Estate planning for blended families means creating a legal strategy that protects everyone you care about when you have children from previous relationships and a current spouse. Your biological kids need security. Your stepchildren might deserve consideration. Your spouse needs financial protection. Standard estate planning templates do not handle these competing priorities. You need a custom approach that prevents family conflict after you are gone.

This guide shows you how to build an estate plan that works for your specific family structure. You will learn which legal tools prevent common disputes, how to use trusts to protect both your spouse and your children, and what mistakes cause the most problems. We cover real strategies that keep your assets out of probate court battles and ensure your wishes are actually followed.

Why blended families need a different estate plan

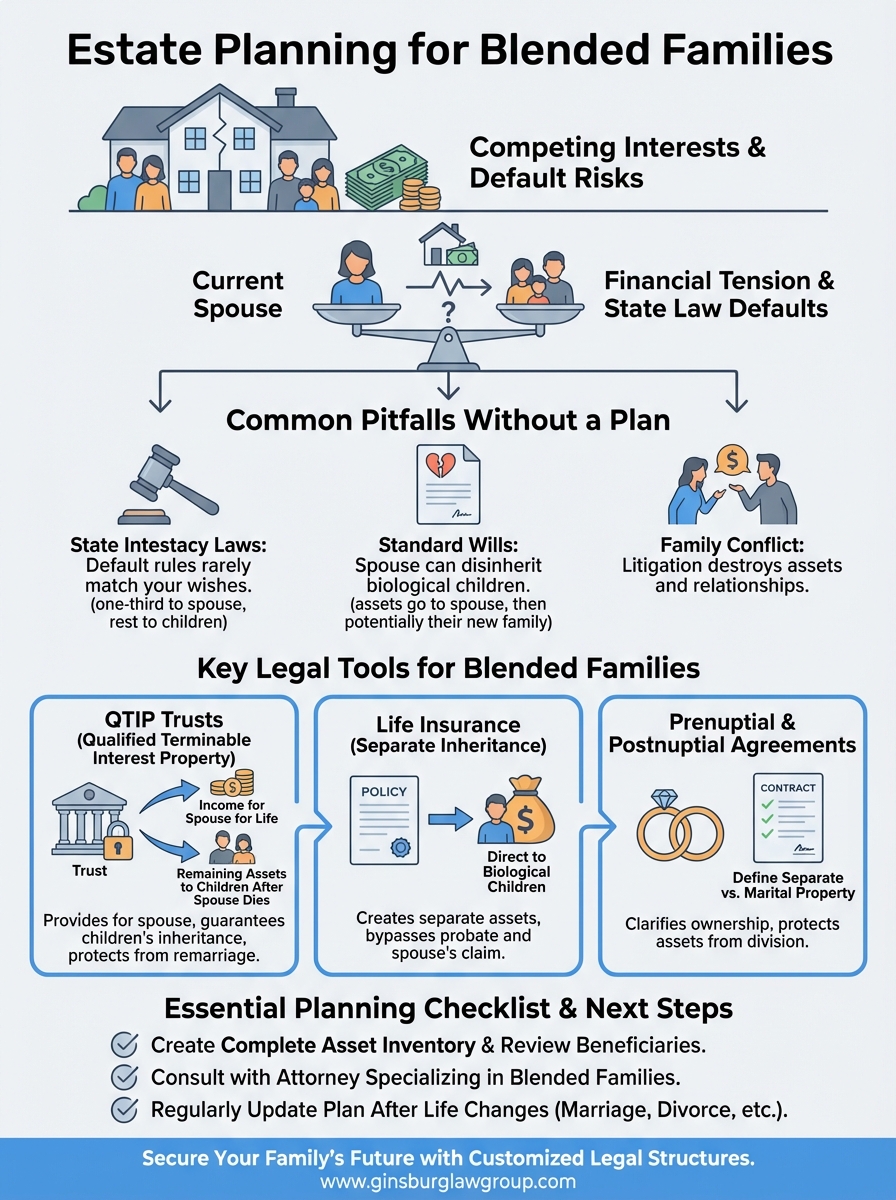

Traditional estate planning assumes you want everything to go to your spouse, then to your children after your spouse dies. This approach fails completely when you have children from a previous marriage. Your current spouse might need financial support, but you also want to protect your biological children’s inheritance. If you use a standard will that leaves everything to your spouse, your children from your first marriage could receive nothing. Your spouse has no legal obligation to pass assets to your biological kids, and they might prioritize their own children instead.

Your spouse and children have competing interests

Financial tension exists between your current spouse and your biological children whether anyone admits it or not. Your spouse might need your house, retirement accounts, and life insurance to maintain their lifestyle. Your children expect to inherit assets you built during your first marriage or before you remarried. These competing claims create automatic conflict that your estate plan must address directly.

You cannot solve this problem by hoping everyone will cooperate after you die. Your spouse might remarry and leave everything to a new partner. They might face financial pressure and spend your children’s inheritance on living expenses. Estate planning for blended families requires legal structures that protect both parties without relying on trust or goodwill.

Standard estate plans create winner-take-all situations that force your family to choose sides after you are gone.

State laws favor current spouses by default

If you die without a valid estate plan, state intestacy laws determine who inherits your property. Most states give your current spouse between one-third and one-half of your estate, with the remainder split among all your children. This default split rarely matches what you actually want. Your spouse might receive too little to maintain the home, or your biological children might get a tiny fraction because the calculation includes stepchildren you never intended to support equally.

Intestacy laws also ignore the context of your relationships. The court does not care that you promised your daughter she would inherit your business. Legal default rules do not account for assets you want to keep in your biological family or property your spouse brought into the marriage. You need an estate plan that overrides these automatic distributions with your actual intentions.

Previous relationships create legal obligations

Your obligations from earlier marriages do not disappear when you remarry. You might still owe child support that continues after your death through your estate. Custody agreements or divorce settlements might include specific promises about life insurance beneficiaries or college funding that you must honor. If your estate plan conflicts with these legal commitments, your children can sue your estate and potentially invalidate your entire plan.

Stepchildren add another layer of complexity. You might have moral obligations to stepchildren you helped raise, but no legal requirement to include them in your estate. Your estate plan needs to clarify which stepchildren receive what, or you create confusion and hurt feelings. Some stepchildren might have claims on assets if you treated them as your own children for years, even without formal adoption.

What can go wrong without a clear plan

Without proper estate planning for blended families, your death triggers automatic legal processes that ignore your relationships and promises. Courts follow state default rules that treat all children equally regardless of your actual intentions. Your spouse might inherit your entire estate, then remarry and leave everything to someone your biological children never met. Alternatively, your children might force the sale of your home to claim their inheritance while your spouse still lives there. These outcomes happen frequently because people assume their family will work things out after they are gone.

Your children might inherit nothing

Your current spouse controls everything you leave to them with no legal obligation to pass assets to your biological children. If you die first and your will leaves your entire estate to your spouse, your children must wait until your spouse dies to receive anything. During that time, your spouse might spend your children’s inheritance on medical bills, lifestyle expenses, or new family members. They could update their own will to exclude your children entirely.

This scenario becomes worse if your spouse remarries after your death. Their new partner might inherit assets you intended for your biological children. Your children watch their inheritance disappear into a new family structure you never anticipated. They have no legal recourse because your spouse legally owned the property and could distribute it however they chose.

Your spouse has complete control over assets you leave to them, regardless of verbal promises about your children’s future inheritance.

Family lawsuits destroy your estate

Unclear estate plans generate litigation costs that consume the very assets your family is fighting over. Your biological children might sue your spouse claiming you promised them specific property or percentages. Your spouse might counter-sue claiming your children are harassing them during grief. Attorney fees and court costs can exceed $50,000 before anyone receives a single asset, and probate litigation often takes two to five years to resolve.

These lawsuits damage relationships permanently. Stepchildren who grew up together become opposing parties in court proceedings. Your spouse and your children stop speaking entirely. Family events split along litigation lines for decades. The financial cost matters less than the emotional destruction these conflicts create among people you wanted to protect.

How to build a blended family estate plan

Building an effective estate plan starts with honest conversations about money, inheritance expectations, and family obligations. You need to discuss with your spouse which assets you want to protect for your biological children and what financial security your spouse requires. These conversations feel uncomfortable, but they prevent confusion and resentment after you die. Document every agreement in writing, even informal ones, so your estate planning attorney understands your complete intentions.

Start with a complete asset inventory

You cannot divide what you do not know you own. Create a detailed list of every asset you and your spouse possess, including retirement accounts, life insurance policies, real property, business interests, and personal belongings with significant value. Identify which assets you owned before marriage, which your spouse brought into the relationship, and what you acquired together. This classification determines which assets you can legally control through your estate plan and which might be subject to community property laws or marital property rights.

Your inventory should note current beneficiary designations on every account. Retirement accounts and life insurance policies transfer directly to named beneficiaries, bypassing your will entirely. If your ex-spouse is still listed as beneficiary on your 401(k), they inherit those funds regardless of what your will states. Review and update these designations immediately.

Estate planning for blended families requires you to coordinate beneficiary designations, will provisions, and trust terms into one unified strategy.

Work with an attorney who specializes in blended families

Generic online estate planning templates cannot handle your family structure. You need an attorney who regularly works with blended family situations and understands how to balance competing interests legally. They will draft documents that prevent the most common disputes and structure your plan to minimize estate taxes and probate costs.

Bring your spouse to attorney meetings when discussing overall strategy, but also schedule individual consultations to discuss provisions for your biological children. Your attorney can explain which approaches work best for your specific state’s laws and family dynamics.

Trusts and tools that prevent conflict

Specific legal instruments solve the dual obligation problem that estate planning for blended families creates. These tools allow you to provide financial security for your current spouse while guaranteeing your biological children receive their inheritance. Unlike simple wills that create winner-take-all situations, properly structured trusts give your spouse access to income and asset protection during their lifetime, then automatically transfer remaining assets to your children. You maintain control over your property’s ultimate destination while meeting both sets of obligations.

QTIP trusts protect both spouse and children

A Qualified Terminable Interest Property (QTIP) trust holds assets that generate income for your surviving spouse during their lifetime, then distribute to your biological children after your spouse dies. Your spouse receives regular payments from trust investments but cannot change the final beneficiaries or withdraw the principal. This structure prevents your spouse from disinheriting your children or leaving your assets to a new partner. The trustee you appoint manages investments and ensures fair treatment of both your spouse and your children.

QTIP trusts also provide estate tax benefits because assets transfer to your spouse tax-free under the marital deduction, then pass to your children according to your original instructions. You specify how much income your spouse receives, whether they can access principal for emergencies, and what happens if your spouse remarries. These detailed instructions eliminate ambiguity that causes family disputes.

Life insurance as separate inheritance

Life insurance policies create inheritance for your biological children without reducing assets available to your spouse. You purchase a policy naming your children as direct beneficiaries, ensuring they receive funds immediately upon your death outside of probate. This approach works particularly well when your spouse needs your retirement accounts and home for living expenses, but you want your children to receive a substantial inheritance.

Placing life insurance in an irrevocable life insurance trust (ILIT) removes death benefits from your taxable estate and protects proceeds from your children’s creditors. The trustee distributes insurance proceeds according to your instructions, potentially staggering payments to minor children or protecting funds from poor financial decisions.

Life insurance creates new assets specifically for your children rather than dividing existing property between competing beneficiaries.

Prenuptial and postnuptial agreements

These contracts define which assets remain separate property and which become marital property subject to division. You can specify that your business, family home, or inherited assets stay outside marital property rights and pass directly to your biological children. Prenuptial agreements signed before marriage provide the strongest protection, but postnuptial agreements executed during marriage accomplish the same goals if both spouses agree.

Courts enforce these agreements during divorce or estate settlement, preventing your spouse from claiming assets you designated for your children. Your estate planning attorney coordinates your marital agreement terms with your trust provisions to create one unified strategy.

Common mistakes and a planning checklist

Most people fail at estate planning for blended families not because they lack good intentions, but because they make easily avoidable errors that undermine their entire strategy. You might create a trust for your biological children but forget to fund it with actual assets, leaving the trust document legally valid but practically worthless. Alternatively, you might update your will but neglect to change beneficiary designations on your retirement accounts, which pass directly to whoever is named regardless of will provisions. These disconnects between different planning documents create the exact conflicts you tried to prevent.

Failing to update documents after life changes

Your estate plan becomes outdated the moment your family circumstances change. You remarry, your children turn 18, you acquire new property, or your spouse’s financial situation shifts dramatically. Each of these events requires immediate updates to your estate planning documents, yet most people wait years between revisions. Your ten-year-old trust that names your brother as guardian makes no sense when your children are now adults with their own families.

Divorce represents the most critical update trigger that people consistently ignore. Your ex-spouse might still be named as beneficiary on life insurance policies, retirement accounts, or as executor of your will. Some states automatically revoke these designations upon divorce, but many do not. Verify every single beneficiary designation after any marital status change.

You cannot assume your estate plan remains valid after major life events; outdated documents create exactly the confusion and conflict you tried to avoid.

Your estate planning checklist

Review your plan using this systematic approach to catch common errors before they cause problems. You should complete this verification process annually and after any significant family or financial change.

Essential verification steps:

- Confirm all beneficiary designations match your current intentions across life insurance, retirement accounts, and bank accounts

- Verify your spouse and children understand the plan’s basic structure and location of original documents

- Review trustee selections to ensure named individuals are still willing and capable of serving

- Update asset valuations and ownership records, particularly for business interests and real property

- Confirm guardianship provisions remain appropriate for minor children’s current ages and circumstances

- Schedule attorney review every three to five years or after remarriage, divorce, birth, death, or major asset acquisition

- Coordinate trust funding by actually transferring titled assets into trust ownership, not just creating trust documents

- Document all informal family agreements about specific heirlooms or property distribution in writing

Next steps for your family

You now understand why estate planning for blended families requires specialized legal structures beyond standard wills. Your family deserves protection from the conflicts and financial losses that unclear plans create. The specific tools we covered (QTIP trusts, life insurance strategies, and marital agreements) work only when an experienced attorney drafts them correctly and you fund them with actual assets.

Start by having honest conversations with your spouse about inheritance expectations and obligations to children from previous relationships. Create your complete asset inventory. Then schedule a consultation with an estate planning attorney who regularly handles blended family situations. Do not wait for a crisis to force these decisions. Your family’s financial security and relationships depend on decisions you make now, while you can still control the outcome.

Ginsburg Law Group provides estate planning services that protect both your current spouse and your biological children. Our attorneys help you build a comprehensive plan that prevents family conflict and ensures your wishes are actually followed.