Summary

A durable power of attorney is a fundamental estate planning document that designates a trusted agent to manage financial and healthcare affairs if the principal becomes incapacitated. Unlike standard powers of attorney that terminate upon mental incapacity, the durable version remains effective, ensuring continuous protection when it is most needed. By establishing this legal relationship, individuals can avoid expensive and intrusive court-appointed guardianship proceedings that often cost thousands and expose private information to the public record. Agents can be granted broad or limited authority, including the power to pay bills, manage investments, and make critical medical decisions based on the principal's expressed values. These documents can take effect immediately or "spring" into action upon medical certification of incapacity. To ensure effectiveness, the document must comply with specific state laws regarding witnesses and notarization. Selecting a responsible agent and discussing expectations beforehand is crucial for a successful transition of authority. Proper storage and sharing copies with financial institutions and medical providers prevent administrative delays during emergencies, ultimately providing peace of mind and maintaining control over one's future welfare.

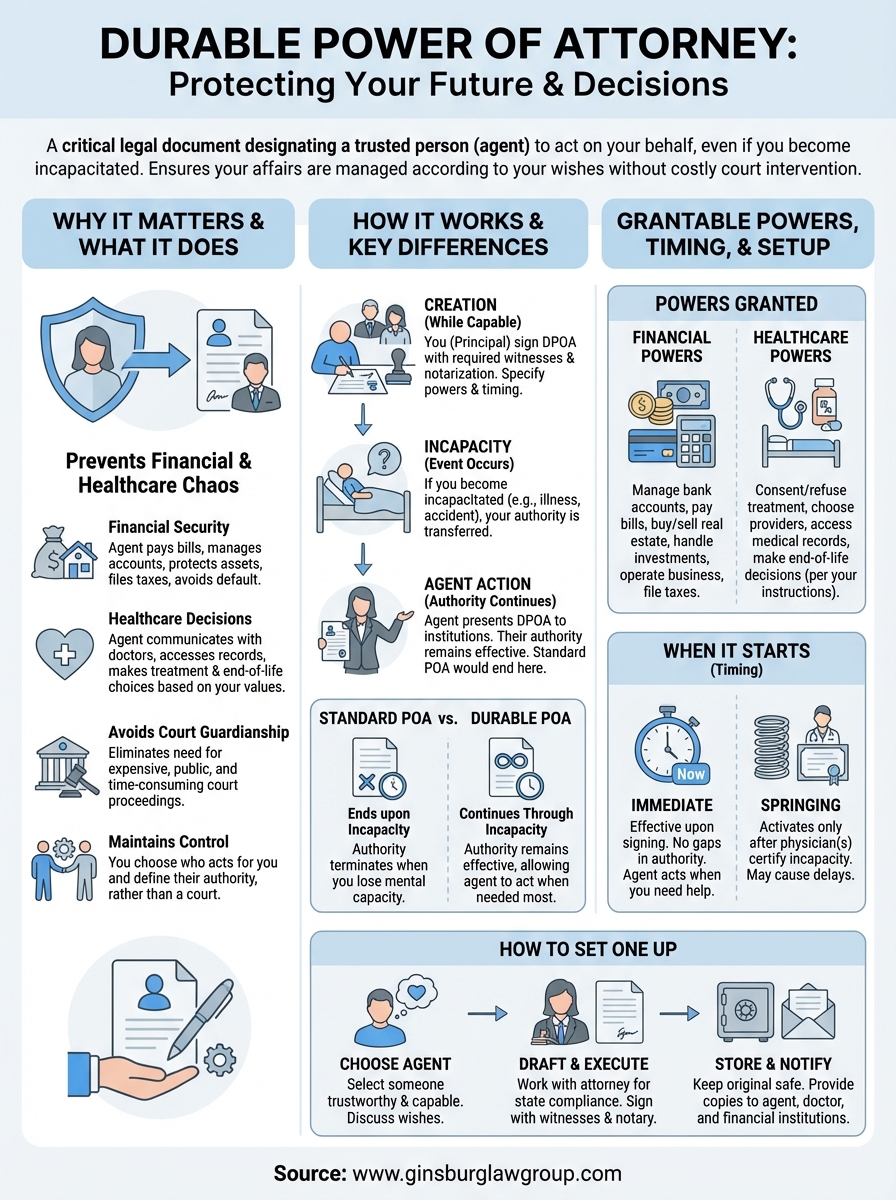

A sudden illness or accident can leave you unable to manage your finances or make healthcare decisions. Without the right legal documents in place, your family may face court proceedings just to pay your bills or authorize medical treatment. A durable power of attorney solves this problem by designating someone you trust to act on your behalf if you become incapacitated.

Unlike a standard power of attorney, which ends the moment you lose mental capacity, a durable power of attorney remains effective precisely when you need it most. This distinction makes it one of the most important documents in any estate plan, yet many people don’t understand how it works or when to use one.

At Ginsburg Law Group, we help clients create estate planning documents that protect their interests and give their families clear authority during difficult times. This guide explains what a durable power of attorney does, the different types available, and how to determine whether you need one for your situation.

Why a durable power of attorney matters

Understanding what is a durable power of attorney becomes critical when you consider that incapacity can happen at any age, not just to elderly individuals. A stroke, car accident, or sudden medical emergency could leave you temporarily or permanently unable to manage your affairs. Without a durable power of attorney, your family faces legal obstacles that delay access to your accounts, interrupt bill payments, and create unnecessary stress during an already difficult time.

Protecting your financial interests

Your bills don’t stop when you’re in a hospital bed. Without someone legally authorized to access your accounts, mortgage payments can go into default, utility services get disconnected, and investment opportunities pass by while your assets sit frozen. A durable power of attorney gives your chosen agent immediate authority to manage these financial matters without waiting for court approval. Your agent can pay bills, file tax returns, manage investments, and handle insurance claims on your behalf.

Banks and financial institutions refuse to work with family members who lack proper documentation. Even if you’re married, your spouse cannot automatically access accounts in your name alone. The financial chaos that follows incapacity often compounds medical stress and forces families to spend thousands on emergency guardianship proceedings.

Making healthcare decisions when you cannot

Medical decisions require someone with legal authority to speak for you. While a healthcare proxy handles treatment choices, a durable power of attorney for healthcare ensures someone can access your medical records, communicate with doctors, and make decisions about your care when you’re unconscious or mentally incapacitated. Doctors will not discuss your condition or treatment options with family members who lack this documentation.

Without proper legal authority, your loved ones may disagree about your care, leading to family conflicts and delays in critical medical decisions.

Your agent can consent to or refuse treatment, choose healthcare providers, and make end-of-life decisions according to your wishes. This authority prevents painful situations where family members must petition a court for guardianship just to authorize necessary medical procedures.

Avoiding costly court intervention

When you lack a durable power of attorney and become incapacitated, a court must appoint a guardian or conservator to manage your affairs. This process typically costs between $3,000 and $10,000 in legal fees and takes several months to complete. The court may appoint someone you wouldn’t have chosen, and your agent must report regularly to the court, creating ongoing administrative burdens and expenses.

Guardianship proceedings become public record, exposing your financial situation and medical condition to anyone who requests court documents. Your family loses privacy during an already vulnerable time. The appointed guardian must also post a bond and seek court approval for many financial transactions, delaying urgent decisions and creating bureaucratic obstacles to managing your affairs.

Maintaining control over who helps you

Creating a durable power of attorney lets you choose the specific person you trust to act on your behalf. You can select someone with financial expertise to handle money matters and designate a different person for healthcare decisions. Without this document, a court decides who manages your life, potentially selecting a professional guardian who charges fees or a family member you wouldn’t trust with these responsibilities.

You can also provide your agent with specific instructions, limitations, and guidance about how to handle different situations. This level of control disappears once a court takes over through guardianship proceedings.

How a durable power of attorney works

A durable power of attorney creates a legal relationship between you (the principal) and someone you designate (the agent or attorney-in-fact). You grant specific powers to your agent, who can then act on your behalf according to the authority you define in the document. The “durable” feature means this authority continues even after you become mentally incapacitated, which distinguishes it from a standard power of attorney that terminates when you lose capacity.

Creating the legal document

You must sign the power of attorney while you have full mental capacity. Most states require two witnesses and notarization to make the document legally valid, though specific requirements vary by jurisdiction. The document must clearly state that the power of attorney remains effective during your incapacity, using language like “this power of attorney shall not be affected by subsequent disability or incapacity of the principal.”

You define the scope of authority your agent receives, from broad powers over all financial matters to narrow authority over specific accounts or transactions. The document becomes effective immediately upon signing, though you can also create a “springing” version that only activates when a doctor certifies your incapacity.

How your agent exercises authority

Your agent presents the power of attorney document to banks, healthcare providers, or other institutions to prove their authority. Financial institutions verify the document and then allow your agent to conduct transactions, access accounts, and manage assets according to the powers you granted. Healthcare providers similarly accept the document as proof of your agent’s authority to make medical decisions.

Your agent has a fiduciary duty to act in your best interests, keep accurate records, and avoid conflicts of interest.

Your agent cannot change your will, make decisions after your death, or override any limitations you specified in the document. You can revoke the power of attorney at any time while you retain mental capacity by signing a written revocation and notifying your agent and relevant institutions.

What happens during incapacity

When you become incapacitated, your agent continues exercising the powers you granted without interruption. Unlike a standard power of attorney, no court involvement is necessary. Your agent manages your financial obligations, communicates with creditors, and handles urgent matters while you recover or receive long-term care. The document remains valid until you revoke it, you pass away, or the document reaches an expiration date you specified.

What powers it can grant and when it starts

When creating a durable power of attorney, you decide exactly which powers your agent receives and when those powers take effect. Understanding what is a durable power of attorney means recognizing that the document’s flexibility allows you to customize it to match your specific needs and concerns. You control the scope of authority, whether broad or limited, and determine the timing that makes sense for your situation.

Financial powers you can delegate

You can grant your agent authority over virtually any financial transaction you could handle yourself. Common financial powers include managing bank accounts, paying bills, filing taxes, buying or selling real estate, managing investments, operating your business, and handling insurance matters. You can grant all these powers or select specific ones that match your needs.

Some people limit their agent to specific accounts or transactions, such as managing only retirement funds or handling real estate sales. Others grant comprehensive authority to manage all financial matters without restriction. You can also include or exclude the power to make gifts on your behalf, which affects estate planning and tax strategies.

Healthcare authority options

Healthcare powers in a durable power of attorney let your agent make medical decisions when you cannot communicate your wishes. Your agent can consent to or refuse treatment, choose doctors and facilities, access medical records, and make end-of-life decisions. You can provide specific instructions about life support, organ donation, and treatment preferences to guide your agent’s choices.

Your agent must follow any healthcare preferences you document, making it essential to discuss your values and wishes before an emergency occurs.

When the document becomes active

Most durable powers of attorney become effective immediately when you sign them, though your agent should only act when you need help. This immediate effectiveness prevents gaps in authority if you suddenly become incapacitated. Your agent cannot override your decisions while you remain capable of managing your own affairs.

Alternatively, you can create a “springing” power of attorney that activates only after one or two physicians certify your incapacity in writing. This approach preserves your autonomy longer but creates potential delays when your agent needs to act quickly. Banks and healthcare providers may hesitate to accept springing documents until they receive proper medical certification.

How it differs from other POA documents

Understanding what is a durable power of attorney requires knowing how it compares to other legal documents that grant decision-making authority. Each type of power of attorney serves different purposes and operates under distinct rules. The “durable” feature represents the critical distinction that determines whether your agent can act when you need help most.

Standard (non-durable) power of attorney

A standard power of attorney terminates automatically when you become incapacitated, which is precisely when you need someone to manage your affairs. This document works well for temporary situations where you need someone to handle specific tasks while you remain mentally capable, such as selling property while traveling abroad or managing business transactions during a planned absence. The moment a doctor declares you mentally incapacitated, this authority ends, and your family must seek court-appointed guardianship.

Standard powers of attorney fail exactly when you need them most, leaving your family without legal authority during medical emergencies or cognitive decline.

Limited power of attorney

A limited power of attorney grants authority over specific transactions or for a defined period, regardless of whether it includes durable language. You might create one to let someone sell your house, manage a single investment account, or handle tax matters for one year. These documents can be durable or non-durable depending on your needs. The narrow scope protects you from giving someone broader control than necessary for their specific task.

Medical directives and living wills

Living wills and advance directives tell healthcare providers what treatments you want or refuse, but they don’t designate someone to make decisions or communicate with your doctors. You need both documents to cover different situations. A living will states your preferences about life support and end-of-life care, while a durable power of attorney for healthcare gives someone authority to make medical decisions beyond what you documented. Your agent interprets your wishes when facing situations you didn’t anticipate in your living will.

How to set one up and avoid common mistakes

Creating a durable power of attorney requires more than just filling out a form. You need to make deliberate choices about who receives authority, what powers they get, and how to ensure the document meets legal requirements in your state. Understanding what is a durable power of attorney means recognizing that small mistakes in setup can invalidate the entire document or create unintended consequences. Taking time to do this correctly now prevents legal problems when your family needs to act.

Choosing and preparing your agent

Your agent should be someone you trust completely with access to your finances and major life decisions. Pick a person who lives nearby, manages their own finances responsibly, and can handle potential family conflicts about your care. Avoid selecting someone simply because they’re your oldest child or closest relative if another person has better judgment or financial skills.

You must discuss your expectations and values with your chosen agent before creating the document. Walk through specific scenarios like selling your home to pay for care, managing investment accounts during market downturns, or making healthcare choices that reflect your religious beliefs. Your agent needs to understand what matters most to you, not just possess legal authority.

Drafting and executing the document

Work with an estate planning attorney to draft a document that complies with your state’s requirements and addresses your specific situation. Generic online forms often lack necessary language for your state or fail to grant all the powers you need. Attorney-drafted documents also receive less scrutiny from banks and healthcare providers who question whether you understood what you signed.

Most durable powers of attorney fail because people don’t notify financial institutions or keep the document accessible when needed.

Sign the document with proper witnesses and notarization according to your state’s rules. Give copies to your agent, backup agent, primary care doctor, and main financial institution. Store the original in a fireproof safe where your agent can access it immediately, not in a safety deposit box that requires court orders to open during incapacity.

Avoid naming multiple agents who must agree on every decision, which creates deadlock during emergencies. Specify a successor agent in case your first choice cannot serve. Review and update the document every five years or after major life changes like divorce, relocation, or the death of your named agent.

Key takeaways and next steps

Understanding what is a durable power of attorney gives you control over who manages your affairs if you become unable to make decisions yourself. This document remains effective during incapacity, unlike standard powers of attorney that terminate precisely when you need help most. Your agent receives the specific powers you grant, whether for financial matters, healthcare decisions, or both.

Start by identifying someone you trust completely to serve as your agent. Discuss your values, preferences, and expectations with this person before creating any documents. Work with an estate planning attorney to draft a document that complies with your state’s requirements and addresses your unique situation. Notify your financial institutions and healthcare providers after you execute the document, and keep copies accessible to your agent.

If you need help creating a durable power of attorney or protecting your family’s future, Ginsburg Law Group provides comprehensive estate planning services that give your loved ones clear legal authority when difficult situations arise.