Summary

A pour-over will acts as a critical safety net in estate planning, functioning as a catch-all mechanism to ensure that assets not formally transferred into a living trust during an individual's lifetime eventually reach their intended destination. Rather than distributing property directly to heirs, this specific legal document names a person's living trust as the sole beneficiary. This ensures a unified distribution strategy according to the trust's terms, preventing forgotten bank accounts, recently acquired real estate, or miscellaneous personal property from falling under state intestacy laws. However, it is essential to understand that assets captured by a pour-over will do not bypass the probate process; instead, they must be validated by a court before they can be funneled into the trust for final distribution. This requirement can lead to delays and additional costs compared to assets properly titled in the trust's name beforehand. Consequently, while the pour-over will provides essential protection against human error and oversight, it should be viewed as a secondary backup rather than a primary method for asset transfer. Keeping both the trust and the will synchronized through regular legal reviews remains vital for maintaining a seamless and efficient legacy for beneficiaries.

You’ve created a living trust to protect your assets and avoid probate, but what happens to property you forgot to include or acquired after setting it up? Without a backup plan, those assets could end up in probate court anyway, undermining your careful planning. This is exactly what a pour-over will solves, acting as a catch-all mechanism that funnels any overlooked assets into your trust after you pass.

A pour-over will works alongside your living trust, not instead of it. Think of it as a safety net that ensures everything you own ultimately lands where you intended, inside your trust and distributed according to your wishes. It’s a simple document with a specific and critical purpose in your overall estate plan.

At Ginsburg Law Group, we help clients build estate plans that actually hold up when it matters most. Below, we’ll explain how pour-over wills function, when they make sense, their advantages and limitations, and how they fit into a complete estate planning strategy. Whether you’re just starting to think about protecting your legacy or refining an existing trust arrangement, understanding this tool will help you make more informed decisions about your future.

What a pour-over will does in an estate plan

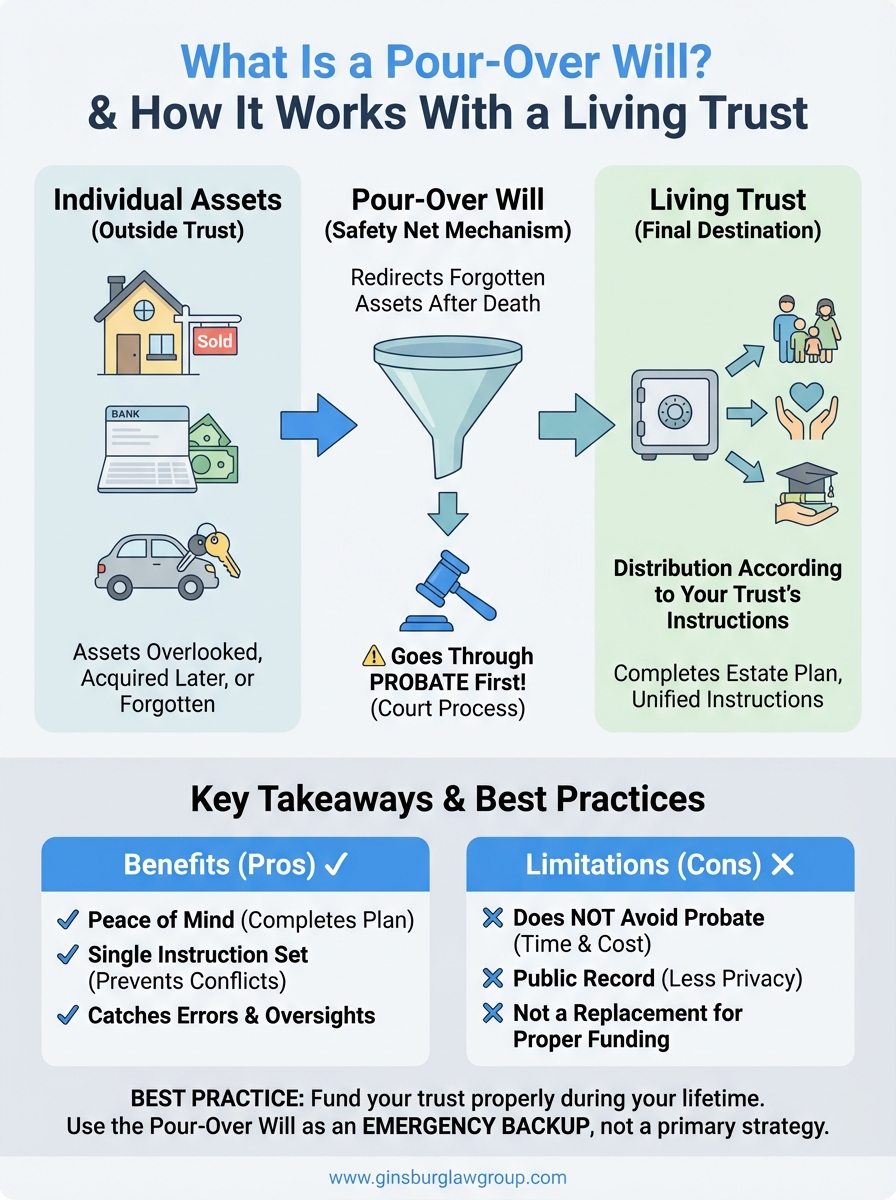

A pour-over will serves one specific function in your estate plan: it transfers any assets you still own in your individual name at death into your living trust. Rather than letting those assets go through probate as standalone property or get distributed according to state intestacy laws, the pour-over will directs your executor to move them into your trust, where they’ll be handled according to your trust’s distribution instructions.

The assets a pour-over will captures

Your pour-over will acts as a backup safety mechanism for assets that didn’t make it into your trust during your lifetime. These typically include property you acquired shortly before death and forgot to title in the trust’s name, bank accounts you opened and never transferred, personal belongings without formal titles, or assets you inherited but never formally moved into the trust.

For example, if you set up your living trust in 2025 but then purchased a rental property in late 2026 without transferring the deed into your trust’s name, your pour-over will would direct that property into the trust after your death. Small checking accounts, gift checks you received, or even refunds that arrive after you pass would all flow through this document into your trust structure.

A pour-over will doesn’t help you avoid probate for the assets it covers; it simply directs where those assets go after the probate process completes.

How it differs from a standard will

Unlike a traditional will that distributes assets directly to named beneficiaries, a pour-over will names your trust as the sole beneficiary. You won’t list specific people or organizations in the pour-over will itself. Instead, all property passes to your trust, and your trust document determines who gets what. This creates a single set of instructions for your entire estate rather than splitting your wishes between two separate documents.

Understanding what is a pour-over will means recognizing its limited but important role. It doesn’t replace your trust or your trust’s distribution plan. Your executor still has to open a probate case for any assets the pour-over will covers, get court approval, and then formally transfer everything into the trust before final distribution happens according to your trust terms.

Why people use a pour-over will

You create a pour-over will primarily to protect against human error and ensure your estate plan stays complete even when you forget to transfer every single asset into your trust. Most people who establish living trusts intend to fund them properly, but life gets busy, memory fades, and assets slip through the cracks. A pour-over will catches those overlooked items and directs them where you originally intended.

The practical reality of trust funding

Trust funding requires you to manually retitle assets in your trust’s name, which means changing deeds, account registrations, and ownership documents. This process takes time and attention to detail. You might transfer your house, investment accounts, and business interests into your trust when you first create it, but then you inherit money from a relative, open a new savings account, or buy a vehicle without remembering to update the ownership. Your pour-over will automatically redirects these stray assets into your trust structure after you pass.

Your pour-over will works like a funnel that captures everything you missed and sends it to the right place, even if probate has to process it first.

Simplifying distribution instructions

Rather than maintaining two separate sets of beneficiary instructions in both a traditional will and a trust, your pour-over will creates a single distribution roadmap. Your trust document contains all your specific wishes about who gets what, and your pour-over will simply points everything toward that central plan. This approach prevents conflicts between documents and ensures consistency across your entire estate, regardless of where assets were titled when you died.

How a pour-over will works with a living trust

Your pour-over will and living trust operate as coordinated partners, not independent documents. The trust holds and manages assets you transferred during your lifetime, while the pour-over will catches anything left outside the trust when you die. Understanding what is a pour-over will means recognizing that it activates only after your death and only for assets you still owned individually, not assets already inside your trust structure.

The two-step transfer process

When you die with a pour-over will, your executor first opens probate for any assets the will covers. The probate court validates your will, authorizes your executor to act, and oversees the transfer of these assets into your trust. Only after probate closes and the assets legally move into your trust do they get distributed to your beneficiaries according to your trust’s instructions. This means property flowing through your pour-over will goes through both the probate system and your trust before reaching its final destination.

Your pour-over will forces a probate process for captured assets, then your trust takes over to complete the distribution according to your predetermined plan.

Timing and coordination requirements

You need to keep both documents current and ensure they reference each other correctly. If you amend your trust’s distribution terms, your pour-over will automatically adapts because it simply directs assets into the trust without specifying beneficiaries itself. However, you must name your trust as beneficiary in the pour-over will using the trust’s exact legal name and date of creation. Any mismatch between these documents can create confusion for your executor and potentially delay the transfer process.

Pros, cons, and common misunderstandings

A pour-over will offers specific advantages but also comes with meaningful limitations that affect your estate plan’s efficiency. Before relying on this document as your safety net, you need to understand what it actually does and what it cannot do for your beneficiaries.

Benefits of using this document

Your pour-over will provides peace of mind that overlooked assets won’t end up distributed according to state intestacy laws or left in legal limbo. It ensures every piece of property you own eventually reaches your trust’s distribution plan, even items you forgot to transfer. This backup mechanism also simplifies your estate planning by creating a single destination for all assets rather than maintaining separate instructions in multiple documents.

Limitations you need to understand

Assets flowing through your pour-over will must go through probate before reaching your trust, which means court supervision, executor fees, and public records. This process can take months to complete and costs money that reduces what your beneficiaries ultimately receive. Understanding what is a pour-over will means accepting that it doesn’t provide the probate avoidance your trust offers for properly funded assets.

Your pour-over will creates a backup plan, but it cannot eliminate probate for the assets it captures.

What people get wrong

Many clients mistakenly believe their pour-over will avoids probate entirely, when it actually requires probate before assets reach the trust. Others assume they don’t need to fund their trust properly because the pour-over will handles everything automatically. In reality, you should minimize pour-over will transfers by keeping your trust funded, treating the will as emergency backup rather than primary strategy.

How to create and keep a pour-over will effective

You need to work with an estate planning attorney to draft a pour-over will that properly references your trust and meets your state’s legal requirements. This document must identify your trust by its exact name and date of establishment, name an executor who will handle probate, and include standard will provisions like guardian nominations if you have minor children. Your attorney ensures the language correctly directs assets into your trust rather than to individual beneficiaries.

The creation process and legal requirements

Your pour-over will must satisfy your state’s formal execution standards, which typically include signing the document in front of witnesses and sometimes a notary. You’ll need to name your trust as the sole residuary beneficiary, meaning everything left in your individual name flows to it after specific bequests, if any. Most attorneys draft pour-over wills alongside living trusts as part of a coordinated estate plan package, ensuring both documents reference each other correctly from the start.

Creating a pour-over will without professional guidance risks errors that could invalidate the document or prevent proper asset transfer to your trust.

Keeping your will synchronized with your trust

Your pour-over will automatically adapts when you amend your trust’s distribution terms because it simply directs assets into the trust without specifying final beneficiaries. However, if you revoke and replace your entire trust, you must update your pour-over will to reference the new trust document by name and date. Regular reviews of both documents, ideally every three to five years or after major life changes, help you catch any necessary updates and verify that your executor still lives and accepts the responsibility.

Key takeaways

Understanding what is a pour-over will helps you build a more complete estate plan that protects against human error. This document acts as a safety net for assets you forget to transfer into your living trust during your lifetime, ensuring everything eventually flows to your intended beneficiaries according to your trust’s instructions. However, you should treat it as backup rather than primary strategy, since assets captured by your pour-over will must go through probate court before reaching your trust and final distribution.

Your best approach combines a properly funded living trust with a pour-over will as emergency protection. Keep transferring assets into your trust throughout your life, review both documents regularly, and make sure your executor knows where to find them. The combination provides comprehensive coverage while minimizing probate exposure for your beneficiaries.

Ginsburg Law Group helps clients create coordinated estate plans that actually work when needed. We draft pour-over wills alongside living trusts to ensure your assets reach the right people efficiently, with clear instructions your executor can follow without confusion.