Summary

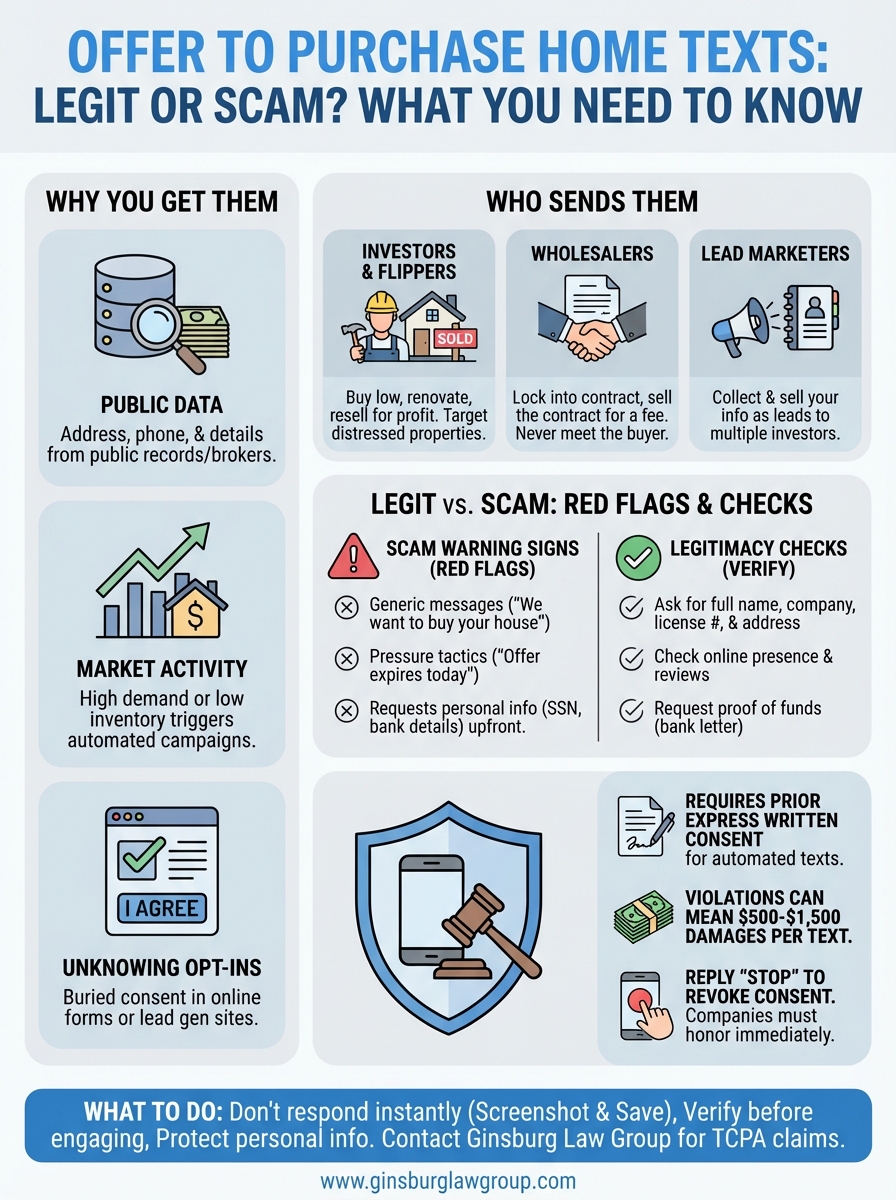

omeowners frequently receive unsolicited text messages offering fast cash for their properties, a practice fueled by the accessibility of public property records and automated marketing tools. These messages typically originate from real estate investors seeking discounted properties, wholesalers looking to flip contracts, or lead generation firms selling contact data. While some offers are legitimate, many are predatory or outright scams designed to harvest personal information. Recognizing red flags—such as generic phrasing, high-pressure tactics, and requests for sensitive financial details—is essential for protection. Legitimate buyers will readily provide company identification and verifiable proof of funds upon request. Legally, the Telephone Consumer Protection Act (TCPA) prohibits companies from sending these automated marketing texts without prior express written consent. Homeowners have the right to revoke consent by replying "STOP" and may be eligible for statutory damages ranging from $500 to $1,500 per unauthorized message. Documentation of these interactions is crucial, as persistent violations can lead to significant legal claims. By understanding these rights and verifying sender identities before engaging, consumers can safeguard their privacy and potentially hold illegal telemarketers accountable for harassment.

Your phone buzzes with another message from an unknown number: “Hi! We want to buy your house at [your address]. Cash offer, close fast!” If you’ve been receiving offer to purchase home texts out of nowhere, you’re not alone. Millions of homeowners across the country are bombarded with these unsolicited messages, sometimes multiple times per week.

The immediate questions are obvious: Is this real? Could someone actually want to pay cash for your home, or is this just another scam designed to steal your personal information? The truth is somewhere in the middle, and understanding the difference matters for both your financial safety and your legal rights.

This article breaks down everything you need to know about these texts: where they come from, how to spot legitimate offers versus potential scams, and what you can do to stop them. At Ginsburg Law Group, we represent consumers who’ve been targeted by illegal telemarketing practices, including unsolicited text messages that may violate the Telephone Consumer Protection Act (TCPA). If these texts keep coming despite your efforts to stop them, you may have legal options, including the possibility of recovering statutory damages from the senders.

Why you get texts offering to buy your home

The flood of offer to purchase home texts hitting your phone isn’t random. These messages target homeowners based on specific data points that companies purchase, scrape, or compile from public records. Your home’s address, your phone number, and details about your property are all part of massive databases that real estate investors and wholesalers use to identify potential sellers.

Several factors determine whether you become a target for these campaigns, and understanding them helps you see why the texts keep coming even when you’ve never expressed interest in selling.

Your contact information is widely available

Your phone number and home address exist in dozens of public and semi-public databases. County property records list you as the owner of your home, and these records are completely accessible to anyone willing to pay for them or scrape them from government websites. Data brokers compile this information and sell it to real estate investors, marketing companies, and lead generation services.

Phone numbers get linked to property records through multiple channels. You might have filled out forms at home improvement stores, responded to online quotes for services, or provided your information when refinancing your mortgage. Each time you share your contact details, companies can legally sell that data to third parties unless you specifically opted out of information sharing.

Public property records make your homeownership status and contact information accessible to anyone willing to purchase or compile that data.

Credit bureaus and data aggregation companies also package information about homeowners with specific characteristics: equity levels, mortgage payment history, estimated property values, and even life events like divorce or retirement. These detailed profiles help text senders identify homeowners who might be more likely to sell.

Real estate markets trigger automated campaigns

When your local housing market shows signs of high demand or low inventory, investor activity increases dramatically. Companies monitor market indicators like median sale prices, days on market, and rental rates to identify neighborhoods where they can flip properties or secure rental income. If you live in one of these hot markets, your phone number enters multiple campaign lists simultaneously.

Property characteristics also make you a target. Investors specifically look for homes with high equity positions, older construction dates, or features that suggest the owner might be ready to downsize or relocate. Even something as simple as your home’s age can trigger automated text campaigns if it fits the profile of properties that typically need updates or repairs.

You may have unknowingly opted in

Sometimes these texts arrive because you actually gave prior express written consent, even if you don’t remember doing so. Online forms that promise free home valuations, cash offer estimates, or property reports often include buried consent language allowing companies to contact you via text message. The checkbox or fine print might say something like “By submitting this form, you agree to receive text messages from our partners.”

Lead generation websites commonly share your information with multiple buyers simultaneously. When you fill out a single online form asking “What’s your home worth?” that information might get sold to ten or twenty different investors, each of whom then adds you to their texting campaigns. This explains why you might suddenly receive a surge of messages all around the same time.

Social media advertising can also capture your information. If you’ve ever clicked on a Facebook or Instagram ad about selling your home quickly or getting a cash offer, you may have unknowingly triggered a data collection process that resulted in your number being added to texting lists.

Who sends these texts and what they want

The senders behind offer to purchase home texts fall into several distinct categories, each with different business models and motivations. Understanding who’s actually reaching out helps you evaluate whether an offer deserves your attention or should be immediately deleted. Most of these messages come from profit-driven operators who view your home as inventory rather than someone’s residence.

Real estate investors and house flippers

Individual investors and small investment companies send texts because they want to purchase properties below market value, renovate them, and resell for a profit. These buyers specifically target homeowners who might need to sell quickly due to financial pressure, divorce, inheritance situations, or property condition issues. They aim to buy your home at a discount of 20 to 40 percent below retail value, factoring in renovation costs and their profit margin.

House flippers typically focus on distressed properties or homes owned by people facing time-sensitive situations. They calculate offers based on the after-repair value minus renovation costs and their expected profit. If your home needs significant repairs or you’re facing foreclosure, these buyers present themselves as a convenient solution to avoid the traditional listing process.

Real estate investors typically offer 20 to 40 percent below market value because they need room for renovation costs and profit margins.

Wholesalers looking for assignment deals

Wholesalers represent a different breed of text sender. These operators have no intention of actually buying your home themselves. Instead, they want to lock you into a purchase contract at a low price, then immediately sell that contract to an actual investor for a fee of $5,000 to $20,000 or more. Your home becomes part of a transaction where you never meet the real buyer.

This business model requires high volume. Wholesalers send thousands of texts weekly because they need only a tiny percentage of recipients to respond. They often use automated systems and purchased phone lists to reach as many homeowners as possible. The person texting you might have never seen your property and has no funding lined up.

Marketing companies selling leads

Lead generation companies send texts not to buy homes but to collect your contact information and sell it to multiple investors simultaneously. When you respond to their message, they qualify you as an interested seller and package your information as a lead worth $50 to $200 per contact. Your single response generates income for the marketing company while flooding your phone with calls from actual buyers.

These companies operate call centers or automated systems designed purely for data collection and resale. They have no interest in your property’s specific characteristics. Their goal is simply to identify homeowners willing to consider selling and monetize that interest by selling your information to their network of investor clients.

Legit or scam: red flags and quick legitimacy checks

Not every offer to purchase home texts comes from a legitimate buyer with actual funding and honest intentions. While some real investors do use text messaging for property acquisition, scammers and unethical operators flood the market with deceptive messages designed to steal your information or waste your time. Learning to spot the difference protects you from financial loss and privacy violations.

The challenge is that legitimate and illegitimate texts often look nearly identical at first glance. Both use similar language about cash offers and quick closings. The difference reveals itself through specific details and how the sender responds when you ask basic questions.

Warning signs of scam texts

Generic language represents the first major red flag. If the message says “We want to buy your house” without mentioning your specific address or any property details, the sender likely blasted the same message to thousands of people. Legitimate buyers who’ve researched your property will reference your actual street address or neighborhood to demonstrate they’ve done basic homework.

Pressure tactics signal trouble immediately. Messages that create artificial urgency with phrases like “offer expires in 24 hours” or “we need your answer today” aim to push you into hasty decisions. Real investors understand that homeowners need time to consider offers and consult with family or advisors.

Requests for personal information before providing details about the buyer should trigger immediate skepticism. If someone asks for your Social Security number, bank account details, or copies of your deed before telling you who they are or providing proof of funds, you’re dealing with a scam. Legitimate buyers introduce themselves and their company first.

Legitimate buyers provide their company name, license information, and proof of funds before requesting any sensitive personal information from you.

Grammar and spelling errors often indicate overseas scam operations. While everyone makes occasional typos, messages filled with awkward phrasing or obvious mistakes suggest the sender isn’t a professional operating a real business in the United States.

How to verify legitimate offers

Ask direct questions about the sender’s identity and funding. Request their full legal name, company name, real estate license number, and physical business address. Legitimate investors provide this information immediately because they’re operating legal businesses. Scammers evade these questions or provide fake details that don’t check out.

Search for the company online and check reviews. A real investor or house-buying company has a verifiable online presence with a website, social media accounts, and reviews on platforms like Google or the Better Business Bureau. If you can’t find anything about them online, or if their reviews describe scam experiences, walk away immediately.

Request proof of funds before discussing your property seriously. Legitimate cash buyers can provide bank letters or verified proof that they actually have money available to purchase properties. Anyone who becomes defensive or refuses to show financial capability isn’t worth your time.

What to do when you receive an offer text

When offer to purchase home texts land on your phone, your first response matters for both your safety and your options. Most people either ignore these messages completely or respond immediately out of curiosity. Neither approach serves your best interests if you want to evaluate whether the offer deserves consideration while protecting yourself from scams and illegal marketing practices. A strategic response gives you control over the situation and helps you determine the sender’s legitimacy before sharing any information.

Don’t respond immediately

Take time to evaluate the message before typing any reply. Responding instantly signals to the sender that your number is active and monitored, which often triggers more frequent texts from both the original sender and other companies they share data with. Your quick response marks you as someone interested in selling, making your contact information more valuable to lead brokers and wholesalers.

Screenshot the message and save all details about when it arrived and the sender’s phone number. This documentation becomes important if you later decide the texts violate your rights or if you want to file a complaint with regulatory agencies. Keep a folder on your phone specifically for these messages so you can track patterns and frequency.

Taking 24 to 48 hours before responding gives you time to research the sender and decide whether the contact deserves any attention at all.

Verify before engaging

Research the phone number and any company name mentioned in the text. Search the number on Google to see if others have reported it as spam or identified it as belonging to a specific real estate company. Check the Better Business Bureau and state real estate commission databases if the sender claims to be a licensed agent or broker.

Ask direct questions if you decide to respond. Request their full legal name, company name, business address, and proof of funds. Legitimate buyers answer these questions immediately because they operate transparent businesses. Anyone who evades or provides vague responses reveals their lack of credibility.

Protect your personal information

Never share sensitive details through text messages. Your Social Security number, bank account information, mortgage account numbers, or copies of your property deed should never go out via text, even if the recipient seems legitimate. Real estate transactions involve secure document platforms and verified communication channels, not casual text exchanges with strangers.

Limit what you reveal about your situation. Saying “I’m facing foreclosure” or “I need to sell quickly because of medical bills” gives the sender negotiating leverage and marks you as someone they can pressure into accepting below-market offers.

Your legal rights under TCPA and other laws

Federal and state laws provide specific protections against unwanted marketing texts, including those offer to purchase home texts that keep hitting your phone. The Telephone Consumer Protection Act (TCPA) represents the most powerful legal tool you have against illegal text message campaigns. This federal law restricts how companies can contact you using automated dialing systems and prerecorded messages, and violations can result in statutory damages of $500 to $1,500 per text message.

Understanding these protections helps you recognize when a sender crosses legal boundaries and gives you options for stopping the messages while potentially recovering compensation for the harassment. Many senders either ignore these laws completely or deliberately structure their campaigns to operate in gray areas they hope avoid enforcement.

TCPA protections against unsolicited texts

The TCPA requires companies to obtain your prior express written consent before sending marketing texts to your cell phone. This consent must be clear, specific, and documented. Simply having your phone number in a database doesn’t give anyone permission to text you about buying your home, and purchasing your information from a data broker doesn’t satisfy the consent requirement either.

Automated texting systems that send messages to large numbers of people trigger TCPA violations when they contact consumers without proper consent. If you never agreed to receive texts from a particular company or individual, their messages likely violate federal law. Each unauthorized text represents a separate violation that can result in $500 in statutory damages, or up to $1,500 if the court finds the violation was willful or knowing.

Companies cannot legally send you marketing texts simply because they purchased your phone number from a data broker or scraped it from public records.

Do Not Call Registry and state laws

Registering your number on the National Do Not Call Registry provides additional protection, though it primarily applies to voice calls rather than texts. Companies must check the registry and avoid contacting numbers listed there, with violations resulting in fines up to $43,792 per call from the Federal Trade Commission. While texts fall into a different category under the registry’s rules, registration demonstrates your clear preference against receiving unsolicited marketing.

State laws often provide stronger protections than federal regulations. California, Florida, and Texas have specific statutes restricting unsolicited commercial texts and allowing consumers to sue for damages. These state laws sometimes offer higher damage amounts or make it easier to prove violations compared to federal TCPA claims.

What consent actually means

Real consent requires you to take a specific action showing you want to receive texts from a particular company. Checking a box on a form, signing a document, or sending a text message to a shortcode can all create valid consent, but the language must clearly explain what you’re agreeing to receive. Consent obtained through deceptive practices or buried fine print doesn’t meet legal standards.

You can revoke consent at any time by replying “STOP” to any text message or contacting the sender directly to request removal from their list. Once you revoke consent, any additional marketing texts from that sender become TCPA violations. Companies must honor your opt-out request immediately and cannot require you to follow complicated procedures or wait through processing periods to stop the messages.

What to do next

The offer to purchase home texts flooding your phone aren’t going away on their own. You now understand the difference between legitimate investors and scammers, your legal rights under the TCPA, and how to verify senders before engaging. Your next step depends on whether you want to stop the messages, explore legitimate offers, or pursue legal action against violators.

If these texts continue despite opt-out requests, or if you never consented to receive them, you may have a TCPA claim worth substantial statutory damages. Companies that ignore federal law face financial consequences, and you’re entitled to compensation for each violation.

Ginsburg Law Group represents consumers targeted by illegal telemarketing practices. Our TCPA cases require no upfront costs, and we handle everything from investigation through settlement. Contact us for a free case evaluation.