Summary

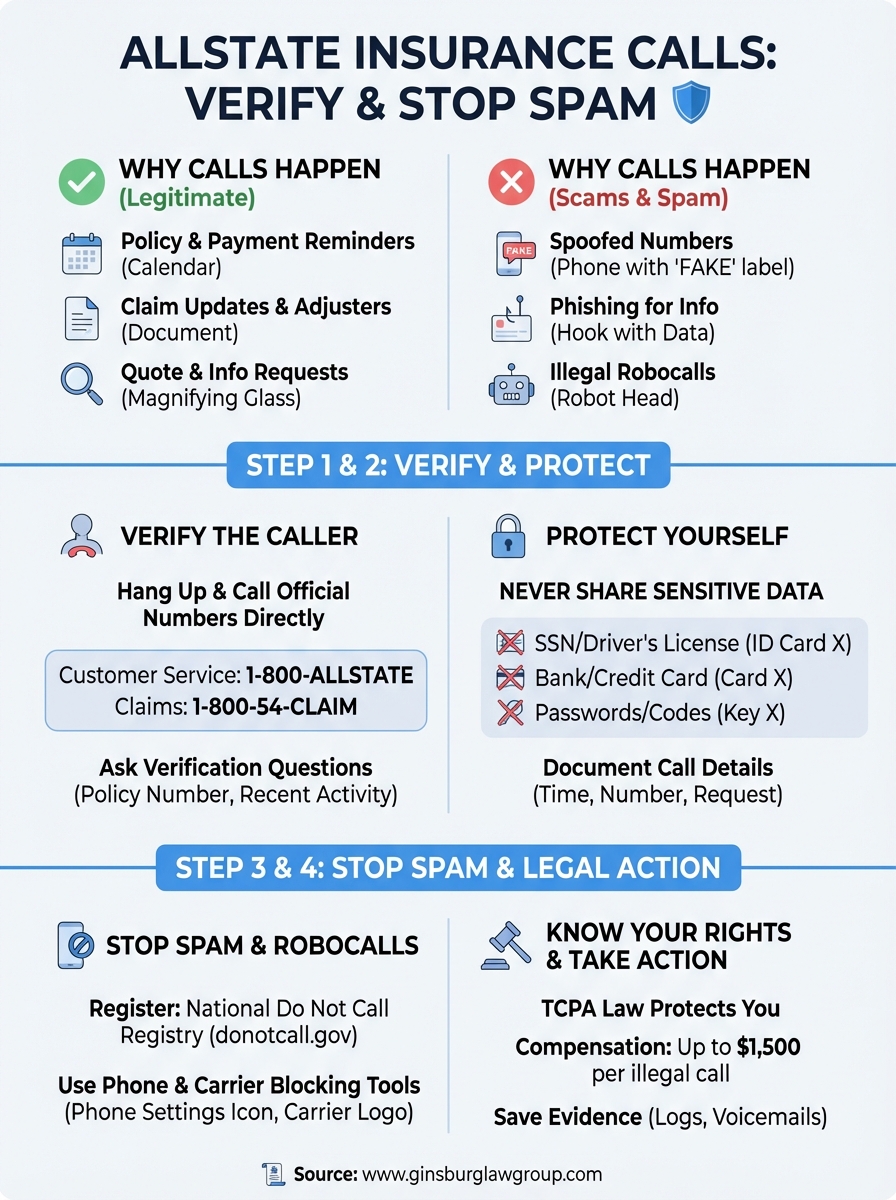

Receiving calls from Allstate can be a routine part of managing an insurance policy, but they are also frequently used by scammers through caller ID spoofing. To distinguish legitimate business from fraud, consumers should never share sensitive data like Social Security numbers or banking details during an incoming call. Instead, they should hang up and contact Allstate directly using verified numbers such as 1-800-ALLSTATE. Protecting oneself involves documenting call details, utilizing the National Do Not Call Registry, and enabling smartphone spam filters. When persistent robocalls or unauthorized telemarketing continue, the Telephone Consumer Protection Act (TCPA) provides a legal avenue for recourse. Violations of this federal law can entitle consumers to compensation ranging from $500 to $1,500 per illegal call. Specialized firms like Ginsburg Law Group help victims hold these companies accountable, often at no upfront cost. By maintaining a detailed log of unwanted contacts and understanding their rights, individuals can effectively combat harassment and potentially secure statutory damages for willful violations. Effective management of insurance-related communication requires a blend of technological blocking tools and legal awareness to ensure personal information remains secure while ending intrusive spam.

Your phone rings, and the caller ID shows Allstate. But is it actually your insurance company, or is it a scammer trying to steal your information? Allstate insurance calls can be legitimate, reminders about policy renewals, claims updates, or payment confirmations. However, they can also be spoofed numbers used by fraudsters to trick you into sharing personal data or money.

If you’re receiving repeated unwanted calls claiming to be from Allstate, you have options. Beyond simply blocking the number, federal laws like the Telephone Consumer Protection Act (TCPA) may entitle you to compensation of up to $1,500 per illegal call. At Ginsburg Law Group, we help consumers fight back against illegal robocalls and telemarketing harassment, often at no upfront cost to you.

This guide will show you how to verify whether a call is legitimately from Allstate, protect yourself from scams, and take legal action if you’re being targeted by persistent spam calls.

Why you may get Allstate insurance calls

Allstate insurance calls come from several sources, and understanding why you’re receiving them helps you determine whether they’re legitimate or fraudulent. If you’re an existing Allstate customer, the company may contact you about policy renewals, payment reminders, claim updates, or coverage changes. These calls are typically expected and part of normal business operations.

Legitimate Allstate contact reasons

Your insurance provider reaches out for specific business purposes related to your account. You might receive calls about upcoming payment deadlines, particularly if your automatic payment failed or needs updating. Claims adjusters contact policyholders to discuss accident details, schedule vehicle inspections, or provide settlement information after you file a claim.

Allstate also calls customers when policy documents require signatures, coverage changes affect your premium, or when they need to verify information on your account. Sales representatives may contact you if you requested a quote online or submitted an inquiry through their website.

Unwanted and illegal calls

Not all allstate insurance calls are from the actual company. Scammers regularly spoof Allstate’s phone numbers to make their calls appear legitimate on your caller ID. These fraudsters attempt to steal personal information, Social Security numbers, or banking details by pretending to be insurance representatives.

If a caller pressures you to provide sensitive information immediately or threatens policy cancellation, it’s likely a scam.

You may also receive illegal robocalls from unlicensed insurance marketers who purchased your contact information from data brokers. These third-party telemarketers violate TCPA regulations when they call your cell phone using autodialing systems or prerecorded messages without your prior written consent. Even if these callers mention Allstate products, they’re not authorized representatives.

Step 1. Verify the caller and phone number

Before sharing any information during allstate insurance calls, you need to verify the caller’s identity and confirm they’re actually from Allstate. Scammers use caller ID spoofing technology to make fraudulent calls appear legitimate on your phone screen, so you can’t trust what your display shows.

Check official Allstate phone numbers

Hang up and call Allstate directly using verified contact information from your insurance documents or the official Allstate website. Don’t use any phone number the caller provides, even if they insist you call them back at that number.

Compare the incoming call number against these official Allstate contact channels:

- Customer service: 1-800-ALLSTATE (1-800-255-7828)

- Claims department: 1-800-54-CLAIM (1-800-542-5246)

- Roadside assistance: 1-800-ALLSTATE

If the caller refuses to let you hang up and call back, or becomes aggressive when you request verification, it’s a scam.

Ask verification questions

When you call back using official numbers, ask the representative to confirm details about the previous call. Request information about your policy number, recent claims, or account activity that only Allstate would know. Legitimate representatives will answer these questions without hesitation or provide alternative verification methods.

Step 2. Protect yourself during the call

Even if you suspect an allstate insurance calls might be legitimate, you need to protect your sensitive information during any conversation. Scammers use psychological tactics to pressure you into sharing data quickly, so knowing what information to guard helps you avoid identity theft and financial fraud.

What to never share during calls

You should never provide specific personal details until you’ve independently verified the caller’s identity by contacting Allstate through official channels. Legitimate Allstate representatives will never demand immediate payment information or threaten policy cancellation without written notice.

Never share these details during inbound calls:

- Social Security number or full driver’s license number

- Bank account numbers or credit card details

- Online account passwords or security questions

- One-time verification codes sent to your phone

Real Allstate representatives access your existing information in their system and don’t need you to recite these details during routine calls.

Document the call details

Record essential information about every suspicious call you receive, including the exact time, phone number displayed, and any names or employee ID numbers the caller provides. Write down the specific reason they give for calling and what information they request. This documentation becomes critical evidence if you later file a complaint or pursue legal action against illegal telemarketers.

Step 3. Stop spam calls and robocalls

Once you’ve identified unwanted allstate insurance calls, you need to take immediate action to block future contact and reduce spam reaching your phone. Multiple blocking methods work together to create layers of protection against persistent telemarketers and robocallers.

Register with the National Do Not Call Registry

Add your phone number to the Federal Trade Commission’s Do Not Call Registry at donotcall.gov or by calling 1-888-382-1222 from the number you want to register. This free service prohibits legitimate telemarketers from contacting you after 31 days, though it doesn’t stop scammers who ignore the law. You only need to register your number once, and the registration never expires.

Legitimate companies face fines up to $43,280 per violation for calling numbers on the registry without consent.

Use call blocking tools

Enable built-in spam filters on your smartphone through your phone’s settings menu. iPhone users activate “Silence Unknown Callers” under Phone settings, while Android users enable “Caller ID & spam” through the Phone app. Contact your wireless carrier (Verizon, AT&T, T-Mobile) to activate their free spam blocking services, which use network-level filtering to stop robocalls before they reach your device.

Step 4. Save evidence and understand your rights

Building a detailed record of unwanted allstate insurance calls strengthens your position if you need to file a complaint or pursue legal action against persistent violators. Federal law provides financial remedies for consumers harmed by illegal telemarketing, but you need solid evidence to support any claim.

Document each unwanted call

Create a log entry for every spam call you receive, capturing specific details that prove the pattern of harassment. Record this information immediately after each call:

- Date and exact time the call arrived

- Phone number shown on caller ID

- Name and company the caller claimed to represent

- What the caller said and requested

- Whether you previously asked them to stop calling

Save voicemails and text messages as audio files or screenshots. These recordings provide direct evidence of violations, particularly if the caller used prerecorded messages or contacted you after you requested removal from their list.

Know your legal protections

The Telephone Consumer Protection Act entitles you to $500 to $1,500 per illegal call when telemarketers violate specific rules. You have grounds for action if callers use autodialing systems or prerecorded messages without your written consent, continue calling after you’ve requested stop, or contact you before 8 AM or after 9 PM in your time zone.

Companies that ignore Do Not Call requests face statutory damages even if you suffered no financial loss.

If the calls won’t stop

When allstate insurance calls continue despite your blocking efforts and Do Not Call registration, you may have grounds for legal action under the TCPA. Persistent robocalls and unauthorized telemarketing violate federal consumer protection laws, and you don’t have to tolerate ongoing harassment just because companies ignore your requests to stop.

Contact a consumer rights attorney who specializes in TCPA violations to evaluate whether your situation qualifies for compensation. Most cases proceed on a contingency basis, meaning you pay nothing upfront while the opposing company covers your legal fees when you win. You could receive $500 to $1,500 for each illegal call that violated TCPA regulations, and damages increase when violations were willful.

At Ginsburg Law Group, we represent consumers nationwide against illegal telemarketing and robocall harassment. Our team reviews your call logs and documentation to determine whether you qualify for statutory damages. Get a free case evaluation to understand your legal options and hold persistent violators accountable for their actions.