Let’s get one thing straight: estate planning isn’t just for the wealthy. It’s the process of creating a clear, legally-binding game plan for your assets and healthcare decisions—both for after you’re gone and in case you ever become unable to make those choices yourself.

Think of it as a set of instructions you leave for your loved ones. A proper plan ensures your wishes are followed to the letter, giving you control and your family peace of mind.

Why Estate Planning Is for Everyone, Not Just the Wealthy

One of the biggest myths is that estate planning is a luxury for people with sprawling mansions and complicated finances. Nothing could be further from the truth. In fact, having a solid plan is often more critical for families with modest assets.

Here’s why: for an ultra-rich family, a legal hiccup might mean a slightly smaller inheritance. But for a family with a home, some savings, and a 401(k), the lack of a plan can be financially devastating. Unexpected legal fees can wipe out savings, and without clear instructions, you can leave your family guessing—or worse, fighting—during an already difficult time.

It’s So Much More Than Just a Will

When people hear “estate planning,” they immediately think of a will. While a will is a cornerstone, a truly effective plan goes much deeper. It’s a comprehensive strategy that answers the tough “what if” questions before they become emergencies.

A complete plan allows you to:

- Appoint your trusted helpers: You get to name the people who will manage your finances (Power of Attorney) and make medical decisions (Advance Healthcare Directive) if you’re ever incapacitated.

- Protect your kids: You can name a guardian to raise your minor children. This is one of the most important decisions you’ll ever make, and you don’t want a court making it for you.

- Skip the courtroom drama: A well-structured plan can help your estate sidestep probate, a court process that’s often expensive, time-consuming, and completely public.

- Provide for your loved ones: You decide who gets what, ensuring your assets are distributed exactly the way you want, which can prevent bitter family disputes down the road.

Estate planning isn’t about how much you have. It’s about protecting what you have for the people you love. It’s a final act of responsibility and care that provides clarity when it’s needed most.

This is especially true if you’re dealing with financial headwinds. For those with debt or creditor issues, a good plan can help protect certain assets and ensure you don’t pass a financial mess on to your family.

Yet, there’s a huge gap between knowing this is important and actually doing it. While 83% of Americans agree that planning is critical, a recent report found that only 31% actually have a will. You can see more stats like this in the comprehensive 2025 Estate Planning Report on trustandwill.com. This gap is often caused by the very misconceptions we’re aiming to clear up right now.

Understanding the Four Cornerstones of Your Estate Plan

Think about building a strong, lasting home. You wouldn’t just throw up some walls and hope for the best, right? You’d start with a solid foundation. Estate planning works the same way. Your foundation is built on four critical documents that work in concert to protect you, your assets, and the people you care about most.

Getting a handle on the basics means understanding what each of these documents does and, just as importantly, what it doesn’t do. Let’s walk through them one by one.

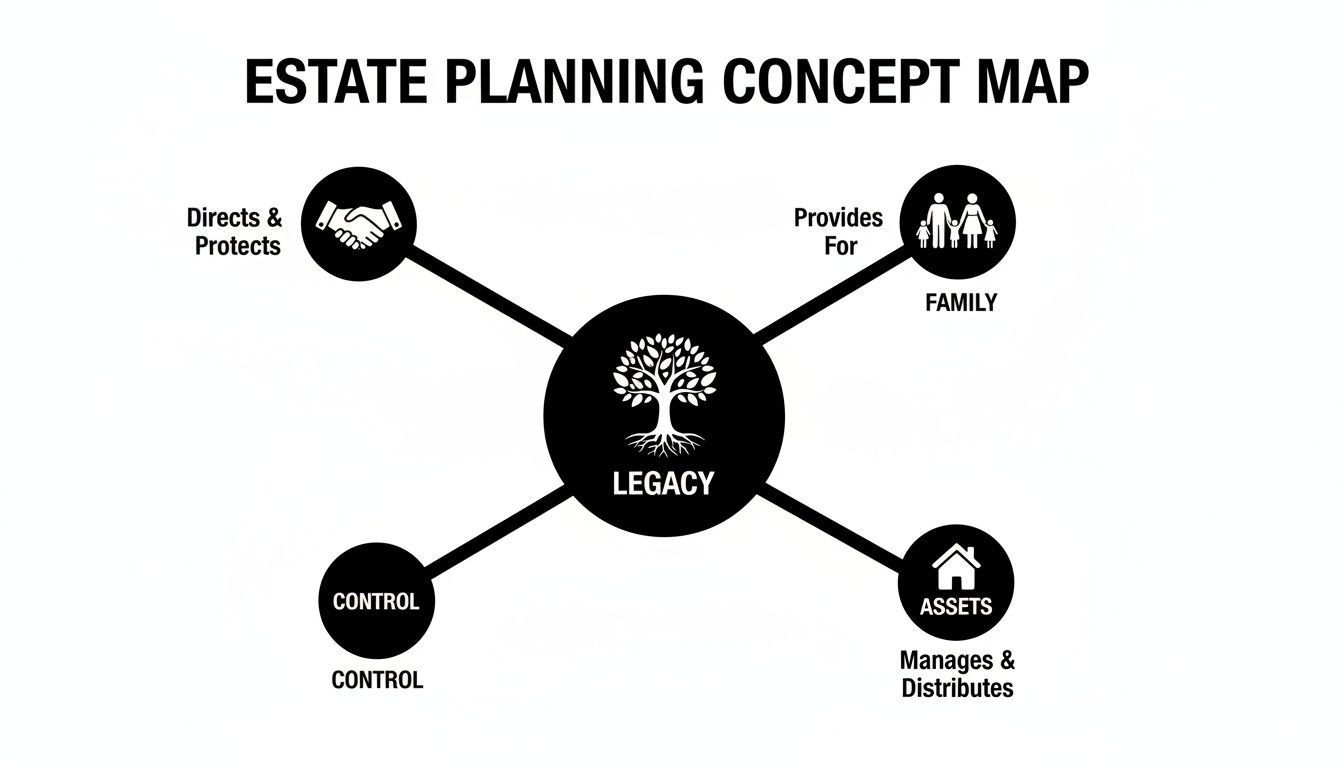

This is all about creating your legacy—a plan that protects your family, manages what you’ve built, and keeps you in control, all backed by the right legal structures.

As you can see, a powerful legacy isn’t just about the money. It’s about the thoughtful framework you put in place to ensure your family’s future is secure.

Your Will: The Master Instruction Manual

A Last Will and Testament is the ultimate instruction manual you leave behind for your loved ones. It’s a legally binding document that spells out precisely who gets what—from your home and savings accounts down to sentimental items like your grandfather’s watch.

The will is also where you name an executor, the person you trust to be in charge of following those instructions. For parents, a will is absolutely non-negotiable. It’s the only place you can legally name a guardian to raise your minor children. If you don’t, you’re leaving that profoundly personal decision in the hands of a court.

Your Trust: The Protective Safe Deposit Box

If a will is your set of instructions, a trust is like a private, secure vault for your most valuable assets. You transfer ownership of property—like your house, brokerage accounts, or business interests—into this vault. A trustee (who you choose) then manages those assets for your beneficiaries according to the rules you set.

What’s the biggest perk? A properly funded trust completely bypasses probate, the often slow, expensive, and very public court process. This gets assets into the hands of your loved ones faster and with far more privacy. We take a much deeper look into the key differences between wills and trusts in our detailed guide.

A trust offers an incredible level of ongoing control. You can dictate exactly when and how your beneficiaries receive their inheritance, which is perfect for protecting assets for young adults or providing long-term financial stability for a loved one with special needs.

Your Power of Attorney: The Financial First Mate

Life has a way of throwing curveballs. A durable power of attorney (POA) is your game plan for what happens if you’re ever unable to manage your own financial affairs due to an accident or illness.

This document appoints your “financial first mate”—an agent you trust implicitly—to step in and handle things for you. They can pay your mortgage, manage your investments, and deal with your bank. Without a POA, your family would be forced to go to court to get a conservatorship, a public and costly legal process that adds immense stress during an already traumatic time.

Your Advance Healthcare Directive: The Medical Voice

Finally, your advance healthcare directive is your voice when you can no longer speak for yourself about medical care. This legal document, which often includes a living will, outlines your wishes on things like life support and other major end-of-life interventions.

It also lets you appoint a healthcare agent (or proxy) to advocate for you and make medical decisions based on your stated wishes. This directive is a profound gift to your family, relieving them of the burden of making gut-wrenching choices in a crisis without knowing what you would have wanted.

These four cornerstones work together, creating a comprehensive safety net for every stage of life.

To make it even clearer, let’s break down these essential documents side-by-side.

Core Estate Planning Documents at a Glance

| Document | Primary Function | Key Benefit |

|---|---|---|

| Last Will & Testament | Distributes property after death and names guardians for minor children. | Ensures your assets go to whom you choose and protects your children. |

| Revocable Living Trust | Holds and manages assets during your life and after, distributing them outside of court. | Avoids the time, cost, and publicity of the probate process. |

| Durable Power of Attorney | Appoints a trusted agent to manage your financial affairs if you become incapacitated. | Prevents the need for a costly and public court-appointed conservatorship. |

| Advance Healthcare Directive | States your medical wishes and appoints an agent to make healthcare decisions for you. | Guarantees your medical preferences are honored and relieves family of difficult choices. |

Seeing them laid out like this really highlights how each document fills a specific, crucial role in protecting you and your family from the unexpected.

How to Navigate and Avoid the Probate Process

So, what exactly is probate? Think of it as the formal, court-supervised detour your assets have to take after you pass away. It’s the official process of validating your will, paying off any final debts, and then, finally, distributing what’s left to your loved ones. While it serves a legal purpose, it has a well-earned reputation for being slow, expensive, and surprisingly public.

Every single step becomes part of the public record—from the person appointed to manage your estate to the final bills paid. This opens your family’s financial life up for anyone to see, which is the last thing anyone wants while grieving.

Why Bypassing Probate Is a Smart Move

For most people diving into estate planning, the number one goal is keeping their family out of probate court. The reasons are straightforward but powerful: it saves money, it saves time, and it protects your privacy.

The financial hit can be a real shock. An estate stuck in probate can languish for months, sometimes even years. The whole ordeal can cost a family up to 5-10% of the estate’s total value in fees and legal wrangling. For families already under financial stress, this added burden is a nightmare. It’s why having a solid plan with a trust and a power of attorney is so critical—it ensures this court process doesn’t derail everything. You can find more data on this in the latest estate planning report from trustandwill.com.

By planning ahead, you’re not just organizing your assets; you’re protecting your family from unnecessary financial strain, public scrutiny, and emotional exhaustion.

Steering clear of probate means your loved ones get their inheritance much faster, often within weeks instead of years. It also keeps your family’s business private, just as it should be, shielding them from nosy outsiders and potential arguments.

Using a Living Trust as Your Probate Bypass

So, how do you create this express lane for your assets? The most powerful tool for the job is a revocable living trust. As we mentioned earlier, a trust is like a private container you set up to hold your assets. During your lifetime, you simply transfer ownership of your major assets—your home, bank accounts, investments—into this container.

Because the trust now owns the property, those assets aren’t technically part of your personal estate when you die. This seemingly small legal step has a massive impact: assets held inside a trust completely bypass probate. Your chosen successor trustee can step in and distribute them directly to your beneficiaries, exactly as you wished, with no court involvement needed.

Here’s a quick rundown of how a living trust helps you sidestep the probate headache:

- Immediate Access: Your successor trustee can manage and hand out assets almost right away, making sure your family has the resources they need, when they need them.

- Total Privacy: Without a court process, the details of your estate—what you owned and who gets what—stay completely confidential.

- Cost Savings: Avoiding probate means avoiding the court fees, attorney bills, and other administrative costs that come with it. The savings can be substantial.

A living trust is truly a cornerstone of smart, modern estate planning. It gives you ultimate control while you’re here and gives your family a much smoother, faster, and more private path forward after you’re gone. If you’re interested in digging deeper, take a look at our guide on what a living trust is and how it can benefit you.

Using Estate Planning to Handle Debt and Creditors

One of the biggest anxieties for many people is, “What happens to my debt when I’m gone?” There’s a valid fear that loved ones will be stuck with a mountain of bills. A smart estate plan is your best defense, ensuring the legacy you leave is one of support, not stress.

Let’s clear up a common myth: debt doesn’t just disappear when you die. Instead, your estate—everything you own—becomes responsible for paying it off. Creditors get first priority, and they must be paid from your assets before your family gets a dime. This is exactly why being proactive is so important.

How to Shield Assets from Creditor Claims

The good news is that not everything you own is up for grabs. Using the right legal structures, you can build a financial firewall around certain assets, keeping them safe for your beneficiaries. This isn’t about hiding money; it’s about using established legal strategies to protect the people you love.

Here are a few of the most effective tools for the job:

- Irrevocable Trusts: When you move assets into an irrevocable trust, you are no longer their legal owner—the trust is. Because of that, those assets are generally out of reach for your personal creditors, both while you’re alive and after you pass away.

- Life Insurance Proceeds: The payout from a life insurance policy almost always goes directly to the people you named as beneficiaries. It bypasses the probate process entirely, which means creditors can’t touch it. It’s a clean, protected source of funds for your family.

- Retirement Accounts: Funds in accounts like 401(k)s and IRAs have powerful built-in protections. As long as you’ve named beneficiaries, the money passes to them outside of your estate and is typically shielded from creditor claims.

The point of asset protection isn’t to dodge your obligations. It’s about legally and ethically making sure that your family’s financial future isn’t torpedoed by the debts you leave behind.

Your Power of Attorney is a Debt-Fighting Tool

What if you’re still alive but can’t manage your own finances due to illness or injury? A Durable Power of Attorney (POA) is absolutely vital here. If creditors are harassing you or threatening legal action, your appointed agent can step in immediately to manage things for you.

They can negotiate with collectors, pay bills from your accounts, and get the records needed to fight back against unfair tactics under laws like the FDCPA. Without a POA, your family would be forced to go to court to get control, a slow and expensive process that leaves you exposed at your most vulnerable.

Your Estate Is Not Your Family

This is a critical distinction to make: in most situations, your family is not personally responsible for your debts. Creditors can come after your estate, but they can’t force your spouse or kids to pay up unless they co-signed on a loan.

That said, aggressive debt collectors might still try. They often call grieving family members and use confusing language to make them feel responsible. Having a clear estate plan in place gives your loved ones a roadmap. It tells them exactly how to handle creditors, settle your final affairs, and shut down any unlawful harassment with confidence.

This link between debt and legacy planning is more critical than ever. Financial anxiety has left 49% of Americans feeling more stressed than last year, a worry that surprisingly affects not just low-income earners but even those making up to $1 million. On top of that, 19% of people worry they’ll leave nothing meaningful behind. A solid plan confronts these fears head-on, giving you a clear path to protect your family, no matter what your balance sheet looks like. You can see more on these financial pressures in the comprehensive 2025 Trust & Will Report.

Common Mistakes to Avoid in Your First Estate Plan

Putting together your first estate plan is a massive step in the right direction. It’s about protecting your family and making sure your wishes are respected. But even with the best intentions, a few common slip-ups can unravel all your hard work, leading to the very legal drama you were trying to avoid.

Let’s walk through the most frequent blunders I see and talk about how to sidestep them. Getting this right from the beginning can save your loved ones a world of stress and money down the road.

Mistake 1: Creating an Empty Trust

This is one of the most heartbreaking—and surprisingly common—mistakes. It’s when you create a trust but fail to actually fund your trust. Think of it like building a brand-new, top-of-the-line safe for your valuables but then leaving everything out on the coffee table. The safe itself doesn’t protect anything if nothing is inside it.

Funding your trust means you have to legally transfer your assets into its name. This is an active process. It involves changing the title on your house deed from your name to the trust’s name, updating your bank and brokerage accounts, and retitling any other significant property. If you skip this critical step, those assets are still legally yours, meaning they’ll almost certainly end up in probate court.

Mistake 2: Forgetting to Name Contingent Beneficiaries

Life throws curveballs. The person you name as your primary beneficiary—the one first in line to inherit—could pass away before you. If you don’t have a backup plan in place, you’ve just created a huge legal question mark. The courts will have to decide where those assets go, and it might not be where you would have wanted.

That’s why naming contingent beneficiaries (a fancy term for your backup choice) is absolutely essential. These are the people or organizations who inherit if your first choice can’t. It’s a simple step that provides a crucial safety net for your plan.

Real-World Scenario: John named his sister, Mary, as the sole beneficiary on his life insurance policy. Tragically, Mary passed away in a car accident. John died a year later, never having updated his policy. Because he didn’t name a contingent beneficiary, the insurance money was paid to his estate, which kicked off a long and expensive probate fight among his distant relatives.

Mistake 3: Using a DIY Plan for a Complex Situation

Those online templates and do-it-yourself will kits can look like a tempting way to save a few bucks. And for someone with an incredibly simple situation, they might be okay. But they can spell disaster for anyone with even slightly more complex needs, such as:

- Blended families: Juggling the needs of a current spouse and children from a previous marriage requires very specific, careful language a template won’t have.

- Business ownership: A simple will is completely inadequate for planning the succession of a business.

- Dependents with special needs: A generic plan could accidentally disqualify a loved one from critical government benefits they rely on.

These cookie-cutter documents can’t account for unique family dynamics and often miss the finer points of state law. The money you think you’re saving now could end up costing your family tens of thousands in legal fees later to clean up the mess.

Your First Steps to Creating an Estate Plan

Getting started with estate planning can feel like a massive undertaking, but it doesn’t have to be. The key is to break it down into a few clear, manageable steps. Moving from knowing what an estate plan is to actually creating one is where you find real peace of mind. This roadmap will help you turn those abstract ideas into a solid plan.

The whole journey begins with a simple, honest look at what you have. You can’t plan for what you don’t account for, so the first real step is to get a clear picture of your financial landscape.

Take Inventory of Your Assets and Debts

Think of this as your personal balance sheet. You’ll want to list everything you own (assets) and everything you owe (debts). Don’t get bogged down in finding exact, to-the-penny valuations right now—the goal is simply to get everything down on paper.

Your list should include things like:

- Real Estate: Your family home, any vacation cabins, or rental properties.

- Financial Accounts: Checking and savings accounts, brokerage accounts, 401(k)s, and IRAs.

- Personal Property: Cars, valuable jewelry, art collections, or anything else of significant worth.

- Life Insurance Policies: Just jot down the company and the policy’s face value.

- Outstanding Debts: This includes your mortgage, car loans, student loans, and credit card balances.

This inventory is the bedrock of your entire plan. It gives you a clear view of what needs to be managed and, eventually, passed on to the people you care about. For a deeper dive into this part of the process, check out our practical guide on how to create a will.

Define Your Goals and Choose Your Team

Once you have a handle on your finances, it’s time to think about the people involved. Who do you want to receive your assets? And just as importantly, who do you trust to see your wishes through?

Start by answering these big questions:

- Who are your beneficiaries? Be specific about the people, charities, or organizations you want to inherit your property.

- Who will be your fiduciaries? This is the team you’ll put in charge. It includes your executor (who handles your will), your trustee (who manages a trust), and the agents you name in your powers of attorney.

- Who will be the guardian for minor children? For parents, this is arguably the most important decision you will make in your entire plan.

Choosing your fiduciaries is an act of profound trust. Select people who are responsible, organized, and capable of handling the duties without being overwhelmed. Always name backups in case your first choice is unable to serve.

Gather Your Documents and Consult an Expert

With your goals set and your team chosen, start pulling together the necessary paperwork. This means finding property deeds, recent bank and investment statements, life insurance policies, and marriage or divorce certificates. Having these documents organized and ready will make the final step much, much easier.

And that last step is the most important one: talk to an experienced estate planning attorney. Despite the clear need for a plan, a staggering 55% of Americans don’t have a single estate document in place, which means the state gets to decide their family’s future. You can discover more insights about estate planning trends on intelmarketresearch.com.

Working with a professional ensures your documents are legally sound, actually do what you want them to do, and provide the best possible protection for your loved ones.

Got Questions? Let’s Talk Estate Planning Basics

It’s completely normal to still have questions swirling around, even after getting a handle on the basics. Estate planning is a big topic, and it’s smart to dig into the details that matter most to you. Let’s tackle some of the most common questions we hear from clients when they’re first starting out.

Think of this as a quick-reference guide to clear up any lingering confusion and help you move forward with confidence.

How Much Does a Basic Estate Plan Cost?

This is usually the first question on everyone’s mind, and the honest answer is: it depends. The cost is tied directly to how complex your life is and even where you live. A simple, do-it-yourself will from an online platform might only set you back a few hundred dollars.

But for a comprehensive plan drafted by an experienced attorney—especially one that includes a trust—you can expect to invest anywhere from $1,000 to $5,000, and sometimes more. While that might sound like a lot, try to see it as a one-time investment. The cost of putting a solid plan in place now is almost always a tiny fraction of the court costs and legal fees your family could face trying to sort things out without one.

Do I Really Need an Estate Plan if I’m Not Wealthy?

Yes, absolutely. This is probably the single biggest myth out there. In fact, you could argue a plan is even more crucial for families with modest assets, simply because there’s no financial buffer to absorb unexpected legal bills or the fallout from a family squabble.

And remember, your estate plan does far more than just distribute your property. It’s the only way to officially:

- Name a guardian for your young children. If you don’t, a judge who doesn’t know you or your family will make this incredibly personal choice.

- Choose someone to make medical decisions on your behalf if you become incapacitated.

- Give a trusted person the power to manage your finances if you’re ever unable to do it yourself.

These are fundamental protections everyone should have, no matter the size of their bank account.

How Often Should I Update My Estate Plan?

Think of your estate plan as a living document, not something you carve in stone and forget about. Life happens, and your plan needs to keep up. A good rule of thumb is to pull it out for a review every three to five years.

That said, you should update it immediately following any major life event. Don’t wait. These events include:

- Getting married or divorced

- Welcoming a new child through birth or adoption

- Losing a beneficiary, executor, or trustee

- Experiencing a significant financial shift (like an inheritance or selling a business)

- Moving to a different state, as laws vary widely

Keeping your plan current is the only way to guarantee it actually reflects what you want when it matters most.

What’s the Difference Between a Revocable and Irrevocable Trust?

It all boils down to flexibility versus permanence.

A revocable trust is exactly what it sounds like—you can change it, amend it, or even cancel it entirely whenever you want. You keep total control over the assets you put into it. The trade-off is that it offers no protection from creditors.

An irrevocable trust, on the other hand, is generally set in stone. Once you transfer assets into it, you usually can’t get them back or change the rules. Why would anyone do this? In exchange for giving up that control, these trusts can provide powerful benefits, like protecting assets from creditors and helping to reduce estate taxes.

Working through the basics of estate planning is your first real step toward protecting your family and your legacy. If you’re ready to build a plan that gives you true peace of mind, the experienced team at Ginsburg Law Group PC is here to guide you. Contact us today for a consultation to talk about what you need.