When a debt collector comes calling, it’s easy to feel overwhelmed and pressured. But before you do anything else, you need to understand your single most powerful tool under federal law: the debt validation letter.

Think of it as your first line of defense. This isn’t just a letter asking for information; it’s a formal legal demand that puts the ball squarely in the collector’s court. Sending this letter within 30 days of their first contact is the critical first step in your debt defense strategy. It triggers powerful consumer rights under the Fair Debt Collection Practices Act (FDCPA), forcing them to hit pause on all collection activities until they can prove you actually owe the debt.

Your First Line of Defense Against Debt Collectors

Let’s be honest—getting that call or letter from a collection agency is stressful. It’s designed to be. But what they don’t always tell you is that you have significant consumer rights designed to shield you from unfair or aggressive tactics.

By sending a debt validation letter, you’re not admitting to anything. You are exercising your rights under the Fair Debt Collection Practices Act (FDCPA), a cornerstone of consumer protection law that puts strict rules on what third-party debt collectors can and cannot do. This formal, written demand is a key debt defense tool that shifts the burden of proof from you to them.

The Power Of The 30-Day Window

The moment a debt collector first contacts you, a legal clock starts ticking. You have exactly 30 days to dispute the debt and demand they validate it. This is a hard deadline with serious implications for your consumer rights.

A phone call to dispute the debt doesn’t cut it. It holds very little legal weight and leaves you with no proof. A written debt validation letter, sent via certified mail, creates a concrete paper trail that proves you formally challenged their claim and invoked your legal protections under the FDCPA.

When you send that letter within the 30-day window, the law is on your side. The collector must immediately cease all collection efforts. No more calls. No more letters. Nothing, until they provide you with legitimate proof that the debt is valid and they legally own it.

Why This Step Is Non-Negotiable in Debt Defense

The debt collection industry is rife with errors. Debts are bought and sold, sometimes multiple times, and paperwork gets lost or mixed up in the process. It’s not uncommon for collectors to violate the FDCPA or the Fair Credit Reporting Act (FCRA) by pursuing the wrong person or the wrong amount.

In fact, a massive CFPB survey found that about one-third of consumers had been contacted by a collector. Of those, an incredible 53% said the collector was attempting to collect on a debt that was a mistake.

Sending a validation letter is your way of forcing them to check their facts. It can expose all sorts of common blunders and FDCPA violations:

- Mistaken Identity: They could be after someone with a similar name, a clear FDCPA violation if they knowingly pursue the wrong person.

- Incorrect Amount: The balance might be wrong, padded with illegal fees or miscalculated interest, violating the FDCPA’s prohibition on misrepresentation.

- Expired Debt: The debt might be so old that the statute of limitations has passed, meaning they can’t sue you for it. Threatening to sue on time-barred debt is a serious FDCPA violation.

- Outright Scams: The “collector” could be a complete fraud with no right to the money.

Demanding proof makes the collector show their hand. If their case is weak or they can’t produce the necessary documents, they often just give up. You can learn more about your fundamental rights against debt collectors and see just how much power you have. This letter is your shield.

Key FDCPA Consumer Protections at a Glance

The FDCPA is your legal backstop, and sending a debt validation letter is what activates its strongest protections. Here’s a quick breakdown of the rights you’re putting into action.

| Your Right | What It Means for You | FDCPA Section |

|---|---|---|

| Right to Dispute | You can formally challenge a debt you don’t believe you owe, or if you think the amount is wrong. | 15 U.S.C. § 1692g(b) |

| Right to Verification | The collector must provide you with proof of the debt before they can resume collection activities. | 15 U.S.C. § 1692g(b) |

| Cease Communication | Once you dispute in writing, the collector must stop contacting you until they provide verification. | 15 U.S.C. § 1692c(c) |

| Honest Representation | The collector cannot lie about the amount owed, its legal status, or who they are. | 15 U.S.C. § 1692e |

| Protection from Harassment | The FDCPA prohibits abusive or harassing behavior, like constant calls or threats. | 15 U.S.C. § 1692d |

Understanding these consumer protection laws is the first step toward taking control of the situation. Never assume a collector’s claim is accurate—always make them prove it.

Understanding the Legal Power of Debt Validation

When you mail a debt validation letter, you’re doing more than just sending a piece of paper. You are officially invoking a powerful legal shield granted to you by the Fair Debt Collection Practices Act (FDCPA). This isn’t some obscure loophole; it’s a federal consumer rights law designed specifically to protect people from abusive, deceptive, and unfair collection tactics.

In short, the FDCPA puts the burden of proof squarely on the collector, not on you.

What the Law Demands from Collectors

The rules are surprisingly direct. Once a debt collector contacts you for the first time, the clock starts ticking. They have just five days to send you a written notice containing some very specific information. This isn’t a suggestion—it’s a legal requirement under the FDCPA.

This initial notice, often called a “G-notice” in the industry, is your official starting gun. It must clearly state:

- The total amount of the debt.

- The name of the original creditor.

- A crucial statement informing you of your right to dispute the debt’s validity within 30 days.

If you don’t dispute it in that window, the collector can legally assume the debt is valid and continue their efforts. That 30-day period is your golden opportunity to challenge them as part of your debt defense.

Here’s the critical takeaway: From the moment a collector receives your written dispute, they must stop all collection activity. No more calls, no more letters, no more pressure. They can’t contact you again until they’ve mailed you legally acceptable proof of the debt.

If they ignore your letter and keep harassing you? They are flat-out breaking federal law. This isn’t just a minor misstep; it’s a violation that can expose them to significant legal trouble, including statutory damages paid directly to you for each FDCPA violation.

Turning the Tables on Collection Errors

You might be surprised how often the debt collection industry violates consumer protection laws. Debts are bought and sold in bulk, sometimes multiple times, and the paperwork often gets messy or lost along the way. Your validation letter is a powerful debt defense tool for exposing these mistakes.

I’ve seen this process uncover all sorts of FDCPA and FCRA violations for my clients. Here are just a few real-world examples:

- Zombie Debt: This is a classic. A collector buys an ancient debt that’s long past the statute of limitations, hoping you don’t know your rights. Threatening a lawsuit on time-barred debt is an FDCPA violation. Your letter forces them to provide the date of original delinquency, which can quickly prove the debt is legally uncollectible.

- Mistaken Identity: Do you have a common name? It’s shockingly easy for collectors to target the wrong person. A demand for validation forces them to connect the debt specifically to you, which is a basic requirement of debt defense.

- Phantom Fees and Inflated Balances: The amount they claim you owe might be padded with unauthorized fees, sky-high interest, or simple accounting errors. Demanding a full, itemized breakdown often reveals these FDCPA violations right away.

The FDCPA has been protecting consumers since 1977, but it’s more relevant than ever. The Telephone Consumer Protection Act (TCPA) also provides rights against harassing robocalls from collectors. When you send that letter, you put an immediate stop to that harassment.

While a key court case clarified that “verification” might only mean a collector has to confirm basic details with the original creditor, this simple step is often enough. In fact, it can weed out the estimated 53% of collection accounts that are based on incomplete or outright wrong information.

By sending a debt validation letter, you fundamentally shift the power dynamic. You’re no longer just dodging calls and feeling helpless. You are taking control, standing on your consumer rights, and making the collector justify their claim. It’s a clear signal that you’re an informed consumer who won’t be easily intimidated.

Customizable Debt Validation Letter Templates

Alright, this is where the rubber meets the road. A strong debt validation letter is your single most important tool for exercising your consumer rights under the FDCPA. It’s how you formally challenge a collector and force them to prove their claim.

Think of it as putting the ball back in their court.

Below, you’ll find three different templates, each tailored to a specific, common scenario in consumer law and estate planning. Just copy the one that fits your situation, fill in your details where you see the brackets, and send it off via certified mail. It’s that simple.

The General Purpose Debt Validation Letter

This is your workhorse, the template you’ll use 90% of the time for basic debt defense. It’s firm but professional and gets the job done without being overly aggressive. I always recommend starting with this one if you’ve just received a collection notice and need to see their proof.

[Your Full Name] [Your Street Address] [Your City, State, ZIP Code]

[Date]

[Debt Collector’s Name] [Debt Collector’s Street Address] [Debt Collector’s City, State, ZIP Code]

RE: Account Number [Account Number Provided by Collector]

To Whom It May Concern:

I am writing in response to your communication dated [Date of Collector’s Letter] concerning the account referenced above. This letter serves as my formal dispute of the alleged debt and a demand for validation under the Fair Debt Collection Practices Act, 15 U.S.C. § 1692g.

Please note this is not a refusal to pay. It is a formal notice that your claim is disputed and validation is required by law. I am not acknowledging any liability for this debt.

I am requesting that you provide me with the following information to validate this claim:

- Proof that you are licensed to collect debts in my state.

- The name and address of the original creditor.

- The original account number and the date the account was established.

- A copy of the original signed contract or agreement with the original creditor.

- A complete, itemized accounting of the alleged debt from the original creditor, breaking down all principal, interest, fees, and other charges.

- Verification that the statute of limitations for collecting this debt has not expired in my state.

Until you provide this validation, you must cease all collection activities related to this account. This includes phone calls, letters, and reporting this disputed account to any credit reporting agency.

Sincerely,

[Your Printed Name] [Your Signature]

Expert Insight: This letter works because it’s legally precise without being hostile. The sentence “This is not a refusal to pay, but a notice that your claim is disputed” is incredibly important. It shuts down any attempt by the collector to claim you’re simply ignoring the debt, which could otherwise prompt them to escalate their actions.

The Assertive Letter For Suspected FDCPA Violations

Sometimes, a collector crosses the line. If you’re dealing with harassing calls, threats, or other illegal behavior, it’s time to be more forceful. This template puts them on notice that you know your consumer rights and are documenting their violations.

[Your Full Name] [Your Street Address] [Your City, State, ZIP Code]

[Date]

[Debt Collector’s Name] [Debt Collector’s Street Address] [Debt Collector’s City, State, ZIP Code]

RE: Account Number [Account Number Provided by Collector] – FORMAL DISPUTE AND DEMAND TO CEASE COMMUNICATION

To Whom It May Concern:

This letter is a formal dispute of the alleged debt referenced above, pursuant to my rights under the FDCPA, 15 U.S.C. § 1692g. I dispute the validity of this debt in its entirety.

I demand you provide complete validation as required by law. At a minimum, this must include the original contract bearing my signature, the name and address of the original creditor, and a full itemized accounting of the alleged balance.

Furthermore, I am documenting what I believe to be violations of the FDCPA and TCPA in your communications with me, including [briefly list violations, e.g., “harassing phone calls at my workplace,” “failure to identify yourself as a debt collector,” “using automated dialing systems to call my cell phone without consent”].

Be advised that I have a right to sue for statutory damages for each violation.

Effective immediately, cease all communication with me regarding this debt, except to notify me that collection efforts are being terminated or that you intend to seek a specific remedy in court. Any further unauthorized contact will be treated as a willful violation of the FDCPA.

Govern yourselves accordingly.

Sincerely,

[Your Printed Name] [Your Signature]

Expert Insight: This version is a game-changer. By explicitly mentioning FDCPA and TCPA violations and your right to sue, you’re signaling that you’re not an easy target. This language often triggers an internal review of your file and can stop illegal collection tactics cold. They know continued harassment could cost them money in a consumer rights lawsuit.

The Specialized Letter For Debt Against An Estate

Getting a collection call about a deceased family member’s debt can be incredibly stressful. As the executor or representative of an estate, you have a legal and fiduciary duty to validate any claims before paying them with estate funds. This is a critical aspect of proper estate planning and administration.

[Your Full Name, as Executor/Administrator of the Estate] [Your Street Address] [Your City, State, ZIP Code]

[Date]

[Debt Collector’s Name] [Debt Collector’s Street Address] [Debt Collector’s City, State, ZIP Code]

RE: Estate of [Deceased Person’s Full Name], Account Number [Account Number Provided by Collector]

To Whom It May Concern:

I am the personal representative for the Estate of [Deceased Person’s Full Name], who passed away on [Date of Death]. I am in receipt of your notice regarding an alleged debt owed by the decedent.

Under both the FDCPA and my fiduciary duties to the estate, I formally dispute this claim and demand full validation. Please provide the following documentation to substantiate your claim against the estate:

- A copy of the original signed agreement between the decedent and the original creditor.

- The name and address of the original creditor.

- A complete itemized statement showing how the alleged balance was calculated.

- Proof that the statute of limitations for filing a claim against the estate has not expired.

Please direct all future correspondence about this matter in writing to me at the address above. Do not contact any other family members about this debt. Until you provide legally sufficient validation, you are to cease all collection efforts.

Sincerely,

[Your Printed Name], Executor/Administrator of the Estate of [Deceased Person’s Full Name] [Your Signature]

Picking the right template for your situation is a huge, confident step forward. For a deeper dive into these strategies, take a look at our guide on how to dispute debt using your consumer rights. Now, let’s talk about how to send this letter correctly to make sure it has the full force of the law behind it.

Sending the Letter and Keeping Meticulous Records

You’ve written a solid debt validation letter. That’s a great first step in your debt defense, but it’s only half the job. How you send that letter and document every single move is what gives it real teeth. If this ever ends up in court as part of a consumer rights case, your records are your best evidence.

Think of it like building a case file from day one. Every piece of paper, every receipt, is a building block for your defense. A simple email or dropping the letter in a mailbox with a regular stamp just won’t cut it when you need to prove they received your FDCPA dispute. You need a method that provides undeniable proof of receipt.

Why Certified Mail is Non-Negotiable

Let me be crystal clear: you should only send your debt validation letter via USPS Certified Mail with a Return Receipt Requested. This isn’t just a best practice; it’s the only way to create the bulletproof paper trail you might need to enforce your consumer rights later.

Here’s why this is so critical:

- Proof You Sent It: The post office hands you a receipt with a tracking number. This is your official proof that you mailed a letter to the collector’s address on a specific date.

- Proof They Got It: The little green “return receipt” card gets signed by someone at the collection agency and mailed back to you. This is your smoking gun—irrefutable evidence of delivery for your FDCPA claim.

This one-two punch leaves no room for debate. A collector can’t play games and claim your letter got “lost in the mail” when you’re holding a receipt with their employee’s signature. Spending less than $10 on this service could save you thousands down the road.

Without that certified mail receipt, any dispute boils down to your word against theirs. Guess who usually wins that fight? The paper trail you create is objective, third-party evidence that holds up in a consumer rights lawsuit.

Before You Go to the Post Office

Take a few minutes to get your ducks in a row before you head out. It’s a simple routine, but skipping a step can cause major headaches.

- Make Two Copies: Print out two identical copies of your letter. One is for them, and one is for your file. Never, ever send your only copy.

- Sign the Right One: Put your signature on the copy you’re sending to the collector. The one you keep doesn’t need a signature, but it has to be an exact duplicate of what you’re mailing.

- Get the Forms Ready: Address your envelope. When you get to the post office, you’ll need to fill out the certified mail form (PS Form 3800) and the green return receipt card (PS Form 3811). If you’ve never done it before, just ask the clerk for help—they handle these all day.

With the letter officially on its way, your next job is to organize your proof.

How to Organize Your File for a Fight

Don’t just toss the receipts in a drawer. The moment you get back from the post office, your documentation work for your debt defense begins.

Staple the flimsy certified mail receipt directly to your copy of the debt validation letter. A week or two later, the green return receipt card will show up in your mailbox. When it does, staple that to the packet as well. Now you have a complete set of evidence: your letter, the proof of mailing, and the proof of delivery, all in one place. Keep it somewhere safe.

This level of detail does more than just keep you organized. It sends a powerful, unspoken message to the collector that you are serious, you know your consumer rights, and you’re prepared to enforce them. If they ignore your dispute and violate the FDCPA, this tidy little file is exactly what a consumer protection attorney will want to see. Your meticulous records are what turn a simple letter into a real legal threat.

What Happens Next? Decoding Collector Responses

Alright, you’ve sent your debt validation letter via certified mail and have the receipts tucked away safely. The hard part is over. Now, it’s a waiting game. How the debt collector responds—or doesn’t respond—will tell you everything you need to know about their claim and whether they are respecting your consumer rights.

Your role now shifts from offense to defense. You’ll need to watch, document, and prepare for whatever comes next. The good news is, by sending that letter, you’ve already put yourself in a position of strength.

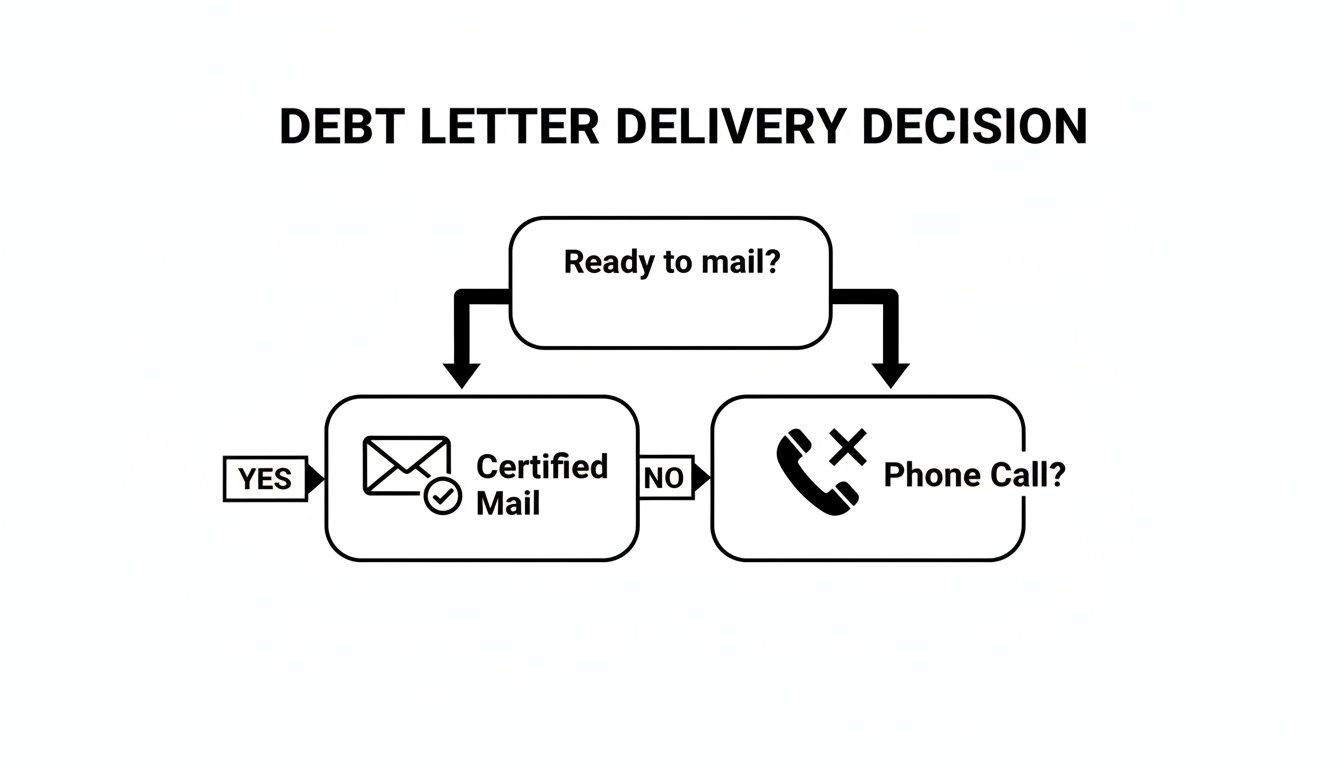

Deciding how to send that letter is a critical first step. This flowchart breaks down why one method is far superior to the other.

As you can see, certified mail is really the only way to go. It creates a legal paper trail that a phone call simply can’t match when it comes to debt defense.

Scenario One: The Collector Sends “Proof”

This is what the collector hopes will happen. A few weeks after you send your letter, you might get a packet of documents from them. But here’s a pro tip: the term “proof” is used very loosely in the collections industry. It’s your job to be skeptical and review every single page with a critical eye.

Don’t let them fool you with a simple spreadsheet printout. For validation to be legally sufficient, you’re looking for concrete evidence. This should include:

- The Original Agreement: A copy of the actual contract you signed with the original creditor.

- Itemized Statements: A detailed breakdown showing how they got to the total they claim you owe—principal, interest, fees, and all.

- Chain of Title: Legal documents showing they have the right to collect this specific debt, proving they bought it or were assigned it properly.

If they actually manage to send convincing evidence that the debt is yours, the amount is right, and it’s not past the statute of limitations, then it’s time to plan your next debt defense move. This might involve negotiating a settlement or looking into other debt-relief strategies.

Scenario Two: The Collector Goes Silent

Honestly? This is often the best possible outcome. If the 30-day validation period passes and you hear nothing but crickets, it’s a great sign for your debt defense. It usually means the collector looked at their file, realized they didn’t have the documentation to back up their claim, and decided you weren’t worth the trouble.

They know that continuing to contact you without providing validation is a direct violation of the FDCPA. So, rather than risk getting sued, they often just close the account and move on to an easier target.

Crucial Takeaway: Silence doesn’t make the debt disappear forever. The collector—or another one who buys the debt down the road—could pop up again. This is precisely why you must keep your certified mail receipt and a copy of your letter indefinitely. If anyone ever contacts you about this debt again, you have ironclad proof that it was disputed and never validated.

Scenario Three: The Harassment Continues (Illegally)

This is the most serious situation, and unfortunately, it happens. If a collector flat-out ignores your letter and keeps calling or sending demands without sending proof, they are breaking federal consumer protection law. This is where all your careful record-keeping becomes your greatest asset.

Let’s be clear: shady collection practices are rampant. The CFPB receives hundreds of thousands of complaints, and debt collection is consistently a top offender. The most common issues? “Attempts to collect debt not owed” and problems with “written notification about debt.” This points directly to a systemic failure in the validation process. You can find more eye-opening debt collection statistics that show just how common these problems are.

If this happens to you, document every single interaction. Log every call, save every letter, and keep every voicemail. Each illegal contact is another FDCPA violation. At this point, you should stop trying to handle it yourself and immediately contact a consumer protection attorney. The evidence you’ve gathered could be the foundation for a lawsuit against the collector, potentially resulting in them having to pay you damages.

Navigating a collector’s response can feel like a chess match. To make it easier, here’s a quick-reference table to help you understand their move and plan your own debt defense strategy.

Collector Responses and Your Next Moves

| Collector’s Response | What It Means | Your Recommended Action |

|---|---|---|

| Provides Complete Validation | They have legitimate, verifiable proof that the debt is yours, the amount is correct, and they have the legal right to collect it. | Review the documents carefully. If valid, begin exploring your debt defense options, such as negotiating a settlement or payment plan. |

| Provides Incomplete “Proof” | They send back a summary sheet, a spreadsheet, or other documents that don’t meet the legal standard for validation. | Send a follow-up letter pointing out the deficiencies and stating they have failed to validate the debt. Reiterate that they must cease collection efforts. |

| Goes Completely Silent | They’ve likely reviewed their file, found they lack sufficient proof, and have decided to drop the matter to avoid legal trouble. | Do nothing but keep your records. File away your certified mail receipt and a copy of your letter permanently in case the debt resurfaces later. |

| Ignores Request & Continues Contact | This is a clear FDCPA violation. They are illegally pursuing a debt they have not validated. | Document every illegal contact (calls, letters). Cease communication with the collector and immediately contact a consumer protection attorney. |

| Sells the Debt to a New Collector | Your old collector gives up, but sells the unvalidated account to another agency who then starts contacting you. | Start the process over. Send a new debt validation letter to the new collector within 30 days of their first contact with you. |

Remember, your validation letter forces the collector to play by the rules. By understanding these potential outcomes, you can stay one step ahead and protect your consumer rights.

Common Questions About Debt Validation

Even when you know the rules, dealing with debt collectors can stir up a lot of questions. Let’s tackle some of the most common ones I hear from people who are about to send a validation letter.

What If I Missed the 30-Day Deadline?

This is a big one, and it’s easy to worry if you’ve let that 30-day window slip by. Don’t panic. Your consumer rights don’t just disappear.

That initial 30-day period is so important because sending your letter within that time legally forces the collector to freeze all collection efforts under the FDCPA. They have to stop the calls and letters until they can prove the debt is yours. If you miss that deadline, they don’t have that legal obligation to pause.

But you should absolutely still send the letter. Even after 30 days, the FDCPA still requires them to provide proof of the debt if you request it. They can’t just ignore your request and move forward with something serious like a lawsuit. Sending the letter late is always, always better than not sending it at all as part of your debt defense.

Does Sending This Letter Mean I’m Admitting I Owe the Debt?

No, not at all. It’s actually the complete opposite.

A well-crafted validation letter makes it crystal clear that you are formally disputing the claim. You aren’t admitting to anything.

Think of it like this: You’re not saying, “I might owe you money.” You’re saying, “You claim I owe you money—now prove it.” This puts the legal burden right back where it belongs: on them. It’s a powerful debt defense move that doesn’t reset the statute of limitations.

This is a critical distinction in consumer law. Your letter is a formal challenge, not a conversation.

What If They Report the Debt to the Credit Bureaus Anyway?

If you sent your dispute on time and the collector reports the debt without marking it as “disputed,” they’ve just broken the law. Both the FDCPA and the Fair Credit Reporting Act (FCRA) have strict rules against this.

Any debt they report after receiving your dispute must be flagged as disputed. If they fail to do this, or if they report a debt they can’t validate, you’ve got a solid case for an FCRA violation.

Here’s your action plan:

- Immediately file a formal dispute with each credit bureau showing the collection—Equifax, Experian, and TransUnion.

- Send them copies of your original validation letter and the certified mail receipt to back up your claim.

- Seriously consider talking to a consumer rights attorney. An FCRA violation like this could mean you’re entitled to damages and removal of the inaccurate item from your credit report.

Sending a debt validation letter is your first line of defense. It’s the most powerful first step you can take to regain control, assert your consumer rights, and hold collectors accountable.

Navigating debt issues can feel overwhelming, but you don’t have to face it by yourself. If you’re dealing with aggressive collectors, finding errors on your credit report, or just need to understand your consumer rights, the team at Ginsburg Law Group PC is ready to step in. Protect your financial future and take the next step by contacting us for a consultation at https://www.gi.