, which many collectors are unwilling or unable to do. You can find more details on how to properly dispute a debt using your consumer rights in our related guide.

Pro Tip: Always, and I mean always, send both debt validation and cease and desist letters via Certified Mail with a return receipt requested. It costs a few extra bucks, but that little green postcard you get back from the USPS is your ironclad proof of the exact date and time the agency received your letter. This proof is priceless if you end up needing to take legal action.

Creating an Unbreakable Paper Trail

Remember, these letters aren’t just polite requests; they are legal instruments. The FDCPA has real teeth, and it lays out specific penalties for collectors who ignore your written instructions.

Your goal here is to build a solid body of evidence. If a collector calls you even one time after receiving your cease and desist letter, they have broken federal law. Your certified mail receipt proves they got your demand, and your call log proves they ignored it. That’s the one-two punch you need to stop them for good.

How to Document Harassment and File Complaints

When a debt collector ignores your certified letters and keeps violating your rights, it’s time to shift your strategy from communication to evidence collection. Think of yourself as a detective building a case. Every illegal call, abusive voicemail, or threatening text message is another piece of evidence that strengthens your position and gives you the leverage to shut them down for good.

This isn’t just about getting annoyed; it’s about systematically proving a pattern of illegal behavior. Vague claims of harassment won’t hold up in a dispute, but a detailed logbook of every violation is a powerful weapon.

Building Your Case Against the Collector

Your best friend in this fight is a simple communication log. Whether you use a dedicated notebook or a spreadsheet doesn’t matter, but consistency is absolutely critical. For every single contact attempt from the collection agency, you have to record the specifics right away before you forget the details.

I’ve found that a simple table is the most effective way to keep your records clean and organized. It forces you to capture the essential information every time and makes it easy to spot patterns of abuse.

Here’s a template you can use to start tracking every interaction.

FDCPA Violation Documentation Log

Use this log to systematically track and record every instance of potential debt collector harassment. Being meticulous here is what makes your case strong.

| Date of Contact | Time of Contact | Collector Name / Agency | Type of Contact (Call, Text, Letter) | Summary of Violation |

|---|---|---|---|---|

Make sure to save all physical evidence, too. Keep every letter they send in a dedicated folder. Save any voicemails they leave and take screenshots of text messages, making sure the date and time are clearly visible.

Where to File Your Official Complaints

Once you’ve documented a few clear violations, it’s time to report the collector to the federal agencies that enforce these laws. Filing a complaint accomplishes two critical things: it creates an official record of the agency’s misconduct tied to your name, and it adds to a national database that helps regulators identify and punish repeat offenders.

You’ll want to file complaints with these two key agencies:

- The Consumer Financial Protection Bureau (CFPB): The CFPB is the main federal watchdog for all things consumer finance, including debt collection. They have a straightforward online complaint process and will forward your complaint directly to the collection agency for a formal response.

- The Federal Trade Commission (FTC): While the FTC doesn’t resolve individual consumer disputes, it uses complaint data to investigate and build cases against companies that engage in widespread deceptive or unfair practices. Think of it as contributing to the greater good.

This is where all that evidence you gathered comes into play. When you submit your complaint, you can reference the specific dates, times, and summaries of FDCPA violations right from your log. This transforms your complaint from a simple grievance into a well-documented legal report.

Your detailed records are what give your complaints teeth. An entry that reads, “John from ABC Collections called my cell at 7:15 a.m. on October 26th and threatened to have me arrested if I didn’t pay,” is infinitely more powerful than just saying, “They’re harassing me.”

Turning Complaints into Action

These complaints are not just for show; they can have real consequences. Often, an official complaint is enough to get a collector to back off immediately because they don’t want federal scrutiny.

More importantly, this documentation is invaluable if you decide to sue the collector for FDCPA violations. Consumer law firms, such as Ginsburg Law Group PC, specialize in using this exact kind of evidence to enforce your rights.

And these issues are far from rare. In 2024, the CFPB received 147,762 complaints against debt collectors. A staggering 54% of those communication complaints cited repeated calls, and 30% involved collectors who simply ignored consumer requests to stop contact. You can discover more about these troubling debt collection statistics and see why your documentation is so vital.

Don’t let their illegal actions go unreported—your complaint is a critical step toward holding them accountable.

When It’s Time to Call in the Pros

You’ve done everything right. You sent the letters, cited the law, and kept meticulous records. Yet, the phone keeps ringing. When a debt collector digs in their heels and flat-out ignores your legal rights, you’ve hit a wall. This isn’t just about stopping annoying calls anymore—it’s about holding a rogue company accountable for breaking the law.

Knowing when to switch from DIY methods to professional legal help is crucial. Some actions from a collector aren’t just pushy; they’re giant, waving red flags telling you it’s time to get a consumer protection attorney involved. Taking this step isn’t admitting defeat. It’s escalating the fight to protect yourself and enforce your rights.https://www.youtube.com/embed/hEyFZQsH4Kg

Red Flags That Mean You Need a Lawyer, Yesterday

While any violation of the FDCPA is a big deal, some tactics are so outrageous they demand immediate legal action. If you’re experiencing any of the following, it’s time to put down the pen and pick up the phone to call an attorney.

These aren’t just aggressive moves; they are clear, illegal actions that can bring serious penalties down on the collection agency.

- You’ve Been Sued: This is the most glaring sign. A lawsuit summons is not something to ignore or handle alone. An experienced debt defense attorney can spot fatal flaws in the lawsuit, like an expired statute of limitations, that could get the case thrown out entirely.

- They Ignore Your Cease-and-Desist Letter: You have the certified mail receipt proving they got your letter, but the calls and notices haven’t stopped. This isn’t an accident; it’s a willful violation of the FDCPA and shows the agency thinks it’s above the law.

- They’re Messing with Your Credit Report: Did the collector report the debt to the credit bureaus after you already disputed it in writing? Or are they reporting completely false information? This could be a violation of the Fair Credit Reporting Act (FCRA), and a lawyer can help you clean up your credit and seek damages.

- They Threaten You with Arrest or Seizure: Let’s be crystal clear: a debt collector cannot have you arrested. Any threat of jail time or seizing your property (without a court order) is a bald-faced, illegal scare tactic. This is a severe FDCPA violation that needs an immediate legal response.

How an Attorney Flips the Script

Bringing a consumer protection attorney into the picture completely changes the power dynamic. That collector who was bullying you over the phone? Their entire attitude changes when they get a formal letter from a law firm. Suddenly, they aren’t dealing with a stressed-out consumer; they’re up against a legal expert who knows every single rule they’ve broken.

A good consumer lawyer lives and breathes laws like the FDCPA, TCPA, and FCRA. They can sue the collection agency for you.

Here’s the best part, and it’s a game-changer: the FDCPA includes a fee-shifting provision. If you win, the debt collector has to pay your attorney’s fees and court costs. This makes getting legal help possible for everyone, as many consumer lawyers will take a strong case with zero out-of-pocket cost to you.

Filing a lawsuit can get you real results:

- It forces the collector to stop contacting you, period.

- You could be awarded statutory damages up to $1,000 just for the violations.

- You can also sue for actual damages, like emotional distress or wages you lost dealing with the harassment.

This is about more than just peace and quiet; it’s about justice. If you want to learn more about the specifics, you can dig into the details on how to sue a debt collector for harassment and see what the process looks like.

Is Bankruptcy the Answer?

Sometimes, the issue isn’t just one out-of-control collector. It’s an overwhelming mountain of debt from every direction. If you’re juggling threats of foreclosure, car repossession, and wage garnishment, suing a single agency won’t fix the core financial problem.

In these tough situations, bankruptcy might be the most powerful tool you have. The moment you file for bankruptcy, a federal protection called the “automatic stay” kicks in. It’s like a legal forcefield that immediately stops all collection activities—from lawsuits to harassing calls to foreclosures. It gives you the critical breathing room needed to get your finances back in order.

Bankruptcy is a serious decision, but it’s a legal remedy designed to give good people a fresh start. Speaking with a firm that handles both debt harassment cases and bankruptcy can give you a clear picture of all your options and help you choose the best path forward.

Got Questions? We’ve Got Answers on Dealing with Debt Collectors

When you’re up against debt collectors, it’s easy to feel lost in a sea of confusing rules and high-pressure tactics. Even with the best plan, you’re bound to have specific questions pop up. Let’s tackle some of the most common situations people find themselves in and clarify the rights you have every step of the way.

Can a Debt Collector Actually Call My Work or My Family?

This is one of the biggest fears people have, and for good reason—it’s embarrassing. But the law is firmly on your side here. The FDCPA puts a tight leash on who a collector can talk to about your debt. They are strictly forbidden from discussing your financial situation with family, friends, or neighbors.

So, what about your job? They can call your employer, but only once, and for the sole purpose of confirming where you work. They absolutely cannot mention the debt or harass your boss. If a collector is blowing up your work phone or telling your sister about your debt, they are flat-out breaking federal law.

What if I’m Sure the Debt Isn’t Mine or the Amount Is Wrong?

Mistakes in the debt collection world are incredibly common. Debts get bought and sold multiple times, and paperwork gets jumbled in the process. This is precisely why your right to demand proof is your most powerful defense.

If you have any reason to believe the debt isn’t yours, the amount is wrong, or it belongs to a different person with a similar name, you need to send a debt validation letter. You must do this within 30 days of their first contact. This letter puts the ball back in their court and legally forces them to stop all collection efforts until they can provide you with proof.

Keep in mind the Fair Credit Reporting Act (FCRA) is also in play here. If a collector reports a debt you’ve disputed to the credit bureaus without marking it as disputed, they could be violating the FCRA, too. This gives you even more leverage.

If I Send a Cease and Desist Letter, Are They Going to Sue Me?

It’s a valid concern, but a lawsuit isn’t always the next step. Sending a cease and desist letter is a serious move that legally forces a collector to stop contacting you. They have only two exceptions: they can reach out to confirm they’ve received your request or to tell you they are taking a specific action, like filing a lawsuit.

Frankly, for many collectors, a lawsuit is more trouble than it’s worth, especially for smaller debts or if their paperwork is shaky. They’ll often just close the account and move on. However, if the debt is large and they have a strong case, a lawsuit is a very real possibility. The letter essentially forces their hand: sue or go away.

What Exactly Is the Statute of Limitations on Debt?

Think of the statute of limitations as a legal expiration date. It’s a law, which varies by state, that dictates how long a creditor has to take you to court over an unpaid debt. The timeline can be anywhere from three to ten years, depending on your state and the type of debt. Once that clock runs out, the debt is called “time-barred.”

A collector can still ask you to pay a time-barred debt, but they can no longer win a lawsuit against you for it. Even threatening to sue you over a debt they know is too old is a major FDCPA violation. Be extremely careful here—making even a small payment on an old debt can sometimes restart the statute of limitations all over again.

What Happens if a Loved One Passes Away and Leaves Debt Behind?

This is a tough and often confusing situation where estate planning principles become vital. When someone dies, their debts don’t just vanish—they become part of their estate. Creditors and collectors are allowed to file claims against the assets the person left behind during the probate process.

However, and this is crucial, you are not personally responsible for a deceased family member’s debt unless you were a co-signer or joint account holder. Collectors might try to guilt or pressure you into paying from your own funds, but you are not legally obligated to do so. The FDCPA extends its protections to surviving family members, so collectors can’t use deceptive or harassing tactics on you while you are managing an estate.

Trying to deal with relentless debt collectors is exhausting, but you don’t have to do it alone. If you’re being harassed, facing a lawsuit, or just feel completely overwhelmed, the experienced consumer protection attorneys at Ginsburg Law Group PC can help you figure out your best move. We specialize in FDCPA violations, debt defense, and bankruptcy—whatever it takes to give you the fresh start you deserve.