The very moment you file for bankruptcy, a powerful consumer protection tool kicks in. It’s called the automatic stay, and it’s your first, most immediate line of defense. Think of it as a legal force field that instantly springs up around you, stopping most creditors dead in their their tracks and enforcing your rights.

This court order means the relentless phone calls, the intimidating letters, and the constant pressure have to stop. It’s a legal mechanism designed to give you desperately needed breathing room so you can start to sort things out without unlawful creditor harassment.

The Automatic Stay: Your Legal Shield Against Creditors

If you feel like you’re being harassed by creditors, the automatic stay is the legal referee jumping in and yelling, “Time out!” It’s an immediate, legally-binding injunction that freezes almost every attempt to collect a debt from you.

This isn’t just a suggestion; it’s a federal court order that creditors must take very seriously. It’s one of the biggest and most immediate benefits of filing for bankruptcy, giving you the space to work through your finances without the constant threat of someone taking your car, your wages, or your home. It effectively supercharges the protections you have under consumer rights laws.

What Does the Automatic Stay Stop Immediately?

The reach of the automatic stay is incredibly broad and it halts a whole range of collection activities right away. Once your case is on file with the court, creditors are legally barred from taking actions like these:

- Harassing Phone Calls and Letters: All those calls and demand letters must stop. The stay basically reinforces and gives teeth to your protections under the Fair Debt Collection Practices Act (FDCPA) and Telephone Consumer Protection Act (TCPA).

- Wage Garnishment: If your paycheck is being garnished, that stops. You’ll immediately start getting your full paycheck again.

- Lawsuits and Judgments: Any current lawsuits against you for debt are put on hold. Creditors also can’t start new ones or try to enforce a judgment they already have against you. This is a core component of debt defense.

- Foreclosure Proceedings: The stay temporarily stops a foreclosure on your home. This can give you invaluable time to figure out a plan, especially in a Chapter 13 bankruptcy.

- Repossession Efforts: Lenders are blocked from repossessing your car or other property. This is a huge relief if you’ve fallen behind on your payments and can even provide leverage in a Lemon Law dispute.

For a deeper dive, you can learn more about how the bankruptcy automatic stay works in our detailed guide.

To make it crystal clear, here’s a quick summary of what stops and what doesn’t.

Immediate Effects Of The Automatic Stay

| Action Halted By Automatic Stay | Brief Explanation |

|---|---|

| Harassing Communication | All collection calls and letters from creditors must cease immediately. |

| Wage Garnishment | Any existing garnishments on your paycheck are stopped. |

| Lawsuits & Judgments | Ongoing lawsuits are paused, and new ones cannot be filed. |

| Foreclosure | The foreclosure process on your home is temporarily halted. |

| Repossession | Creditors are blocked from taking your car or other secured property. |

| Bank Levies | Attempts to freeze or take money from your bank account are stopped. |

While the stay is a powerful tool against most common debts, it’s not a silver bullet for everything. Certain obligations, like criminal fines and ongoing child support, will continue.

Understanding the Bigger Picture

The need for this kind of powerful legal protection is very real. With economic pressures squeezing households across the country, more people are turning to bankruptcy for a lifeline. In a recent calendar year, total U.S. bankruptcy filings jumped to 565,759, which is an 11% increase from the year before.

A huge chunk of that increase came from Chapter 7 filings, which shot up by 15% to 332,706 cases as people sought to wipe out unsecured debts like credit cards and medical bills.

The automatic stay provides more than just financial relief; it restores your peace of mind. It allows you to answer your phone without fear and check your mail without anxiety, marking the first step toward reclaiming control over your life.

Remember, while the automatic stay is an incredible tool, it has its limits. It typically doesn’t stop things like criminal proceedings, some tax actions, or domestic support obligations like child support and alimony. But for the debts that push most people to their breaking point, it’s the powerful first step on the road back to financial stability.

Navigating The Bankruptcy Process Step By Step

Thinking about what happens when you file for bankruptcy can be intimidating, but it’s a lot more organized than most people realize. It’s not one giant, scary event but a sequence of well-defined steps, each with a specific goal. If you can see it as a guided journey instead of a plunge into the unknown, you’ll find the whole experience much less stressful.

The journey actually starts well before you ever file any paperwork. It begins the moment you decide to sit down with a consumer rights attorney who knows the ins and outs of debt defense and bankruptcy. That first meeting is where the real work begins—they’ll look at your specific financial picture and start mapping out a strategy just for you.

The Pre-Filing Steps

Before your case officially gets underway, you have to tick a couple of mandatory boxes. These initial requirements are there to make sure you have a complete handle on your finances and truly understand what filing for bankruptcy means.

First, you’ll need to complete a credit counseling course from a government-approved agency. Think of this as an educational pit stop, not a test. It’s designed to help you go over your budget, see if any other options make sense, and confirm that bankruptcy really is the right path forward.

Next, you’ll work closely with your attorney to pull together all your financial documents. This is a deep dive into your finances and includes:

- A complete list of everything you own (your assets) and everyone you owe (your debts).

- A clear accounting of your current income and regular monthly expenses.

- Details on any significant financial transactions you’ve made recently.

Getting this part right is crucial. The more accurate and thorough you are here, the smoother the rest of the process will be, and the better your attorney can protect you and your property.

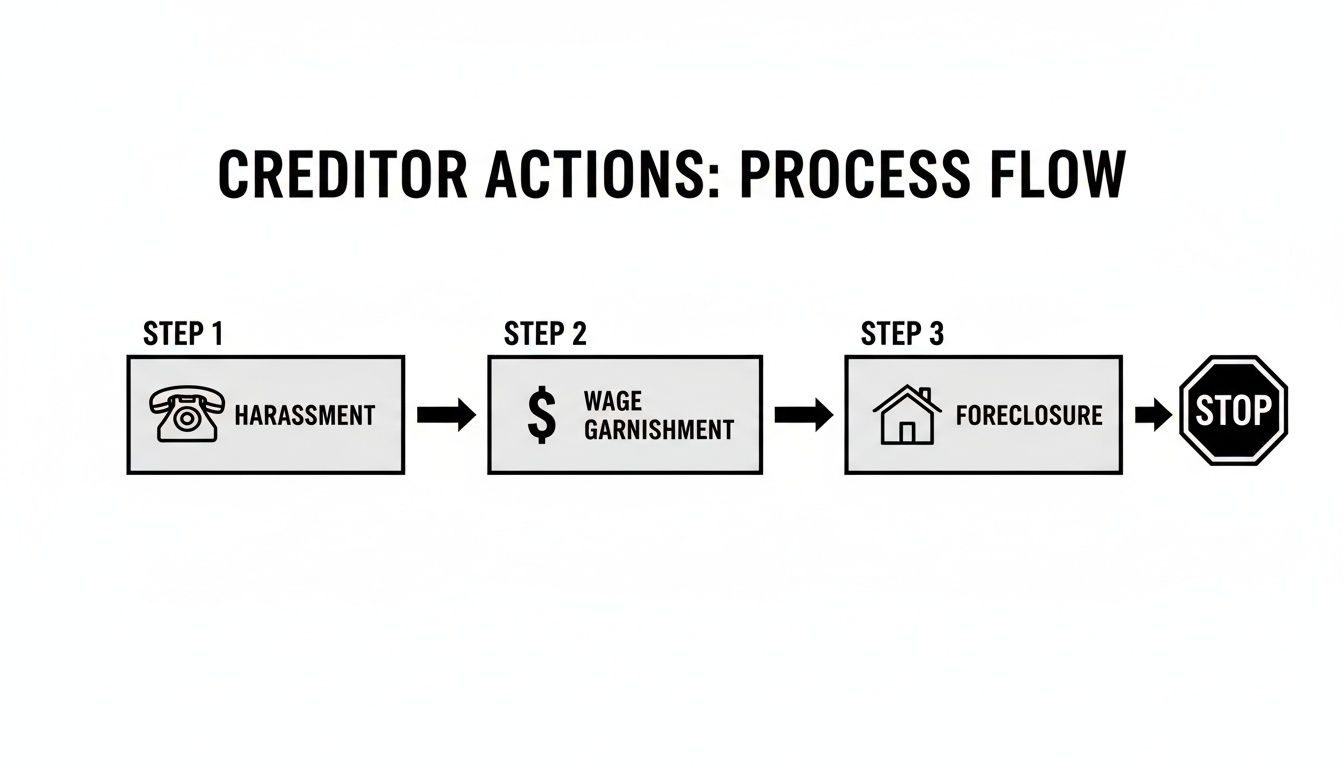

The moment you file, the process puts an immediate brake on all those aggressive creditor actions, as you can see below.

This image really highlights how filing for bankruptcy acts as a powerful stop sign against creditor harassment, wage garnishment, and foreclosure.

Filing The Petition And The Meeting Of Creditors

With all your prep work done, your attorney will file the official bankruptcy petition with the court. This is the magic moment. The instant it’s filed, that powerful “automatic stay” we talked about kicks in. From there, the court appoints a bankruptcy trustee to oversee your case.

About a month later, you’ll attend a hearing called the 341 meeting of creditors. The name sounds intense, but it’s usually a very quick and low-key affair, often held in a simple meeting room, not a formal courtroom. No judge will be present.

The whole point of the 341 meeting is for the trustee to confirm your identity and ask you some basic questions, under oath, about the financial information you provided. Creditors have the right to show up and ask questions, too, but honestly, in most consumer bankruptcy cases, they don’t.

Your attorney will be by your side the entire time to make sure things go smoothly. The only thing you need to do is answer every question honestly. For the vast majority of people, this is the one and only time they’ll have to make an appearance during the whole process.

The Path To Discharge

Once the 341 meeting is behind you, you’re on the home stretch. If you filed for Chapter 7, things tend to move pretty fast. The trustee’s job is to see if you have any non-exempt assets that could be sold to pay your creditors. But thanks to generous exemption laws, most people who file Chapter 7 don’t lose a single thing.

If you’re in a Chapter 13 case, this final phase is about sticking to your court-approved repayment plan, which usually lasts for three to five years. As long as you keep up with the payments, you remain protected from your creditors.

The final, and best, step is getting your bankruptcy discharge. This is the official court order that wipes the slate clean, legally eliminating your responsibility to pay back those eligible debts. It’s the fresh start you’ve been working toward. Our guide to filing for bankruptcy provides a more detailed overview of these important milestones.

Choosing Your Path: Chapter 7 Versus Chapter 13 Bankruptcy

When you decide to file for bankruptcy, you’re not just picking one option. You’ve arrived at a fork in the road, with two main paths leading to financial relief. For most people, the choice comes down to Chapter 7 or Chapter 13 bankruptcy, and they work in very different ways.

A simple way to think about it is that Chapter 7 is a sprint to the finish line—a quick, clean break. On the other hand, Chapter 13 is a marathon—a structured journey of repayment over several years. Figuring out the core differences is the most important step in understanding what will happen when you file and which path best protects what you own.

Chapter 7: The Liquidation Path

Chapter 7 is often called “liquidation” bankruptcy, a term that sounds pretty scary. The reality is, for the vast majority of people who file, nothing is actually sold or liquidated. That’s because generous state and federal exemption laws protect your essential property, like your home, car, and personal belongings.

The whole point of Chapter 7 is to completely wipe the slate clean of eligible unsecured debts. We’re talking about things like credit card balances, medical bills, and personal loans. It’s a remarkably fast process, usually wrapping up in just four to six months. This route is designed for folks with limited income who simply don’t have the means to pay back their debts.

To get on this path, you have to pass what’s known as the “means test.” This test basically compares your household income to your state’s median income for a family of your size. If your income is below that line, you typically qualify. If it’s higher, the test gets more complicated to see if you truly have enough disposable income to fund a Chapter 13 plan instead.

Chapter 13: The Reorganization Path

Chapter 13 offers a completely different kind of solution. Instead of eliminating debts right away, it lets you reorganize them into a single, affordable monthly payment. This court-approved repayment plan lasts for a period of three to five years.

This path is often a lifeline for people who have a steady income but have fallen behind on secured debts, like their mortgage or car loan. It’s a powerful tool that can immediately stop a foreclosure or repossession, giving you a chance to catch up on those missed payments over time. It’s also the go-to option if your income is too high to qualify for Chapter 7.

One of the biggest advantages of Chapter 13 is that you get to keep all of your property, even assets that might not be fully protected by exemptions. Because you’re committing to repaying a portion of what you owe, you don’t risk losing anything.

Chapter 13 empowers you to take control of your debts on your own terms, guided by a court-approved plan. It’s not about surrendering; it’s about restructuring your finances to create a sustainable path forward while protecting the things you’ve worked hard for.

Chapter 7 vs. Chapter 13 At a Glance

Making the right choice between these two chapters requires a clear look at how they stack up. While a good attorney will guide you, knowing the fundamentals helps you ask the right questions from the start.

Here’s a direct comparison of what happens under each chapter.

| Feature | Chapter 7 (Liquidation) | Chapter 13 (Reorganization) |

|---|---|---|

| Primary Goal | To quickly eliminate most unsecured debts for a fresh start. | To reorganize debts into a manageable 3-5 year repayment plan. |

| Typical Timeline | Usually completed in 4-6 months. | Lasts for the duration of the 3-5 year plan. |

| Asset Treatment | Non-exempt assets can be sold by the trustee (though most filers keep all their property). | You keep all of your assets in exchange for making plan payments. |

| Debt Discharge | Eligible debts are wiped out upon successful completion of the case. | Remaining eligible debts are discharged after the repayment plan is finished. |

| Eligibility | You must pass the “means test” based on your income and expenses. | You must have a regular source of income to fund the repayment plan. |

| Foreclosure/Repossession | Provides a temporary stop via the automatic stay, but doesn’t offer a long-term solution to catch up. | Allows you to stop foreclosure or repossession and cure the default over the life of the plan. |

In the end, the decision between Chapter 7 and Chapter 13 is a strategic one that hinges on your income, your assets, and your financial goals. An experienced debt defense attorney can analyze your unique situation and help you choose the path that offers the most effective and lasting relief.

Protecting What You Own With Bankruptcy Exemptions

One of the biggest myths I hear about bankruptcy is the idea that you’ll lose everything you own. It’s a terrifying thought—a court official showing up to sell your house, car, and furniture. That fear alone stops so many people from getting the help they desperately need. But for the vast majority of people filing, it’s just not true.

The whole point of bankruptcy is to give you a fresh start, not to leave you with nothing. To make that possible, the law provides a powerful tool called exemptions. Think of exemptions as a legal shield that protects your essential property from creditors and the bankruptcy court.

How Do Exemptions Actually Work?

When you file for bankruptcy, everything you own technically becomes part of what’s called a “bankruptcy estate.” A court-appointed trustee then looks at this estate to see if there’s anything they can sell to pay your creditors.

This is where exemptions come in. You get to legally claim certain assets as “exempt,” which pulls them out of the estate and puts them safely out of the trustee’s reach. The goal is simple: to make sure you can keep the things you need to live, work, and rebuild. Without them, the “fresh start” wouldn’t mean much at all.

What Property Can You Protect?

Exemption laws exist at both the federal and state levels. Some states have their own specific list you must use, while others give you a choice between the state and federal versions. This is one of those areas where having a good attorney really matters—they’ll know which set of rules provides the best protection for your specific situation.

While the exact dollar amounts can change depending on where you live, the types of property you can protect are generally the same. Here are the most common categories:

- Homestead Exemption: This is a big one. It protects a certain amount of equity in the home you live in. In many cases, this exemption is generous enough to fully protect a family’s house.

- Motor Vehicle Exemption: This protects the equity in your car (or sometimes more than one). It’s designed to make sure you can keep the transportation you rely on for work and daily life.

- Tools of the Trade: If you’re a contractor, freelancer, or need specific equipment for your job, this exemption protects those essential tools up to a certain value.

- Household Goods: This covers your everyday necessities like furniture, clothing, and appliances.

- Retirement Accounts: This is a critical protection. Funds in qualified retirement accounts, like a 401(k) or IRA, are almost always 100% protected under federal law.

On top of these, there’s often a “wildcard” exemption you can apply to any type of property, which gives you the flexibility to protect something sentimental or cover a bit of extra equity in your car.

Exemptions are the foundation of a successful bankruptcy filing. They are the legal mechanism that transforms bankruptcy from a process of loss into a genuine opportunity to reset your finances without losing the essential assets you need to move forward.

Figuring out how to apply these exemptions correctly is both an art and a science. It can get complicated, and a simple mistake could put your property at risk. To see how these rules might apply to you, you can learn more about navigating bankruptcy exemptions with professional guidance. An experienced attorney’s insight is crucial for making sure every protection is used to its fullest.

Life After Bankruptcy: Building Your Financial Future

When the court officially discharges your debts, it’s not the end of the road—it’s the beginning of a new one. Think of it as hitting a reset button. While a bankruptcy filing does cause a temporary hit to your credit score, it also erases the very debts that were dragging you down.

This is your chance to build a financial foundation on solid ground this time. If you’re smart and deliberate about your next moves, you can bounce back and start restoring your credit much sooner than most people believe is possible.

Taking the First Steps to Rebuild Credit

Getting back to good credit is a marathon, not a sprint. It starts with small, consistent actions that show lenders you’re reliable. You’re not just recovering; you’re proving you’ve adopted new, responsible habits. One of the best first moves you can make is opening a secured credit card.

Here’s how it works: you put down a small cash deposit, typically $200-$500, which then becomes your credit limit. For the bank, this makes you a no-risk customer, which is why these cards are so accessible for people fresh out of bankruptcy. Use it for small, everyday purchases like gas or a streaming subscription, and here’s the crucial part: pay the balance in full, on time, every single month. This positive payment history is reported to the credit bureaus and is the first real building block for a better score.

Your Rights Under the Fair Credit Reporting Act

Once your bankruptcy case is closed, checking your credit reports should become a regular habit. You have a legal right to an accurate report under the Fair Credit Reporting Act (FCRA), and this law is your best defense against errors that could hold you back.

Make it a point to pull your reports from all three main bureaus—Equifax, Experian, and TransUnion. When you do, you need to check a few things:

- Are discharged debts reported correctly? They must show a zero balance and be noted as “included in bankruptcy.”

- Have old debts resurfaced? Creditors are legally forbidden from trying to re-report a discharged debt as if it were a new problem. This illegal practice is sometimes called “zombie debt” collection.

- Is your personal information right? A simple misspelling or wrong address can cause major headaches.

If you spot a mistake, the FCRA empowers you to dispute it with the credit bureau. They are required by law to investigate and fix any inaccuracies. This isn’t just paperwork; it’s about actively managing your fresh start to make sure it’s truly a clean one.

What happens when you file bankruptcy isn’t a life sentence. It’s a strategic reset—a powerful tool for clearing overwhelming debt and starting over with a clean slate, one smart decision at a time.

Setting Realistic Goals for the Future

Rebuilding your financial life doesn’t happen overnight, but it absolutely does happen. After about two years of consistent, positive credit habits—like always paying on time and keeping debt levels low—many people are surprised to find they can qualify for major loans again. Yes, you can still buy a home or finance a car after bankruptcy.

The idea that bankruptcy permanently ruins your financial life is one of the biggest myths out there. In truth, it’s a legal safety net designed to give honest people a second chance. By understanding the process and knowing your rights, you can turn that second chance into a lasting success story.

Got Questions? Let’s Cover the Big Ones.

Even with a roadmap of the process, you’re bound to have some practical, “what-if” questions pop into your head. That’s completely normal. These are the real-world concerns that matter when you’re thinking about how filing for bankruptcy will actually play out in your life. Here are some straightforward answers to the questions we hear most often.

“Can I Get Fired for Filing Bankruptcy?”

This is a big one, and it causes a lot of anxiety. Let’s put it to rest: the law is on your side.

Federal law—specifically 11 U.S.C. Section 525—makes it illegal for employers, both government and private, to fire you or discriminate against you just because you filed for bankruptcy. They can’t cut your pay, pass you over for a promotion, or change your job duties for this reason.

Think of it this way: the whole point of bankruptcy is to give you a fresh start. That fresh start would be pretty meaningless if you could immediately lose your income. Of course, this doesn’t mean you have a free pass to underperform. An employer can still let you go for legitimate reasons that have nothing to do with your bankruptcy case.

“My Spouse Isn’t Filing. Will This Affect Them?”

This is a classic “it depends” situation, and the answer hinges on where you live and what kind of debt you have.

In what are known as “community property” states, most assets and debts you take on during the marriage are considered to belong to both of you, legally speaking. In that case, one spouse filing for bankruptcy can definitely have a ripple effect on the other.

But in “common law” states, the lines are clearer. You’re typically only responsible for debts that are in your name or that you co-signed. If you file alone, your spouse’s separate property and individual credit score are generally insulated.

The big exception here is joint debt. If you both co-signed for a car loan or a credit card, bankruptcy can get tricky. Your obligation to pay might be wiped out, but the creditor can—and will—go after your spouse for the full remaining balance. This is an area where talking to a lawyer is absolutely critical to avoid any nasty surprises for your partner.

“What If I Accidentally Forget to List a Creditor?”

It’s an honest mistake, but it can create real problems. If you leave a creditor off your bankruptcy paperwork, that particular debt might not get discharged.

Why? Because the court system is built on proper notification. If a creditor never gets the official notice about your case, they aren’t bound by its outcome and can resume collection efforts as soon as your case closes. This could even lead to violations of the FDCPA if they attempt to collect a discharged debt.

Forgetting to list a debt is probably the single most common—and costly—mistake people make when trying to file on their own. A good attorney has a system for this, usually involving a deep dive into your credit reports, to make sure every single creditor is accounted for. This is key to protecting your fresh start.

In a “no-asset” Chapter 7 case (meaning you don’t have any property that the trustee can sell), there’s sometimes a chance the debt can still be discharged. But if you have assets or you’re in a Chapter 13 plan, it becomes a much bigger headache. Your best bet is to be meticulous from the very beginning.

“Will I Actually Have to Go to Court and Face a Judge?”

The mental picture most people have is of a dramatic courtroom scene from a movie. The reality is far less intimidating. For the overwhelming majority of people filing Chapter 7 or Chapter 13, you will never step foot in a courtroom or speak to a judge.

The only mandatory appearance is the “341 meeting of creditors,” which we talked about earlier. It’s not held in a courtroom but usually in a simple meeting room (and often, it’s just a conference call). Your lawyer will be right by your side as you answer a few basic questions from the bankruptcy trustee. The whole thing is surprisingly quick, often lasting less than 10 minutes.

“Does Bankruptcy Get Rid of All My Debts?”

Bankruptcy is a powerful tool for debt relief, but it’s not a magic wand that makes every single debt disappear. The law carves out specific types of debt that are considered “non-dischargeable.” You’ll still be on the hook for these even after your case is successfully completed.

The usual suspects include:

- Domestic Support: Things like child support and alimony are never wiped out by bankruptcy.

- Most Taxes: While some very old income tax debt can sometimes be discharged, most recent tax bills from the IRS or state are here to stay.

- Student Loans: This is the big one for many people. Wiping out student loans in bankruptcy is notoriously difficult. You have to file a separate action and prove “undue hardship,” a legal standard that is incredibly high and very rarely met.

- Debts from Fraud or Injury: If you incurred a debt through fraudulent activity or by willfully and maliciously injuring someone, bankruptcy won’t help you escape it.

Knowing exactly which of your debts will be eliminated is a huge part of the process. Your attorney will go over your debt list with you to give you a clear picture of what your finances will look like on the other side.

Navigating the complexities of bankruptcy requires a clear understanding of your rights and a strategy tailored to your specific situation. At Ginsburg Law Group PC, our focus is on protecting consumers and providing the guidance needed for a true financial fresh start. If you are struggling with debt, facing creditor harassment, or considering bankruptcy, contact us for a confidential consultation to explore your legal options. Learn more about how we can help at https://www.ginsburglawgroup.com.