When you hear “estate planning,” you might picture a straightforward process of passing assets to a spouse and children. But for blended families, it’s a whole different ballgame. A proper estate plan in this context is about creating a very specific legal strategy—one that ensures your current spouse is taken care of while also protecting the inheritance you want to leave for children from a previous relationship.

This isn’t about a simple will. It’s about navigating the unique dynamics of step-relationships to prevent assets from accidentally ending up in the wrong hands. Getting this right is absolutely essential for keeping the peace and making sure your legacy is secure.

Why Standard Estate Plans Fail Blended Families

Think about trying to build a new house using the blueprint for a completely different home. Sure, the foundation might be there, but the walls won’t line up and the doors will lead to nowhere. That’s exactly what happens when a blended family tries to use a generic, “one-size-fits-all” estate plan. These documents are built for a traditional family structure and almost always fall apart when faced with the realities of a modern blended family.

The root of the problem is that default inheritance laws and simple wills are designed to give everything to the surviving spouse. In a first marriage, this usually works out fine. Assets go to the spouse, who eventually passes them down to their shared children.

But in a blended family, this same legal logic can lead to truly heartbreaking outcomes.

The Risk of Accidental Disinheritance

The most common and devastating failure of a standard plan is accidental disinheritance. When you leave all your assets directly to your new spouse, you’re handing over complete control. Once you’re gone, those assets become legally theirs. There is absolutely no legal requirement for them to pass a single penny on to your biological children from a previous marriage.

Even if everyone has the best intentions today, life happens. Here’s what we see all the time:

- Your surviving spouse remarries, and the assets you meant for your kids could end up with their new partner.

- They might create a new will that only names their own biological children as heirs, cutting your kids out completely.

- The money could simply be spent over their lifetime, leaving nothing behind for your children to inherit.

A thoughtfully crafted estate plan is more than just a legal document; it is a vital tool for preserving family harmony. It prevents the emotional and financial turmoil that can arise from ambiguity, ensuring your legacy is one of peace, not conflict.

Relying on good faith or a verbal promise is a recipe for disaster. Without a legally enforceable plan, your children’s inheritance is left entirely to chance.

Common Pitfalls of Not Having a Blended Family Estate Plan

Failing to create a customized plan isn’t just a missed opportunity; it opens the door to serious risks. Many families assume that basic wills or state laws will sort things out, but the reality is often the opposite. The table below highlights the most critical dangers blended families face when they don’t have a tailored strategy in place.

| Risk Area | What Happens Without a Plan | Potential Consequence |

|---|---|---|

| Accidental Disinheritance | Assets transfer directly to the surviving spouse with no legal strings attached. | Your spouse can remarry, change their will, or spend the assets, leaving your biological children with nothing. |

| State Intestacy Laws | If you die without a will, the state decides who inherits your property. | State laws almost never recognize stepchildren. Your assets could go entirely to your spouse and any children you have together. |

| Family Conflict | Ambiguity and perceived unfairness lead to disputes between the surviving spouse and your children. | Costly and emotionally draining legal battles can destroy family relationships and deplete the estate’s assets. |

| Asset Mismanagement | Your surviving spouse may not have the financial expertise or desire to manage assets intended for your children. | Inherited wealth can be lost due to poor investment decisions, creditor claims, or being commingled with new marital assets. |

| Loss of Control | You give up the power to dictate how and when your children receive their inheritance. | Your children might inherit a large sum before they are mature enough to handle it, or the funds may be used in ways you never intended. |

As you can see, the default outcomes rarely align with what most people want for their families. A proactive, specialized plan is the only way to avoid these common pitfalls and ensure your wishes are honored.

The Problem with Default State Laws

What if you die without a will? This is called dying “intestate,” and it means the state’s laws get to decide who gets your property. These intestacy laws are blunt instruments that almost never recognize stepchildren as legal heirs. The result is that your assets would likely be split between your surviving spouse and any biological children you have together, completely bypassing your children from a prior relationship.

A specialized approach to estate planning for blended families is not just a good idea—it’s non-negotiable. It requires specific legal tools and carefully worded strategies to balance two crucial goals: providing for your current spouse’s well-being while guaranteeing an inheritance for your children. Without a tailored plan, you risk leaving behind a legacy of confusion, resentment, and ugly legal battles that could tear apart the very family you worked so hard to build.

Navigating the Unique Challenges Blended Families Face

When you have a blended family, estate planning becomes more than just a financial task—it’s an exercise in navigating a delicate emotional and legal landscape. The core challenge is a classic balancing act: How do you provide lifelong financial security for your current spouse while also ensuring the children from your previous marriage receive their intended inheritance? This is the central friction point where even the best intentions can crumble without a rock-solid plan.

Think of your estate like a river. For a first family, the river flows in one clear direction—from you to your spouse, and eventually to your shared children. But in a blended family, you need that river to split and flow to two distinct destinations. If you don’t build the right legal channels, like trusts, the entire flow will naturally go to the path of least resistance, which is almost always straight to the surviving spouse.

The Stepparent Dilemma and Unintentional Disinheritance

One of the most common and heartbreaking scenarios we see involves the surviving stepparent. Imagine you leave everything to your new spouse, trusting they will follow your wishes and take care of your kids down the road. But life is unpredictable. Your spouse might remarry, starting a new family with its own financial demands. Suddenly, the assets you earmarked for your children are at risk of being diverted to support a new partner or even stepsiblings your kids don’t know.

This isn’t necessarily malicious. It’s often just the natural consequence of life’s twists and turns when there isn’t a binding legal plan in place.

Your estate plan must act as a legal backstop for your intentions. It replaces assumptions and verbal promises with legally enforceable instructions, ensuring your wishes are carried out regardless of how a surviving spouse’s life may change.

This is precisely why estate planning for blended families is so critical. It lets you anticipate these potential future events and build in protections that safeguard your children’s legacy no matter what happens.

When Outdated Paperwork Creates Conflict

Another major pitfall can come from something as simple as outdated paperwork. The beneficiary designations on your 401(k)s, IRAs, and life insurance policies are powerful legal contracts. In fact, they completely override what’s written in your will or trust.

Here’s an all-too-common example:

- You named your first spouse as the beneficiary on a large life insurance policy years ago.

- You get divorced and remarry but forget to update that single form.

- When you pass away, the entire life insurance payout legally goes to your ex-spouse, leaving both your current spouse and your children with nothing from that policy.

This kind of “accidental disinheritance” is a preventable tragedy, but it happens all the time and can ignite bitter family conflicts and expensive court battles. This is especially true for blended families, which make up about 16% of U.S. households but face a shocking 40% conflict rate over inheritances. A big reason for this is that default state laws are designed to favor the current spouse, often leaving stepchildren out in the cold. You can find more data on these estate planning gaps in Trust & Will’s 2025 report.

The first step is to identify your family’s specific friction points. Whether it’s the risk of a spouse remarrying or simply forgetting to update an old account form, facing these challenges head-on is the key to creating a plan that works and keeps the peace.

Essential Legal Tools for Your Blended Family Estate Plan

Knowing the unique challenges blended families face is one thing; building a plan to solve them is another. Let’s get into the toolkit. A successful estate plan for a blended family isn’t about a single document, but about using the right combination of legal tools to balance providing for your spouse while guaranteeing your children’s inheritance.

These tools are the building blocks of a plan that turns good intentions into legally binding instructions.

The three cornerstones for any blended family are a well-drafted Will, a flexible Revocable Living Trust, and meticulously updated Beneficiary Designations. Each plays a different role, and when they work together, they create a powerful strategy that smooths over all the friction points we’ve talked about.

Let’s break down how each one works for you.

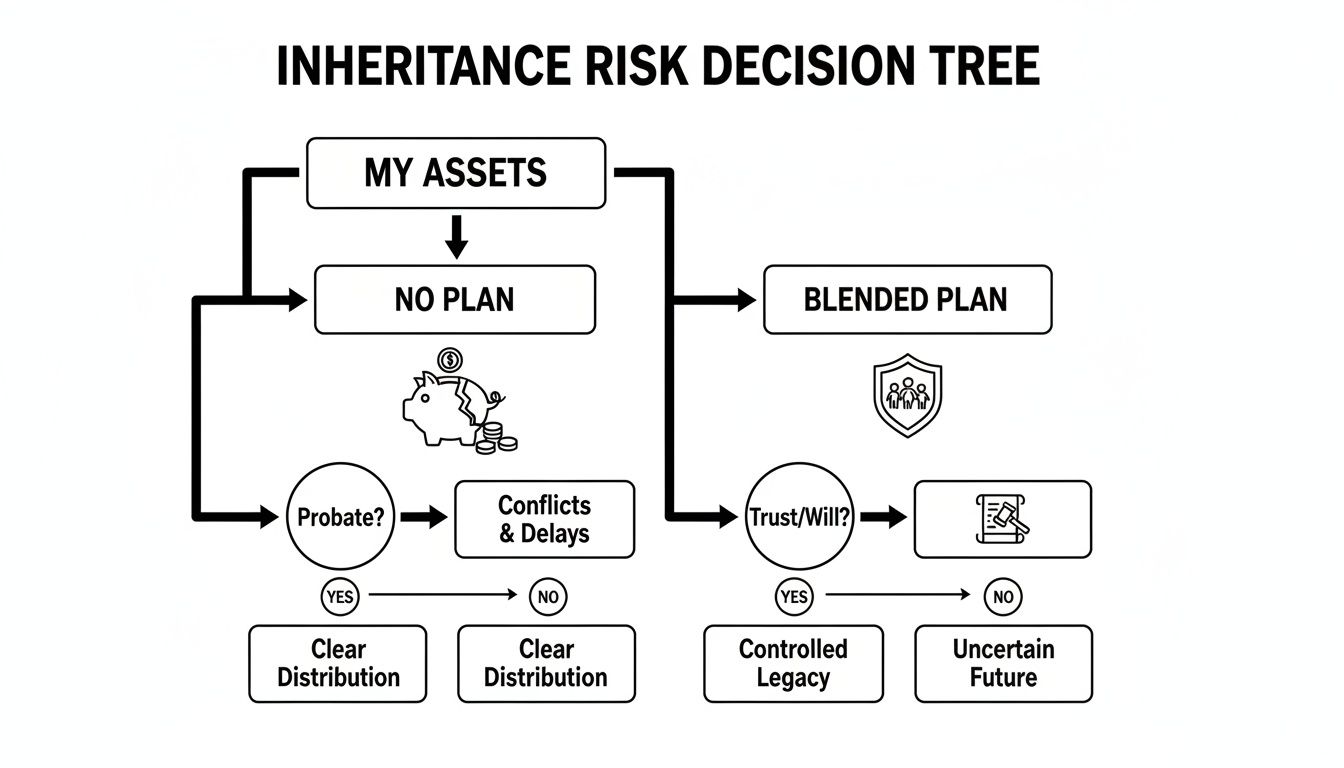

This decision tree shows the two roads your legacy can take. One is the default path—no plan, leaving everything to chance. The other is a specialized plan designed specifically for blended families, which acts as a protective shield for everyone you love.

As you can see, without a custom strategy, your assets are exposed to serious risks. A thoughtfully structured plan, on the other hand, provides the security and clarity your family needs.

To help you get a clearer picture of these tools, here’s a side-by-side comparison of the most common strategies we use for blended families.

Comparing Estate Planning Strategies for Blended Families

| Strategy | Primary Purpose | Key Benefit for Blended Families |

|---|---|---|

| Last Will & Testament | To name an executor, designate guardians for minor children, and outline basic asset distribution. | Provides foundational instructions but offers limited protection against accidental disinheritance on its own. |

| Revocable Living Trust | To hold and manage assets, bypass probate, and provide detailed instructions for asset distribution after death. | Creates a private, controlled environment to provide for a spouse while legally ensuring children receive their inheritance. |

| QTIP Trust | To provide a surviving spouse with income and/or access to trust assets for their lifetime. | Guarantees that the remaining trust assets pass to your biological children after your surviving spouse’s death. |

| Beneficiary Designations | To directly transfer assets like retirement accounts and life insurance proceeds outside of a will or trust. | Allows for a direct and immediate transfer of specific assets, bypassing probate, but requires careful coordination with the overall plan. |

| Life Insurance Trust | To hold a life insurance policy, keeping the proceeds out of the taxable estate. | Provides immediate, tax-free cash to beneficiaries (like your children) to ensure they have funds without waiting for the estate to settle. |

Each of these legal instruments has a specific job to do. The real power comes from combining them in a way that aligns perfectly with your family’s unique situation and your personal goals.

The Foundational Role of a Will

A Last Will and Testament is what most people think of when they hear “estate planning,” and it’s still a crucial piece of the puzzle. For a blended family, your will is where you officially name a guardian for your minor kids and appoint an executor—the person or company you trust to settle your affairs and follow your instructions.

But here’s a common misstep: relying only on a will. Wills have to go through probate, a court-supervised process that can be public, slow, and expensive. More importantly, a simple will that just says “I leave everything to my spouse” offers zero guarantees for your kids.

Think of the will as the starting point, not the finish line.

Gaining Control with a Revocable Living Trust

This is where a Revocable Living Trust really shines. A trust is like a private rulebook for your assets. You transfer ownership of your property—your house, investments, bank accounts—out of your individual name and into the name of the trust. Don’t worry, you still have complete control as the trustee during your lifetime.

The real advantage comes after you’re gone. Because the trust owns the assets, not you, they completely bypass the probate process. This keeps your family’s finances private and allows for a much faster, smoother transition.

A Revocable Living Trust is the cornerstone of effective estate planning for blended families. It provides the structure needed to support your surviving spouse while creating an unbreakable guarantee that your assets will ultimately pass to your children.

For a blended family, this is where you can build in your specific protections. The trust can spell out exactly how assets should be used for your surviving spouse’s care, and then lock in the fact that whatever is left over must go to your children. This takes away all the guesswork and prevents your legacy from being accidentally diverted. You can dive deeper into trust options in our detailed guide on revocable vs. irrevocable trusts.

Using QTIP Trusts to Protect Everyone

One of the most powerful tools in our blended family playbook is a special provision called a Qualified Terminable Interest Property (QTIP) Trust. The name sounds complicated, but the idea behind it is brilliant and simple.

A QTIP essentially splits the benefit of an asset in two. Think of it like this:

- You leave the family home in a QTIP trust for your surviving spouse. They get the “keys to the house” for the rest of their life. They can live in it and enjoy it.

- However, the legal “deed” to the house is already in the names of your children.

- Your spouse can’t sell the home, take out a mortgage on it, or give it to someone else in their will. When they pass away, the house automatically and legally belongs to your kids, just as you intended.

This strategy is a perfect compromise. It ensures your spouse has a secure place to live while you maintain ultimate control over where your most valuable assets end up.

The Overlooked Power of Beneficiary Designations

Finally, don’t ever underestimate your beneficiary designations. The forms you filled out for your 401(k), IRA, and life insurance policies are powerful legal contracts. They actually override whatever your will or trust says.

This is a critical detail. If your ex-spouse is still listed on an old 401(k), they get the money. Period. It doesn’t matter what your will says.

Making a habit of reviewing and updating these forms is one of the easiest and most important things you can do. Ensuring your current spouse and children are named exactly how you want them to be is the only way to prevent a simple paperwork mistake from causing a devastating—and irreversible—outcome.

Advanced Strategies to Protect and Equalize Inheritances

While essential tools like wills and revocable trusts are the bedrock of any good estate plan, sometimes the complexities of a blended family demand more. When your goal is to create absolute certainty and fairness for everyone, a few advanced strategies can add the extra layers of protection needed to support your spouse while safeguarding your children’s inheritance.

These techniques are specifically designed for those tricky situations, ensuring your plan is built to withstand future uncertainties and keep the peace.

One of the most powerful tools for this job is the Irrevocable Life Insurance Trust (ILIT). Think of an ILIT as a way to create a dedicated, protected inheritance fund just for your children from a previous marriage. It works by setting up an irrevocable trust, which then purchases and owns a life insurance policy on your life.

Since the trust owns the policy—not you personally—the death benefit isn’t considered part of your taxable estate. This is a huge advantage. When you pass away, the ILIT delivers a substantial, tax-free cash payout directly to your children, completely bypassing the probate process and separate from any shared marital assets. It’s an elegant way to equalize inheritances without forcing your surviving spouse to sell the family home or a business to make things fair.

Fortifying Your Plan with Marital Agreements

The strongest estate plans are always built on a solid foundation. For a blended family, that foundation is often a prenuptial or postnuptial agreement. It’s important to understand that these legal contracts aren’t about planning for divorce; they’re about creating financial clarity and transparency right from the start.

A marital agreement clearly defines what is considered separate property (what you each brought into the marriage) versus marital property (what you’ve acquired together). By spelling out these financial boundaries, you remove the ambiguity that so often leads to disputes down the road. This agreement then works hand-in-glove with your trust, making sure the instructions in your estate plan line up perfectly with the financial agreements made during your marriage.

For example, a prenup can waive certain spousal inheritance rights to your pre-marital property, which reinforces your trust’s ability to direct those specific assets to your children. This creates a powerful, multi-layered defense for their inheritance.

Adding Protective Clauses to Your Trust

Even within a beautifully structured trust, you can add specific clauses that act like guardrails, protecting your plan from unexpected life events. These provisions give you an extra layer of control, making sure your wishes are followed no matter what happens in the future.

A remarriage clause is one of the most common and important. This provision can change how the trust operates if your surviving spouse remarries. It might state that upon remarriage, certain trust assets are immediately distributed to your children, or it could simply clarify that the new spouse has absolutely no claim to any of the trust’s assets. This is a simple but effective way to prevent your legacy from being accidentally commingled with or redirected to a new family.

To further mitigate inheritance risks, Irrevocable Life Insurance Trusts (ILITs) stand out as a powerhouse tool. By holding a life insurance policy outside of your taxable estate, an ILIT can deliver tax-free proceeds—sometimes millions—directly to children from a first marriage. This can be used to cover estate taxes or simply to equalize their inheritance without touching shared marital assets. For anyone dealing with debt or potential creditor claims, an ILIT also provides a shielded inheritance pool that is immune to judgments. This strategy is an excellent complement to other tools, such as the testamentary trusts that can be established within a will. Learn more about how these trusts offer asset protection for your heirs in our detailed guide.

Creating a Multi-Layered Defense

The truth is, no single tool can solve every challenge in estate planning for blended families. The most resilient and effective plans layer these advanced strategies together, creating a comprehensive defense for your legacy.

Here’s how they can work in synergy:

- Prenuptial Agreement: Establishes the ground rules by clearly defining separate and marital property.

- Revocable Living Trust: Manages and distributes your assets according to your specific instructions, bypassing probate and providing for both your spouse and children.

- QTIP Provisions: Allows your spouse to benefit from trust assets for their entire lifetime while legally guaranteeing the remaining principal goes to your children.

- ILIT: Creates a separate, tax-free pot of money for your children, ensuring they receive a fair inheritance immediately and without potential conflict.

By combining these strategies, you can build a plan that truly does it all: provides lasting financial security for your spouse, guarantees your children’s inheritance, and fosters the long-term family harmony you envision.

How Debt and Creditor Claims Can Impact Your Estate

When planning your estate, it’s easy to focus on who gets your assets. However, your estate’s debts must be settled before any inheritance is distributed. Overlooking liabilities like mortgages, credit card debt, or potential creditor lawsuits can seriously complicate the process and reduce the assets available for your beneficiaries. An executor or trustee is legally obligated to pay legitimate debts, which can force the sale of assets you intended for your family.

This is where consumer protection laws intersect with estate administration. Your estate’s representative has the right to use laws like the Fair Debt Collection Practices Act (FDCPA) to challenge illegitimate or inaccurate debt claims. They can demand debt validation and dispute errors, preventing predatory collectors from draining the estate’s resources. This act of “debt defense” is a critical, often overlooked step in preserving the full value of your legacy for your loved ones.

It’s also crucial to understand how laws like the Fair Credit Reporting Act (FCRA) can play a role, ensuring that a deceased person’s credit history is handled correctly and doesn’t lead to fraudulent claims against the estate. Effectively managing and defending against these claims ensures that your assets are distributed according to your wishes, not diverted to pay questionable debts. A comprehensive estate plan for a blended family must account for these potential liabilities to provide true security. You can learn more about how windfalls like inheritances are treated in bankruptcy in our related article.

Your Action Plan for Creating a Blended Family Estate Plan

Understanding the risks and solutions is the first half of the journey. The second, more powerful half is turning that knowledge into concrete action. This section gives you a clear roadmap to get from thinking about a plan to having a finished one, breaking down the complex process of estate planning for blended families into manageable steps.

Putting a plan together isn’t a one-time event; it’s a thoughtful process. Each phase builds on the last, ensuring your final documents are a true reflection of your goals and provide the security your family deserves. Follow these steps to move forward with confidence and clarity.

Step 1: Inventory Your Assets and Define Your Goals

Before you can decide how to divide up your assets, you need a complete picture of everything you own. This is the bedrock of your entire plan, informing every decision you make down the line. Don’t just think in broad strokes—get specific.

Create a detailed list that includes:

- Real Estate: Every property you own, from your primary residence to vacation homes or rentals.

- Financial Accounts: Checking and savings accounts, brokerage accounts, and any certificates of deposit (CDs).

- Retirement Plans: Your 401(k)s, IRAs, pensions, and any other retirement funds.

- Life Insurance Policies: Both term and whole life policies, making sure to note the death benefit amounts.

- Personal Property: Valuables like vehicles, jewelry, art, and collectibles.

Once you have that full inventory, it’s time to ask the hard questions. What does “providing for my spouse” really look like? What specific inheritance do I want to guarantee for my children? Your answers become the guiding principles for the whole plan.

Step 2: Initiate Open and Honest Conversations

This is often the toughest step, but it’s absolutely essential for keeping the peace. While you don’t need to share every last financial detail, having frank conversations with your spouse is critical to getting on the same page.

Talking through your intentions can prevent a world of misunderstanding and resentment later on. The goal is to create a plan that feels fair to everyone involved, and that starts with clear, respectful communication about your shared goals and individual responsibilities to your children.

A successful blended family estate plan is built on a foundation of communication. These conversations, while sometimes difficult, transform the process from a legal task into a collaborative act of love and foresight for the entire family.

Step 3: Assemble Your Professional Team

For blended families, DIY estate planning is incredibly risky. The nuances of trust language, state inheritance laws, and tax implications demand professional expertise. Your team should be led by an experienced estate planning attorney who specializes in these complex family structures.

A good attorney does more than just draft documents. They act as your strategist, helping you pick the right legal tools (like QTIP trusts or ILITs) and making sure they all work together seamlessly to hit your specific objectives.

Step 4: Draft and Execute Your Legal Documents

With your goals defined and your professional team in place, it’s time to make your plan official. Your attorney will draft all the necessary documents, which will likely include a will, a revocable living trust, powers of attorney, and healthcare directives.

Go over every document with a fine-toothed comb alongside your attorney. You need to be sure the language is precise and leaves zero room for misinterpretation. Once you’re satisfied, you’ll formally execute the documents by signing them according to state law, which usually requires witnesses and a notary. This is the moment your plan becomes legally binding.

Step 5: Fund Your Trust and Update Beneficiaries

This final step is absolutely critical and, unfortunately, often overlooked. A trust is just an empty shell until you transfer assets into it—a process called funding the trust. You’ll need to retitle your home, bank accounts, and other specified assets into the name of the trust.

At the same time, you must review and update the beneficiary designations on every single retirement account and life insurance policy. These designations are powerful—they override your will and trust—so they must be perfectly aligned with your overall estate plan to prevent accidentally disinheriting someone you meant to protect.

Frequently Asked Questions

When it comes to estate planning for blended families, a lot of questions pop up. It’s completely normal. Here are some of the most common ones we hear, with straightforward answers to help you see the path forward.

Can’t I Just Name My Kids as Beneficiaries on My Accounts?

That’s a start, but it’s rarely the whole picture. Naming your children directly as beneficiaries on things like a 401(k) or life insurance policy is a good first step, but it leaves you with zero control over what happens next. The money goes to them outright.

What if your child is still a minor? Or has special needs? Or simply isn’t ready to handle a large sum of money responsibly? This direct approach also does nothing for all the other things you own—your house, your car, your personal belongings. A well-designed trust is what gives you control, protecting those assets and letting you spell out exactly how and when your legacy is passed on.

We Already Have a Prenup. Isn’t That Enough?

A prenuptial agreement is a fantastic tool for blended families, but it does a completely different job than an estate plan. Think of it this way: a prenup primarily deals with what happens if you get divorced. It draws a line around assets and can clarify spousal inheritance rights, but it’s for a “what if” scenario during your lifetime.

Your will and trust, on the other hand, are the documents that kick in when you pass away. They are your final instructions. Your estate plan needs to work hand-in-hand with your prenup, not against it. It’s crucial to have a lawyer look at both to make sure they’re aligned and there aren’t any contradictions that could cause problems down the road.

Key takeaway: A prenup manages assets in a divorce. An estate plan distributes assets after death. You really need both for full protection in a blended family.

How Often Should We Revisit Our Estate Plan?

As a general rule, it’s smart to look over your estate plan every 3 to 5 years. But for blended families, life changes often mean your plan needs an immediate update. Things are just more complex.

You should definitely schedule a review if:

- Someone in the family gets married or divorced.

- A new child or grandchild is born or adopted.

- Your financial situation changes in a big way (up or down).

- One of your chosen beneficiaries, executors, or trustees passes away.

Life doesn’t stand still, and neither should your plan. Regular check-ins ensure that your documents always reflect your current reality and your most important wishes.

Protecting your family takes more than good intentions—it takes a precise legal strategy. The team at Ginsburg Law Group PC has the experience to help you build a customized estate plan that secures your spouse’s future and guarantees your children’s inheritance. Schedule a consultation to start creating the peace of mind your family deserves.