A living trust is a private legal document you create during your lifetime to hold and manage your property, from your house and bank accounts to investments. Think of it as a personal rulebook for your assets. This powerful tool lets you keep full control while you are alive and ensures your legacy is passed directly to your loved ones when you are gone, all while bypassing the long and often costly court process called probate.

What Is a Living Trust and How Does It Work

It is easy to get caught up in the day-to-day and forget about planning for the future. What happens to your hard-earned home or savings if something unexpected happens to you? This is where a living trust comes in. It’s a foundational estate planning tool that allows you to place your assets into a legal entity that you control, ensuring they are seamlessly transferred to your beneficiaries without the headache of probate court.

It is shocking how many people put off this kind of planning. A 2025 report revealed that only 11% of Americans have a trust, and an alarming 55% have no estate planning documents at all. You can read the full report on estate planning trends to see just how widespread this issue is.

At its heart, a living trust is like a protective container for your most valuable possessions. You create the container, then you formally transfer ownership of your assets into it. While it might sound technical, it is just a legal step that changes an asset's title from your individual name to the name of your trust.

For instance, the deed to your home would no longer be in the name of "Jane Doe." Instead, it would be titled to "The Jane Doe Living Trust." The crucial part is that you still manage and use everything inside that container just like you always did.

The Three Key Players in Your Trust

To really get a handle on what a living trust is, you need to understand the three main roles that make it work. In most cases, especially with a revocable living trust, one person—you—starts out by wearing all three hats, which keeps things simple.

Here’s a quick breakdown of who’s who in a living trust.

The Three Key Roles in a Living Trust

| Role | Who It Is | Primary Responsibility |

|---|---|---|

| Grantor | You (The Creator) | The person who establishes the trust and puts their assets into it. The grantor is the one who sets all the rules. |

| Trustee | You (The Manager) | The person or institution tasked with managing the assets in the trust according to the grantor's instructions. |

| Beneficiary | You (The Recipient) | The person or people who get to benefit from the assets in the trust. While the grantor is alive, they are usually the main beneficiary. |

So, you, as the Grantor, create the trust. You then name yourself the Trustee, which gives you the authority to manage your assets exactly as before. You also name yourself the initial Beneficiary, so you continue to enjoy your own property. This setup gives you total control.

A living trust provides a clear succession of management. It allows you to name a "successor trustee"—a trusted person or institution—to take over if you become incapacitated or pass away, ensuring your financial affairs are handled without court intervention.

This is a huge difference from a will, which only kicks in after you die. A living trust, on the other hand, is active during your lifetime. This provides a safety net against unexpected events, like a sudden illness or injury that could leave you unable to manage your own finances. It’s this proactive protection that makes a living trust such a cornerstone of modern estate planning, giving both you and your family invaluable peace of mind.

Choosing Between Revocable and Irrevocable Trusts

So, you have decided a living trust is right for you. Great! The next big question is: which kind? This is where you have to make a critical choice between a revocable trust and an irrevocable one.

This is not just a minor detail; it completely changes the game in terms of control, flexibility, and protection. Think of it as the difference between writing a document in pencil versus carving it in stone.

The Revocable Trust: Your Flexible Estate Plan

A revocable living trust is exactly what it sounds like—changeable. You can modify it, add or remove assets, switch beneficiaries, or even cancel the whole thing whenever you want. Because you keep full control, it’s far and away the most popular choice for everyday estate planning.

For most people, this is the perfect fit. It’s your personal financial playbook, and you get to update the plays as your life changes—you get married, have kids, buy a new house. In your day-to-day life, nothing really feels different. You’re still the one calling the shots and managing your assets, just as you always have.

The primary mission here is simple: keep your family out of probate court. A well-drafted revocable trust allows your chosen successor trustee to step in and distribute your assets privately and without the court’s permission. This is a huge deal, especially in states where probate can drag on for 18 months and eat up to 7% of the estate's value. The growing desire for this kind of privacy and control has helped the Trusts & Estates industry reach a staggering $290.1 billion in revenue. You can discover more insights about the booming Trusts & Estates industry if you are curious about the market drivers.

The key tradeoff with a revocable trust is that you give up asset protection for total flexibility. From a legal standpoint, the assets are still considered yours, which means they’re fair game for creditors or in a lawsuit.

The Irrevocable Trust: Your Asset Protection Fortress

Now, let us talk about the irrevocable trust. This is a more specialized tool, built for serious asset protection and sometimes, significant tax planning.

When you move property into an irrevocable trust, you are making a permanent decision. You are formally giving up ownership and control. The trust effectively becomes its own legal entity, creating a protective wall around those assets. This shields them from future creditors, legal judgments, and certain taxes.

This powerful structure is a go-to for people in high-liability professions or those with substantial wealth who are focused on legacy preservation. For instance, a surgeon might place their home and savings into an irrevocable trust. If a malpractice suit ever arises, those assets are no longer legally theirs and cannot be touched.

But that level of protection demands a sacrifice: you lose all flexibility. Need to sell that house in the trust? Want to change who gets what? You cannot just make that call on your own. It is a complex process that often requires the beneficiaries' consent.

To get a complete picture of these two options, take a look at our detailed guide on the distinctions between revocable vs. irrevocable trusts. Making the right choice is fundamental to your long-term financial security.

Revocable Trust vs Irrevocable Trust Head-to-Head

To make things even clearer, let us put these two trust types side-by-side. This direct comparison should help you see the fundamental differences and get a better sense of which one fits your specific needs.

| Feature | Revocable Living Trust | Irrevocable Trust |

|---|---|---|

| Flexibility | High. Can be changed or canceled by the creator at any time. | Low. Generally permanent and cannot be easily changed. |

| Asset Control | Full Control. You manage the assets as both grantor and trustee. | No Control. You give up ownership and management to the trustee. |

| Probate Avoidance | Yes. Assets in the trust bypass the probate court process. | Yes. Assets are not part of the probate estate. |

| Creditor Protection | No. Assets are seen as yours and are exposed to creditors. | Yes. Provides strong protection from future lawsuits and creditors. |

| Estate Tax Benefits | No. Assets are included in your taxable estate. | Yes. Can be structured to remove assets from your taxable estate. |

Ultimately, the best choice depends entirely on your goals. If your main objective is to avoid probate and maintain control over your assets during your lifetime, the revocable trust is almost always the answer. But if your priorities are asset protection and estate tax reduction, the powerful—but rigid—irrevocable trust is worth a serious look.

How a Living Trust Manages Your Assets

So, how does a living trust actually work in the real world? Think of it less as a single action and more as a dynamic tool that adapts to your life. The process kicks off the moment you sign the documents, but the real magic happens in the next step.

This critical step is called funding the trust. It’s the process of formally moving your assets from your name into the trust’s name. Imagine the trust is a secure box you’ve built to protect your valuables; funding is the act of actually placing everything inside. An unfunded trust is just an empty box—a great plan with nothing to execute.

To bring the trust to life, you have to retitle your property. The deed to your home, for example, would change from "John and Jane Doe" to "The Doe Family Revocable Trust." Bank accounts, investment portfolios, and other major assets need the same treatment, with ownership updated to the trust.

You Are Still in the Driver's Seat

A common fear is that putting assets into a trust means giving up control. With a revocable living trust, that’s simply not true. As the person who creates the trust (the grantor), you also name yourself as the first trustee. This means you maintain 100% control over every asset inside it.

You can still buy a new car, sell stocks, or spend your money exactly as you did before. Your day-to-day financial life does not change one bit. The only difference is the name on the legal title, which is the secret sauce that makes the trust work when you need it most.

Before you start funding, it is a good idea to understand the full scope of your assets. Taking inventory first ensures that no valuable property gets left behind.

Planning for Incapacity and Beyond

The real power of a living trust shines through when life throws you a curveball. If you become incapacitated and cannot manage your affairs, your designated successor trustee can step in immediately.

This transition happens privately, with no court involvement needed. Your successor trustee—whether it is a responsible family member, a close friend, or a professional—has the legal authority to pay your bills and manage your finances based on the rules you already set in the trust.

A living trust is a dynamic plan for both life and death. It provides a clear, private, and immediate line of succession for your financial management, ensuring your needs are met without the public scrutiny and delays of a court-appointed guardianship.

When you pass away, that same successor trustee steps up to their final duty: distributing your assets to the beneficiaries you’ve chosen. The entire process unfolds privately, efficiently, and completely outside of the probate court system. This sidesteps the public records, creditor claim periods, and frustrating delays that often tie up estates settled with a will.

Considering that financial anxiety impacts 49% of Americans, this kind of preparation offers immense relief. Yet, a shocking 76% of U.S. adults don’t have an estate plan, and that includes nearly half of those over 55. As you can learn more from the 2025 Estate Planning Report, this planning gap leaves families exposed. A living trust closes that gap by creating a clear, private roadmap, giving you—and your loved ones—true peace of mind.

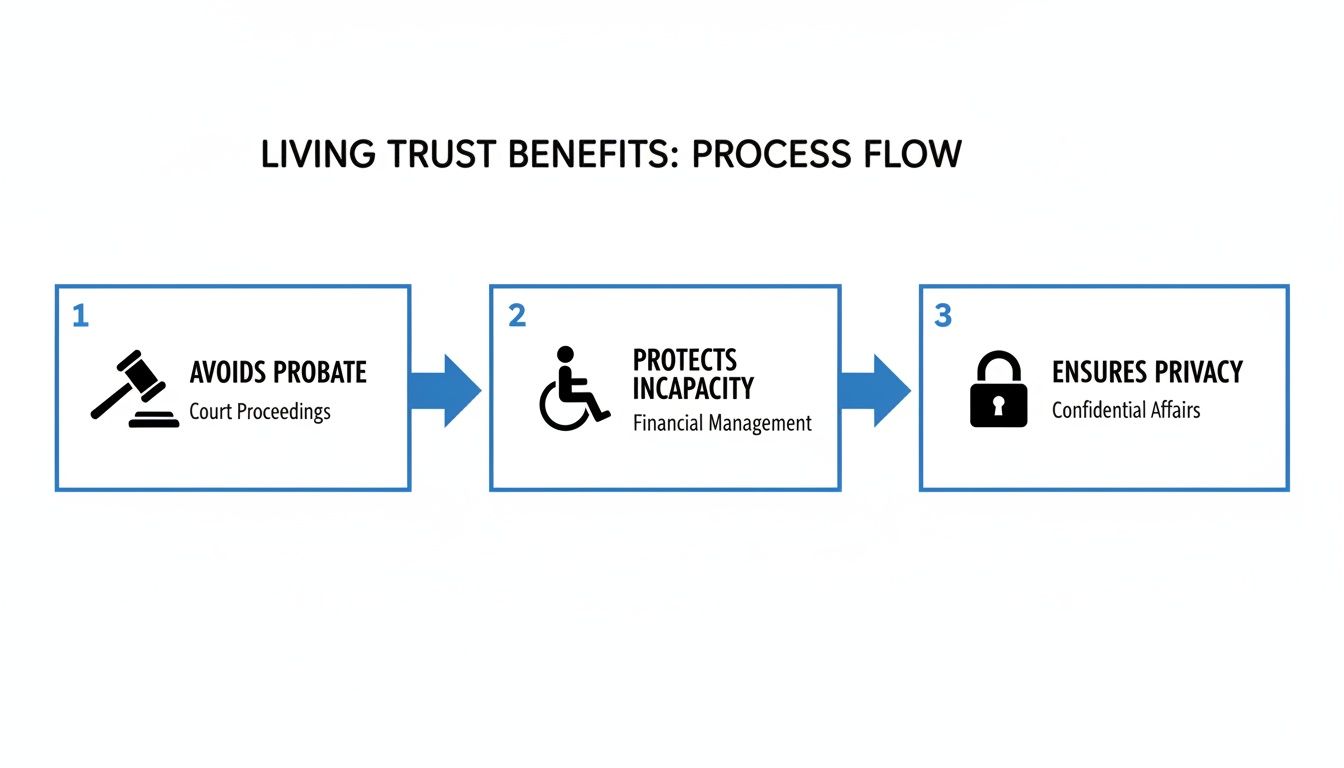

The Real Benefits of a Living Trust

Avoiding probate is the headline feature everyone talks about, but it’s really just the tip of the iceberg. The true power of a living trust lies in the comprehensive protection it offers your assets, your privacy, and—most importantly—your family’s peace of mind when they need it most. It delivers a level of security and control that a simple will just cannot touch.

One of the most immediate advantages is keeping your family's affairs private. When a will goes through probate, it becomes a public record. That means anyone, from a curious neighbor to a predatory salesperson, can walk into the courthouse and see a complete list of what you owned, who you owed, and who got what.

A living trust, by contrast, is a private document. The entire process of managing and distributing your assets is handled quietly and efficiently by the successor trustee you appointed. This privacy shields your loved ones from unwanted attention and protects them from scammers or disgruntled relatives who might see your estate as an opportunity.

A Plan for Incapacity, Not Just Death

Here’s a crucial difference: a will does absolutely nothing for you while you are alive. It only kicks in after you die. But what happens if you have a stroke or a serious accident and can no longer manage your own affairs?

This is where a living trust truly shines. If you become incapacitated, your chosen successor trustee can step in immediately to manage the assets held in the trust. They can pay your mortgage, handle your investments, and make sure your financial life continues smoothly without missing a beat. This completely bypasses the need for a court-ordered conservatorship—a public, expensive, and often humiliating process for everyone involved.

Planning for incapacity is no longer a "nice-to-have"; it is a fundamental part of a solid estate plan. A trust provides a clear, private, and instant plan for managing your finances if you cannot, avoiding the bureaucratic nightmare of court intervention.

Cutting Down on Family Stress and Conflict

Losing a family member is devastating. The last thing anyone needs is to be thrown into a confusing legal battle or a drawn-out financial mess on top of their grief. A living trust is designed to prevent exactly that.

By creating a detailed, private roadmap for what happens to your assets, you leave very little room for confusion or arguments. Your successor trustee has a fiduciary duty to follow your instructions to the letter. This gives your family a much clearer and smoother path forward.

Faster Distribution: Because you skip the probate court's red tape, assets can often be distributed to your heirs in a matter of weeks, not the months or even years it can take with a will.

Simpler Management: All the assets you have funded into the trust are gathered under one roof, making it much easier for your trustee to manage everything without having to track down scattered accounts.

Harder to Challenge: While nothing is completely challenge-proof, it is generally much more difficult and expensive for someone to contest a living trust compared to a will. The process is private, and the legal hurdles are higher.

At the end of the day, a living trust is more than a legal tool; it’s an act of love. It’s about making sure your legacy supports your family instead of becoming a source of stress. You are giving them the gift of clarity and peace during one of life's most difficult times.

How to Set Up and Fund Your Living Trust

Going from understanding a living trust to actually creating one can seem daunting, but it is a journey we can break down into manageable steps. Think of it less like a single giant leap and more like a structured process involving careful planning, key decisions, and precise legal work.

Let’s walk through the roadmap for bringing your living trust to life, from initial prep to the final, crucial step of funding it.

Phase 1: Compile a List of Your Assets

First things first: you need a clear picture of everything you own. You cannot put an asset into a trust if you do not account for it. This is the time to create a detailed, comprehensive inventory.

Start by gathering the paperwork for your most significant assets, such as:

Real Estate: Grab the deeds for your home, any vacation properties, or rental units.

Financial Accounts: Collect recent statements for all checking, savings, and money market accounts, along with any CDs.

Investment Portfolios: Pull together the details on your stocks, bonds, mutual funds, and brokerage accounts.

Business Interests: If you own a business, find the ownership documents for your LLC, partnership, or corporation.

Valuable Personal Property: Do not forget titles for vehicles and boats, or appraisals for high-value collections like art, antiques, or jewelry.

Getting this all together gives you and your attorney a complete snapshot of your estate, making sure nothing important gets left behind.

Phase 2: Choose Your Key People

With your assets lined up, the next step is all about people. You will need to name a successor trustee and decide on your beneficiaries. These are some of the most personal decisions you will make in the process.

Your successor trustee is the person or institution you pick to step in and manage the trust if you cannot, either due to incapacity or after your death. This needs to be someone you trust completely—a person who is responsible, organized, and can handle financial matters with total integrity.

Your beneficiaries are the people or organizations who will ultimately receive the assets from your trust. Here, you are in the driver's seat. You get to spell out exactly who gets what, when, and how. This is your chance to make sure your legacy is handled precisely the way you want.

Phase 3: Draft the Legal Document

This is where having a professional in your corner is non-negotiable. You’ll work closely with an estate planning attorney to draft the formal trust document. This is not a fill-in-the-blank form; it’s a sophisticated legal instrument crafted to fit your unique family situation, financial picture, and goals.

Your attorney will make sure the language is airtight, legally compliant with state laws, and leaves no room for misinterpretation. In this phase, you will nail down all the specifics, from the powers your successor trustee will have to the detailed instructions for distributing your assets.

The trust document is the foundational rulebook for your estate. Working with an experienced attorney ensures this rulebook is clear, enforceable, and capable of protecting your family as intended, preventing ambiguity that could lead to disputes later on.

Phase 4: Fund Your Living Trust

We’ve arrived at the final—and most critical—step. It’s also the one that people most often get wrong or forget entirely. An unfunded trust is essentially a useless document. Funding the trust means officially transferring ownership of your assets out of your individual name and into the name of the trust.

As the chart shows, the core benefits of a trust only kick in once it actually owns your assets. Here is what that looks like in practice:

Real Estate: A new deed is drawn up and recorded, changing the owner from "John Doe" to "The John Doe Revocable Living Trust."

Bank Accounts: You will work with your bank to retitle your accounts, moving them under the trust's name.

Investments: Your financial advisor will help you change the ownership on your brokerage accounts to the trust.

This retitling process can be meticulous, and every detail matters for the trust to work as intended. To see how this vital step is handled with precision, you can learn more about how an attorney can help with trust funding. A properly funded trust is what truly activates the powerful protections you have worked so hard to put in place for your family.

Common Questions About Living Trusts

Even after getting the basics down, you are bound to have more questions about how a living trust works in the real world. That is completely normal. Let us tackle some of the most frequent questions we hear from clients to help clear things up.

Do I Still Need a Will if I Have a Living Trust?

Yes, you absolutely do. Think of a special type of will, called a pour-over will, as the essential companion to your living trust. It acts as a safety net.

Its main purpose is to "catch" any assets you might have forgotten or did not get around to funding into your trust. After you pass away, this will directs those assets to be "poured over" into the trust. More importantly, a will is the only place you can legally name guardians for your minor children. A trust cannot do that, making a pour-over will an indispensable part of your plan.

Is a Living Trust Expensive to Set Up?

There is an upfront cost to getting a living trust drafted correctly by an experienced attorney, and that is a valid consideration. But it is crucial to look at the bigger picture. The costs of probate—which can include hefty court fees, executor compensation, and legal bills—often dwarf the initial investment in a trust.

Think of it this way: Creating a trust is a one-time investment in avoiding a much more expensive, time-consuming, and stressful process for your family down the road. It’s a proactive step that truly pays for itself by keeping your estate out of the court system.

Can a Trust Protect My Assets From Creditors?

This is a very common misconception. A standard revocable living trust offers no protection from your personal creditors while you are alive. Because you still have complete control and access to the assets, the law views them as your own, making them fair game for satisfying your debts.

On the other hand, certain kinds of irrevocable trusts are specifically engineered for asset protection. These are far more complex tools that involve giving up control over your assets. Setting one up properly requires highly specialized legal guidance to make sure it is structured to meet your objectives without creating unintended problems.

What Happens if I Forget to Put an Asset in My Trust?

It happens more often than you would think, and this is exactly why that pour-over will is so critical. If an asset is not officially titled in the name of your trust when you die, the trust's instructions simply do not apply to it.

Without a pour-over will to catch it, that forgotten bank account or property will almost certainly have to go through the public and lengthy probate process. This can unfortunately defeat one of the primary reasons for creating a trust in the first place: keeping your affairs private and efficient.

Trying to figure out all the nuances of a living trust on your own can feel like a heavy lift, but you do not have to go it alone. The experienced team at Ginsburg Law Group PC is here to offer clear, straightforward guidance. We can help you build a solid estate plan that protects your legacy and gives your family genuine peace of mind. To talk about your situation and make sure your trust is set up and funded correctly from the start, we invite you to schedule a consultation with us today.

Article created usingOutrank