When planning your estate, the central choice often comes down to one fundamental tradeoff: flexibility versus protection. Understanding this distinction is the key to making the right decision for your family's future and ensuring your assets are managed according to your wishes.

A revocable trust is your tool for flexibility. As the creator, you can change it, add or remove assets, or even cancel it entirely. On the other hand, an irrevocable trust is built for protection. Once you create it and place assets inside, they are shielded from certain creditors and can offer significant tax advantages, but you have given up your ability to easily change your mind.

Revocable Vs Irrevocable Trust: The Essential Tradeoff

As you begin your estate planning journey, this is the first concept to master. Think of a revocable trust like a personal checking account. The money is yours, you can access it anytime, but it’s also completely exposed if someone sues you.

An irrevocable trust is more like a high-security vault with a time lock. Once you place assets inside, they are incredibly safe from outside threats, but you can’t simply walk up and take them out on a whim.

This single decision has ripple effects across your entire financial life. It determines how you manage your property, how vulnerable you are to lawsuits or long-term care costs, and how your wealth is eventually passed on. Your primary goal will steer the ship. Do you need a simple way to avoid probate while staying in the driver's seat, or do you need to build a fortress around what you've worked so hard to accumulate?

Quick Comparison: Revocable Vs. Irrevocable Trusts

To help you see the differences at a glance, this straightforward comparison breaks down the core features of each trust so you can quickly see which one might be a better fit for your goals.

| Feature | Revocable Trust (Living Trust) | Irrevocable Trust |

|---|---|---|

| Flexibility | High – You (the grantor) can change, amend, or completely cancel it anytime. | Low – It's generally a permanent structure and very difficult to change once created. |

| Control Over Assets | Full Control – You manage and use the assets just like you did before. | No Control – You give up direct control; a trustee manages assets for your beneficiaries. |

| Asset Protection | None – Your assets are still vulnerable to creditors, lawsuits, and judgments. | Strong – Protects assets from your future creditors and potential legal claims. |

| Probate Avoidance | Yes – Assets in the trust bypass the public, lengthy, and costly probate court. | Yes – Assets also bypass probate, allowing for a private and efficient transfer. |

| Medicaid Planning | No – Assets are fully countable for Medicaid eligibility, providing no benefit. | Yes – A key tool for protecting assets from long-term care costs after the 5-year look-back period. |

| Estate Tax Reduction | No – The assets are still considered part of your taxable estate. | Yes – Can remove assets from your taxable estate, potentially reducing or eliminating taxes. |

As you can see, there's no "one-size-fits-all" answer. The right choice is deeply personal and depends entirely on what you're trying to accomplish with your estate plan.

Understanding the Foundation of Trusts

Before diving into the specifics of revocable vs. irrevocable trusts, let's establish what a trust is. At its core, a trust is a private legal agreement—a detailed instruction manual you create for your assets. It’s an incredibly effective tool for controlling how your property is managed and passed on, both during your lifetime and after your death.

This "instruction manual" always involves three key roles. Understanding these roles is the first step in deciding which type of trust makes the most sense for you and your family.

The Key Players in Every Trust

No matter the type, every trust operates with three fundamental parties. In many cases, especially with a revocable trust, one person can even hold multiple roles simultaneously.

- The Grantor (also called the Settlor or Trustor): This is you. You are the one who creates the trust, defines the rules, and transfers your assets into it.

- The Trustee: This is the manager. The trustee is legally responsible for managing the trust's assets according to your instructions, always acting in the best interest of the beneficiaries. If you create a revocable living trust, you’ll almost certainly name yourself as the initial trustee.

- The Beneficiary: This is who the trust is for. A beneficiary is the person, people, or even an entity (like a charity) who will ultimately benefit from the assets held in the trust.

This simple three-part structure is the engine that drives your entire estate plan. For a deeper look at the fundamentals, feel free to read our comprehensive guide to living trusts.

A trust is essentially a contract you make with yourself (or a chosen trustee) to care for your assets on behalf of your loved ones. The core difference between revocable and irrevocable is how much power you keep to change that contract later.

Revocable and Irrevocable: What It Really Means

The labels "revocable" and "irrevocable" boil down to one simple question: can you change your mind? This distinction is the single most important factor, influencing everything from your personal control over assets to your tax situation and protection from creditors.

A revocable trust is flexible. As the grantor, you hold all the power to amend its terms, add or remove assets, or even dissolve the entire thing whenever you want, as long as you are competent. Because you retain this control, the assets inside are still considered legally yours for tax and liability purposes.

On the other hand, an irrevocable trust is set in stone. Once you transfer assets into it, you generally cannot take them back or alter the rules. This is a permanent decision. That very permanence is what creates powerful benefits, like shielding assets from creditors and potentially reducing estate taxes.

For many, the federal estate tax exemption is a major factor in this decision. The exemption is currently high at $13.61 million per individual, meaning most estates won't owe federal estate tax. However, this high exemption is scheduled to be cut by about half at the end of 2025. This future change might make an irrevocable trust a more valuable tool for preserving wealth for the next generation.

A Practical Comparison of Key Trust Differences

Knowing the textbook definitions of revocable and irrevocable trusts is one thing, but seeing how they perform in the real world is where it really clicks. The theoretical differences between control and permanence have direct, tangible impacts on your financial security, tax bills, and even your ability to qualify for long-term care down the road.

To get to the heart of the revocable vs. irrevocable trust debate, let's compare them across four critical areas. This isn't just about what each trust is—it’s about what each trust does for you and your family.

Control and Flexibility

The most immediate difference you'll feel is the level of control you retain over your assets. This single factor dictates how you can interact with your wealth once the trust is established.

A revocable trust leaves you in the driver's seat, offering complete and ongoing control. As the person who creates the trust (the grantor), you're typically also the initial trustee. This means you can:

- Amend the terms whenever you wish, such as changing beneficiaries or altering distribution plans.

- Add or remove assets as your life changes. You can sell a house held by the trust or move a new investment account into it without any difficulty.

- Revoke the entire trust if it no longer serves your needs.

Think of a revocable trust as a flexible extension of your personal ownership. It’s designed to evolve with you, making it an excellent tool for managing assets and avoiding probate without locking you into a permanent decision.

On the other hand, an irrevocable trust is built on the concept of relinquishing control. Once you transfer assets into it, you give up direct control—they are no longer legally yours. The trustee you appoint takes over, managing them according to the fixed rules you established from the start. While this sounds restrictive, this permanence is precisely what unlocks its most powerful benefits.

Asset Protection from Creditors and Lawsuits

Here's where the distinction becomes critical for anyone concerned about future financial risks. The ability of these trusts to shield your assets from lawsuits or creditors couldn't be more different.

A revocable trust offers zero asset protection. Because you hold the power to revoke the trust and take everything back, the legal system considers those assets yours. If you are sued, a creditor can compel you to dissolve the trust and use the assets to satisfy a judgment.

An irrevocable trust, however, can be a fortress for your assets. By legally transferring ownership to the trust, you place those assets beyond the reach of your future personal creditors. There’s a good reason why physicians, business owners, and others in high-liability professions rely on them.

The core principle is straightforward: if you can get to the assets, so can your creditors. The permanent nature of an irrevocable trust creates the legal firewall needed to protect your wealth.

This type of protection is vital. Creditor actions and lawsuits can arise unexpectedly, and a properly structured irrevocable trust provides robust defense. This means creditors can't easily breach the trust's walls, even with a court order, as long as the trust was designed correctly and funded well in advance of any claim. You can discover more insights about this powerful legal shield from our trusted legal partners.

Tax Implications and Estate Planning

How each trust is treated by the IRS is another major point of difference, especially for those with larger estates.

With a revocable trust, your tax situation remains unchanged. The assets are still considered part of your estate. You'll report any income the trust generates on your personal tax return, using your own Social Security Number. Upon your death, those assets are included in your taxable estate and may be subject to federal or state estate taxes if you exceed the exemption limit.

An irrevocable trust operates under a different set of tax rules. It is a separate legal and tax entity with its own tax ID number (an EIN). By moving assets out of your name and into the trust, you can also remove them from your taxable estate. For families with significant wealth, this can translate into substantial tax savings for their heirs. This is especially relevant now, as the federal estate tax exemption is scheduled to be cut nearly in half at the end of 2025.

Example Scenario:

- Situation: A couple has an estate worth $15 million. Let's assume the federal estate tax exemption drops to about $7 million per person in 2026.

- With a Revocable Trust: Their entire $15 million estate is exposed to taxes. After using their combined $14 million exemption, the remaining $1 million is subject to a hefty estate tax (around 40%), creating a $400,000 tax bill.

- With an Irrevocable Trust: Had they moved $3 million into a well-drafted irrevocable trust years ago, their taxable estate would shrink to $12 million. This amount is now completely covered by their exemption, potentially eliminating the estate tax bill entirely.

Government Benefit Eligibility

For many, planning for the significant cost of long-term care is a top priority. In the revocable vs. irrevocable trust comparison, there's a clear winner when it comes to preserving assets from nursing home costs.

A revocable trust does nothing to help you qualify for Medicaid. Since you still control the assets, they are fully "countable." This means you would have to spend down nearly everything in the trust on your care before Medicaid would provide assistance.

In contrast, an irrevocable trust is a cornerstone of modern long-term care planning. By transferring assets into it well in advance, they are no longer considered yours when it's time to apply for Medicaid. This strategy allows you to get the care you need without having to sacrifice your life's savings, preserving that legacy for your spouse or children.

However, you must plan ahead. Medicaid implements a five-year look-back period. Any assets you transfer into an irrevocable trust within the five years before you apply can trigger a penalty period, delaying your eligibility. This makes it absolutely critical to put these plans in place long before you anticipate needing care.

When to Choose a Revocable or Irrevocable Trust

Knowing the technical differences is one thing, but seeing these trusts in action is where the real understanding clicks. The right choice for you and your family hinges entirely on your specific situation and what you're trying to accomplish.

Let's walk through some common, real-world scenarios. By understanding how others use these powerful tools, you can get a much better feel for which path aligns with your vision for the future.

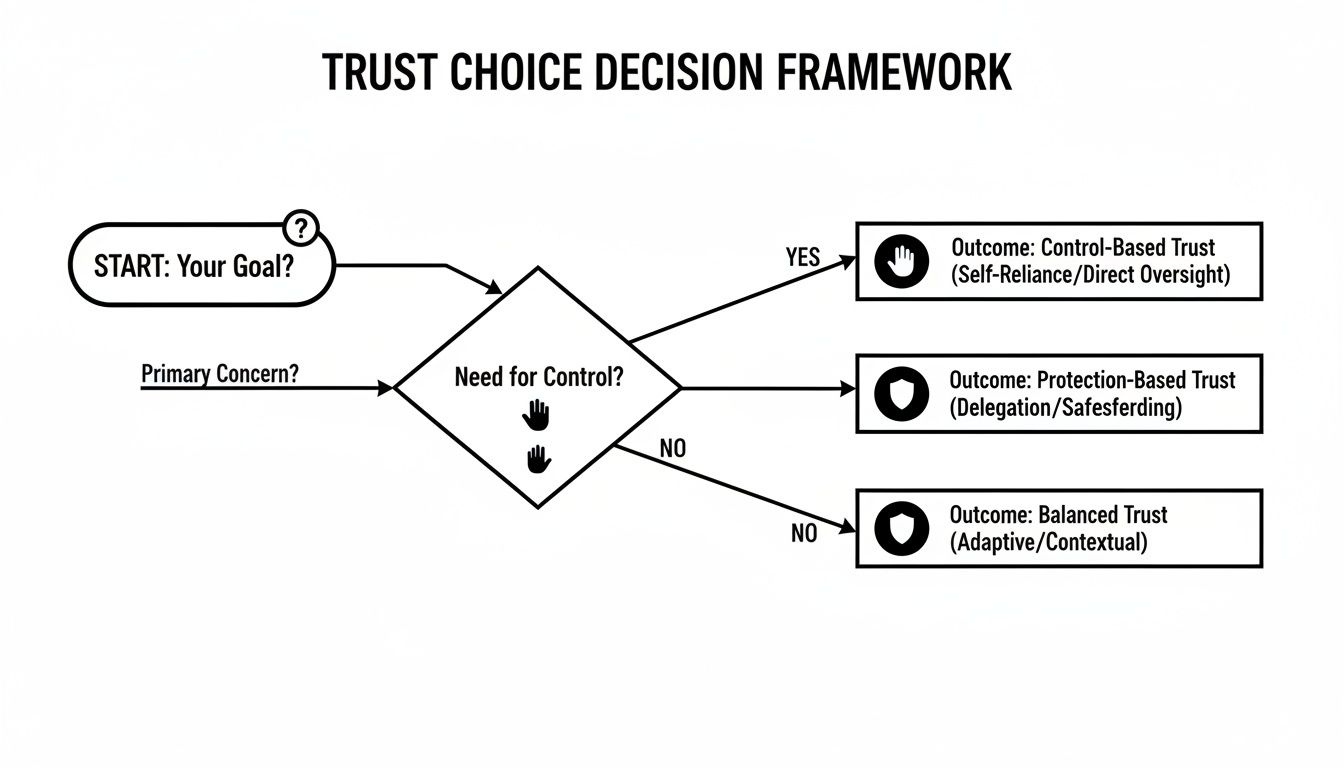

This decision tree can help you visualize whether your main priority is flexibility or rock-solid protection.

If keeping total control and the ability to change your mind is what matters most, a revocable trust is your natural starting point. But if you need to shield assets, plan for long-term care, or minimize taxes, you’re headed straight toward an irrevocable trust.

Common Scenarios for a Revocable Trust

A revocable trust shines when your primary goals are to bypass the probate process and keep complete control over your assets during your lifetime. It's an excellent tool for organization and efficiency, not for asset protection.

Example 1: The Young Family

- Situation: Sarah and Tom, a couple in their mid-30s with two small children, have a house, savings, and life insurance.

- Goals: Their main concern is ensuring their chosen guardian can easily access funds to care for the children if something happens to them. They want to avoid the probate court, which would freeze their assets and make the process public.

- Solution: A revocable living trust is a perfect fit. They can act as their own trustees, maintaining full control. They can also amend the trust as their family or finances change. Most importantly, it allows them to specify exactly how assets should be used for their children, ensuring they are cared for without court interference.

Example 2: The Retiree Planning for Incapacity

- Situation: David is 68, single, and healthy, but he worries about what would happen if he had a stroke or developed dementia and couldn't manage his finances.

- Goals: He needs a plan that allows his trusted daughter to step in to pay bills and manage investments without the legal burden of a court-ordered conservatorship.

- Solution: Again, a revocable trust is the answer. David can name himself as the trustee and his daughter as the successor trustee. This creates a seamless transition. If he ever becomes incapacitated, his daughter can take control immediately, ensuring his financial affairs and care continue without interruption.

Common Scenarios for an Irrevocable Trust

An irrevocable trust is the solution when the goal is to protect assets from significant threats like lawsuits, long-term care costs, or estate taxes. This level of protection requires giving up direct control.

Example 1: The High-Risk Professional

- Situation: Dr. Evans is a successful surgeon with a significant net worth. She knows that a single malpractice lawsuit could jeopardize her family's financial security.

- Goals: She needs to create a legal firewall between her personal assets and her professional life to make them unreachable in a potential legal judgment.

- Solution: An irrevocable asset protection trust is her best option. By transferring assets into this trust, she is no longer their legal owner. Years later, if a lawsuit is filed against her, those assets are generally shielded from creditors. She trades direct control for priceless peace of mind.

Example 2: The Senior Planning for Long-Term Care

- Situation: The Millers are in their early 70s, own their home, and have $400,000 in savings. They worry that if one of them needs nursing home care, the cost could deplete the nest egg they want to leave their children.

- Goals: They want to become eligible for Medicaid to cover long-term care expenses without spending down all their assets. They aim to preserve their home and savings for the next generation.

- Solution: A Medicaid asset protection trust, a specific type of irrevocable trust, is designed for this scenario. By moving their assets into the trust and waiting out the five-year "look-back" period, those assets no longer count against them for Medicaid eligibility. This strategy allows them to receive necessary care without sacrificing their life's savings.

It’s worth noting that trusts can also be established through a will, though these operate differently. To learn more, you can read up on the role of estate planning with testamentary trusts and see how they stack up against the living trusts we've discussed here.

How to Properly Establish and Fund Your Trust

Many people believe that once they sign their trust document, their work is done. This is a common and costly mistake. A trust agreement with no assets in it is like an empty vault—a set of instructions with nothing to manage.

To bring your trust to life, you must complete the critical second step: funding it. Funding is the process of transferring your assets—your home, bank accounts, investments—from your individual name into the name of the trust. This legal transfer of title allows the trust to work as intended, ensuring your estate avoids the delays and costs of probate.

The Initial Setup Steps

Establishing a trust involves creating a personalized legal plan tailored to your specific situation and family.

-

Drafting the Trust Agreement: First, you’ll work with an attorney to create the core legal document. This agreement names the key players (trustees and beneficiaries) and lays out the rules for managing and distributing your assets.

-

Choosing Your Trustee: You need to select someone to manage the trust. For a revocable trust, you'll almost always name yourself as the initial trustee and appoint a successor. For an irrevocable trust, you must select a reliable third party or financial institution from the outset.

-

Executing the Document: To make it official, you’ll sign the trust agreement in front of a notary. At this point, the trust legally exists, but it remains an empty shell until funded.

An unfunded trust is one of the most common and tragic mistakes in estate planning. It provides a false sense of security while leaving your family to face the exact legal hurdles you intended to prevent.

The Critical Process of Funding Your Trust

With the legal document signed, the real work begins. Funding your trust means methodically changing the title on every asset you want it to protect.

-

Real Estate: For your home or other properties, an attorney will prepare and file a new deed. The ownership will officially change from, for example, "John and Jane Smith" to "John and Jane Smith, Trustees of the Smith Family Trust."

-

Bank Accounts: You'll need to visit your bank to retitle your checking and savings accounts. This may involve opening new accounts in the trust's name and transferring the funds.

-

Non-Retirement Investment Accounts: Your brokerage accounts for stocks, bonds, and mutual funds also need to be formally retitled. Your financial advisor can provide the specific forms required.

-

Business Interests: Ownership in an LLC or a partnership can often be assigned to your trust. This move requires a careful review of the company's operating agreement to ensure it’s permitted.

Properly funding a trust is a detailed process where one small error can derail the whole plan. For a complete overview, you can learn more by exploring our detailed guide on trust funding. Because this step is so crucial, working with an experienced attorney is essential to ensure every asset is transferred correctly and your plan works when your family needs it most.

When to Call an Estate Planning Attorney

Deciding between a revocable and an irrevocable trust on your own can be overwhelming. It’s a decision with significant, long-term consequences, and it is not something you should tackle alone. While DIY legal websites may seem tempting, they are a classic case of "you get what you pay for."

Those one-size-fits-all templates cannot possibly grasp the nuances of your life—your family, your finances, or specific state laws. A poorly drafted trust can be worse than no trust at all, leading to court battles, invalidation of your wishes, and the very family conflict you were trying to prevent.

Why You Can't Replace an Expert

When you work with an experienced estate planning attorney, you're not just buying documents; you're investing in a strategy tailored specifically to you and your family.

Here’s what that actually looks like:

- A Custom Fit: We listen to your goals first. Are you trying to protect a child with special needs? Are you worried about the future costs of long-term care? Do you want to minimize estate taxes? The answers to these questions shape every clause in your trust.

- Keeping it Legal: Laws around trusts and estates constantly change. We stay on top of these shifts to ensure your trust is legally sound and will not be successfully challenged later.

- The Crucial Follow-Through: A trust is just an empty box until you put your assets into it. We guide you through the critical funding process, making sure your house, bank accounts, and other assets are properly retitled. This is the step that keeps your estate out of probate.

Creating a trust without a lawyer is like performing your own dental work after watching a video. You might get it done, but the risk of a painful, expensive mistake is incredibly high.

Ultimately, getting professional advice isn't just an expense; it's an investment in your peace of mind. It’s the confidence of knowing that when the time comes, your plan will work exactly as you intended, protecting the people you love most.

Frequently Asked Questions About Trusts

Once we get past the main differences between revocable and irrevocable trusts, the questions usually get very specific. Let’s tackle a few of the most common questions clients ask.

Can I Be the Trustee of My Own Revocable Trust?

Yes, and that is how most revocable trusts are structured. When you create a revocable living trust, you typically name yourself as the trustee. This is the key to maintaining full control over your assets.

You can still buy, sell, invest, and manage everything just as you always have. The real magic happens when you also name a successor trustee—someone you trust to step into your shoes if you become incapacitated or pass away. This feature ensures a smooth, court-free transition of power exactly when it's needed most.

What Happens if I Put My House Into an Irrevocable Trust?

This is a significant legal step. When you transfer your house into an irrevocable trust, the trust now owns the property, not you. It's this act of giving up ownership that unlocks the powerful asset protection and tax advantages these trusts are known for.

While you might be able to continue living there under the terms of certain trusts (like a Qualified Personal Residence Trust), you can't simply decide to sell the house or take out a home equity loan.

All decisions about the property are now in the hands of the trustee you appointed, who must follow the strict rules you laid out in the trust document. It's a permanent move, and one you should only make after getting solid legal advice.

Does a Revocable Trust Protect My Assets From a Lawsuit?

No. A revocable trust provides zero asset protection from lawsuits, creditors, or legal judgments. The law reasons that since you can revoke the trust and take the assets back anytime, they're still legally yours.

If someone wins a lawsuit against you, a court can order you to dissolve the trust and use the assets to pay the judgment. For durable protection against legal and financial threats, an irrevocable trust is the necessary tool because it formally severs your ownership of the assets.

Deciding between a revocable vs. irrevocable trust is one of the most important moves you'll make in securing your family's future, and it’s critical to get it right. At Ginsburg Law Group PC, we provide the one-on-one guidance needed to build a plan that truly protects your legacy. Schedule a consultation today to ensure your estate plan is built to last.

Article created using Outrank