When a company violates your rights, whether through a defective vehicle, harassing robocalls, or illegal debt collection tactics, you need legal representation that fights back. Ginsburg Law Group consumer law practice focuses exclusively on protecting individuals against corporations, creditors, and businesses that cross the line.

This article covers the specific services we offer, the types of cases we handle, and how to reach us for a free case evaluation. Whether you’re dealing with a lemon vehicle, credit report errors, or aggressive debt collectors, you’ll find the information you need to understand your options and take the next step toward holding the right parties accountable.

What Ginsburg Law Group does in consumer law

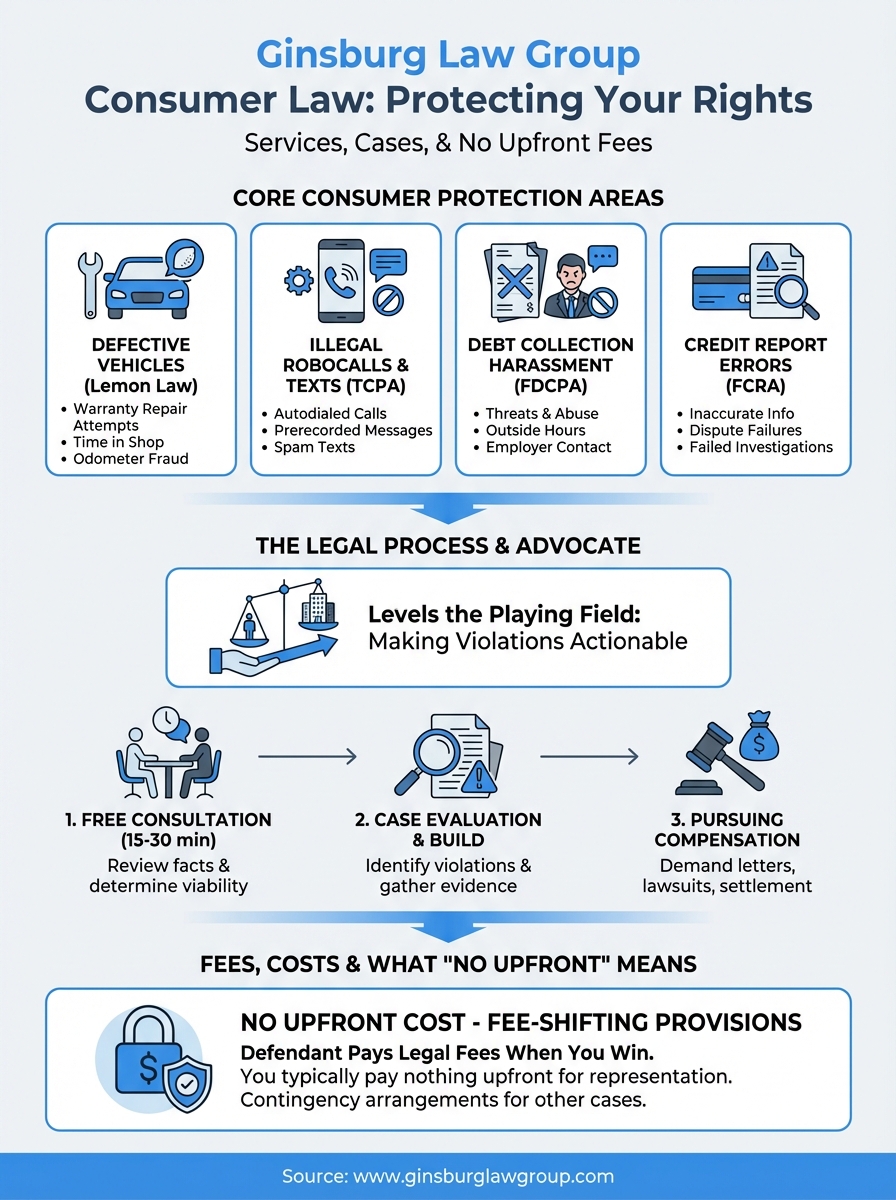

We represent individual consumers in legal disputes against corporations, manufacturers, creditors, and financial institutions. Ginsburg Law Group consumer law services focus on cases where businesses violate federal statutes designed to protect your rights. Our practice handles defective vehicle claims under state Lemon Laws, illegal robocall cases under the Telephone Consumer Protection Act (TCPA), debt collection harassment under the Fair Debt Collection Practices Act (FDCPA), and credit reporting errors under the Fair Credit Reporting Act (FCRA).

When a company breaks the law, you shouldn’t have to pay to enforce your rights.

Core practice areas

You’ll find our representation most relevant if you’re dealing with a lemon vehicle, repeated unwanted marketing calls, abusive debt collectors, or false information on your credit report. Vehicle defect cases include situations where your car has spent excessive time in the shop for warranty repairs or where a dealer committed odometer fraud. TCPA violations cover autodialed calls to your cell phone without prior express consent, prerecorded telemarketing messages, and text message spam. Debt and credit cases involve collectors using threats, calling outside permitted hours, or reporting inaccurate account information that damages your credit score.

How we differ from general practice firms

Most general law firms handle a wide range of cases across multiple legal areas. We concentrate exclusively on consumer protection statutes, which means you’re working with attorneys who understand the specific federal laws corporations violate. This focus allows us to identify violations faster and build stronger cases. Fee-shifting provisions in these statutes mean the defendant pays our legal fees when we win, so you typically pay nothing upfront for representation.

Why consumer law matters for everyday problems

You face situations every day where businesses hold more power, more information, and more resources than you do. Consumer protection laws exist to level that playing field by giving you enforceable rights when companies violate specific rules. Without these statutes, a corporation with unlimited legal resources could ignore your complaints, refuse refunds for defective products, harass you with collection calls, or report false information that destroys your credit score with zero consequences.

Federal consumer protection statutes put teeth behind your rights by allowing you to sue and recover damages.

When violations become actionable legal claims

Ginsburg Law Group consumer law practice translates everyday problems into cases with real legal remedies. A robocall becomes a TCPA violation worth $500 to $1,500 per call. A credit report error becomes an FCRA case that can remove damaging information and award compensation. Debt collector threats turn into FDCPA violations that stop the harassment and potentially pay you damages. The key difference between a frustrating consumer experience and an actionable legal claim is whether the business broke a specific federal statute that grants you the right to sue and recover.

How the firm handles a case from intake to outcome

Your case begins with a free consultation where we review the facts and determine whether you have a viable claim under federal consumer protection statutes. You’ll speak directly with an attorney who asks specific questions about violation dates, the company involved, and any documentation you already have. Ginsburg Law Group consumer law intake process takes between 15 and 30 minutes, and you’ll receive a clear answer about whether we can take your case.

We only accept cases where federal statutes give you the right to sue and recover damages.

Initial case evaluation

During the evaluation, we identify which federal statute the business violated and what evidence we need to prove your claim. TCPA cases require phone records showing when calls came in. FDCBA violations need documentation of collection calls or threats. You’ll provide repair orders, credit reports, or call logs depending on your case type. We review everything before signing a representation agreement.

Building the case and pursuing compensation

Once we accept your case, we send demand letters to the company outlining the violations and statutory damages you’re entitled to recover. Many cases settle because businesses face mandatory attorney fee awards if they lose in court. If settlement negotiations fail, we file a lawsuit and take your case through discovery and trial if necessary.

Common cases and laws the firm covers

Ginsburg Law Group consumer law practice concentrates on four primary federal statutes that protect you from corporate misconduct. You’ll find our representation most effective when businesses violate specific rules that trigger statutory damages and mandatory attorney fee awards. These statutes include the Magnuson-Moss Warranty Act (federal Lemon Law), state Lemon Laws, the Telephone Consumer Protection Act, the Fair Debt Collection Practices Act, and the Fair Credit Reporting Act.

Lemon Law and vehicle defect cases

You have a valid Lemon Law claim when your vehicle requires multiple repair attempts for the same problem within the warranty period, or when your car spends 30 or more cumulative days in the shop for warranty repairs. We also handle odometer fraud cases where dealers roll back mileage and dealer fraud involving hidden damage or misrepresented vehicle history. State laws vary on the specific number of repair attempts required, but most states require between three and four attempts for the same issue.

TCPA robocall and robotext violations

Companies owe you $500 per illegal call when they use automatic dialing systems or prerecorded messages without your prior express written consent. Willful violations increase damages to $1,500 per call. You can pursue TCPA claims for telemarketing calls to your cell phone, political robocalls, and text message advertisements you never agreed to receive.

One robocall campaign can generate hundreds of violations worth significant statutory damages.

Credit report errors and debt collection abuse

Collectors break FDCPA rules when they call you outside permitted hours (before 8 a.m. or after 9 p.m.), use threats, or contact your employer after you request they stop. Credit bureaus violate FCRA when they report inaccurate information after you dispute it or fail to investigate your complaints within 30 days.

Fees, costs, and what no upfront cost means

You pay nothing upfront when we take your consumer protection case because federal statutes include fee-shifting provisions that require the violating company to pay our legal fees when we win. Ginsburg Law Group consumer law practice operates on this model for TCPA, FDCPA, FCRA, and Lemon Law cases. The defendant covers our attorney fees and court costs as part of the judgment or settlement, which means you can afford to sue corporations with unlimited legal resources.

Fee-shifting provisions exist specifically to ensure consumers can enforce their rights without financial barriers.

How fee-shifting protections work

Fee-shifting statutes award attorney fees to the winning plaintiff as a separate component of the judgment. Your statutory damages remain separate from what the court orders the defendant to pay your attorney. For example, in a TCPA case worth $5,000 in damages, the defendant also pays the legal fees we incurred prosecuting your claim. This structure removes the financial risk that typically prevents individuals from suing large companies.

Contingency arrangements for bankruptcy and estate planning

Cases outside fee-shifting statutes operate on contingency agreements where we receive a percentage of your settlement or recovery. Bankruptcy filings and certain debt defense cases require upfront filing fees, though payment plans make these costs manageable. You’ll receive a clear explanation of all fees before signing any representation agreement.

Next steps

You now understand how Ginsburg Law Group consumer law practice protects your rights when businesses break federal statutes. Whether you’re dealing with a defective vehicle, illegal robocalls, debt collector harassment, or credit report errors, you have enforceable legal remedies that don’t require upfront payment.

Your case starts with a free consultation where we evaluate whether federal law gives you the right to sue and recover damages. We review your documentation, identify specific violations, and explain what compensation you can pursue. Most cases settle because businesses face mandatory attorney fee awards when they lose in court.

Contact our firm today if you suspect a company violated your consumer rights. We handle cases nationwide and take calls seven days a week. Schedule your free case evaluation to discuss your situation with an experienced consumer protection attorney who focuses exclusively on holding corporations accountable for statutory violations.