Debt can pile up fast. Medical bills stack on top of credit cards. Your phone rings nonstop with collectors. You might feel stuck with no way out. The good news is bankruptcy exists to give people like you a fresh start. If you’re wondering how to file for bankruptcy, you’re not alone. Thousands of Americans use this legal tool every year to escape crushing debt and stop harassment.

Filing for bankruptcy is a structured legal process that can eliminate most of your unsecured debts. The court grants you protection from creditors while you either liquidate certain assets or create a payment plan. You don’t need to face foreclosure or wage garnishment when better options exist.

This guide walks you through every step of the bankruptcy filing process. You’ll learn the differences between Chapter 7 and Chapter 13. We’ll cover the mandatory counseling requirements, the documents you need, and what happens at your creditor meeting. You’ll also discover whether you can file without an attorney and how bankruptcy affects your credit long term.

Understanding chapter 7 versus chapter 13

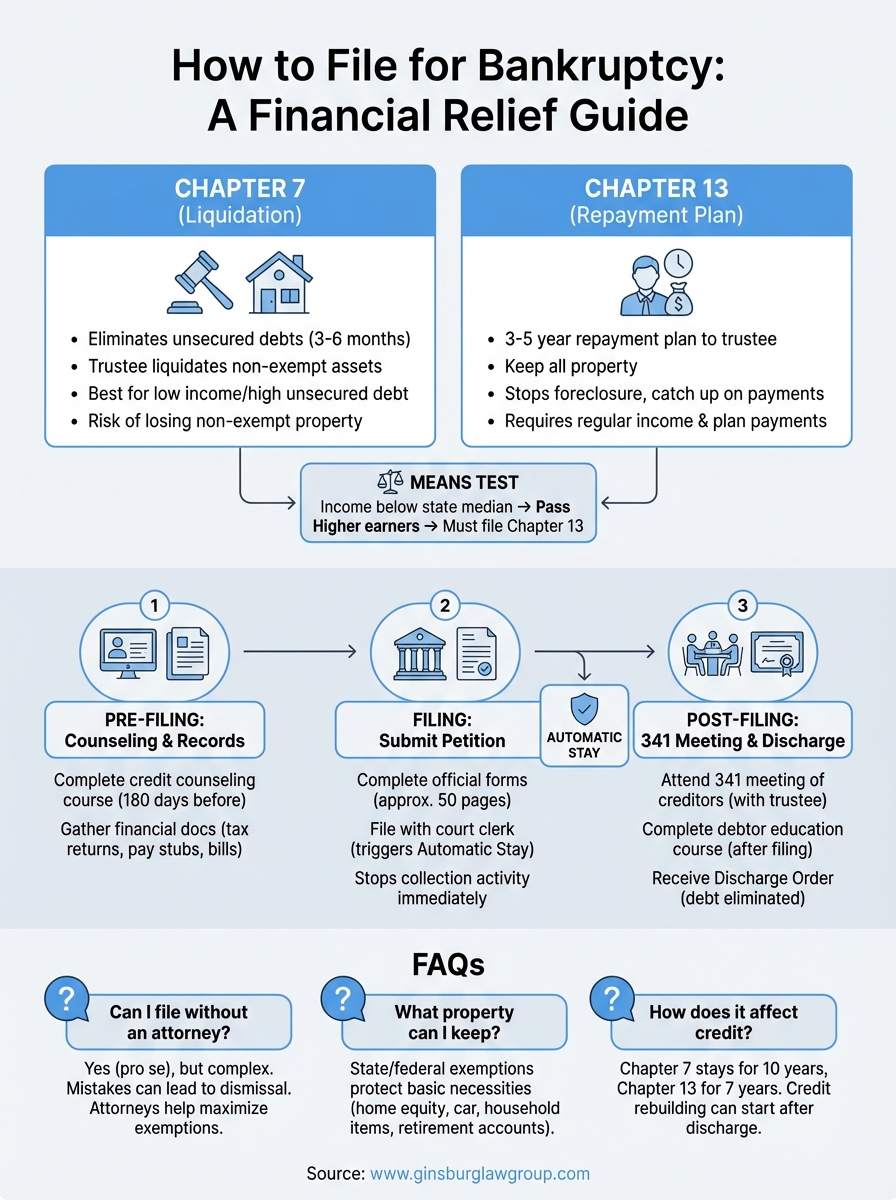

The bankruptcy code offers two main paths for individuals. Chapter 7 and Chapter 13 serve different purposes and work best for specific financial situations. Your income level, the types of debt you carry, and whether you own a home all influence which option suits you best.

Chapter 7 bankruptcy (liquidation)

Chapter 7 eliminates most unsecured debts within three to six months. The court appoints a trustee who reviews your assets and sells anything not protected by exemption laws. Most people keep their essential property because state and federal exemptions protect basic necessities like a modest car, household items, and retirement accounts.

This option works best if you earn below your state’s median income and carry significant credit card debt, medical bills, or personal loans. You won’t make monthly payments to creditors. The process moves quickly compared to Chapter 13. However, you might lose non-exempt assets like a second vehicle, vacation property, or valuable collections.

Chapter 13 bankruptcy (repayment plan)

Chapter 13 creates a three-to-five-year repayment schedule where you make monthly payments to a trustee. The trustee then distributes funds to your creditors based on a court-approved plan. You keep all your property but must have regular income to maintain the payment schedule.

Homeowners facing foreclosure often choose this route because it stops the foreclosure process and allows you to catch up on missed mortgage payments over time. The plan consolidates your debts into one manageable monthly payment. You must earn enough to cover both your living expenses and your plan payments. People who make too much to qualify for Chapter 7 typically end up here.

The means test determines your path

The bankruptcy means test compares your income to your state’s median for a household of your size. This calculation determines whether you qualify for Chapter 7 or must file Chapter 13. You add up your gross income from the six months before you file, then multiply by two to get an annual figure.

If your income falls below the state median, you pass the test and can file Chapter 7. Higher earners must complete a second calculation that deducts allowed expenses from income. The formula uses IRS standards for housing, food, transportation, and other costs. Some expenses like mortgage payments and car loans use your actual amounts rather than standardized figures.

The means test exists to prevent abuse of Chapter 7 by people who could realistically repay some debt through a Chapter 13 plan.

Your disposable income after deductions determines your eligibility. If you have significant money left over each month, the court expects you to repay creditors through Chapter 13. Understanding how to file for bankruptcy starts with knowing which chapter fits your financial profile. The wrong choice can lead to case dismissal and wasted filing fees.

Step 1. Complete counseling and gather records

The bankruptcy process requires you to complete specific tasks before you can file. These pre-filing requirements protect both you and your creditors by ensuring you understand your options and present accurate financial information. Skipping or rushing through this stage can result in case dismissal and wasted filing fees.

Complete the pre-filing credit counseling course

You must finish an approved credit counseling session within 180 days before filing. The course typically lasts 60 to 90 minutes and costs between $10 and $50. You can complete it online, by phone, or in person through agencies approved by the United States Trustee Program.

The counselor reviews your finances and discusses alternatives to bankruptcy like debt management plans or budget adjustments. You receive a certificate of completion that you must file with your bankruptcy paperwork. Most people choose online courses because they offer flexibility and immediate certificate delivery.

Credit counseling serves as your final checkpoint to confirm bankruptcy is the right solution for your situation.

Gather your financial documentation

Building a complete financial picture requires specific documents from the past two years. Your bankruptcy forms ask detailed questions about income, expenses, assets, and debts. Missing or inaccurate information gives creditors grounds to challenge your case.

Start collecting these essential records now:

- Tax returns from the last two years

- Pay stubs covering the six months before filing

- Bank statements showing account balances and recent transactions

- Property deeds and vehicle titles proving ownership

- Credit card statements with current balances

- Loan documents for mortgages, car loans, and personal loans

- Medical bills and collection notices

- Utility bills as proof of monthly expenses

List every asset you own and every debt you owe with exact amounts. Include retirement accounts, life insurance policies, and any money others owe you. When you learn how to file for bankruptcy, accuracy matters more than speed. The trustee cross-checks your statements against credit reports and public records.

Step 2. Submit forms to the bankruptcy court

Filing bankruptcy paperwork transforms your financial struggle into a legal process. You complete official forms that detail every aspect of your finances, then submit them to the bankruptcy court in your district. The court clerk stamps your petition with a case number the moment you file, triggering immediate legal protections.

Complete the official bankruptcy forms

The bankruptcy petition consists of approximately 50 pages of forms asking about your income, expenses, assets, debts, and recent financial transactions. You must answer every question truthfully under penalty of perjury. Download the official forms from the court’s website or obtain paper copies at the clerk’s office.

Your petition package includes these critical documents:

- Voluntary Petition (Form 101) with basic information and declaration of bankruptcy type

- Schedules A/B listing all property you own

- Schedules D, E/F detailing secured, priority, and unsecured debts

- Schedule I showing current income from all sources

- Schedule J itemizing monthly living expenses

- Statement of Financial Affairs covering two years of financial history

- Means Test calculation (Chapter 7) or proposed payment plan (Chapter 13)

File your documents with the bankruptcy court

You submit your completed forms to the clerk’s office in the federal district where you’ve lived for the past 180 days. Most courts accept electronic filing through their online portal. Paper filing requires you to bring three copies of your entire petition to the courthouse.

The clerk assigns you a case number and bankruptcy trustee immediately upon filing. You receive a notice with your case details and the date of your 341 meeting. Understanding how to file for bankruptcy includes knowing that this filing date stops all collection activities against you.

Understand the automatic stay

An automatic stay goes into effect the second the court receives your petition. This federal injunction prohibits creditors from contacting you, garnishing wages, repossessing vehicles, or continuing lawsuits. The stay remains active throughout your bankruptcy case unless a creditor successfully files a motion to lift it for specific property like a mortgage.

The automatic stay gives you breathing room to complete the bankruptcy process without harassment or fear of losing essential assets.

Step 3. Attend the 341 meeting and finish courses

The bankruptcy court schedules two mandatory steps after you file your petition. These requirements ensure creditors have the opportunity to question you and that you receive proper financial education. Completing both tasks moves your case toward discharge and the elimination of eligible debts.

The 341 meeting of creditors

The trustee assigned to your case conducts a meeting approximately 20 to 40 days after filing. This “341 meeting” takes place at a designated location, often a federal building or office complex. You must appear in person or via telephone if the court allows remote participation.

The trustee asks questions about your petition under oath to verify accuracy and identify any assets you failed to disclose. Creditors can attend and pose their own questions, though most don’t show up. Typical questions include how you calculated your income, whether you expect tax refunds, and if you’ve transferred property to relatives recently.

Bring these items to your meeting:

- Government-issued photo ID (driver’s license or passport)

- Social Security card or proof of Social Security number

- Bank statements from the most recent month

- Pay stubs if employed

The meeting typically lasts 10 to 15 minutes when you provide complete and honest answers. Hiding assets or lying under oath can result in criminal charges and case dismissal without debt relief.

The 341 meeting serves as the trustee’s opportunity to investigate your financial situation and protect creditor interests.

Complete the debtor education course

You must finish an approved debtor education course after filing but before receiving your discharge. Unlike the pre-filing counseling, this course focuses on money management and budgeting skills to help you avoid future financial problems. Most people complete the two-hour course online within days of their 341 meeting.

The course costs between $10 and $25. You file the completion certificate with the court to satisfy this final requirement.

Receive your discharge

The court issues a discharge order 60 to 90 days after your 341 meeting in Chapter 7 cases. Chapter 13 discharges occur after you complete your three-to-five-year payment plan. The discharge permanently eliminates your legal obligation to repay most unsecured debts, including credit cards, medical bills, and personal loans. When people ask how to file for bankruptcy, this discharge represents the ultimate goal of the entire process.

Frequently asked questions about filing bankruptcy

People researching how to file for bankruptcy often have the same concerns about legal representation, asset protection, and credit impact. These questions address the most common uncertainties that prevent people from seeking debt relief. Understanding the answers helps you make informed decisions about your financial future.

Can you file bankruptcy without an attorney?

You have the legal right to file “pro se” without hiring an attorney. The court provides all necessary forms and basic instructions online. Pro se filing saves thousands in legal fees, which matters when you’re already struggling financially. The complexity of bankruptcy law makes errors common among self-filers, though.

Mistakes in your petition can lead to case dismissal, lost assets, or denied discharge. Trustees and creditors closely examine pro se filings for inconsistencies because they know unrepresented debtors make more mistakes. An attorney handles form completion, represents you at the 341 meeting, and protects your exemptions from creditor challenges.

Most bankruptcy attorneys offer free consultations and accept payment plans, making professional help more accessible than many debtors realize.

What property can you keep?

State and federal exemption laws protect specific assets from liquidation in Chapter 7. You choose either your state’s exemptions or the federal bankruptcy exemptions, depending on which set provides better protection. Most people keep their car, home equity up to a certain amount, retirement accounts, household goods, and tools needed for work.

Federal exemptions protect up to $27,900 in home equity and $4,450 in vehicle equity as of 2024. State exemptions vary widely, with some states offering unlimited homestead protection. You must list all assets accurately and claim your exemptions properly to retain property.

How long does bankruptcy affect your credit?

Chapter 7 bankruptcy remains on your credit report for ten years from the filing date. Chapter 13 stays for seven years. Your credit score typically drops 130 to 200 points initially. You can begin rebuilding credit immediately after discharge by opening a secured credit card, making on-time payments, and keeping balances low.

Many people qualify for car loans within one to two years and mortgages within two to four years post-bankruptcy. The impact on your score decreases each year as the bankruptcy ages and you establish positive payment history.

Conclusion section

Learning how to file for bankruptcy gives you the power to escape overwhelming debt and start rebuilding your financial life. You now understand the differences between Chapter 7 and Chapter 13, the mandatory counseling requirements, and the documents you need to prepare. The process follows clear steps from filing your petition through attending the 341 meeting and completing debtor education.

Filing bankruptcy without proper guidance can lead to costly mistakes that delay your discharge or result in case dismissal. The automatic stay protects you immediately, but maximizing your exemptions and avoiding procedural errors requires careful attention to detail. You don’t have to navigate this complex legal process alone.

The attorneys at Ginsburg Law Group provide free case evaluations and help clients across the United States achieve debt relief through bankruptcy. Contact us today to discuss your financial situation and determine whether Chapter 7 or Chapter 13 offers the best path to your fresh start.