Summary

Chapter 13 bankruptcy in Orlando offers a structured path for residents to reorganize debt and protect essential assets like homes and vehicles. Unlike liquidation-based Chapter 7, this process involves a court-approved repayment plan spanning three to five years, managed by a trustee. Eligibility requires meeting specific debt thresholds and demonstrating regular income to cover monthly consolidated payments. In the Middle District of Florida, the court calculates these payments by subtracting necessary living expenses from disposable income, prioritizing secured debts and tax obligations. Mandatory steps include completing credit counseling before filing and attending a 341 meeting of creditors. While filing fees and attorney costs apply, legal fees are often incorporated into the repayment schedule, making representation more accessible. Success depends on maintaining consistent payments and transparent communication regarding financial changes. Avoiding common pitfalls like incurring new debt or missing deadlines is crucial for achieving a final discharge. For those facing foreclosure or overwhelming creditor pressure, Chapter 13 provides immediate legal protection and a realistic bridge toward financial stability without the need to surrender property.

Facing overwhelming debt while trying to keep your home, car, or other essential assets puts you in a difficult position. Bankruptcy Chapter 13 Orlando filings offer a structured path to reorganize your finances without surrendering everything you’ve worked for. Unlike Chapter 7, which liquidates assets, Chapter 13 lets you create a repayment plan that spans three to five years.

If you’re researching this option, you likely have questions about whether you qualify, what it costs, and how the process actually works in the Middle District of Florida. These are critical details that can determine whether Chapter 13 is the right choice for your situation, or whether another approach makes more sense.

At Ginsburg Law Group, we help Orlando-area residents navigate bankruptcy decisions with clarity. This guide breaks down Chapter 13 eligibility requirements, filing costs, and the step-by-step process so you can make an informed decision about your financial future.

What Chapter 13 bankruptcy means in Orlando

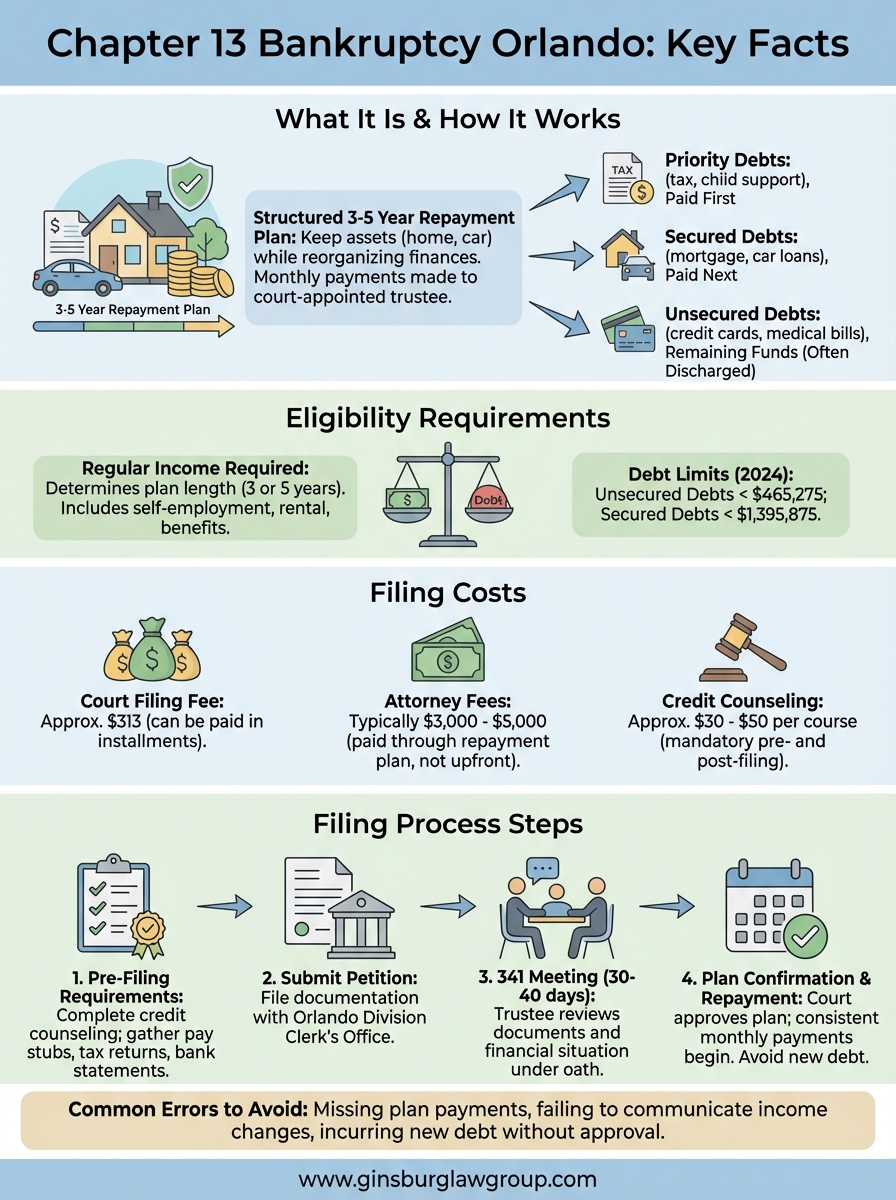

Chapter 13 bankruptcy lets you restructure your debts into a manageable payment plan while keeping your property. You continue making monthly payments to a court-appointed trustee, who distributes funds to your creditors according to a plan approved by the bankruptcy court. This process protects you from foreclosure, repossession, and wage garnishment while you catch up on missed payments.

How Chapter 13 reorganization works

The court reviews your income, expenses, and debts to determine how much you can afford to pay each month. Your repayment plan typically lasts three to five years, depending on your income level relative to Florida’s median income. During this period, you make one consolidated payment to the trustee rather than juggling multiple creditor bills.

Priority debts like tax obligations and child support get paid first, followed by secured debts such as mortgage arrears and car loans. Unsecured creditors receive whatever remains based on your disposable income after necessary living expenses. Many unsecured debts get discharged at the end of your plan, even if you only paid a fraction of what you owed.

Chapter 13 stops collection actions immediately when you file, giving you breathing room to stabilize your finances.

Key differences from Chapter 7 in the Middle District

Chapter 7 liquidates non-exempt assets to pay creditors and typically concludes within four to six months. Chapter 13 requires no asset liquidation but demands a multi-year commitment to your payment plan. You need regular income to qualify for Chapter 13, while Chapter 7 has income limits that might disqualify higher earners.

Orlando filers use bankruptcy chapter 13 orlando proceedings when they earn too much for Chapter 7 or need to protect specific assets that exceed Florida’s exemption limits. The Middle District court in Orlando processes your case using the same federal bankruptcy code as other districts, but local trustees and judges apply regional procedures and payment standards specific to Central Florida’s cost of living.

Who qualifies in Florida and common eligibility issues

You must meet specific income and debt requirements to file Chapter 13 in Florida. Your unsecured debts cannot exceed $465,275, and secured debts must stay below $1,395,875 as of 2024. These limits adjust periodically for inflation, so verify current thresholds with the bankruptcy court before filing.

Income and debt limits you must meet

Your income determines your payment plan length in bankruptcy chapter 13 orlando cases. If you earn less than Florida’s median income for your household size, you qualify for a three-year plan. Earning above the median requires a five-year commitment to your repayment schedule.

Chapter 13 requires regular income, but that doesn’t mean you need traditional employment.

Self-employment income, rental property payments, and government benefits all count toward your income calculation. You need enough monthly income to cover current expenses plus your proposed plan payment. The court scrutinizes your budget to ensure your plan is feasible and treats creditors fairly according to bankruptcy law.

Common disqualifications Orlando filers face

Previous bankruptcy filings create waiting periods before you can file again. You must wait two years after a previous Chapter 13 discharge or four years after Chapter 7. Pending criminal proceedings or failure to complete credit counseling within 180 days before filing also disqualifies your case immediately.

What Chapter 13 costs and how payments get set

Filing Chapter 13 in Orlando requires an initial court filing fee of $313, which you can pay in installments if you demonstrate financial hardship. Attorney fees typically range from $3,000 to $5,000 in the Middle District, though your lawyer can include their fees in your repayment plan rather than requiring full payment upfront.

Court fees and attorney expenses

The bankruptcy chapter 13 orlando court charges separate fees for administrative costs, while your attorney’s compensation gets built into your monthly plan payment. Credit counseling courses cost approximately $30 to $50 for both the pre-filing requirement and the post-filing debtor education course. These costs are mandatory and must be completed through court-approved agencies.

Your attorney fees get approved by the court and paid through your Chapter 13 plan, making legal representation accessible even with limited cash reserves.

How your monthly payment amount gets determined

The court calculates your payment by subtracting necessary living expenses from your monthly income. Necessary expenses include housing, utilities, food, transportation, and mandatory payroll deductions. Your disposable income determines how much you pay creditors over three to five years, with the court using IRS Collection Financial Standards to evaluate whether your proposed expenses are reasonable for Central Florida residents.

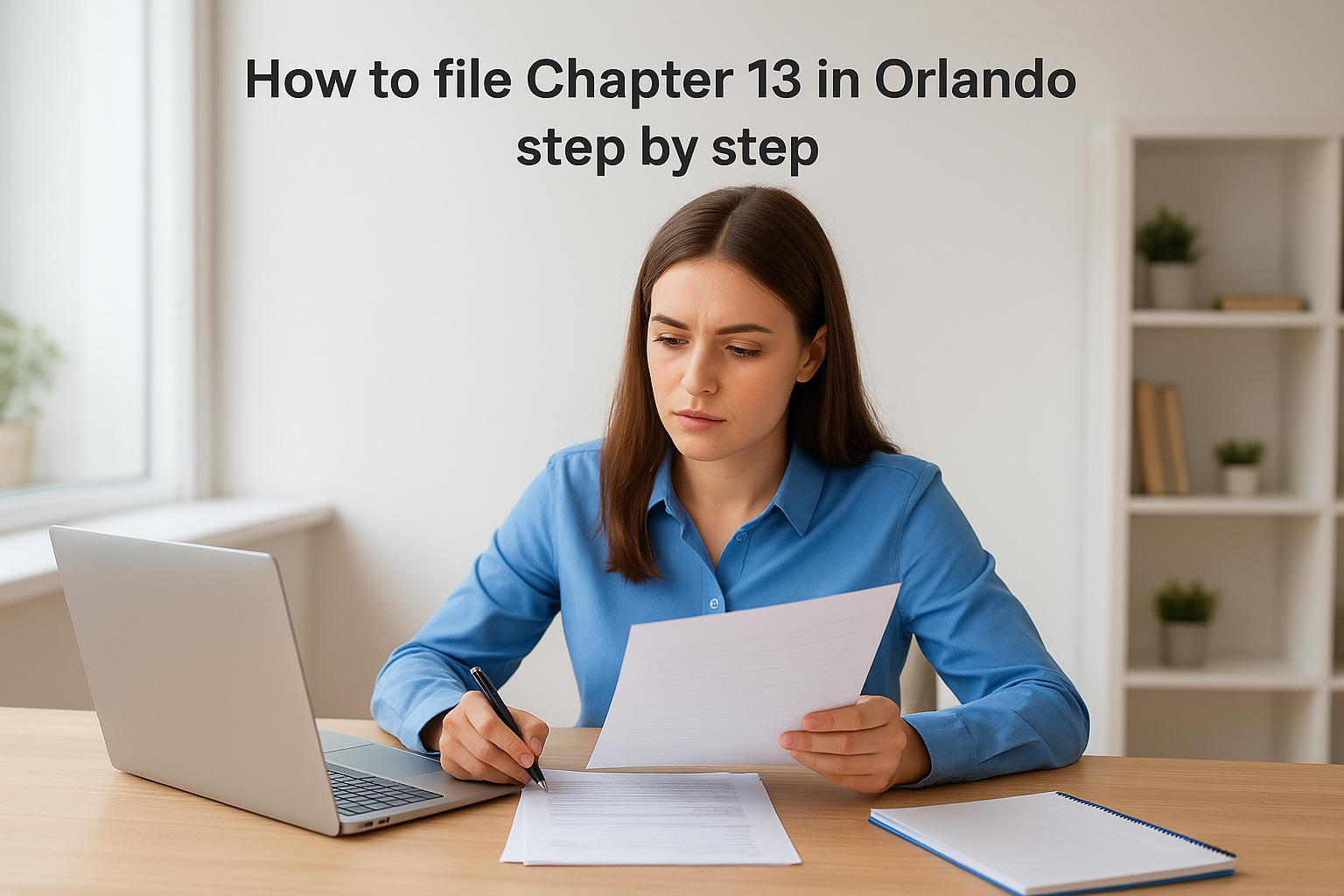

How to file Chapter 13 in Orlando step by step

Filing bankruptcy chapter 13 orlando cases requires specific documentation and strict adherence to court procedures. The Middle District court processes your case through several mandatory stages, starting months before your official filing date and extending through plan confirmation. Understanding each step prevents delays and helps you prepare accurate paperwork that satisfies the trustee’s requirements.

Complete pre-filing requirements first

You must complete credit counseling from a court-approved agency within 180 days before filing your petition. This session typically lasts 60 to 90 minutes and costs approximately $30 to $50. The agency issues a certificate that you must file with your bankruptcy petition, and missing this requirement gets your case dismissed immediately.

Gather six months of pay stubs, tax returns, and bank statements before filing. You need these documents to complete your means test calculation and monthly budget schedules. Your attorney uses this information to determine your disposable income and proposed plan payment.

Missing documents or incomplete schedules are the most common reasons Orlando trustees object to confirmation.

Submit your petition and documentation

File your petition electronically through the court’s CM/ECF system or submit paper forms to the Orlando Division Clerk’s Office. Your filing includes over 20 separate schedules detailing assets, debts, income, and expenses. The court schedules your 341 meeting approximately 30 to 40 days after filing, where the trustee reviews your documents and questions you under oath about your financial situation.

Mistakes to avoid and alternatives to consider

Filing bankruptcy chapter 13 orlando cases without understanding common pitfalls can result in case dismissal or denial of your discharge. You also need to evaluate whether Chapter 13 actually serves your situation better than alternative debt relief methods available in Florida.

Common filing errors that derail cases

Missing your plan payments is the fastest way to lose your case. The court expects consistent monthly payments starting 30 days after you file, and falling behind typically results in trustee motions to dismiss. You must also avoid incurring new debt without court approval, as additional obligations can make your existing plan unfeasible.

A single missed payment can trigger dismissal proceedings, so automate your trustee payments through payroll deduction whenever possible.

Failing to communicate income changes to your attorney and trustee creates serious problems. Your plan payment adjusts if your earnings increase substantially, and hiding income constitutes bankruptcy fraud with criminal consequences.

Other debt relief options for Orlando residents

Chapter 7 bankruptcy eliminates unsecured debts within months if you qualify, though you risk losing non-exempt assets. Debt settlement negotiations with creditors can reduce balances without court involvement, but settlements damage your credit and provide no legal protection from lawsuits. Mortgage modification programs through your lender might prevent foreclosure without requiring full bankruptcy filing, particularly if your only issue involves catching up on housing payments.

Where to go from here

Understanding bankruptcy chapter 13 orlando requirements gives you the foundation to make an informed decision, but your specific situation demands personalized legal analysis. Your income level, debt types, and property values all influence whether Chapter 13 serves your interests better than alternatives. You need to evaluate these factors with someone who understands Middle District procedures and local trustee expectations in Orlando.

Start by gathering your financial documents, including pay stubs, tax returns, and a complete list of creditors with current balances. This preparation makes your initial consultation more productive and helps your attorney provide accurate guidance on your options. Many people discover they qualify for debt relief strategies they hadn’t considered.

If you’re ready to explore your options with an experienced consumer protection attorney, contact Ginsburg Law Group for a free case evaluation. We help Orlando residents navigate bankruptcy decisions without upfront costs, giving you clarity on the best path forward.