When a debt collector gets in touch, it’s natural to feel cornered or intimidated. But it's crucial to know that federal law gives you a powerful shield and very specific rights against debt collectors. You have the absolute right to demand they prove you owe the money, to tell them to stop contacting you, and to be protected from any abusive or shady tactics.

Understanding Your Core Rights Against Debt Collectors

Feeling overwhelmed by collection calls is a completely normal reaction, but you are far from defenseless. A robust framework of consumer rights laws, including the Fair Debt Collection Practices Act (FDCPA), the Telephone Consumer Protection Act (TCPA), and the Fair Credit Reporting Act (FCRA), is on your side.

Think of these laws as a strict rulebook for debt collectors. Their entire purpose is to prevent abusive, unfair, or deceptive practices. These federal laws change the dynamic, shifting you from a target to a legally protected consumer. While these rights don't erase a valid debt, they form the core of your debt defense strategy and guarantee you are treated with dignity and fairness.

Getting a handle on these protections is the first real step toward taking back control.

Your Fundamental FDCPA Protections

The FDCPA puts you in the driver’s seat with a set of foundational rights. Unfortunately, many people don't know these rights exist, leaving them vulnerable to illegal pressure tactics. Simply knowing what a collector is and isn't allowed to do is your single best defense.

Let's break down some of your most important rights:

- You Control the Conversation: You can dictate when and how a debt collector contacts you. For instance, you can tell them they are not allowed to call you at work if your employer doesn't permit personal calls.

- You Can Stop All Contact: You have the power to send a written request—often called a "cease and desist" letter—demanding they stop contacting you entirely. Once they get it, their only permitted follow-ups are to confirm they've received your request or to inform you of a specific legal action, like filing a lawsuit.

- You Can Demand Proof: If you don't recognize the debt or believe it's incorrect, you have the right to dispute it and ask for validation. If you send this written request within 30 days of their first contact, they must halt all collection efforts until they send you proof.

- You Are Protected from Harassment: Collectors are legally forbidden from harassing, oppressing, or abusing you. This covers everything from threats of violence and using obscene language to calling you over and over just to annoy you.

To make these rules crystal clear, the table below summarizes what collectors are legally banned from doing.

Your Core FDCPA Rights at a Glance

This table breaks down your most important rights under the Fair Debt Collection Practices Act (FDCPA) and what debt collectors are legally forbidden to do.

| Your Right | What Debt Collectors Are Banned From Doing |

|---|---|

| Right to Honesty and Transparency | Lie about the amount you owe, misrepresent their identity (e.g., claim to be an attorney or government agent), or falsely claim you've committed a crime. |

| Right to Privacy | Discuss your debt with third parties like your employer, neighbors, or family (with very limited exceptions). They cannot use postcards for communication. |

| Right to Be Free From Harassment | Use threats of violence or harm, use obscene or profane language, or call you repeatedly with the intent to annoy, abuse, or harass you. |

| Right to Control Communication | Call you before 8 a.m. or after 9 p.m. in your local time, or contact you at work if they know your employer prohibits it. They must honor your "cease and desist" request. |

| Right to Fair Practices | Threaten to take actions they cannot legally take (like having you arrested) or do not intend to take (like suing you if they have no plans to do so). |

| Right to Verify the Debt | Continue collection efforts after you've submitted a written request for debt validation within 30 days until they have provided you with proof of the debt. |

Knowing these rules isn't just for your peace of mind—it's about holding collectors accountable to the law.

Why These Rights Matter

These protections aren't just friendly suggestions; they are federal laws with real teeth. If a debt collector violates the FDCPA, TCPA, or FCRA, you can sue them, and they may have to pay you statutory damages, cover your attorney fees, and compensate you for any actual harm caused. This legal backing turns your rights from simple guidelines into powerful debt defense tools you can use.

By standing up for yourself, you can put an end to the harassment, challenge debts that aren't yours, and make sure you only pay what you truly owe. You can learn much more about how the Fair Debt Collection Practices Act shields you in our in-depth guide.

How to Spot Illegal Debt Collection Tactics

It's one thing for a debt collector to be persistent; it's another thing entirely when they cross the line into illegal territory. So, how can you tell the difference?

Thankfully, a federal law called the Fair Debt Collection Practices Act (FDCPA) draws that line for you. It lays out exactly what collectors can and cannot do. Once you know the rules of the game, you can spot a violation from a mile away and know precisely when to push back.

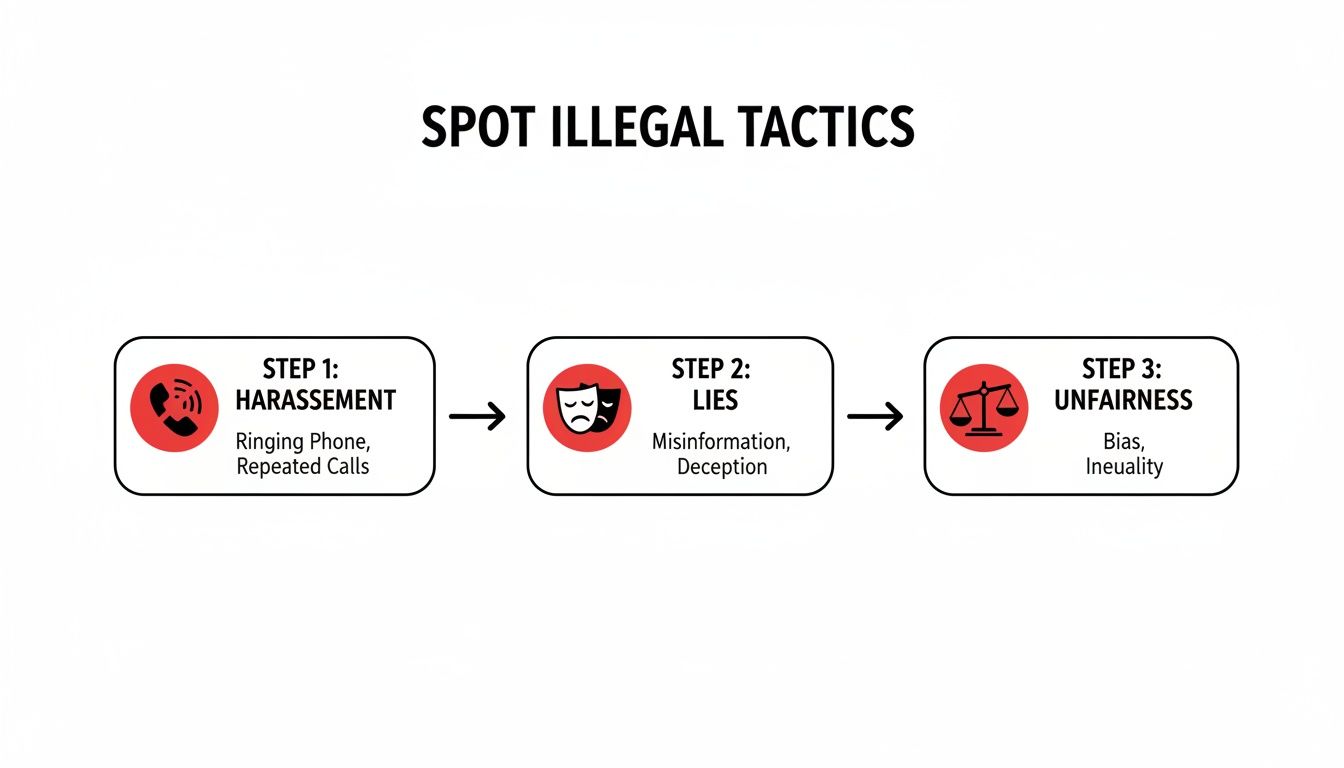

Most illegal tactics boil down to three things: harassment, lies, and dirty tricks. Recognizing these for what they are is the first, most crucial step in standing up for yourself.

Harassment and Abusive Conduct

The FDCPA has a zero-tolerance policy for any behavior designed to harass, oppress, or abuse you. This isn’t about a collector being firm in their requests. This is about outright bullying meant to intimidate you and grind you down.

Here are some classic examples of illegal harassment:

- Non-Stop Phone Calls: A collector can't blow up your phone just to annoy you. Calling you over and over again, sometimes back-to-back, is a clear sign they’ve crossed the line. This may also violate the Telephone Consumer Protection Act (TCPA), which governs robocalls.

- Profane or Abusive Language: There's absolutely no excuse for a collector to use obscene or abusive language. If they're cussing at you or insulting you, that's a direct violation.

- Threats of Violence or Harm: It goes without saying, but any threat of physical harm against you, your family, or your property is completely illegal.

And this isn't rare. A survey from the Consumer Financial Protection Bureau (CFPB) found that more than 27% of consumers felt threatened by a debt collector. Even worse, the same report revealed that three out of four people who told a collector to stop calling were ignored. You can see the full, eye-opening statistics in the CFPB's report on consumer experiences.

False or Misleading Statements

Truthfulness is not optional for a debt collector. They are legally barred from using any false, deceptive, or misleading statements to get you to pay. Simply put, they can't lie to you.

Watch out for these common lies:

- Impersonating an Attorney: A collector can't pretend to be a lawyer or send you a letter that looks like it came from a law firm if it didn't.

- Inflating the Debt: They can’t legally misrepresent what you owe. This means no tacking on unauthorized fees or mystery interest charges.

- Threatening Arrest or Lawsuits They Can’t Win: A collector can't threaten to have you arrested. They also can't threaten to sue you, garnish your wages, or seize your property unless they have the legal right and the actual intention to do so.

Key Takeaway: You cannot be sent to jail for an unpaid consumer debt like a credit card bill or medical bill. A collector who threatens you with arrest is committing one of the most serious and blatant violations of federal law. It's a scare tactic, pure and simple.

Unfair Collection Practices

The last category covers what the law calls "unfair" practices. These are the dirty tricks and underhanded tactics collectors use to gain an unjust advantage. They might seem like minor details, but they are all illegal.

A few examples include:

- Trying to collect extra money—like fees or charges—that wasn't in your original agreement or isn't allowed by law.

- Cashing a post-dated check before the date you wrote on it.

- Reporting false information to credit bureaus, a violation that could also trigger your rights under the Fair Credit Reporting Act (FCRA).

- Threatening to take your property when they have no legal right to do so.

Collectors count on you not knowing your rights. Their whole strategy often hinges on consumer ignorance. To get a better look at their methods and how to counter them, check out our guide on the debt collector playbook versus the consumer defense playbook. Learning to spot these illegal tactics is the first step toward taking back control.

Your Action Plan to Stop Debt Collector Harassment

Knowing your rights is one thing, but actually using them to stop a collector in their tracks is where the real power lies. When you're facing harassment, you don't just have to take it. You have a playbook, and it’s time to run some plays. This is your step-by-step guide to turning legal knowledge into a powerful shield.

The absolute most important thing you can do is document everything. I can't stress this enough. Good records are the bedrock of any solid debt defense case against a collector who crosses the line.

Start Your Evidence Log Immediately

Your memory will fade, but a written log is ironclad. From this moment forward, after every single interaction with a debt collector, write it all down. Think of yourself as a detective building a case—because that's exactly what you're doing.

For every phone call, your log needs to capture a few key details:

- Date and Time of the Call: Be precise. Note when they called and how long you were on the phone.

- Collector's Name and Agency: Get this information right at the start of the call. If they refuse to give it to you, make a note of that, too.

- Phone Number They Called From: Check your caller ID or call history and jot it down.

- Summary of the Conversation: What did they say? Did they threaten you, use foul language, or lie about what you owe? Try to write down direct quotes if you can.

- Witnesses: Was anyone else in the room who heard the conversation? Get their name down.

And don't stop with phone calls. Keep a digital paper trail of everything else. Save every voicemail, every text message, and every email. This evidence can be incredibly persuasive if you need to file a complaint or even a lawsuit down the road.

This simple breakdown shows you the most common illegal tactics collectors rely on, so you can spot them as they happen.

The visual above groups violations into three main buckets—harassment, lies, and unfairness—to help you quickly recognize when a collector has stepped over a legal boundary.

Wield Your Two Most Powerful Tools

Once you start documenting, it's time to go on the offensive with two very powerful letters. These aren't just polite requests; they are formal legal demands that force the collector to follow specific rules under the FDCPA.

One crucial tip: Always, and I mean always, send these letters via certified mail with a return receipt requested. That little green card you get back in the mail is your undeniable proof that the collection agency received your letter.

1. The Debt Validation Letter

The goal of a debt validation letter is simple: to make the collector prove you actually owe the money and that they have the legal right to collect it. You have a limited window to use this tool—it must be sent within 30 days of the collector’s first contact with you.

Sample Language for a Debt Validation Letter

"I am formally disputing the alleged debt you referenced. Under my rights in the Fair Debt Collection Practices Act, 15 USC 1692g(b), I demand that you provide complete verification of this debt. You must cease all collection efforts until you provide this verification. Please provide documentation proving I am responsible for this debt, including a copy of the original signed contract."

Once they get this letter, the law says they have to stop all collection activities—no more calls, no more letters—until they mail you valid proof of the debt.

2. The Cease and Desist Letter

If the harassment won't stop, or if you just want to silence them for good, the cease and desist letter is your trump card. This letter is a formal, legally-binding instruction telling the debt collector to stop contacting you. Period.

Sample Language for a Cease and Desist Letter

"Pursuant to my rights under the Fair Debt Collection Practices Act, 15 USC 1692c(c), I am instructing you to cease and desist all communications with me regarding this account. Do not call, write, or contact me in any other way. Any violation of this demand may result in legal action against you and your agency."

After receiving this, a collector is legally allowed to contact you for only two reasons: to tell you they are stopping all communication, or to inform you they are taking a specific legal action, like filing a lawsuit. If they reach out for any other reason, they've just broken the law. These letters are your first real line of defense—use them to put the law squarely on your side.

Challenging a Debt and Demanding Proof

Just because a debt collector calls you and says you owe money doesn't automatically make it true. Far from it. Mistakes are incredibly common in the world of debt collection—accounts get mixed up, balances are wrong, and sometimes, collectors are chasing debts that aren't even legally enforceable anymore.

This is exactly why one of your most powerful rights against debt collectors is the ability to challenge their claim. The law gives you the right to demand they prove you actually owe the money. Think of it as your legal right to say, "Show me the receipts."

You are under no obligation to pay a single dime on a debt you don't recognize or believe is inaccurate until the collector provides legitimate, verifiable proof. This is your first and best line of defense.

The Critical 30-Day Window

The FDCPA gives you a very specific, and very important, timeframe to exercise this right. You have 30 days from the collector's initial contact to mail them a written dispute and a request for debt validation.

When you send this letter within that 30-day window, the law forces the collector to hit the brakes. They must immediately stop all collection activities. No more calls. No more letters. They can't start again until they've actually mailed you verification that the debt is valid and belongs to you. This pause gives you invaluable breathing room and puts the burden of proof squarely on them.

Important Takeaway: This 30-day period is not a suggestion; it's a hard legal deadline that unlocks your strongest protections. If you miss this window, you can still dispute the debt later, but the collector isn't legally required to stop their collection efforts while they look into it.

This timeline table breaks down the key steps and deadlines for disputing a debt and highlights what the collector is legally required to do in response.

| Event | Your Action and Deadline | Debt Collector's Obligation |

|---|---|---|

| Initial Contact | A collector first communicates with you (call, letter, etc.). | Must provide a "validation notice" within 5 days of this contact. |

| Dispute Period | You have 30 days from receiving the validation notice to act. | The collector can continue collection efforts during this time unless you send a dispute. |

| You Send a Dispute | You mail a written dispute and validation request within the 30-day window. | Must immediately cease all collection activities (no calls, letters, or reporting). |

| Collector Responds | The collector receives your letter and investigates the debt. | Cannot resume collection until they mail you verification of the debt. |

| Post-Verification | After sending proof, the collector may resume collection activities. | If their "proof" is inadequate, you can continue to dispute it. |

Understanding this flow is crucial because timing is everything. Acting quickly within the first 30 days gives you maximum leverage.

What Counts as Real Proof?

A common trick from sketchy collectors is to send back a simple printout with your name and an amount owed, calling it "verification." Don't fall for it—that's often not enough.

Real, legitimate debt validation should give you enough information to confidently determine if the debt is yours and if the amount is correct. While the law isn't perfectly explicit, meaningful proof should generally include:

- The name of the original creditor you supposedly owed money to.

- The specific account number tied to the original debt.

- Documentation showing the original amount owed before fees and interest piled on.

- An itemized breakdown clearly showing how they got to the current total, including all interest, fees, and penalties.

- Proof that they have the legal authority to collect the debt, such as a copy of the contract assigning the debt to them.

A copy of an original bill or a statement from the original creditor is great. A simple spreadsheet they whipped up themselves is not.

Why Challenging a Debt Is So Important

Demanding proof is your go-to move in many situations. It's not just for debts you've never heard of; it's a critical tool for ensuring fairness and accuracy.

You should absolutely use this right if you run into any of these scenarios:

- Mistaken Identity: They're chasing you for a debt that belongs to someone with a similar name or a previous resident at your address.

- Incorrect Amounts: The balance they're demanding seems way off, likely pumped up with questionable fees or miscalculated interest.

- 'Zombie' Debt: You're getting calls about a very old debt, possibly one that's past the statute of limitations. This is critical, as in some states, making even a small payment can reset the clock on a dead debt.

- You've Already Paid: You're certain you settled this account years ago, and now a new collector is trying to get you to pay it twice.

By demanding proof, you force them to open their files and justify their claim. This simple act can expose errors, fraud, or a lack of documentation that can make the debt go away for good.

When to File a Complaint or a Lawsuit

So you’ve documented the illegal calls, sent the certified letters, and the debt collector is still ignoring the law. Don’t think you're out of options. Now is the time to shift from defending your rights to actively enforcing them. It’s about making sure their unlawful actions have real consequences.

You've already built a solid case with your call logs and paper trail. The next step is to put that evidence in front of the people who can actually do something about it. You have two main paths forward: filing official complaints with government agencies or taking the collector to court yourself.

Filing a Formal Complaint

Filing a complaint is a powerful, no-cost way to get a regulator's eyes on your case. That evidence log you've been keeping? It becomes the backbone of your complaint, giving it immediate credibility. The two best places to start are the Consumer Financial Protection Bureau (CFPB) and your state's Attorney General.

- The Consumer Financial Protection Bureau (CFPB): Think of the CFPB as the top federal watchdog for the entire financial industry, and they take debt collection issues very seriously. Filing a complaint on their website is straightforward. The agency then forwards it to the collection company—which has to respond—and the CFPB makes the outcome public.

- Your State Attorney General: Your state AG is the chief consumer protection officer where you live. They often enforce state-level laws that give you even more muscle than the federal FDCPA. Your complaint could become part of a larger investigation into a rogue agency's pattern of abuse.

And make no mistake, this is a massive problem. Roughly 30 million Americans have at least one debt in collections. In fact, consumers complain to the CFPB more about debt collectors than any other industry. A shocking 45% of those complaints are about attempts to collect a debt that isn't even owed. You can find more of these shocking debt collection statistics on directrecovery.com.

Taking the Collector to Court

While filing a complaint can get results, consumer rights laws like the FDCPA give you an even more direct and powerful tool: the right to sue the law-breaking collector yourself. This move completely flips the script. Instead of asking a government agency for help, you're taking direct legal action to demand compensation for the harassment you've been put through.

The Ultimate Accountability: A lawsuit isn't just about stopping the calls; it's about making the collector pay for their illegal behavior. The FDCPA, TCPA, and FCRA were designed so that consumers can hold collectors financially accountable, creating a strong deterrent against future abuse.

One of the best parts about a consumer rights lawsuit is how the legal fees are structured. If you win, the law requires the debt collector to pay your reasonable attorney’s fees and court costs. This is a game-changer. It means you can hire a qualified consumer protection lawyer without having to pay them out of your own pocket, leveling the playing field and giving everyone access to justice.

A successful lawsuit can provide real relief and a sense of vindication.

Potential Remedies in an FDCPA Lawsuit

| Type of Damages | What It Covers | Example |

|---|---|---|

| Actual Damages | Compensation for the real harm you suffered. | This could be money for emotional distress, anxiety, lost wages from taking time off work, or any other tangible harm the collector's actions caused. |

| Statutory Damages | A penalty the court can hit the collector with. | Even if you can't prove you lost a dime, the court can award you up to $1,000. This is purely to punish the collector for breaking the law. |

| Attorney's Fees | Covers the cost of your legal help. | If you win your case, the debt collector is on the hook for your lawyer's fees and the costs of filing the lawsuit. |

This means the law not only has your back but also makes the abusive collector pay for the lawyer you needed to hire. If you feel your rights have been violated and want to see what your options are, you can learn more about how to sue a debt collector for harassment in our detailed guide. Deciding to file a lawsuit is a big step, but it’s often the most effective way to get justice and finally put an end to illegal collection tactics for good.

Common Questions About Debt Collection

It’s one thing to know the rules, but it’s another to see how they play out in real life. Let’s walk through some of the most common questions people have when a debt collector starts calling. Understanding these scenarios will help you feel more in control.

Can a Debt Collector Call My Job or Family?

This is a huge one, and the law is crystal clear: collectors are extremely limited in who they can talk to about your debt.

They are allowed to contact other people—like a family member or even your boss—but only for one very specific reason: to get your current address and phone number. That's it. They are strictly forbidden from even hinting that you owe a debt.

Once they have your location info, they can't call that person again. And if they call you at work? If you tell them your employer doesn’t allow personal calls, or if they have any reason to believe it’s not allowed, they must stop immediately. Spilling your private financial details to someone else or repeatedly calling your office is a direct violation of the law.

What Is the Statute of Limitations on Debt?

Think of the statute of limitations as a legal stopwatch on your debt. It’s a time limit, set by your state’s laws, that determines how long a collector or creditor has to sue you to collect.

This clock runs differently depending on where you live and what kind of debt it is (credit card debt often has a different timeline than a formal written loan, for example).

Once that time is up, the debt becomes "time-barred." A collector can still ask you to pay, but they lose their most powerful tool—they can no longer win a lawsuit against you. Be careful, though. In some states, making even a small payment or simply promising to pay can reset that stopwatch, breathing new legal life into an old, unenforceable debt.

Key Takeaway: Before you even think about paying a very old debt, find out your state's statute of limitations. You could accidentally give a collector the power to sue you over a debt they couldn't have touched otherwise.

Will Sending a Cease and Desist Letter Hurt My Credit?

Absolutely not. Sending a cease and desist letter is you exercising a legal right granted by the FDCPA. It has zero impact on your credit score. The credit bureaus don’t track this kind of communication.

However, a collector reporting inaccurate information about the debt can hurt your credit. This action could violate the Fair Credit Reporting Act (FCRA), which gives you the right to dispute incorrect information on your credit report.

What a cease and desist letter doesn't do is make the debt disappear. The debt itself can still sit on your credit report, reported by the original creditor or the collection agency, and continue to affect your score. The letter is for your peace of mind, not a magic eraser for your credit history.

Do I Have to Pay a Debt I Don’t Recognize?

No, you do not. In fact, you shouldn’t pay a dime until you see undeniable proof that the debt is yours. The law puts the burden of proof squarely on the collector’s shoulders, not yours.

If a collector contacts you about a debt that doesn't ring a bell, your first step is to send them a debt validation letter (make sure you send it via certified mail). You have a 30-day window from their first contact with you to send this letter. Doing so within that timeframe triggers your strongest protections under the law.

Once they receive your request, the collector must legally halt all collection activity until they can mail you proof of the debt, like a copy of the original bill or contract you signed. If they can’t prove it, they can’t collect it. End of story.

Dealing with aggressive collectors or navigating complex consumer laws can be overwhelming. If you believe your rights have been violated or you need a strong advocate in your corner, the experienced team at Ginsburg Law Group PC is here to help. We focus exclusively on defending consumers against unfair practices. Contact us today to learn how we can protect your rights.