When you’re staring down a mountain of debt, it’s easy to feel like you’re completely stuck. But you have powerful legal rights designed to help you. So, how does bankruptcy actually work? Think of it as a federally protected, court-guided process that stops creditors in their tracks and gives you a structured way to either wipe the slate clean or reorganize what you owe. It’s not the end of the road; it’s a strategic exercise of your consumer rights to secure a fresh start.

Understanding Bankruptcy as a Financial Reset

When the financial pressure is constant, it’s completely understandable to feel like you’re out of options. The endless calls from collectors, the threatening letters, and the fear of losing your home or car can take a huge emotional toll. This is often where consumer protection laws like the Fair Debt Collection Practices Act (FDCPA) come in, but even they have limits. Bankruptcy, however, is a legal system built specifically to give people a way forward when their debt becomes too much to handle. It’s not a personal failure—it’s a strategic choice to use your rights as a consumer to find financial stability again.

The moment you file, the law steps in to protect you. The most powerful protection is the automatic stay, a legal order that immediately forces your creditors to stop all collection efforts. That means the harassing calls, the lawsuits, and the wage garnishments have to stop right away. It gives you the breathing room you desperately need to figure out your next steps without constant pressure.

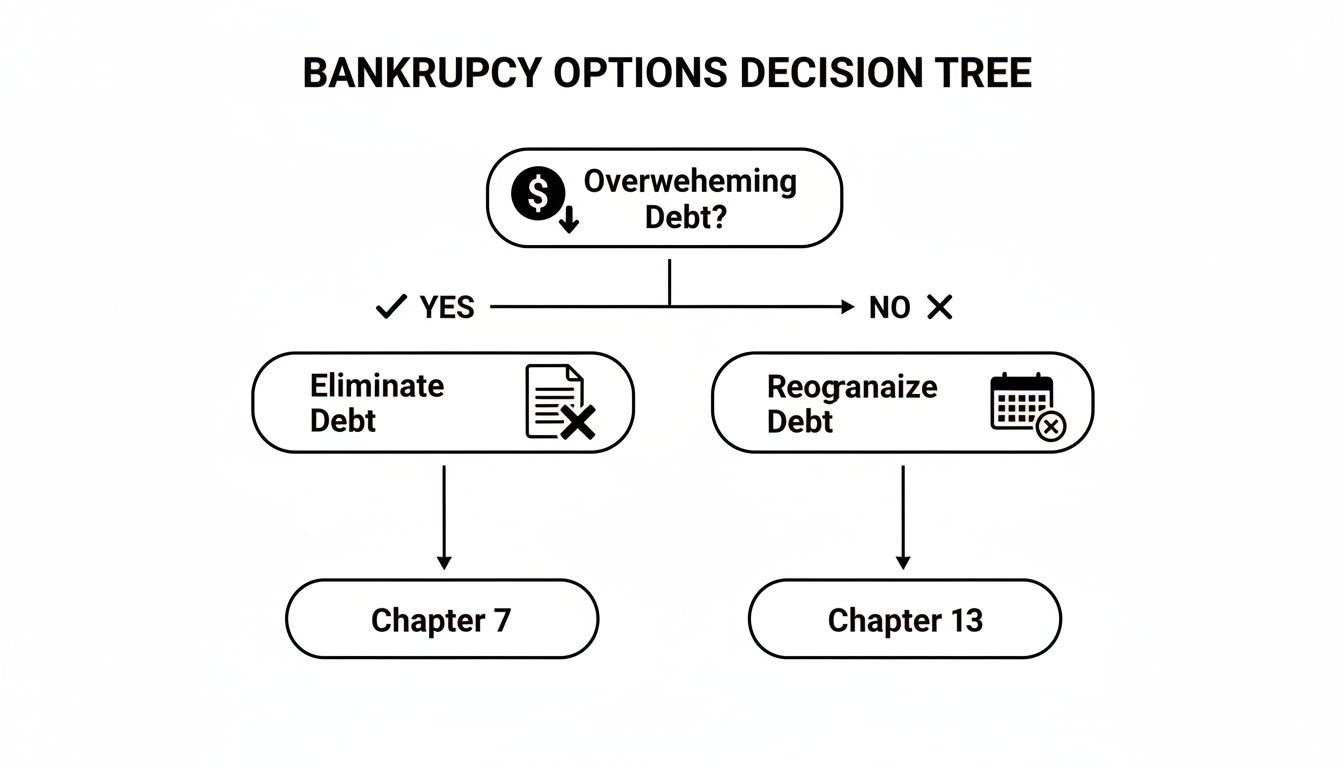

The Two Main Paths for Consumers

For individuals and families, bankruptcy usually goes down one of two main paths. Each one is built for a different kind of financial situation and offers a different type of relief.

- Chapter 7 Bankruptcy: This is often called a “liquidation” or “fresh start” bankruptcy. It’s designed to wipe out most of your unsecured debts—things like credit card balances, medical bills, and personal loans—fairly quickly.

- Chapter 13 Bankruptcy: Known as a “reorganization,” this path lets you create a manageable repayment plan that lasts 3 to 5 years. You pay back a portion of your debts over time, which is a great option if you have a steady income and want to protect assets like your house from foreclosure.

To make this clearer, here’s a quick comparison of the two main types of consumer bankruptcy. This table gives you a snapshot of the key differences so you can see how they stack up against each other.

Chapter 7 vs. Chapter 13 At a Glance

| Feature | Chapter 7 (Liquidation) | Chapter 13 (Reorganization) |

|---|---|---|

| Primary Goal | Eliminate most unsecured debts quickly. | Reorganize debts into a single, affordable monthly payment. |

| Timeline | Typically 4-6 months from filing to discharge. | A 3-to-5-year repayment plan. |

| Who It’s For | People with lower income and few assets they can’t protect. | Individuals with regular income who can afford a monthly payment. |

| Asset Protection | You can keep “exempt” property, but non-exempt assets may be sold. | You get to keep your property, including your home and car. |

| Debt Type | Best for credit cards, medical bills, and personal loans. | Ideal for catching up on mortgages or car loans to prevent foreclosure/repossession. |

Ultimately, the right choice really comes down to your unique financial situation and what you’re trying to accomplish.

The key takeaway is that the right path depends entirely on your goals. Getting the paperwork right is a critical first step, and you can see what’s involved by reviewing the official bankruptcy information sheet before you begin. The goal is to move from fear to facts and see how this process gives you a clear, structured way to get back on your feet.

Chapter 7 Bankruptcy: Wiping the Slate Clean

People often hear Chapter 7 bankruptcy called a “liquidation,” and that word alone can be terrifying. But for the vast majority of people who file, it’s much more like hitting a financial reset button. It’s a powerful legal process designed to completely eliminate most of your unsecured debts—think credit card balances, medical bills, and personal loans—often in just a few months.

If you’re struggling just to keep your head above water, Chapter 7 provides a clear path forward. It offers a final end to the crushing weight of debt, giving you the chance to start fresh and rebuild your financial life.

Qualifying Through the Means Test

So, how do you know if you can file for Chapter 7? The first step is passing what’s known as the means test. It’s a straightforward formula that determines if your income is low enough to qualify.

The test looks at your average household income for the past six months and compares it to the median income for a family of your size in your state. If your income falls below that median, you’ll almost always qualify. If it’s higher, you move on to a second calculation that accounts for certain necessary expenses. This part of the test figures out if you have any “disposable” income left over to pay back a portion of your debts. It’s all about making sure Chapter 7 is there for those who truly need it most.

Think of the means test as a financial snapshot. It doesn’t judge your past decisions; it simply assesses your current ability to pay. Its purpose is to direct people to the right type of bankruptcy for their situation.

The Automatic Stay: Your Legal Shield

One of the most powerful and immediate benefits of filing for bankruptcy is something called the automatic stay. The second your case is filed with the court, this legal protection kicks in, acting like a shield that instantly stops most creditors from coming after you.

This is a critical protection for consumers, working hand-in-hand with your rights under laws like the Fair Debt Collection Practices Act (FDCPA). The automatic stay isn’t a suggestion—it’s a court order that legally forces creditors to stop all collection activities, including:

- Harassing phone calls and relentless letters, which are also often violations of the FDCPA and Telephone Consumer Protection Act (TCPA).

- Wage garnishments that take money right out of your paycheck.

- Lawsuits filed against you to collect on old debts.

- Foreclosure proceedings on your home.

- Repossession of your car or other property.

This immediate halt provides incredible breathing room. It gives you the peace of mind you need to navigate the bankruptcy process without the constant stress and pressure, letting you focus on getting back on your feet.

How Exemptions Protect Your Property

One of the biggest fears I hear from clients is that filing for Chapter 7 means they’ll lose everything they own. This is probably the most persistent myth out there. In reality, the law has built-in protections called exemptions that allow you to keep your essential property.

Every state has its own set of exemption laws that spell out exactly what you can protect and how much it can be worth. These laws are there to ensure you have what you need for a genuine fresh start. Common exemptions usually cover things like:

- A certain amount of equity in your home (the homestead exemption).

- A vehicle you need for work and daily life.

- Retirement accounts, such as 401(k)s and IRAs.

- Household goods, furniture, clothing, and other personal items.

- The tools of your trade that you need to do your job.

That scary word, “liquidation,” only comes into play for non-exempt assets—things with value beyond what the exemptions can protect. In those cases, a court-appointed trustee sells the assets to pay back creditors. But here’s the reality for most people: almost everything they own is fully covered by exemptions.

In fact, as consumer bankruptcy filings rise, recent data shows that over 95% of individual Chapter 7 cases are “no-asset” cases. That means the filers keep all of their property because it’s completely protected. You can read more about these consumer bankruptcy trends and see for yourself.

Chapter 13 Bankruptcy: A Path to Reorganization

If Chapter 7 is like wiping the slate clean, think of Chapter 13 as a structured, court-supervised “financial workout.” It’s not about immediate liquidation; it’s about giving people with a regular income a chance to catch their breath and reorganize their finances without losing everything they’ve worked for.

With Chapter 13, you consolidate your debts into one manageable payment. Instead of juggling a dozen different bills, you make a single monthly payment to a bankruptcy trustee over a three- to five-year period. The trustee then distributes the money to your creditors according to the plan. It’s a powerful way to regain control.

Stopping Foreclosure and Saving Your Home

For many families, the most powerful feature of Chapter 13 is its ability to stop a foreclosure in its tracks. If you’ve fallen behind on your mortgage and the bank is threatening to take your home, Chapter 13 can be a lifeline. The moment your case is filed, the automatic stay kicks in, immediately halting the foreclosure process.

Your repayment plan is then set up to help you catch up on those missed mortgage payments (the arrears) over several years. As long as you keep up with your regular mortgage payments and the new plan payment, you can stay in your home. This provides invaluable stability when you need it most.

Managing Debts That Chapter 7 Cannot Erase

Chapter 13 is also incredibly useful for handling debts that Chapter 7 simply can’t eliminate. It offers a structured way to pay back obligations that would otherwise follow you for years.

Here are a few common examples:

- Recent Tax Liabilities: Priority tax debts can’t be discharged in a Chapter 7. But in a Chapter 13, you can roll them into your repayment plan and pay them off over time, often without any further interest or penalties piling up.

- Domestic Support Arrears: If you’re behind on child support or alimony, Chapter 13 provides a clear path to get current on these crucial family obligations.

- Non-Exempt Equity: What if you own a home or vehicle with more equity than you can protect with exemptions? Instead of having to sell it, Chapter 13 lets you keep the asset by paying your unsecured creditors an equivalent amount through your plan.

This makes Chapter 13 the go-to option for anyone whose financial picture is a bit more complex than just credit card balances and medical bills.

A key takeaway: Chapter 13 is fundamentally about control. It empowers you to propose a realistic repayment plan, protect your most important assets, and manage debts that other forms of bankruptcy can’t touch.

Protecting Co-Signers with the Co-Debtor Stay

Here’s another unique benefit: Chapter 13 protects the people who have helped you. If a friend or family member co-signed a loan for you, filing for Chapter 7 leaves them completely exposed; creditors can immediately start pursuing them for the full amount.

Chapter 13 provides something called the co-debtor stay. This powerful protection generally forbids creditors from contacting or collecting from your co-signer while your plan is active. It gives your loved ones peace of mind while you get your finances back in order.

What Is a Cramdown?

Chapter 13 has another trick up its sleeve called a “cramdown,” which is most often used for car loans. If you owe more on your vehicle than it’s actually worth—a common situation—a cramdown lets you reduce the loan’s principal balance to the car’s current fair market value.

Let’s say you owe $20,000 on a car that’s only worth $12,000 today. A cramdown can slash the loan balance to that $12,000 figure. You’d pay that amount off through your plan, and the leftover $8,000 gets reclassified as unsecured debt, which often gets paid back at just pennies on the dollar. This one move can dramatically lower your total debt and make keeping your car affordable.

The Automatic Stay: Your Shield from Creditor Actions

The second you file for bankruptcy, something powerful and immediate happens: a legal injunction called the automatic stay kicks in. Think of it as a federally mandated ceasefire. It’s a court order that legally forces your creditors to stop all collection activities, giving you instant and much-needed relief from the relentless pressure.

This isn’t just a polite suggestion—it’s the law. The automatic stay is your shield, giving you the critical breathing room to work through the bankruptcy process without being harassed. For many people, this immediate halt to creditor actions is one of the single biggest reasons to file.

What Creditors Are Instantly Forbidden From Doing

The automatic stay is incredibly broad, covering almost every imaginable collection tactic. The moment your case is on file with the court, creditors are legally barred from continuing their efforts.

Here’s what must stop immediately:

- Harassing Phone Calls and Letters: All those stressful, non-stop calls and demanding letters from debt collectors have to end. This builds on your existing rights under the Fair Debt Collection Practices Act (FDCPA), which already prohibits abusive collection behavior.

- Wage Garnishment: If a creditor is taking money directly from your paycheck, that garnishment stops. No new ones can start, either. You’ll finally get to take home your full, earned pay.

- Lawsuits and Legal Proceedings: Any pending lawsuits filed against you for debt collection are put on hold. Creditors also can’t start any new legal actions against you while the stay is active.

- Foreclosure and Repossession: If you’re at risk of losing your home or your car, the automatic stay temporarily stops these proceedings. This gives you precious time to figure out a permanent solution, often through a Chapter 13 plan.

The automatic stay delivers more than just financial relief—it provides priceless mental and emotional peace. It’s the law stepping in to say, “Enough,” giving you the space to regain control without constant fear and pressure.

Real-World Scenarios: The Power of the Stay

To really understand the impact, let’s look at a few common situations. Imagine getting dozens of calls a day from an aggressive collector—a potential violation of the TCPA. The day you file for bankruptcy, those calls become illegal. Or picture a creditor taking a full 25% of your paycheck through wage garnishment. With your bankruptcy filing, that stops with your very next paycheck.

What about the homeowner just weeks away from a foreclosure auction? Filing for bankruptcy can stop that sale cold, creating a crucial opportunity to save the home. This is what makes bankruptcy such a powerful tool—it puts the law squarely on your side.

While most creditors know the rules and respect the court order, it’s critical to know your rights if they don’t. You can learn more about what happens when debt collectors ignore the automatic stay and how to make sure your protections are enforced.

Protecting Your Property with Bankruptcy Exemptions

One of the most persistent and damaging myths about bankruptcy is that you’ll lose everything you own. This fear alone stops countless people from getting the legal help they desperately need. But the truth is, the system isn’t designed to leave you destitute—it’s built to give you a genuine fresh start.

This protection is possible because of a powerful legal tool called bankruptcy exemptions. Think of exemptions as a legal shield that you can place over your essential assets, making them untouchable by creditors and the bankruptcy trustee. Every state has its own specific list of these exemptions, detailing exactly what property you can keep and up to what value.

What Property Can You Typically Protect?

While the exact details can vary quite a bit depending on where you live, the goal of exemptions is always the same: to protect the things you need to work and live. They ensure you have a foundation to stand on as you rebuild your financial life after your case is complete.

Common types of property that are usually protected include:

- Homestead Exemption: This is often the big one. It protects a certain amount of the equity you have in your primary home.

- Motor Vehicle Exemption: This lets you keep your car, truck, or other vehicle up to a certain value, so you can still get to work and take care of your family. This is separate from consumer protections like Lemon Law, which deals with defective vehicles.

- Retirement Funds: Your future is a priority. In nearly all cases, funds in qualified retirement accounts like 401(k)s and IRAs are completely safe.

- Personal Belongings: This category covers your everyday household items—think furniture, clothing, appliances, and even jewelry, all up to a set limit.

- Tools of the Trade: If you need specific equipment or tools for your job, this exemption protects them so you can continue to earn a living.

The whole point of exemptions is to make sure that filing for bankruptcy doesn’t push you into poverty. The law understands that you need your basic assets to live, work, and actually get the “fresh start” you’re looking for.

The Critical Role of State Laws and Local Expertise

This is where things can get tricky. Correctly applying these exemptions is one of the most complex parts of the entire bankruptcy process. There’s no single, nationwide set of rules; what’s protected in one state might be at risk in another. To make it even more complicated, some states let you choose between their own exemption list and a federal one, which adds a whole other layer of strategy.

For instance, Texas has a famously generous homestead exemption that can protect a home of almost any value. Other states offer far less protection. This is precisely why local legal expertise isn’t just helpful—it’s essential.

An experienced local bankruptcy attorney lives and breathes these specific state and federal exemption laws. They can sit down with you, go through your assets, and strategically choose and apply the right exemptions to protect as much of your property as legally possible. This isn’t just about filling out paperwork; it’s about crafting a legal strategy to secure your future.

Life After Bankruptcy: Rebuilding Your Financial Health

Filing for bankruptcy isn’t the end of your financial story—far from it. Think of it as turning the page to a completely new chapter. While the bankruptcy process itself brings immediate relief from overwhelming debt, the real work begins after your case is closed. This next phase is all about rebuilding, and with a smart, deliberate strategy, you can come out of this stronger than ever.

Yes, your credit score will take a hit. There’s no sugarcoating that. But the damage isn’t permanent. Your post-bankruptcy credit is like a blank slate, and every wise financial move you make from here on out adds a positive brushstroke. The key is to start right away with small, consistent habits.

Taking the First Steps to Rebuild Credit

The absolute most important thing you can do is simple: pay every single bill on time, every time. This isn’t just about new credit; it covers everything from your rent and utilities to any car loans you decided to keep through the bankruptcy. This consistent payment history is the bedrock of a good credit score.

Once you have that down, it’s time to add a tool specifically for building new, positive credit. For most people, a secured credit card is the perfect starting point. It’s a straightforward and low-risk way to get back in the game.

Here’s how it works:

- You make a small cash deposit to the credit card company, often around $300.

- This deposit becomes your credit limit, which removes the risk for the bank.

- Use the card for small, everyday purchases you can easily manage, like a tank of gas or your weekly groceries, and—this is crucial—pay the balance off in full every month.

- The card issuer reports these timely payments to the major credit bureaus, which slowly but surely starts to build your score back up.

Protecting Your Fresh Start with the FCRA

As you work on rebuilding, you have to become the guardian of your credit report. Your best tool for this is the Fair Credit Reporting Act (FCRA), a federal law that protects you from inaccurate information. The FCRA guarantees you the right to a free credit report from each of the three main bureaus (Equifax, Experian, and TransUnion) every year.

It’s absolutely critical to check that your old, discharged debts are being reported correctly. They should all show a zero balance and be noted as “included in bankruptcy.” A creditor still reporting a balance due is not only wrong—it’s a violation of your rights that can unfairly drag your new score down.

If you find an error, you need to dispute it immediately. An incorrect report can make it harder to get approved for a new apartment, a car loan, or even certain jobs. Under the FCRA, both the credit bureau and the creditor that supplied the bad information are legally required to investigate your dispute and fix any mistakes. Being diligent here is a non-negotiable part of making sure your fresh start is a clean one.

For a deeper dive into this, you can learn more about the process of rebuilding credit after bankruptcy and how to fully protect your rights as a consumer.

Ultimately, remember that rebuilding your financial life is a marathon, not a sprint. With the disciplined use of secured credit, a commitment to on-time payments, and vigilant monitoring of your credit reports, you’ll lay the foundation for a much healthier financial future.

Common Questions About How Bankruptcy Works

When you’re staring down a mountain of debt, it’s natural to have a lot of questions. Thinking about bankruptcy can feel overwhelming, but getting straight answers is the first step toward taking back control. Let’s tackle some of the most common concerns people have.

How Much Does It Cost to File for Bankruptcy?

The total cost to file for bankruptcy breaks down into two main parts: court filing fees and attorney’s fees. The court fees are set by the government, but what you pay for legal help will depend on your situation—things like how complicated your finances are and whether a Chapter 7 or Chapter 13 makes more sense for you.

It’s understandable to want to cut costs, but trying to handle bankruptcy without an experienced attorney can backfire spectacularly. A good lawyer often saves you far more than their fee by making sure you use every legal exemption to protect your property. Most consumer bankruptcy firms offer a free first meeting where they’ll lay out all the costs upfront, so you know exactly what to expect.

What Debts Can’t Be Erased in Bankruptcy?

Bankruptcy is a powerful way to reset your finances, but it’s not a magic wand that makes every single debt disappear. Some obligations are “non-dischargeable,” which is a legal way of saying you’ll still have to pay them even after your case closes.

Generally, you can’t get rid of debts like:

- Domestic Support Obligations, which means alimony and child support.

- Most Tax Debts, particularly if they are recent.

- Student Loans, unless you can prove “undue hardship” in a separate, difficult-to-win lawsuit.

- Debts from Fraud, or those connected to willfully harming someone or their property.

This is why it’s so important to go over your specific list of debts with an attorney. They can give you a clear picture of what will be wiped out and what will remain.

Will I Be Fired for Filing for Bankruptcy?

This is a huge source of anxiety for many, but the law is on your side. Federal law—specifically 11 U.S.C. § 525—makes it illegal for a private employer to fire you, demote you, or discriminate against you simply because you filed for bankruptcy.

This protection is a core part of the “fresh start” that bankruptcy is designed to provide. The system is set up to help you get back on your feet, and that includes ensuring your job is safe while you do it.

You can pursue financial relief without having to worry about your boss retaliating.

How Do I Know if Bankruptcy Is My Best Option?

Making the call to file bankruptcy is a deeply personal decision. It’s often the right move when you’re being sued by creditors, your wages are being garnished, or you’re facing foreclosure. If you’re looking at your debts and see no realistic path to paying them off in the foreseeable future, it’s time to seriously consider it.

But it’s not the only answer. Sometimes, a strong debt defense strategy, which involves challenging a lawsuit in court, could be a better option. The only way to know for sure what’s right for you is to sit down with a consumer rights attorney who handles bankruptcy and debt defense. They can dig into your financial details, walk you through all the pros and cons, and help you choose the path that leads to real, long-term stability.

If you’re feeling crushed by debt, remember you don’t have to figure this out on your own. The team at Ginsburg Law Group PC is here to protect your rights and offer clear, compassionate advice on bankruptcy and debt defense. Contact us today to schedule a confidential consultation and take the first step toward your fresh start.