That feeling of dread when you get a notice that your paycheck is about to be garnished is overwhelming. But you have rights. More importantly, you have options for stopping wage garnishment. The best path forward often involves asserting your consumer rights, filing a claim of exemption to protect your income, challenging the validity of the debt, or, in some cases, using the power of bankruptcy to get an “automatic stay” that halts the process immediately.

What To Do When Your Paycheck Is At Risk

Discovering that your hard-earned money is at risk can send anyone into a panic. Wage garnishment isn’t just a legal procedure; it’s a real-world crisis that leaves you scrambling to figure out how to pay for rent, groceries, and utilities on a suddenly smaller paycheck. My goal here is to cut through the confusing legal jargon and give you a clear, actionable plan based on your powerful consumer rights.

The process typically kicks off after a creditor wins a lawsuit against you and gets a court order. This is a critical step we cover in our guide on dealing with money judgments. This court order, called a judgment, is what gives the creditor the legal muscle to force your employer to withhold a portion of your wages. Understanding your rights under laws like the FDCPA and FCRA is the first step to taking back control.

Know What Income Is Protected

Before you assume the worst, you need to know that creditors can’t just take everything. Both federal and state laws put strict limits on how much of your income can be garnished. The law protects your disposable earnings, which is the amount you have left after mandatory deductions like federal, state, and local taxes are taken out.

Under federal law, a creditor trying to collect a consumer debt can generally only take the lesser of two amounts:

- 25% of your weekly disposable earnings.

- The amount by which your disposable earnings are more than 30 times the federal minimum wage.

This rule is designed to make sure you’re left with at least a baseline amount of money to live on. Keep in mind that many states have laws that offer even stronger protections, so it’s critical to check the rules where you live.

The Growing Problem of Wage Garnishment

This isn’t a rare occurrence. Imagine showing up to work every day, only to see a significant chunk of your paycheck disappear before it ever reaches your bank account. That’s the reality for a growing number of Americans.

Projections show that wage garnishment could impact nearly two million Americans by mid-2025, potentially soaring to four million by the end of the year. For the average person, this means losing about 11% of their gross pay over a typical five-month garnishment period. It’s the kind of financial shock that can lead to late rent, food insecurity, and impossible budget choices.

Garnishment rates actually peaked at 3.9% of all workers back in March 2020 before COVID relief measures caused them to drop. By January 2024, the rate had crept back up to 2.8%. This isn’t just a statistic; it’s a trend that affects millions of households.

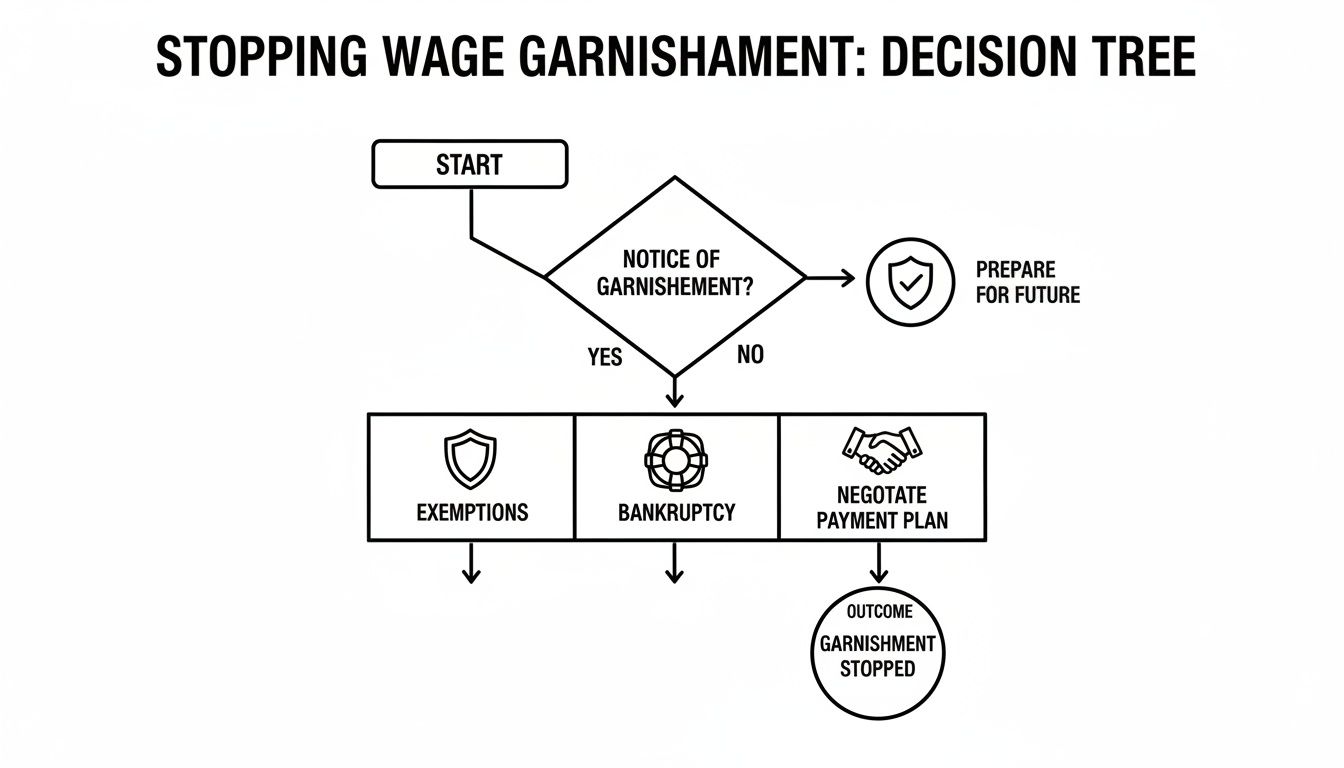

This decision tree gives you a visual map of the main paths you can take once you get that garnishment notice.

As you can see, you have several strategic choices. The right one depends entirely on your specific situation, from protecting your income with exemptions to using legal tools like bankruptcy.

Your Immediate Options To Stop Wage Garnishment

Here’s a quick-glance table summarizing the moves you can make as soon as you receive a garnishment notice.

| Action | What It Does | Best For |

|---|---|---|

| Claim Exemptions | Protects certain types of income (like Social Security) or income below a legal threshold from being garnished. | Individuals whose income is legally protected or who are the primary provider for their family. |

| Assert Consumer Rights (FDCPA, FCRA) | Challenges the debt based on illegal collection tactics, harassment, or credit reporting errors. | Anyone who has experienced abusive behavior from collectors or believes the debt information is inaccurate. |

| File Bankruptcy | Immediately triggers an “automatic stay,” a court order that legally forces all collection activities, including garnishment, to stop. | Those with overwhelming debt who need a comprehensive solution and immediate relief from multiple creditors. |

| Contest the Garnishment | You file a motion with the court to challenge the garnishment’s validity, either on procedural grounds or because of a mistake. | Situations where the debt amount is wrong, you weren’t properly served, or the creditor made a legal error. |

Each of these paths offers a way out, but choosing the right one requires a clear understanding of your finances and legal standing.

Your Immediate Action Plan

Once you receive that garnishment notice, the clock starts ticking. You have a very small window to act before the money starts coming out of your check. The key is to move from a state of shock to a position of strength by knowing your options.

You are not powerless here. The law gives you specific shields to protect your livelihood, but it’s up to you to raise them. The single worst thing you can do is ignore the notice.

We’ll break down each of these strategies in more detail, but for now, just know that you can fight back. Whether it’s by challenging the garnishment itself, claiming your income is exempt, or using your rights under consumer protection laws, stopping a wage garnishment is absolutely possible.

When that garnishment notice shows up, it feels like a final judgment. It’s easy to feel defeated, thinking there’s nothing you can do. But that’s not true. Just because a creditor has a court order doesn’t automatically mean it’s legally airtight. You have powerful rights and tools to fight back.

Think of it this way: the creditor had to follow a very specific legal path to get that garnishment order. Any mistake or shortcut they took along the way could be your opportunity to have the whole thing thrown out.

Filing a Motion to Challenge the Garnishment

Your primary tool for formally objecting to the garnishment is to file a motion with the court. This is a legal document where you tell the judge you’re disputing the order and ask for a hearing to make your case. Depending on your state, this might be called a motion to quash or a claim of exemption.

But you have to move fast. The law gives you a very narrow window to act—sometimes just a few days after you get the notice. If you miss that deadline, you could lose your right to object entirely.

Your challenge isn’t about arguing whether you owe the debt. It’s about whether the creditor followed every single legal rule to get that garnishment order.

Common Grounds for a Successful Challenge

You need a solid legal reason to challenge a garnishment, and you’d be surprised how often creditors or their lawyers make mistakes. Here are some of the most effective arguments I’ve seen work for clients:

- Improper Service of the Lawsuit: Before a creditor can get a judgment against you, they have to legally notify you that you’re being sued. This is called “service of process.” If you never received the original lawsuit papers—maybe they sent them to an old address or didn’t follow the rules—the judgment is invalid, and so is the garnishment.

- Expired Statute of Limitations: Every state sets a time limit, the statute of limitations, on how long a creditor has to sue you for a debt. If they sued you after that time was up, the judgment they got is void.

- Inaccurate Information (FCRA Violation): The Fair Credit Reporting Act (FCRA) requires that information on your credit report be accurate. If the garnishment is based on a debt with incorrect details (wrong amount, not your debt), you can dispute it. An FCRA violation could invalidate the creditor’s claim.

- The Debt Was Discharged in Bankruptcy: If you’ve been through bankruptcy and this specific debt was included and discharged, the creditor is legally forbidden from ever trying to collect it again, including through garnishment.

- FDCPA Violations: If a third-party debt collector used illegal tactics to pursue the debt, you may be able to use this violation as leverage to stop the garnishment or even file a counterclaim for damages.

A garnishment is the last step in a long legal process. A single flaw anywhere in that chain—from the initial lawsuit to the final court order—can be enough to break it. You have every right to hold the creditor accountable for following the law to the letter.

The FDCPA: Your Strongest Defense

Beyond court procedures, don’t forget your consumer rights. The Fair Debt Collection Practices Act (FDCPA) is a powerful federal law that lays down strict rules for how third-party debt collectors must behave. If a debt collector broke these rules, it could potentially invalidate their entire collection effort.

These violations aren’t just minor technicalities; they are serious offenses. If a collector harassed you, lied to you, or used other illegal tactics to pursue the debt, you might be able to use that misconduct to not only stop the garnishment but also to sue the collector for damages. If you’re dealing with aggressive collectors, it’s vital to see if their actions cross the line. You can learn more about common FDCPA violations that might fit your situation.

This kind of financial pressure is incredibly common. As of 2019, wage garnishment was a harsh reality for more than one in every 100 U.S. workers. The average garnishment lasted five months and took about 11% of a person’s gross earnings. Research from 2014-2019 even showed that the immense stress often leads to people quitting their jobs or missing work. When you’re in that position, consumer protection laws are your most important shield.

How Bankruptcy Immediately Stops Garnishment

When a wage garnishment is relentlessly eating away at your paycheck, you need a way to stop it—fast. Sometimes, the most powerful and immediate tool at your disposal is filing for bankruptcy. The very moment your case is filed, a federal law called the Automatic Stay kicks in.

This isn’t a polite request to your creditors. It’s a legally binding court order. The automatic stay acts like an instant shield, forcing all collection activities to come to a screeching halt. This means no more wage garnishments, no more collection calls, and no more foreclosure actions. Your employer will be legally notified to stop withholding money from your pay immediately.

The Power of the Automatic Stay

Think of the automatic stay as hitting a giant pause button on all of your debts. It provides immediate, critical breathing room from the constant financial pressure. This isn’t just a temporary patch; it’s the first step toward a permanent, legal solution to unmanageable debt.

The relief is often instantaneous. One day you’re watching your paycheck shrink, and the next, your employer is legally barred from taking another dime for that old debt. This immediate effect is one of the biggest reasons people turn to bankruptcy for stopping wage garnishment. For a closer look at the mechanics, you can learn more about the specifics of the bankruptcy automatic stay and the protections it offers.

Bankruptcy often gets a bad rap as a last resort, but it’s really a strategic legal tool designed by federal law to give honest people a fresh start. It’s not a sign of failure; it’s a powerful way to assert your right to financial recovery.

This process was created because Congress understood that overwhelming debt can happen to anyone, providing a structured and fair path forward.

Choosing Your Path: Chapter 7 vs. Chapter 13

When you decide to file, you’ll generally choose between two main types of bankruptcy: Chapter 7 and Chapter 13. Both will stop a garnishment in its tracks, but they are designed for very different financial situations and work in fundamentally different ways.

- Chapter 7 Bankruptcy: This is what most people think of as a “fresh start” or “liquidation” bankruptcy. It’s designed to completely wipe out (discharge) most of your unsecured debts, like credit card balances, medical bills, and personal loans.

- Chapter 13 Bankruptcy: This is often called a “reorganization” or “wage earner’s plan.” It involves creating a manageable repayment plan that usually lasts for three to five years. People with a steady income often use it to catch up on secured debts, like a mortgage or car loan, while protecting their assets.

Deciding between these two is one of the most important financial choices you’ll make. It all comes down to your income, the kinds of debts you have, and what you want your financial future to look like.

When Is Chapter 7 the Right Choice?

Chapter 7 is often the fastest and most direct route to debt relief. To be eligible, you have to pass a “means test,” which basically compares your household income to the median income for a family of your size in your state. If your income falls below that line, you typically qualify.

This path is a great fit if you’re drowning in unsecured debt and don’t have significant assets you’re at risk of losing. The good news is that most people who file Chapter 7 can keep all their property by using legal “exemptions.” The entire process is usually over in just a few months, and when it’s done, your qualifying debts are gone for good.

When Does Chapter 13 Make More Sense?

Chapter 13 is the go-to solution for people who don’t qualify for Chapter 7—usually because their income is too high—or for those who want to protect assets that aren’t fully covered by exemptions. It’s also an incredibly powerful tool if you’re behind on your mortgage or car payments and want to stop a foreclosure or repossession.

Instead of just wiping out debts, Chapter 13 reorganizes them into a single, affordable monthly payment. You make these payments to a bankruptcy trustee over the life of your plan. Once you’ve successfully completed it, any remaining unsecured debt is discharged. It offers a structured way to regain financial control without having to liquidate important assets.

Ultimately, bankruptcy provides a definitive and immediate end to the stress of wage garnishment. It’s a formal legal process that gives you the protected space you need to reset and rebuild your financial life.

Negotiating With Creditors To Avoid Garnishment

When you’re facing a wage garnishment, it can feel like you’re out of options. But going to court or filing for bankruptcy aren’t your only moves. Believe it or not, one of the most effective ways to stop a wage garnishment is to pick up the phone and talk to the creditor or their attorney.

I know it sounds daunting, but opening that line of communication can lead to a resolution that’s far better than having money ripped from your paycheck.

Before the garnishment is set in stone, creditors are often more willing to talk than you’d think. The truth is, garnishing wages is a hassle for them, too. It involves court filings, administrative costs, and dealing with your company’s HR department. Most would much rather get a voluntary payment from you. This gives you a small but crucial window of opportunity to strike a deal.

Crafting a Winning Negotiation Strategy

Your goal here is simple: make the creditor an offer that’s better for them than the garnishment. In my experience, there are two main ways to do this: propose a voluntary payment plan or offer a lump-sum settlement. Which one you choose really depends on your financial situation.

A voluntary payment plan is straightforward. You agree to make a consistent monthly payment, but one that’s less than the 25% garnishment would take. For instance, if a garnishment would pull $500 from your pay, you might offer to pay them $250 directly each month. For the creditor, it’s a steady stream of cash without the bureaucratic headaches. For you, it’s a more manageable payment that keeps a formal garnishment off your employment record.

The other option, a lump-sum settlement, can be a game-changer if you can get your hands on some cash (maybe from savings, a family loan, or a tax refund). You offer to pay a chunk of the debt all at once, and in return, they agree to forgive the rest. It’s not uncommon for creditors to accept settlements of 50% or even less of the total balance. They get their money now, and they can close the file for good.

Key Talking Points for Your Conversation

When you make that call, you need a plan. Don’t go in with just a story of hardship; treat it like a business proposal. You need to be clear, confident, and prepared.

Here are a few talking points I’ve seen work well:

- Acknowledge the debt and state your goal. Start by showing you’re taking it seriously. “I’m calling about the judgment for account number [your account number]. I’d like to work with you directly to set up a payment arrangement and avoid the garnishment.”

- Make a specific, realistic offer. Tell them exactly what you can do. “A 25% garnishment would create a serious financial hardship for my family, but I can commit to a voluntary payment of $150 per month, starting on the 1st.”

- Frame it as a win-win. Show them what’s in it for them. “By setting this up, you’ll receive consistent payments immediately without the delays and administrative costs of going through my employer.”

Always, always, always get any agreement in writing before you send a single penny. A verbal promise means nothing. The written agreement must clearly state that the creditor will stop all garnishment proceedings as long as you make the agreed-upon payments.

Critical Mistakes to Avoid During Negotiations

This can be a powerful strategy, but a few wrong moves can backfire badly.

First, never offer more than you can actually afford. It’s tempting to promise a higher payment to get them to agree quickly, but if you can’t keep up, you’ll default. The creditor will then likely move forward with the garnishment immediately, and they won’t be in a mood to negotiate a second time.

Second, be very careful you don’t accidentally revive a “zombie debt.” Every state has a statute of limitations—a time limit for how long a creditor can sue you over a debt. If that time has passed, you’re in the clear. However, making even a tiny payment can reset the clock, giving them a brand-new legal right to pursue you. Before you call, do your homework and check the age of the debt. A little bit of proactive research can save you from a huge headache.

Using Exemptions To Protect Your Income

When a wage garnishment notice lands in your hands, it’s easy to feel powerless. But here’s something many people don’t realize: the law doesn’t let creditors take everything. A significant chunk of your income might be legally untouchable, thanks to something called exemptions.

Think of exemptions as a legal shield. They’re specific rules that protect certain types of income and assets from being seized. Understanding how to use them is one of the most effective ways to either stop a garnishment cold or seriously reduce how much they can take from your paycheck.

What Income Is Completely Off-Limits?

Some sources of income are almost always off the table for typical consumer debts. While there are a few exceptions—usually for things like back taxes, federal student loans, or child support—most creditors can’t touch these funds.

Here are the most common sources of income that are generally safe:

- Social Security Benefits (this includes both retirement and disability)

- Supplemental Security Income (SSI)

- Veterans’ Benefits

- Child Support and Alimony that you receive

- Unemployment and Workers’ Compensation payments

- Federal Student Aid

If your only income comes from one or more of these sources, your wages could be 100% exempt. But you have to speak up. The court and the creditor aren’t mind-readers; you must formally claim this protection to make it stick.

The Head of Household Exemption: A Powerful Tool

One of the most powerful, yet frequently overlooked, protections is the head of household exemption. This isn’t just a term for your tax forms. In the world of debt collection, it can be a game-changer.

So, who qualifies? Generally, you’re considered the head of household if you provide more than half of the financial support for a child or another dependent. In some states, this status gives you incredible protection. Florida, for example, completely prohibits wage garnishment for a head of household. A creditor can’t touch a dime of your pay.

This one exemption can be the difference between staying afloat and going under. Because the rules vary so dramatically from state to state, you absolutely have to check your local laws to see if you qualify and what it means for you.

State vs. Federal Exemptions: What You Need To Know

When it comes to protecting your income, there’s a two-layer system: federal law and state law. The good news is that you always get to use whichever law is more generous.

Federal law sets the minimum protection. It shields the greater of:

- 75% of your disposable (after-tax) earnings.

- An amount equal to 30 times the federal minimum wage each week.

But many states go much further. Texas, for instance, doesn’t allow wage garnishment for consumer debts at all. North and South Carolina also have very strong protections for heads of household. This is precisely why you can’t rely on general advice—you have to dig into your state’s specific rules to build your defense.

To give you a better idea of how much this can vary, here’s a quick comparison of a few states.

State-Specific Wage Garnishment Exemption Examples

The table below highlights just how different the protections can be across the country. It shows how some states offer much stronger safeguards for families and primary earners than the federal minimums.

| State | Head of Household Protection | Other Key Exemptions |

|---|---|---|

| Florida | 100% of wages are exempt for a head of household providing more than 50% support for a dependent. | Pensions and retirement benefits are also fully exempt. |

| Texas | Not applicable; all current wages are exempt from garnishment for consumer debts for everyone. | Certain personal property is also protected up to specific value limits. |

| North Carolina | A “head of family” can protect 100% of their earnings for the 60 days preceding the garnishment if needed for family support. | A “wildcard” exemption allows protection of any property up to a certain value. |

| California | No specific “head of household” wage exemption, but has a higher general protection floor based on the state minimum wage. | Strong protections for public benefits and private retirement accounts. |

As you can see, where you live plays a huge role in how much of your paycheck you can keep. Always confirm the current laws in your state, as they can and do change.

The Critical Step: Filing Your Claim of Exemption

Knowing your income is protected is one thing; proving it is another. You have to formally notify the court and the creditor that your money is off-limits by filing a Claim of Exemption.

This legal document is your official tool for stopping the garnishment. You should receive a blank copy of this form along with the initial garnishment notice. You need to fill it out immediately, listing all your exempt income and any dependents, and get it filed with the court clerk before the deadline.

And that deadline is no joke. It’s often just a few days away, so you can’t afford to wait. If you miss it, you risk waiving your right to these powerful protections, even if you are 100% entitled to them. Once you file the form, the court will typically schedule a hearing where a judge reviews your claim and makes a final decision.

This is especially critical now, with certain types of debt collections on the rise. For instance, by mid-2025, a student loan borrower was defaulting every nine seconds as collections resumed. Data showed that 29% of federal student loan borrowers in repayment, or 5.4 million people, were delinquent in July 2025. Projections suggest nearly 25% of all borrowers could eventually face garnishment. You can discover more about the scale of the student debt crisis on WGBH.org. These trends underscore why asserting your exemption rights is more important than ever.

Common Questions About Wage Garnishment

When you find out a creditor is coming after your paycheck, your mind starts racing. It’s completely normal to have a ton of questions and worries. Getting straight answers is the first step to getting back on solid ground. Here, we’ll tackle the most pressing concerns people face when their income is on the line.

Let’s cut through the legal jargon and give you the essential information you need to protect yourself.

Can My Employer Fire Me for a Wage Garnishment?

This is a huge fear, and for good reason. Thankfully, federal law offers some real protection here.

Under the Consumer Credit Protection Act (CCPA), your boss cannot legally fire you over a single wage garnishment. This law was put in place specifically to prevent people from losing their jobs just because they ran into a debt problem.

But there’s a catch. This protection only applies to your first garnishment. If you get hit with a second or third garnishment from completely different creditors, that protection is gone. It’s worth noting, though, that multiple orders related to the same debt are still considered one.

What’s the Difference Between a Wage Garnishment and a Bank Levy?

Both are aggressive collection tactics, but they hit you in different ways.

A wage garnishment is a continuous process. A court order goes to your employer, and they are required to take a slice out of your paycheck every single pay period. This continues until the debt is fully paid off.

A bank levy is a different beast entirely. It’s a one-time ambush on your bank account. The creditor gets an order, sends it to your bank, and the bank freezes your account and hands over the money—up to the full amount you owe. It can be financially devastating because it happens without warning, wiping out funds you were counting on for rent, groceries, and other essentials.

How Long Does a Wage Garnishment Last?

Unfortunately, a garnishment order doesn’t just expire. It stays in effect until the entire debt is satisfied—that means the original judgment amount, plus all the accrued interest and fees.

How long that takes really depends on a few things:

- The total amount you owe.

- How much you earn.

- The percentage of your income being taken.

Unless you actively take steps to stop the wage garnishment—by using your consumer rights to challenge the debt, filing for bankruptcy, or successfully negotiating a settlement—it will keep chipping away at your income until the balance hits zero.

It’s crucial to understand that a garnishment is a long-term problem, not a short-term inconvenience. Ignoring it means allowing a slow drain on your finances that could last for months or even years.

Are There Special Rules for Government Debts?

Absolutely. When your creditor is the government, the rulebook changes dramatically. Debts for federal student loans, back taxes to the IRS, or child support arrears don’t follow the same process as a credit card or medical bill.

For most private debts, a creditor has to sue you and win in court before they can touch your wages. The government often gets to skip that step. For example, the Department of Education can start an administrative wage garnishment for a defaulted federal student loan after just sending you a notice.

The amount they can take is usually much higher, too. While most consumer garnishments are capped at 25% of your disposable income, a child support order can take as much as 60%. The IRS has its own set of powerful collection tools that bypass many of the usual consumer protections. This is why tackling government debts needs to be a top priority.

Facing a wage garnishment can feel isolating, but you don’t have to navigate this complex legal landscape alone. The attorneys at Ginsburg Law Group PC are dedicated to protecting consumers’ rights and finding strategic solutions to debt problems. If you’re struggling with garnishment, creditor harassment, or overwhelming debt, we can help you understand your options and take decisive action. Schedule a consultation with our experienced consumer law team today.