Summary

Dying without a will, a state known as intestacy, transfers control of your estate to the probate court, which distributes assets according to rigid, impersonal formulas. These state laws prioritize legal and blood relationships, often ignoring the actual dynamics of modern families. Consequently, unmarried partners and step-children may be left with nothing, while estranged relatives inherit substantial shares, frequently triggering bitter family disputes. Although assets with named beneficiaries or joint ownership bypass this process, the court-appointed administrator must still navigate a lengthy, expensive probate journey that can deplete the estate’s value. Perhaps most critically, intestacy removes a parent's right to choose a guardian for their minor children, leaving that vital decision to a judge. Without a customized will, the distribution of your property and the care of your dependents fall to a generic legal template that rarely aligns with personal desires. Establishing a clear estate plan prevents these complications, ensuring that your specific wishes are honored and your loved ones are protected from the legal limbo and financial strain associated with state-mandated asset distribution. Taking these proactive steps saves time, reduces legal fees, and provides ultimate peace of mind for the future.

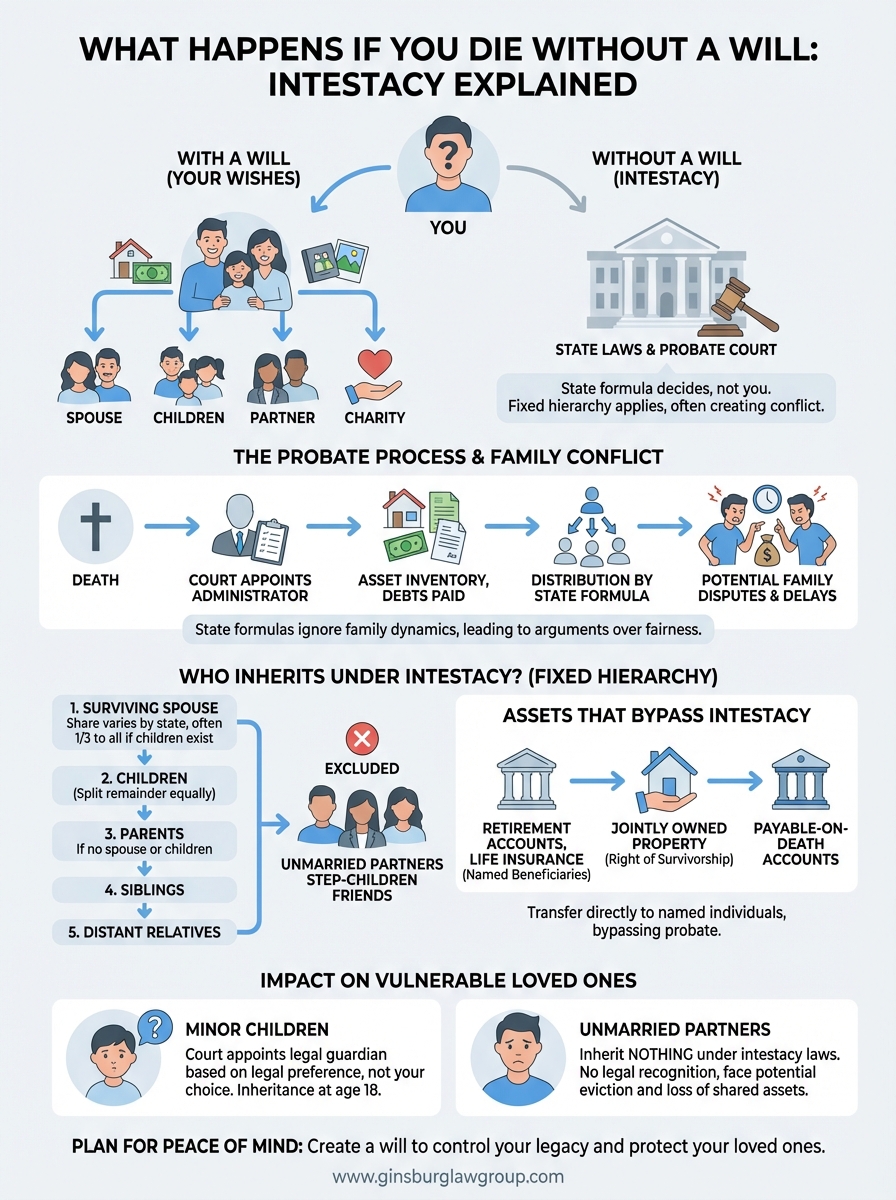

When you die without a will, the state decides who gets your property. This situation is called intestacy, and it means your assets get distributed according to predetermined state laws rather than your personal wishes. The probate court steps in to divide everything among your surviving relatives based on a fixed formula. Your spouse might not receive everything. Your unmarried partner could get nothing. Your minor children face uncertainty about who will raise them.

This article explains the intestacy process from start to finish. You’ll learn how probate courts handle estates without wills, which relatives inherit under state law, and how this affects your minor children. We’ll cover the property that bypasses intestacy entirely, who gets appointed to manage your estate, and why intestacy often creates family disputes. You’ll also discover what happens to unmarried partners and how to avoid leaving your loved ones in legal limbo.https://www.youtube.com/embed/0j8ZROHjsnM

Why relying on state laws creates family conflict

State intestacy laws treat your family like a generic template. These rigid formulas divide your estate based on legal relationships alone, completely ignoring the actual dynamics of your family. Your brother who hasn’t spoken to you in twenty years gets the same share as your sister who visited you every week. The nephew you helped raise receives nothing while a distant cousin you’ve never met inherits part of your estate. What happens if you die without a will is that the court applies these inflexible rules regardless of fairness or your known wishes.

State formulas ignore your family dynamics

Intestacy laws assume all children deserve equal treatment and all siblings have identical relationships with you. The state doesn’t recognize that you paid for one child’s college while another refused your help. Your step-children receive nothing under most state laws, even if you raised them from infancy. The formula treats your estranged spouse the same as a devoted partner. You cannot reward the family member who cared for you during illness or exclude the relative who caused harm.

State intestacy formulas cannot account for the complexities and nuances of real family relationships.

Disputes over who deserves what

Your relatives will argue over perceived unfairness in the state’s distribution. The sibling who helped manage your finances believes they deserve more than the legal share they receive. Family members question why estranged relatives inherit anything at all. Arguments erupt over who truly needs the money versus who the law says gets it. These disputes destroy relationships and drain your estate through legal battles that can last years. Relatives hire separate attorneys to contest the distribution, turning grief into combat. Your children might never speak again after fighting over assets you could have distributed clearly with a simple will.

How the probate court distributes your assets

The probate court follows your state’s intestacy statute to divide your property. A judge appoints an administrator (similar to an executor) who inventories your assets, pays your debts, and distributes what remains to your legal heirs. The court uses a fixed hierarchy that typically starts with your spouse and children, then moves to parents, siblings, and more distant relatives if no closer family exists. This process takes months or years and costs your estate thousands in court fees and administrator compensation.

The state’s priority order for inheritance

Your surviving spouse gets first priority, but the actual share depends on whether you have children. Most states give your spouse between one-third and all of your estate. Your children split the remainder equally, including biological and legally adopted children. If you die with no spouse or children, your parents inherit. When your parents are deceased, your siblings divide everything. The court keeps moving down the family tree to aunts, uncles, cousins, and beyond until someone qualifies.

The state determines who inherits based solely on blood relation and legal marriage, not on who you actually wanted to benefit.

Your spouse’s share varies by state

Community property states like California and Texas give your spouse half of all marital assets automatically. Common law states calculate your spouse’s share based on whether you have surviving children or parents. Your spouse might receive only one-third if you have kids from a previous relationship. What happens if you die without a will in these situations is that your current spouse must share your estate with children who may resent them.

Property that skips the intestacy process

Not everything you own goes through intestacy when you die without a will. Certain assets transfer directly to named individuals through legal mechanisms built into the ownership structure itself. These properties bypass probate court entirely and reach your beneficiaries within weeks instead of months or years. Understanding which assets skip the intestacy process helps you see the full picture of what actually gets distributed under state law versus what goes directly to specific people.

Assets with named beneficiaries

Your retirement accounts, life insurance policies, and bank accounts with payable-on-death designations transfer straight to whoever you named as beneficiary. The person listed on these forms receives the assets regardless of intestacy laws or what any potential will might have said. Your 401(k) goes to the beneficiary on file at your employer, not to your next of kin under state law. What happens if you die without a will is that these beneficiary designations become even more critical because they represent the only assets you actually controlled the distribution of before death.

Beneficiary designations override intestacy laws and control where these specific assets go.

Jointly owned property passes automatically

Property you own as joint tenants with right of survivorship transfers to your co-owner immediately when you die. Your jointly owned home, bank account, or vehicle becomes your co-owner’s sole property without court involvement. The probate court never touches these assets because the surviving owner already holds legal rights to the entire property.

The impact on minor children and unmarried partners

What happens if you die without a will leaves your minor children and unmarried partners in the most vulnerable positions. State intestacy laws offer zero protection for domestic partners, long-term companions, or step-children you consider your own. Your minor children face a court battle over who raises them while your devoted partner of twenty years receives nothing. The law treats legal relationships as the only relationships that matter.

Minor children face court-appointed guardians

Your children under age 18 need a legal guardian to raise them and manage their inheritance until they turn 18. The probate court decides who gets custody based on what the judge thinks is best, not what you would have wanted. Your children’s other parent typically gets first priority, even if you separated or that person struggles with addiction. When no parent exists, the court picks from available relatives or appoints a state guardian. Relatives fight over custody while your children wait in temporary care. Your kids also receive their full inheritance at age 18 with no restrictions, potentially gaining access to hundreds of thousands of dollars before they develop financial maturity.

Without a will, the court appoints a guardian for your minor children based on legal preference, not your personal choice.

Unmarried partners inherit nothing

Your domestic partner gets completely excluded under intestacy statutes. The person who shared your home, raised children with you, and supported you during illness receives zero legal recognition. All your assets go to blood relatives or your legal spouse instead. Your partner faces eviction from your shared home when it passes to your siblings. They lose access to bank accounts, vehicles, and everything you built together. Unmarried partners must rely on other legal mechanisms like joint ownership or beneficiary designations to receive anything when you die.

Who takes charge of your estate administration

The probate court selects an administrator to handle your estate when you die without a will. This person performs the same duties as an executor but gets appointed by a judge rather than chosen by you through a will. The court follows state priority lists that typically favor your surviving spouse first, then adult children, then parents and siblings. Your closest relative willing to serve gets the job by default, regardless of their financial skills or trustworthiness.

The court appoints an administrator

Your surviving spouse receives first priority for appointment in most states. If your spouse declines or doesn’t exist, the court moves to your adult children. The judge can appoint multiple children to serve together, which often creates disagreements about estate decisions. What happens if you die without a will is that family members who want the position must petition the court and potentially compete against each other. Relatives might fight over the appointment when they disagree about who should control the assets. The court picks based on legal hierarchy, not on who actually understands your finances or respects your values.

The court appoints your administrator based on a statutory priority list, not on competence or your personal preference.

Administrator responsibilities and delays

Your administrator must inventory all assets, notify creditors, pay debts and taxes, and distribute remaining property according to intestacy law. This process typically takes 12 to 18 months minimum, though complex estates drag on for years. The administrator gets paid from your estate, usually a percentage of total assets or hourly fees approved by the court. They post a bond that costs your estate additional money to guarantee proper handling of assets.

Planning your estate for peace of mind

A simple will prevents the chaos that happens when intestacy laws take over. You control who inherits your assets, who raises your minor children, and who manages your estate. Creating a will takes a few hours but saves your family months of court battles and thousands in legal fees. You protect your unmarried partner, reward the relatives who matter most, and exclude those who don’t deserve your assets.

What happens if you die without a will is that strangers make decisions about your children and property. Your state legislature wrote intestacy laws for generic situations, not your specific family. A properly drafted estate plan costs far less than the probate disputes and family conflicts that follow intestacy. You gain peace of mind knowing your wishes will be followed. Contact Ginsburg Law Group to create a will that protects your loved ones and ensures your wishes control what happens to everything you’ve built.