Summary

You can only remove a bankruptcy from your credit report if it is inaccurate or reported longer than the law allows—legitimate bankruptcies remain for 7 years (Chapter 13) or 10 years (Chapter 7) from the filing date, not the discharge date. The Fair Credit Reporting Act (FCRA) gives you the right to dispute errors such as wrong dates, incorrect chapter type, outdated records, or accounts that still show balances after discharge. If you find an error, you can formally dispute it with the credit bureaus, which must investigate within 30 days and remove the item if they cannot verify its accuracy. When bureaus ignore disputes, reinsert deleted items improperly, or cause financial harm, you may have the right to pursue legal action under the FCRA.

Before trying to remove a bankruptcy from your credit report, understand one crucial truth: you can only succeed if the information is inaccurate or outdated. If the bankruptcy is legitimate and within the legal reporting period, it’s there to stay—typically for seven to ten years, depending on the type you filed.

Your first step is to determine if the bankruptcy listed on your report violates your consumer rights under federal law, either by being too old or containing factual errors. This guide will walk you through how to use your rights to clean up your credit file.

Understanding the Legal Timelines for Bankruptcy Reporting

To challenge a bankruptcy on your credit report, you must know the rules the credit bureaus are legally required to follow. The primary federal law governing this is the Fair Credit Reporting Act (FCRA). This powerful piece of consumer rights legislation ensures that a past financial mistake doesn’t permanently penalize you.

The FCRA establishes clear deadlines for how long a bankruptcy can be reported. If a credit bureau continues to report a bankruptcy after its legal expiration date, they are in violation of the law. This violation gives you the explicit right to dispute the error and demand its removal. Understanding these timelines is the foundation of your case.

Chapter 7 vs. Chapter 13 Timelines

The two most common types of consumer bankruptcy—Chapter 7 and Chapter 13—have different reporting periods under the FCRA because they represent different approaches to handling debt.

- Chapter 7 Bankruptcy: Known as “liquidation” bankruptcy, this process involves selling non-exempt assets to repay creditors. Because it results in a full discharge of most debts, it stays on your credit report longer.

- Chapter 13 Bankruptcy: This is a “reorganization” bankruptcy where you follow a court-approved plan to repay a portion of your debts over three to five years. Since it involves a good-faith repayment effort, the FCRA mandates a shorter reporting period.

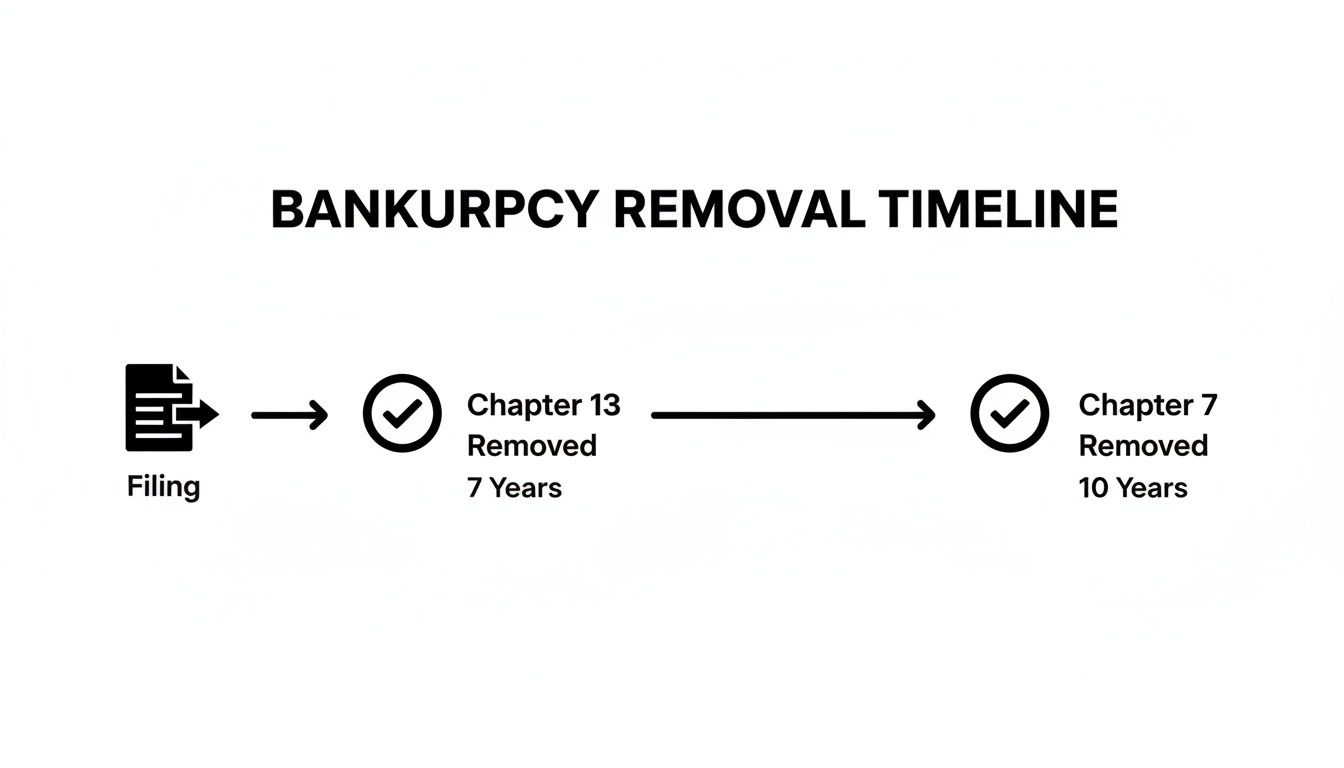

This timeline provides a quick visual of the maximum legal reporting periods for both Chapter 7 and Chapter 13, measured from the official filing date.

The key takeaway is that the countdown for removal begins the moment you file, not when the case is discharged or closed.

Bankruptcy Reporting Timelines Under the FCRA

This table breaks down the legally mandated maximum reporting periods. Use it to check if a bankruptcy entry on your credit report is outdated and in violation of your rights.

| Bankruptcy Type | Maximum Time on Credit Report (from filing date) | Typical Use Case |

|---|---|---|

| Chapter 7 | 10 years | For individuals seeking to liquidate assets to discharge most unsecured debts like credit cards and medical bills. |

| Chapter 13 | 7 years | For individuals with regular income who want to create a plan to repay all or part of their debts over 3-5 years. |

| Chapter 11 | 10 years | Typically used by businesses for reorganization, but sometimes used by individuals with very large debts. |

| Dismissed Bankruptcy | 10 years | A bankruptcy case that was thrown out by the court without a discharge. The 10-year clock still applies. |

Knowing these dates is your most powerful tool. If a credit bureau reports a Chapter 13 bankruptcy nine years after you filed, they are violating the FCRA, and you have a clear right to dispute it.

The Filing Date Is What Matters Most

Many people mistakenly believe the reporting clock starts on the discharge date. The law is crystal clear: the countdown begins the second your case is officially filed with the bankruptcy court.

Under the FCRA, the timeline is calculated from the date of filing. A bankruptcy cannot legally remain on your credit report a single day longer than the prescribed seven or ten years from this initial date.

A Chapter 7 bankruptcy, for example, stays on your credit report for exactly 10 years from the filing date. Not the discharge date. If you filed on August 1, 2014, it must be removed by July 31, 2024. The FCRA caps the reporting at 10 years to protect consumers from being punished indefinitely. You can find more detail on how the FCRA protects your credit history from these old debts.

This distinction is vital. A credit bureau that uses your discharge date as the starting point is breaking the law and illegally extending the negative impact on your credit. That is a clear, factual error you can—and should—dispute immediately.

Chapter 7 vs. Chapter 13 Reporting Rules

Not all bankruptcies leave the same footprint on your credit report. The type you file—Chapter 7 or Chapter 13—directly dictates its legal lifespan on your report. This rule is based on the fundamental difference in how each chapter treats your debt and reflects your level of repayment.

The FCRA sets different timelines for Chapter 7 and Chapter 13 because they involve very different commitments from the consumer.

Why Chapter 13 Has a Shorter Timeline

A Chapter 13 bankruptcy is a “reorganization” or a “wage earner’s plan.” It is a structured approach where you commit to a court-approved repayment plan over three to five years. Because you are actively repaying a portion of what you owe, the Fair Credit Reporting Act (FCRA) grants it more leniency.

As a result, a Chapter 13 bankruptcy can only legally remain on your credit report for seven years from the filing date. This shorter period acknowledges your good-faith effort to work with your creditors.

A Chapter 7 bankruptcy, on the other hand, is a “liquidation.” This is a faster process where non-exempt assets are sold to pay creditors, and eligible debt is discharged without a repayment plan. Because it offers a complete wipeout of debt, it is considered a more significant event and stays on your report for the full 10 years. You can dive deeper into the specifics of the Chapter 7 process to see why it carries that longer reporting period.

Understanding How Individual Accounts Are Treated

A common point of confusion is the difference between the public record of the bankruptcy filing and the individual accounts included within it. Your credit report has multiple components, and some negative items can be removed long before the main bankruptcy record.

Each account discharged in your bankruptcy—an old credit card, a personal loan, a medical bill—is subject to its own reporting clock. The FCRA dictates that these individual accounts can typically only be reported for seven years from the date of the first delinquency that led to the charge-off or inclusion in bankruptcy.

Key Takeaway: Your credit score may begin to recover well before the main bankruptcy record is gone. As individual negative accounts age off your report according to their own timelines, their negative impact is removed, even while the public record of the bankruptcy itself is still visible.

Consider this real-world example:

- June 2020: You missed a credit card payment and never caught up. This is the date of first delinquency.

- July 2021: You filed for Chapter 7 bankruptcy.

- The bankruptcy public record itself will stay on your report until July 2031 (10 years from filing).

- However, the original credit card account should be removed by June 2027 (7 years from the initial default).

This is a critical aspect of your consumer rights, as it allows your credit profile to start healing much sooner than you might think.

The Impact on Your Financial Future

That three-year difference between a seven-year and a ten-year reporting period is significant when you’re rebuilding your financial life. Lenders often view the repayment effort in a Chapter 13 as a sign of lower future risk.

The seven-year timeline for Chapter 13 is by design. Both Experian and the FCRA guidelines acknowledge that making payments for 3-5 years demonstrates financial accountability. This is an important distinction, especially since Chapter 7 still accounts for about 70% of annual consumer filings in the U.S.

Your job is to monitor both the main public record and the individual tradelines. By tracking each item’s expiration date, you can exercise your right to dispute anything that overstays its welcome, proactively cleaning up your report and helping your score recover faster.

How to Dispute Inaccurate Bankruptcy Information

If you’ve identified an error in how a bankruptcy is listed on your credit report, it’s time to take action. Whether the dates are wrong, the chapter type is incorrect, or it’s simply too old, you have the legal right to dispute it and demand a correction. The process requires a methodical approach to be effective.

First, you need official data. You are entitled to a free credit report from each of the three major bureaus—Equifax, Experian, and TransUnion—annually. The only federally authorized source for these free reports is AnnualCreditReport.com.

It is crucial to pull reports from all three bureaus. They do not share data, so an error might appear on your Experian report but be absent from the others. You need a complete picture to build your case.

Finding Errors That Give You Grounds to Dispute

With your reports in hand, it’s time to search for specific, factual mistakes that give you legal grounds for a dispute.

Here is exactly what to look for:

- Incorrect Dates: The filing date is paramount. Compare the date on your report to your official court documents. If the bureau has a later date, they are illegally extending the reporting period. This is a clear-cut violation of your rights.

- Wrong Chapter Type: Did you file Chapter 13, but the report shows Chapter 7? This is a major error that could keep the bankruptcy on your record for an extra three years.

- Records That Are Too Old: A Chapter 13 must be removed after seven years. A Chapter 7 must be removed after ten years. If yours is older, it has no legal right to be on your report.

- Accounts Still Showing a Balance: Any debt included in the bankruptcy must be updated to a $0 balance and noted as “discharged in bankruptcy.” If old accounts still show you owe money, this is a serious reporting error.

Finding even one of these inaccuracies is sufficient grounds to launch a formal dispute and enforce your right to an accurate credit history.

Writing a Dispute Letter That Gets Noticed

While the bureaus encourage online disputes, sending a physical letter by certified mail is a superior strategy. It creates a paper trail and provides legal proof that an online form cannot offer.

Your letter must be professional, direct, and factual. Do not include emotional appeals or personal stories. Get straight to the point.

Here’s a template you can adapt:

[Your Name]

[Your Address]

[Your City, State, ZIP Code]

[Date]

[Credit Bureau Name]

[Credit Bureau Address]

Subject: Dispute of Inaccurate Information in Credit File # [Your File Number]

To Whom It May Concern,

I am writing to dispute an inaccurate bankruptcy public record on my credit report.

- Item in Dispute: [e.g., Chapter 7 Bankruptcy]

- Case/Account Number: [Case Number from Report]

This information is inaccurate. The report incorrectly states [briefly describe the error, e.g., “the filing date is MM/DD/YYYY”]. According to my official court records, the correct filing date was [Provide Correct Date].

To support my claim, I have enclosed copies of:

- My official court filing document confirming the correct date.

- The relevant page of my credit report with the inaccurate item highlighted.

Under my rights outlined in the Fair Credit Reporting Act, I request a full investigation and the immediate removal of this inaccurate entry.

Sincerely,

[Your Signature]

[Your Printed Name]

Treating this as a formal credit dispute is critical. You are not asking for a favor; you are exercising your legal rights.

Why Certified Mail is Your Secret Weapon

Sending your dispute letter via certified mail with a return receipt is a crucial legal tactic. It provides undeniable proof of when you sent the letter and when the credit bureau received it.

This receipt starts the 30-day investigation clock mandated by the FCRA. Without it, a bureau could claim they never received your dispute, leaving you with no recourse. This simple step transforms your request into a formal legal demand they cannot legally ignore.

Know Your Rights Under the FCRA

When you find a damaging error on your credit report, it’s easy to feel powerless. However, you have a powerful federal law on your side. Understanding the Fair Credit Reporting Act (FCRA) is the key to holding credit bureaus accountable.

The FCRA was enacted to ensure accuracy and fairness in credit reporting. It places the legal responsibility squarely on Equifax, Experian, and TransUnion to maintain accurate information.

The 30-Day Investigation Clock

Once you submit a dispute, a legal clock starts. The FCRA gives the credit bureau 30 days to conduct a “reasonable investigation” into your claim. This is a hard deadline, not a suggestion.

During this period, the bureau must forward all the information you provided to the original source of the data, known as the “furnisher.” The furnisher—which could be a court or a public records company—must then investigate on their end and report back to the bureau.

Key Takeaway: The FCRA shifts the burden of proof. You don’t have to prove the information is wrong. You only need to raise a valid dispute. The credit bureau must then prove the information is 100% accurate and verifiable. If they fail, it must be deleted.

If their investigation finds the bankruptcy is inaccurate, incomplete, or can no longer be verified, they must remove it from your file. They are also required to send you the results of their investigation within five business days of its completion.

What Happens When They Can’t Prove It?

This is where many consumer disputes are won. While a public record like a bankruptcy seems easy to verify, it can be challenging for a large bureau to find definitive proof of an old filing. Records get archived, data becomes corrupted, and errors occur.

If the data furnisher fails to respond to the bureau’s request within the 30-day window or cannot provide solid proof, the FCRA is clear: the bureau must delete the disputed item.

Their failure to verify is treated the same as if the information was proven to be false. Your victory often comes not from a complex legal battle, but from a simple bureaucratic failure to meet a strict deadline. You can learn more about how the Fair Credit Reporting Act protects consumers from these reporting issues.

Your Right to Take Them to Court

What if a credit bureau ignores your dispute or fails to remove a confirmed error? The FCRA grants you the right to sue them in state or federal court for violating the law.

If a court finds the bureau’s non-compliance was willful, you may be awarded:

- Actual damages: Any money you lost due to the error (e.g., denial of a loan, higher interest rates), plus compensation for emotional distress.

- Statutory damages: Between $100 and $1,000 for each violation, even without proving actual losses.

- Punitive damages: Awarded to punish the credit bureau for their actions.

- Attorney’s fees and costs: If you win, the credit bureau is required to pay your legal fees.

This legal backstop is what gives the dispute process its power. The threat of legal action turns your dispute into a formal demand for the accuracy you are legally owed.

When You Need a Consumer Law Attorney

While you can handle many credit report errors yourself, some situations require professional intervention. Knowing when to contact a consumer law attorney can be the most critical decision for your financial future, especially when credit bureaus refuse to comply with the law.

If you find yourself stuck in a frustrating cycle of ignored disputes and unresolved claims, these are red flags that you need expert legal help.

The Bureaus Are Ignoring You

You followed the law perfectly. You sent a detailed dispute letter via certified mail with clear evidence. The legally mandated 30-day investigation period passed with no response.

This is a clear violation of the Fair Credit Reporting Act (FCRA). When a credit bureau ignores its legal duty to investigate and respond, you need more leverage than another letter. A consumer law attorney can file a lawsuit that forces them to not only respond but also answer for their negligence in court.

A Deleted Error Magically Reappears

It’s an infuriating scenario: you win your dispute, and the bureau removes the incorrect bankruptcy. Months later, it’s back on your report. This practice, known as reinsertion, is illegal unless the bureau follows strict procedures.

Under the FCRA, the bureau must send you written notice within five business days of reinserting the item. The notice must explain why it was reinserted and remind you of your right to dispute it again. If they reinsert it without formal notification, they have broken the law. An attorney is your best recourse for fighting an illegal reinsertion and potentially seeking damages.

The Error Causes Significant Financial Harm

An erroneous bankruptcy on your report can have catastrophic real-world consequences:

- Denial of a mortgage you were qualified for.

- Rejection for a necessary car loan.

- Inability to lease an apartment.

- Being forced into predatory, high-interest loans.

- Losing a job offer that was contingent on a credit check.

If an inaccurate bankruptcy directly caused a major financial loss, you may be entitled to recover actual damages. An attorney is essential in these cases. They can calculate your losses—from financial damages to emotional distress—and build a strong case against the credit bureau that caused the harm.

When a credit reporting error leads to a direct and measurable financial loss, the stakes are simply too high to go it alone. An attorney is skilled at legally connecting the bureau’s mistake to your damages, which is the key to holding them financially responsible under the FCRA.

You Are a Victim of Identity Theft

The worst-case scenario: the bankruptcy on your report is not yours because an identity thief filed it using your information. This is a complex legal problem involving not just the credit bureaus but also the court system.

Unraveling a fraudulent bankruptcy filing is far more complicated than a standard dispute. A consumer protection attorney is crucial for navigating the court system, proving the fraud, and compelling the credit bureaus to clear your record. Their expertise is vital for restoring your financial identity.

Answering Your Top Questions About Bankruptcy Removal

When you’re rebuilding after bankruptcy, many questions arise. Getting clear, honest answers is the first step toward financial recovery. Here are some of the most common questions about cleaning up a credit report after bankruptcy.

Can I Just Pay a Credit Repair Company to Get Rid of a Legitimate Bankruptcy?

No. It is crucial to understand that no one can legally remove an accurate bankruptcy that is still within its reporting period. Credit repair companies must follow the same rules you do—the ones established by the Fair Credit Reporting Act (FCRA).

Their legitimate function is to help you find and dispute inaccurate information. Any company promising to erase a valid, recent bankruptcy is likely a scam. For a legitimate bankruptcy, the only path is patience: waiting out the seven years for Chapter 13 or ten years for Chapter 7.

If the Bankruptcy Comes Off, Do All the Included Accounts Disappear Too?

Not always, and this can be beneficial for your credit score. The public record of the bankruptcy is a single entry on your report. The individual accounts discharged in that bankruptcy—old credit cards, loans, etc.—are separate entries.

Each of those accounts has its own seven-year reporting clock that starts from the date of the first missed payment, not the bankruptcy filing date. This often means those negative accounts will fall off your report years before the bankruptcy record itself, allowing your score to begin recovering much sooner.

An Expert’s Take: I advise clients to view their credit report like a garden. The bankruptcy is a large tree stump. The discharged accounts are smaller weeds. You can pull the weeds one by one as they age off, improving the garden’s appearance long before the stump is finally gone.

What if I Send a Dispute and the Credit Bureau Just Ignores Me?

If a credit bureau fails to respond to your formal dispute within the legally required 30 to 45 days, they are in violation of federal law. This is a direct violation of your consumer rights under the FCRA.

When this occurs, you have several powerful options:

- File a complaint with the Consumer Financial Protection Bureau (CFPB). The CFPB is a federal watchdog agency that can pressure the bureau to comply.

- Take the credit bureau to court. The FCRA gives you the right to sue for their failure to investigate. This can include recovering actual and statutory damages.

Being ignored by a credit bureau is a clear signal that it’s time to consult a consumer protection attorney who can enforce your rights.

Will Disputing Something on My Report Hurt My Credit Score?

Absolutely not. Filing a legitimate dispute will never harm your credit score. It is the only way to repair a score that is being suppressed by errors.

If your dispute is successful and an incorrect bankruptcy is removed, your score will almost certainly increase. If the bureau investigates and verifies the information as accurate, your score remains unchanged. There is no penalty for exercising your legal right to demand a fair and accurate credit report.

When credit bureaus violate your FCRA rights or debt collectors won’t stop harassing you, you shouldn’t have to fight them by yourself. Ginsburg Law Group PC focuses on defending consumers and making sure their rights are enforced. If you’re struggling with credit report errors, relentless collection calls, or debt lawsuits, reach out to us for a consultation to explore how we can help safeguard your financial future. You can learn more at https://www.ginsburglawgroup.com.